Rural goods retailer Tractor Supply (NASDAQ:TSCO) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 2.9% year on year to $3.39 billion. On the other hand, the company's full-year revenue guidance of $14.9 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $1.83 per share, improving from its profit of $1.65 per share in the same quarter last year.

Tractor Supply (TSCO) Q1 CY2024 Highlights:

- Revenue: $3.39 billion vs analyst estimates of $3.40 billion (small miss)

- EPS: $1.83 vs analyst estimates of $1.72 (6.4% beat)

- The company reconfirmed its revenue guidance for the full year of $14.9 billion at the midpoint (below expectations of $15.0 billion)

- The company reconfirmed its EPS guidance for the full year of $10.18 billion at the midpoint (below expectations of $10.24)

- Gross Margin (GAAP): 36%, up from 35.5% in the same quarter last year

- Free Cash Flow of $100.2 million is up from -$138.4 million in the same quarter last year

- Same-Store Sales were up 1.1% year on year (beat vs. expectations of up 1.1% year on year)

- Store Locations: 2,435 at quarter end, increasing by 82 over the last 12 months

- Market Capitalization: $27.86 billion

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

The core customer is typically a farmer, rancher, or general rural homeowner who tends to be handy, which explains the company’s tagline of “for life out here.” These customers make their living or heavily rely on their equipment, livestock, and land. They need a dependable source for essential supplies such as trailers for trucks, animal feed, and fencing supplies, all of which can be purchased from Tractor Supply.

Tractor Supply stores can vary in size, but the average location is fairly small at 15,000 feet with outdoor display and storage space for larger products and equipment. These stores tend to be located in rural and suburban shopping centers and retail plazas. Many of these rural areas don’t have a high density of other retailers, so Tractor Supply aims to be a nearly one-stop shop for customer needs.

The company established its e-commerce platform in 2007, and today, customers can buy online for home delivery or store pickup. The site and app also feature online-only deals and a blog about rural living that includes product reviews/comparisons, animal care guides, and primers on farming and agriculture.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that offer one or more overlapping product categories include Home Depot (NYSE:HD), Lowe’s (NYSE:LOW), and Petco Health and Wellness (NASDAQ:WOOF).Sales Growth

Tractor Supply is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

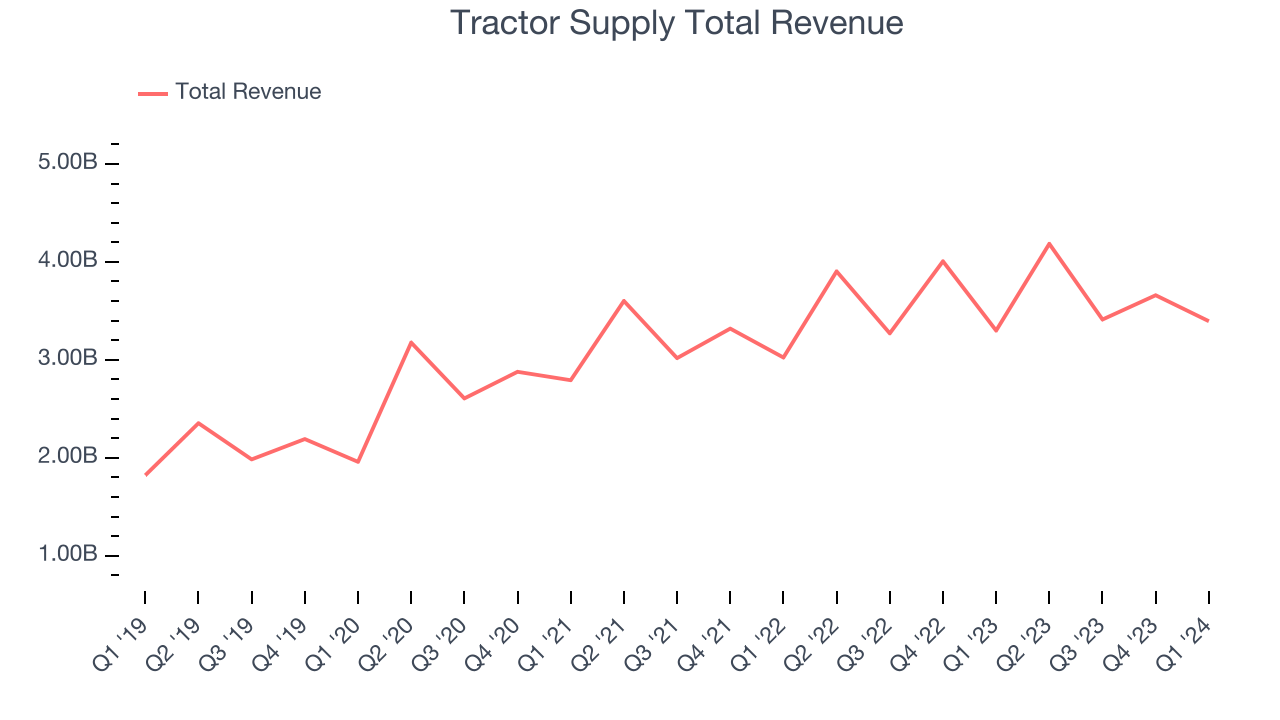

As you can see below, the company's annualized revenue growth rate of 12.7% over the last five years was solid as it opened new stores and grew sales at existing, established stores.

This quarter, Tractor Supply's revenue grew 2.9% year on year to $3.39 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.9% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

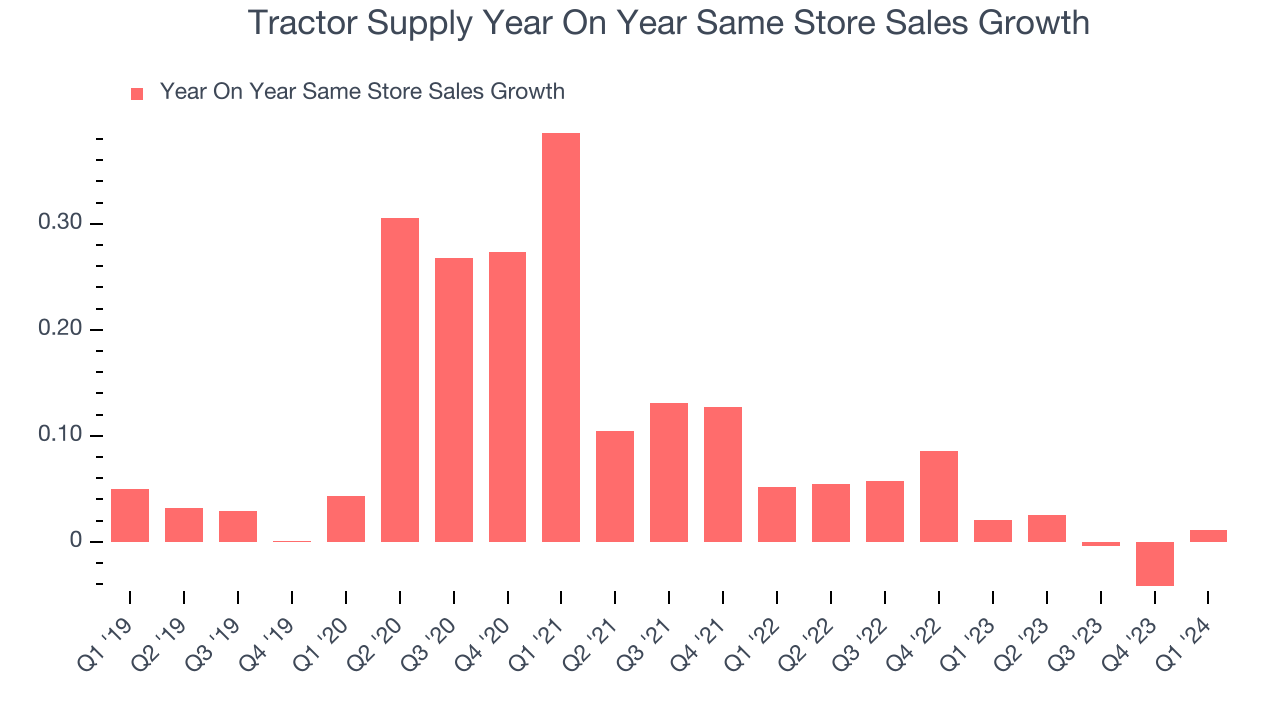

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Tractor Supply's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.6% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Tractor Supply is reaching more customers and growing sales.

In the latest quarter, Tractor Supply's same-store sales rose 1.1% year on year. This growth was a deceleration from the 2.1% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Number of Stores

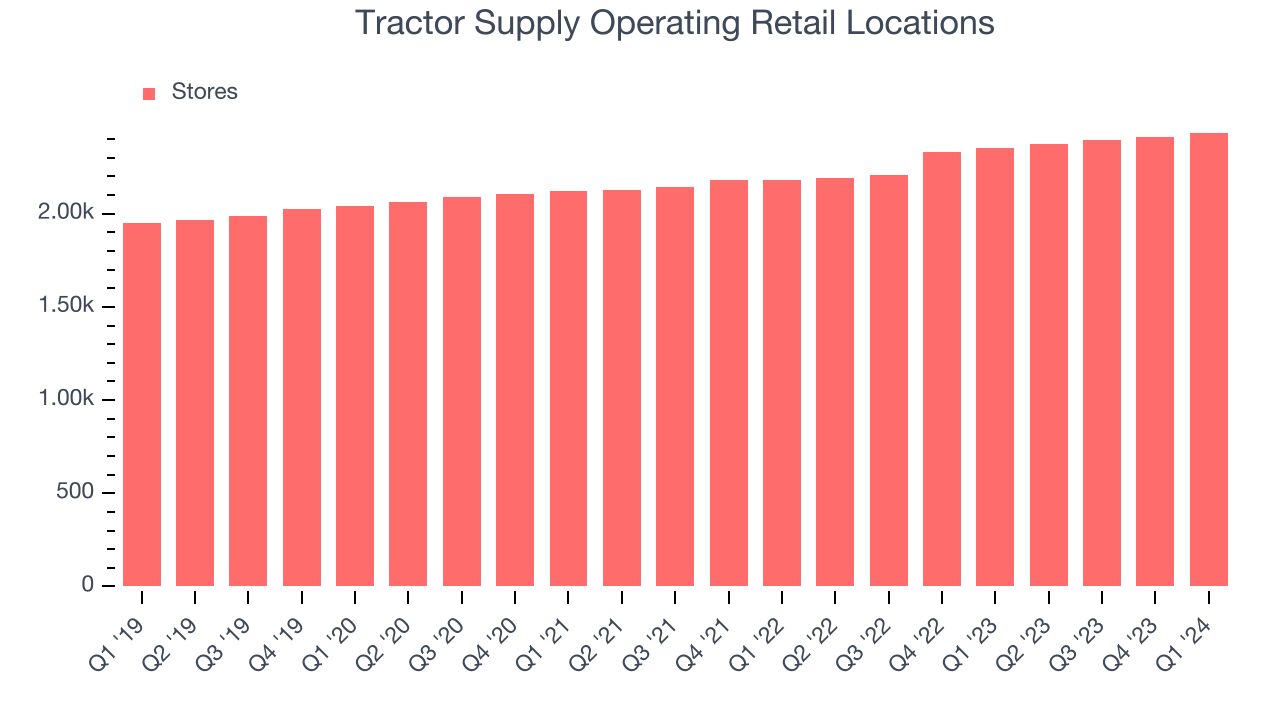

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Tractor Supply is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Tractor Supply's store count increased by 82 locations, or 3.5%, to 2,435 total retail locations in the most recently reported quarter.

Taking a step back, the company has opened new stores quickly over the last eight quarters, averaging 5.5% annual growth in new locations. This store growth outpaces the broader consumer retail sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

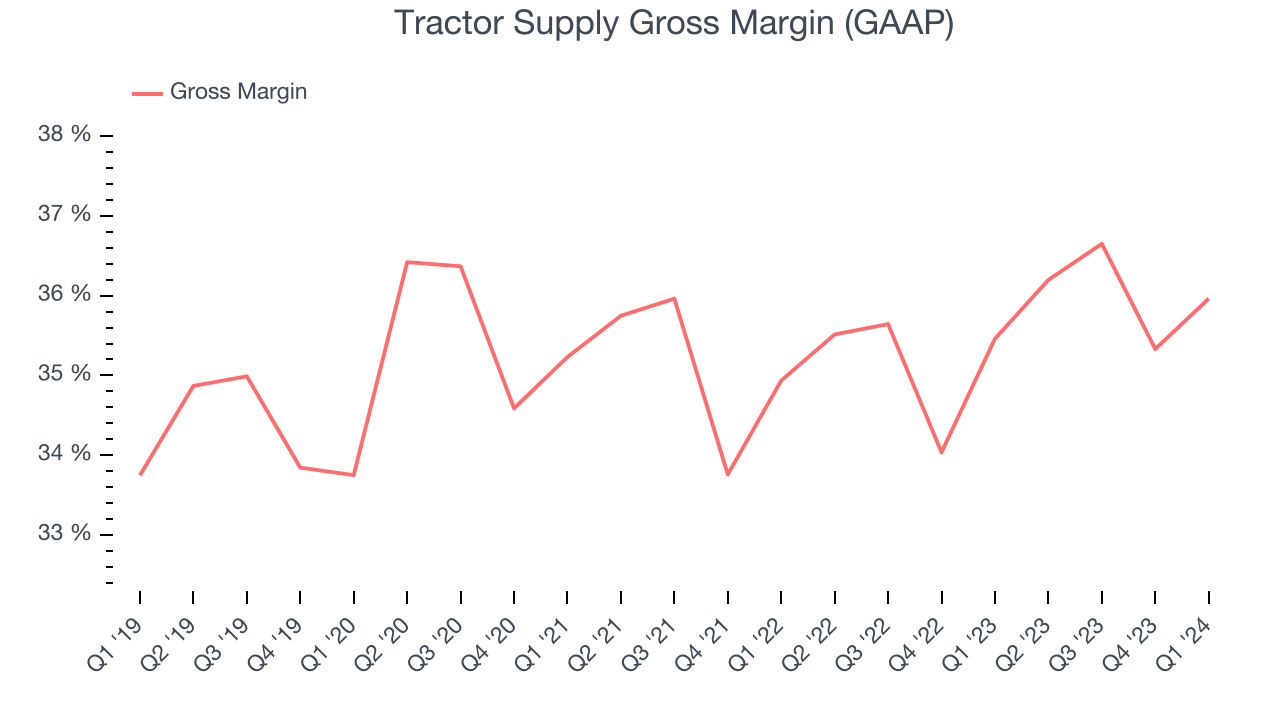

We prefer higher gross margins because they make it easier to generate more operating profits.

Tractor Supply's unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it's averaged a decent 35.6% gross margin over the last eight quarters. This means the company makes $0.36 for every $1 in revenue before accounting for its operating expenses.

Tractor Supply's gross profit margin came in at 36% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

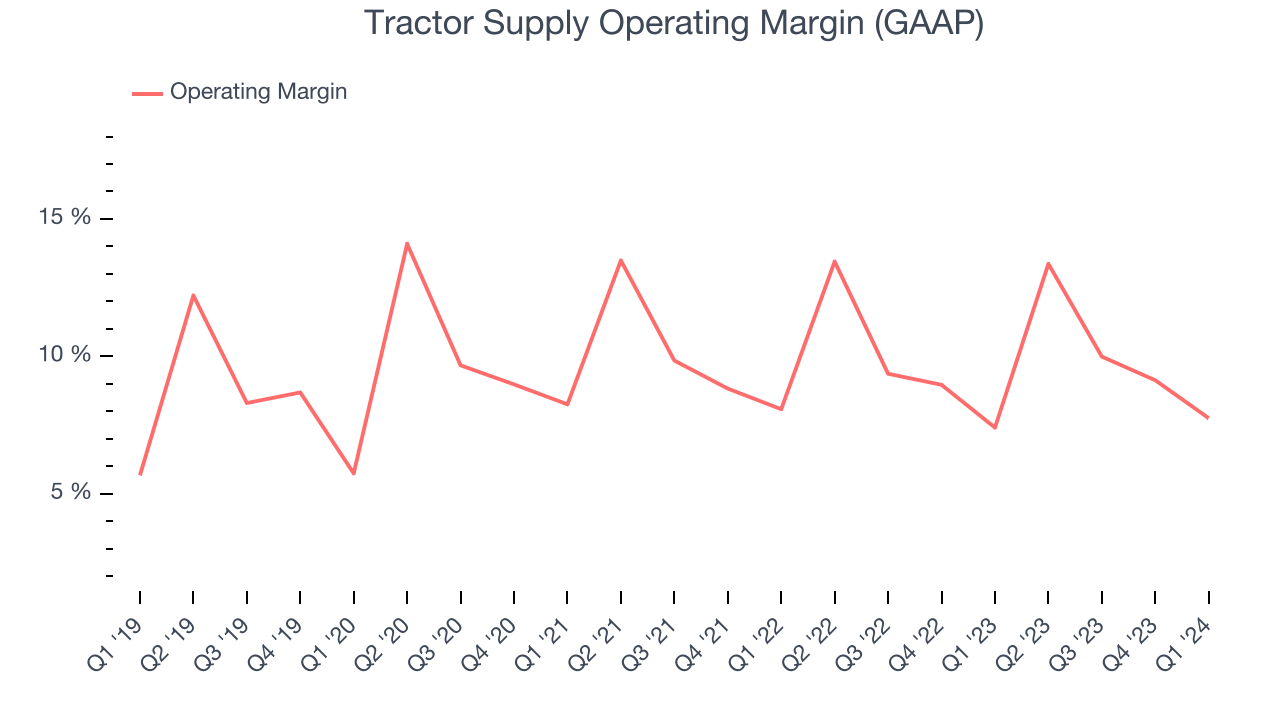

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Tractor Supply generated an operating profit margin of 7.8%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Tractor Supply has done a decent job managing its expenses over the last eight quarters. It's produced an average operating margin of 10.1%, higher than the broader consumer retail sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Tractor Supply has done a decent job managing its expenses over the last eight quarters. It's produced an average operating margin of 10.1%, higher than the broader consumer retail sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

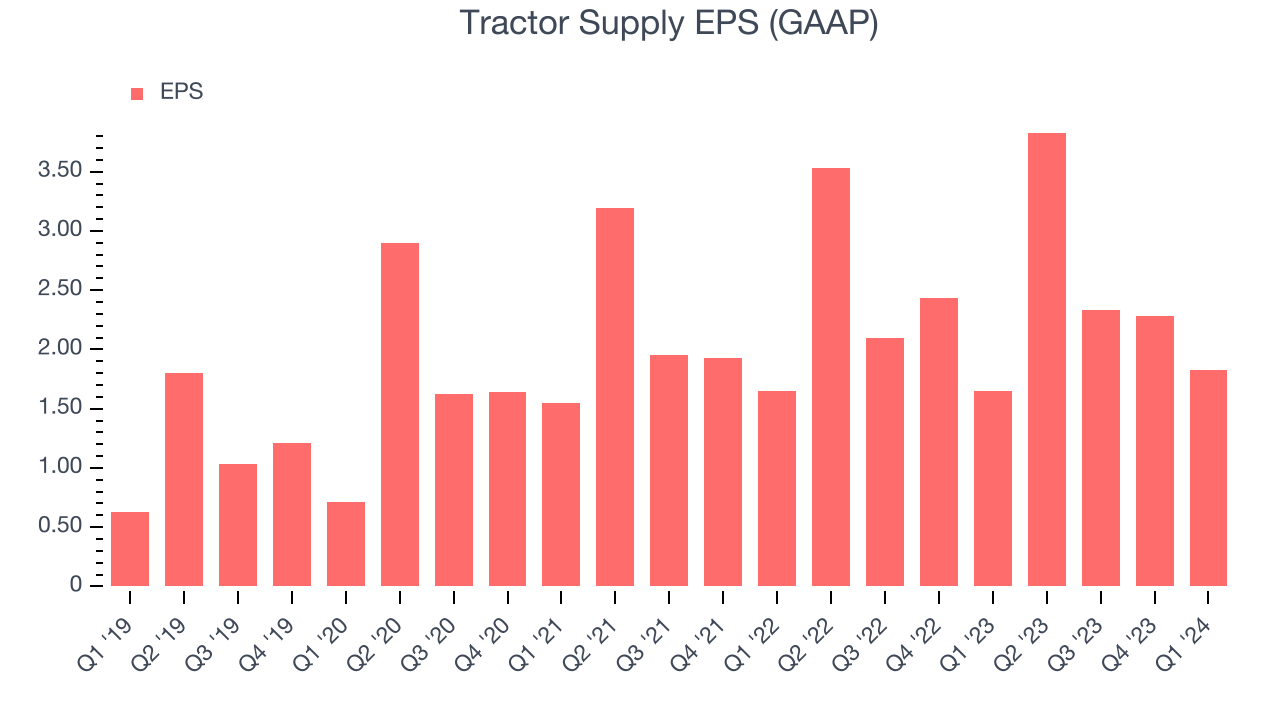

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Tractor Supply reported EPS at $1.83, up from $1.65 in the same quarter a year ago. This print beat Wall Street's estimates by 6.4%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 1.6% year-on-year increase in EPS.

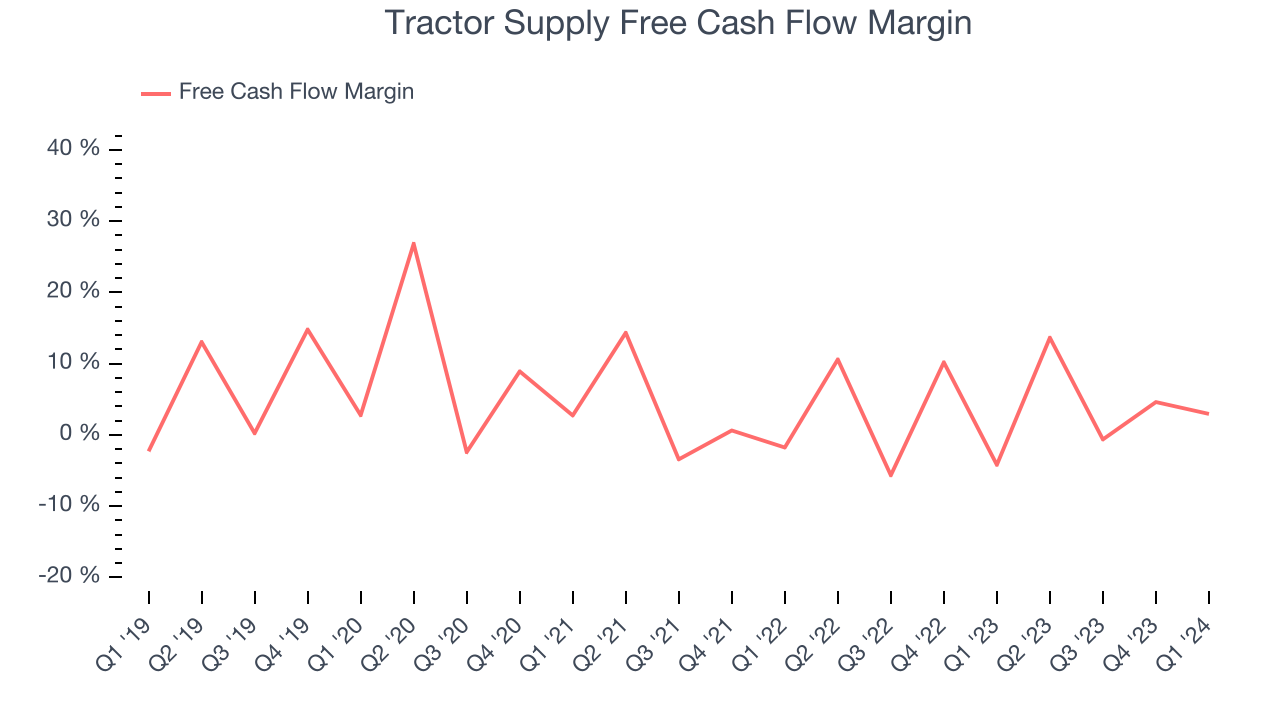

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Tractor Supply's free cash flow came in at $100.2 million in Q1, representing a 3% margin and flipping from negative in the same quarter last year to positive this quarter. Seasonal factors aside, this was great for the business.

Over the last eight quarters, Tractor Supply has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 4.5%, well above the broader consumer retail sector. Furthermore, its margin has averaged year-on-year increases of 2.1 percentage points. This likely pleases the company's investors.

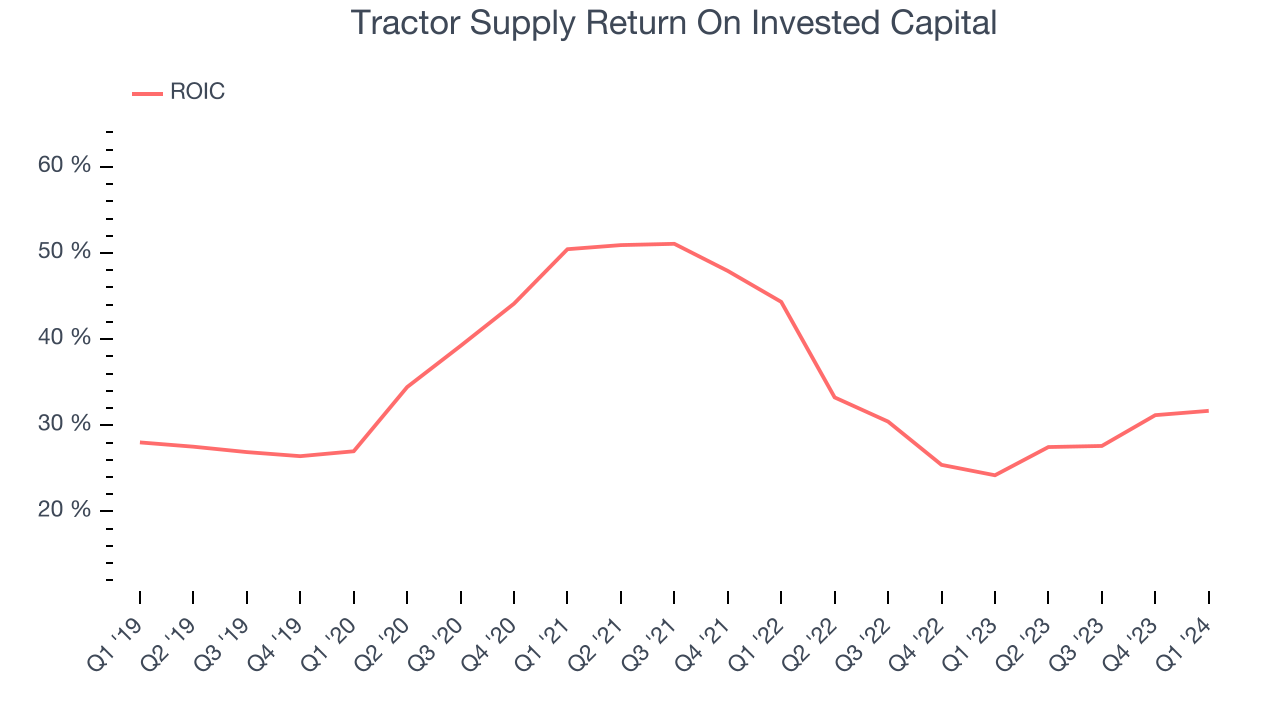

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Tractor Supply's five-year average ROIC was 35.5%, placing it among the best retail companies. Just as you’d like your investment dollars to generate returns, Tractor Supply's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Tractor Supply's ROIC averaged 10.8 percentage point decreases over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Tractor Supply reported $264.1 million of cash and $1.73 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.90 billion of EBITDA over the last 12 months, we view Tractor Supply's 0.8x net-debt-to-EBITDA ratio as safe. We also see its $21.93 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Tractor Supply's Q1 Results

It was good to see Tractor Supply beat analysts' same store sales and EPS expectations this quarter. On the other hand, its revenue and gross margin missed analysts' expectations and its full-year revenue and earnings guidance, while maintained from the previous outlook, missed Wall Street's estimates. Overall, this was a mixed quarter for Tractor Supply. The stock is flat after reporting and currently trades at $256.97 per share.

Is Now The Time?

When considering an investment in Tractor Supply, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Tractor Supply is a solid business. First off, its revenue growth has been solid over the last five years. And while its poor same-store sales performance has been a headwind, its stellar ROIC suggests it has been a well-run company historically. On top of that, its new store openings show it's growing its brand.

Tractor Supply's price-to-earnings ratio based on the next 12 months is 24.8x. There are definitely things to like about Tractor Supply and there's no doubt it's a bit of a market darling, at least for some investors. But when considering the company against the backdrop of the consumer landscape, it seems there's a lot of optimism already priced in. We wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $247.42 per share right before these results (compared to the current share price of $256.97).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.