Workforce housing company Target Hospitality (NASDAQ:TH) reported Q1 CY2024 results topping analysts' expectations, with revenue down 27.8% year on year to $106.7 million. The company's full-year revenue guidance of $417.5 million at the midpoint also came in slightly above analysts' estimates. It made a GAAP profit of $0.20 per share, down from its profit of $0.38 per share in the same quarter last year.

Target Hospitality (TH) Q1 CY2024 Highlights:

- Revenue: $106.7 million vs analyst estimates of $102 million (4.6% beat)

- EPS: $0.20 vs analyst estimates of $0.15 (36.4% beat)

- The company reconfirmed its revenue guidance for the full year of $417.5 million at the midpoint

- Gross Margin (GAAP): 46%, down from 55.4% in the same quarter last year

- Free Cash Flow of $50.46 million, up 62% from the previous quarter

- Utilized Beds: 14,049

- Market Capitalization: $1.11 billion

Essentially a builder of mini communities, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

The company creates and manages "man camps" or workforce housing communities, which provide temporary accommodations for workers in remote or underserved areas. Its main customers are energy companies, and its facilities are typically located in or near shale plays (areas with petroleum and natural gas components) and other industrial projects across North America, particularly in the Permian Basin, the most prolific oil-producing area in the United States.

Target Hospitality also offers a comprehensive suite of hospitality services, including catering, housekeeping, laundry, security, and recreational facilities, ensuring a comfortable and productive living environment. This holistic approach to workforce housing solutions is a key differentiator for Target Hospitality, allowing it to meet its clients' complex needs.

The company mostly develops and operates its own properties, occasionally enlisting third parties to help run its locations. This hybrid approach allows Target Hospitality to scale rapidly and provide flexible solutions. Its accommodation solutions range from single-occupancy rooms to larger communal living facilities, all designed with a focus on safety, comfort, and efficiency.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Target Hospitality's primary competitors include Civeo (NYSE:CVEO), Black Diamond Group (TSX:BDI), ATCO (TSX:ACO.X), ProPetro Holding (NYSE:PUMP), and Halliburton (NYSE:HAL).Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Target Hospitality's annualized revenue growth rate of 13% over the last five years was mediocre for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Target Hospitality's annualized revenue growth of 26.6% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Target Hospitality's annualized revenue growth of 26.6% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Target Hospitality's revenue fell 27.8% year on year to $106.7 million but beat Wall Street's estimates by 4.6%.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Target Hospitality has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 39.7%.This quarter, Target Hospitality generated an operating profit margin of 28.5%, down 13.4 percentage points year on year.

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Target Hospitality's EPS grew 1,957%, translating into an astounding 83.1% compounded annual growth rate. This performance is materially higher than its 13% annualized revenue growth over the same period. Let's dig into why.

While we mentioned earlier that Target Hospitality's operating margin declined this quarter, a five-year view shows its margin has expanded 41.8 percentage points, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Target Hospitality reported EPS at $0.20, down from $0.38 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 36.4%. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Target Hospitality has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer discretionary sector, averaging 31.6%.

Target Hospitality's free cash flow came in at $50.46 million in Q1, equivalent to a 47.3% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter.

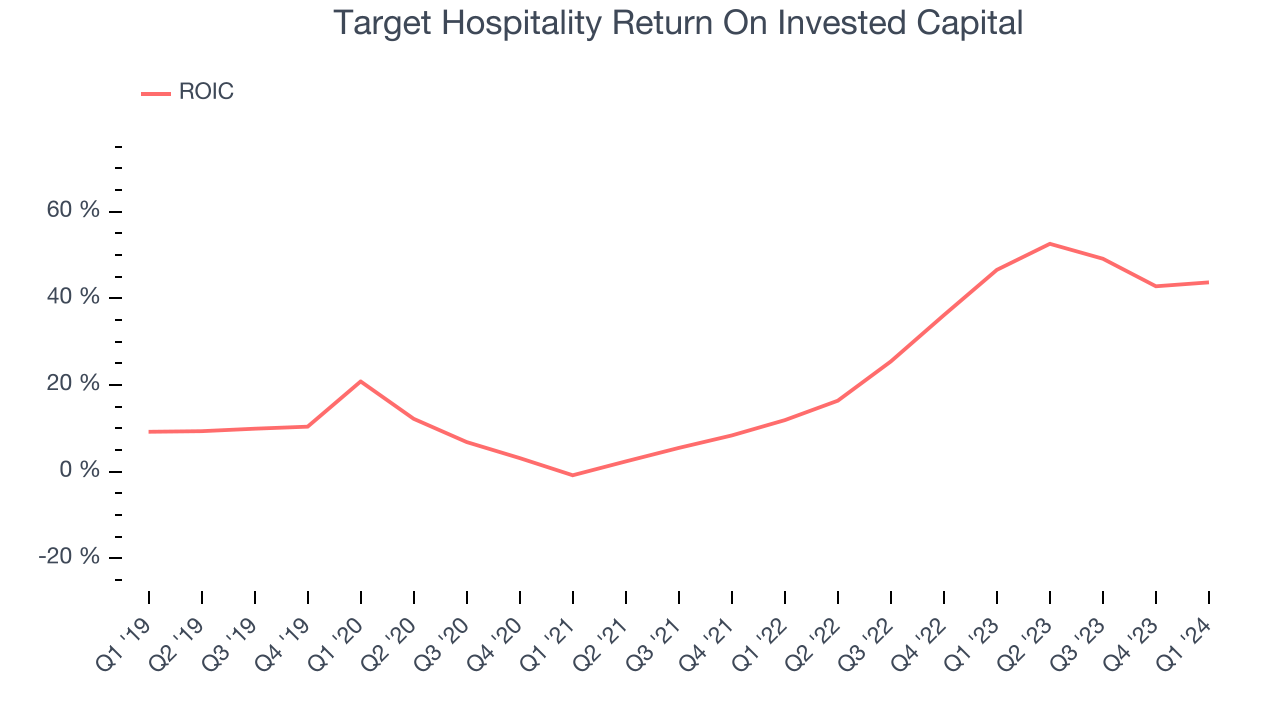

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Target Hospitality's five-year average ROIC was 24.5%, placing it among the best consumer discretionary companies. Just as you’d like your investment dollars to generate returns, Target Hospitality's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Target Hospitality's ROIC has significantly increased. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Target Hospitality reported $124.3 million of cash and $178.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $307.3 million of EBITDA over the last 12 months, we view Target Hospitality's 0.2x net-debt-to-EBITDA ratio as safe. We also see its $10.56 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Target Hospitality's Q1 Results

We were impressed by how significantly Target Hospitality blew past analysts' EPS estimates this quarter, driven by its better-than-expected operating margin. The company's full-year revenue and EBITDA guidance also beat Wall Street's projections. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 3.5% after reporting and currently trades at $11.5 per share.

Is Now The Time?

Target Hospitality may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are numerous reasons why we think Target Hospitality is one of the best consumer companies out there. Although its revenue growth has been mediocre over the last five years with analysts expecting growth to slow from here, its impressive operating margins show it has a highly efficient business model. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Looking at the consumer discretionary landscape today, Target Hospitality's qualities really stand out and we like it at this price.

Wall Street analysts covering the company had a one-year price target of $11.33 per share right before these results (compared to the current share price of $11.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.