Earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Trade Desk (NASDAQ:TTD) and the rest of the sales and marketing software stocks fared in Q2.

The Internet and exploding amounts of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, with sales and marketing software providers the tools of evolving customer interaction.

The 15 sales and marketing software stocks we track reported a a decent Q2; on average, revenues beat analyst consensus estimates by 5.23%, while on average next quarter revenue guidance was 3.57% above consensus. On average the share price was down 0.17% the day after the earnings.

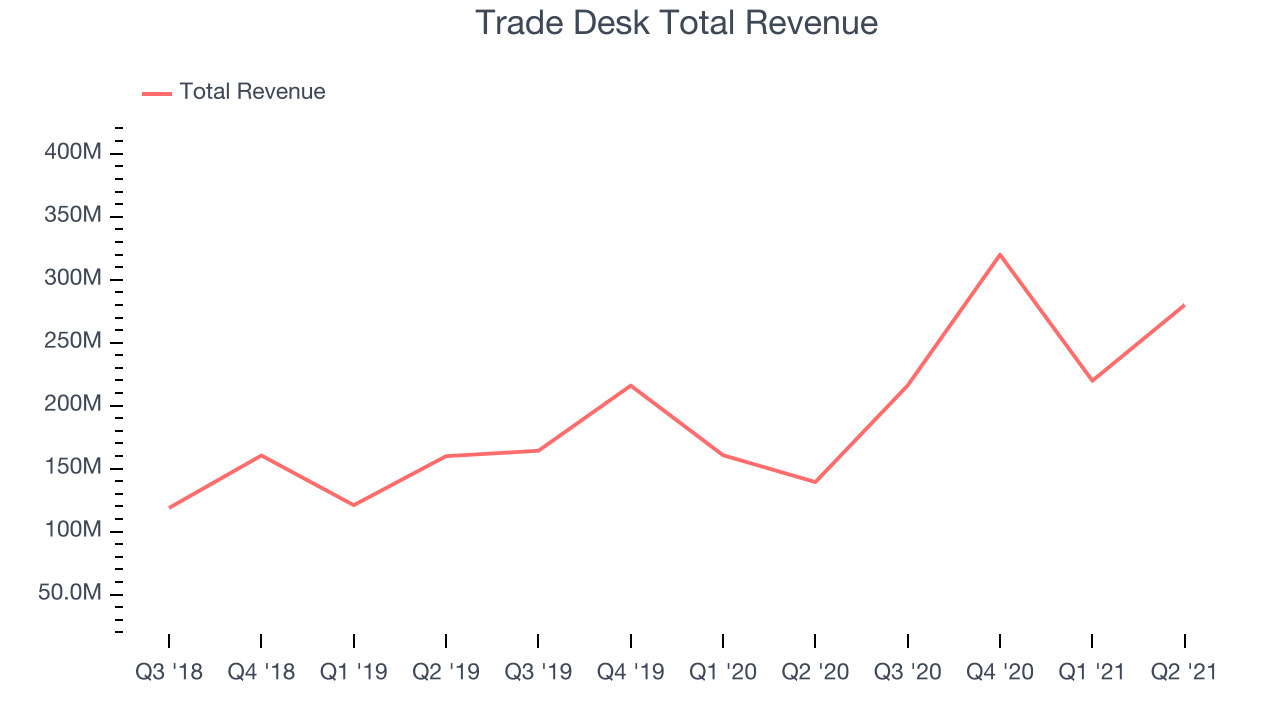

Best Q2: Trade Desk (NASDAQ:TTD)

Founded in 2009, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place and target their online ads.

Trade Desk reported revenues of $279.9 million, up 100% year on year, beating analyst expectations by 6.52%. It was an impressive quarter for the company, with an exceptional revenue growth and a significant improvement in gross margin.

“Revenue more than doubled year-over-year to $280 million in the second quarter. Our growth speaks to The Trade Desk’s position as the default DSP for the open internet. Nowhere is this more apparent than in Connected TV, as more premium streaming inventory becomes available to meet growing marketer demand for data-driven TV advertising,” said Jeff Green, founder and CEO of The Trade Desk.

Trade Desk pulled off the fastest revenue growth and highest full year guidance raise of the whole group. The stock is up 4.24% since the results and currently trades at $66.49.

We think Trade Desk is a good business, but is it a buy today? Read our full report here, it's free.

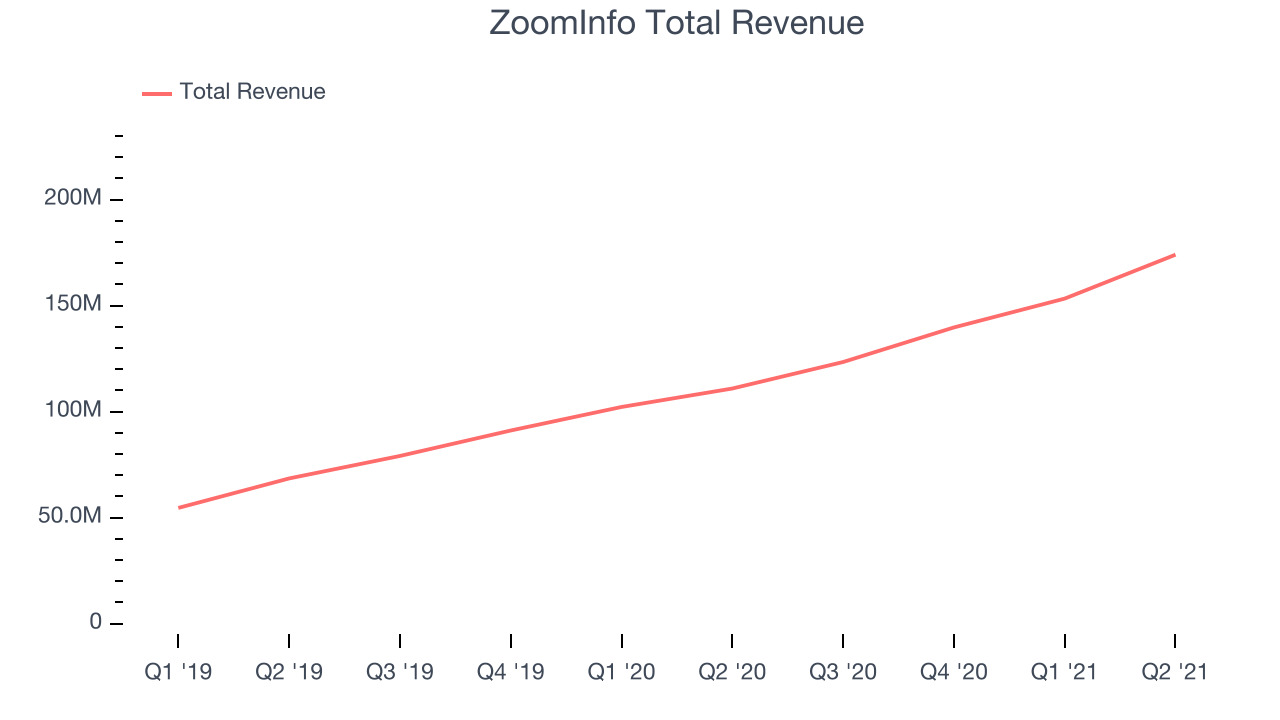

ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $174 million, up 56.8% year on year, beating analyst expectations by 7.09%. It was an impressive quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

ZoomInfo delivered the strongest analyst estimates beat among its peers. The company added 150 enterprise customers paying more than $100,000 annually to a total of 1,100. The stock is up 3.21% since the results and currently trades at $60.40.

Is now the time to buy ZoomInfo? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $316.4 million, up 34% year on year, beating analyst expectations by 1.52%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations.

The stock is down 19% since the results and currently trades at $184.

Read our full analysis of Wix's results here.

BigCommerce (NASDAQ:BIGC)

Founded in 2009, BigCommerce provides software for businesses to easily create online stores.

BigCommerce reported revenues of $49 million, up 34.9% year on year, beating analyst expectations by 4.71%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter.

The company added 477 enterprise customers paying more than $2,000 annually to a total of 10,986. The stock is down 11.4% since the results and currently trades at $47.75.

Read our full, actionable report on BigCommerce here, it's free.

LiveRamp (NYSE:RAMP)

Founded in 2011, LiveRamp provides software as a service that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $119 million, up 19.7% year on year, beating analyst expectations by 6.29%. It was a very strong quarter for the company, with accelerating customer growth.

The company kept the number of enterprise customers paying more than $1m annually flat at a total of 70. The stock is up 22.1% since the results and currently trades at $45.61.

Read our full, actionable report on LiveRamp here, it's free.

The author has no position in any of the stocks mentioned