Advertising software maker The Trade Desk (NASDAQ:TTD) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 25.9% year on year to $584.6 million. Guidance for next quarter's revenue was also optimistic at $618 million at the midpoint, 2.1% above analysts' estimates. It made a non-GAAP profit of $0.39 per share, improving from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy The Trade Desk? Find out by accessing our full research report, it's free.

The Trade Desk (TTD) Q2 CY2024 Highlights:

- Revenue: $584.6 million vs analyst estimates of $578.1 million (1.1% beat)

- EPS (non-GAAP): $0.39 vs analyst estimates of $0.36 (9.5% beat)

- Revenue Guidance for Q3 CY2024 is $618 million at the midpoint, above analyst estimates of $605.5 million

- Gross Margin (GAAP): 81.1%, in line with the same quarter last year

- Free Cash Flow of $56.68 million, down 67.8% from the previous quarter

- Market Capitalization: $41.53 billion

“Q2 was another strong quarter for The Trade Desk, with revenue of $585 million, representing 26% year-over-year growth,” said Jeff Green, Co-founder and CEO of The Trade Desk.

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

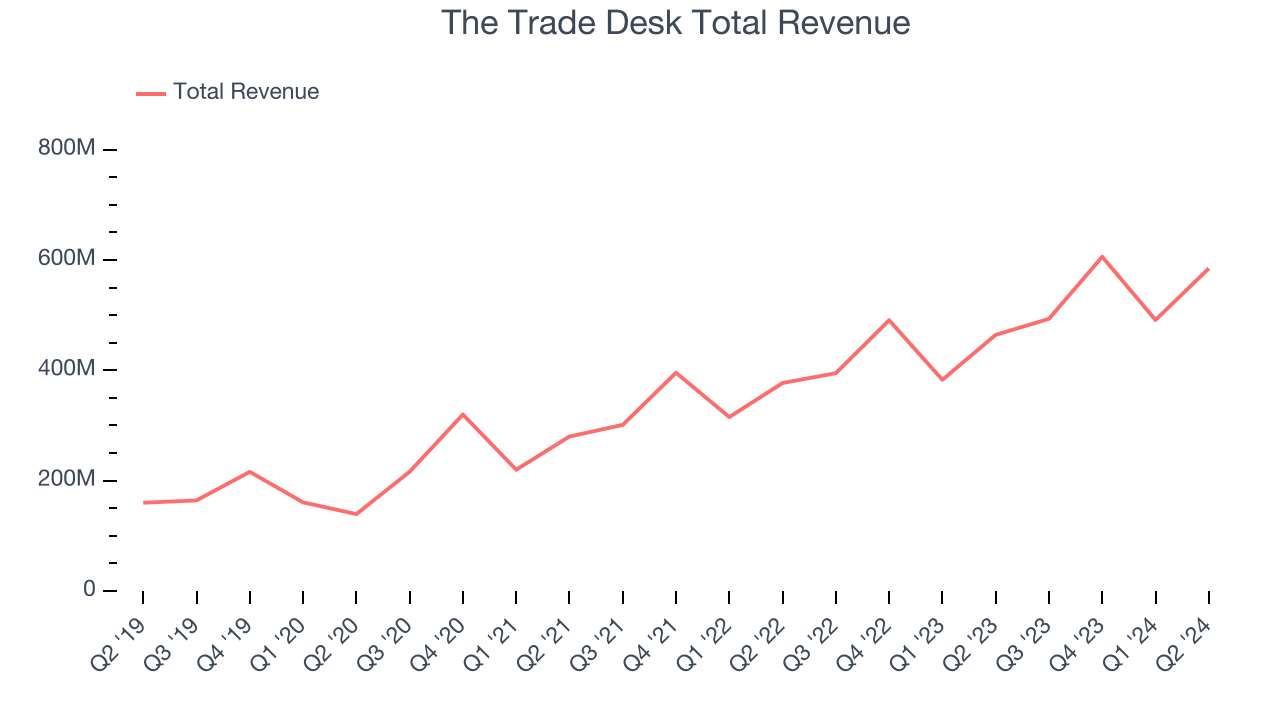

As you can see below, The Trade Desk's 28.1% annualized revenue growth over the last three years has been impressive, and its sales came in at $584.6 million this quarter.

This quarter, The Trade Desk's quarterly revenue was once again up a very solid 25.9% year on year. On top of that, its revenue increased $93.3 million quarter on quarter, a strong improvement from the $114.5 million decrease in Q1 CY2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that The Trade Desk is expecting revenue to grow 25.3% year on year to $618 million, in line with the 24.9% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 21.1% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

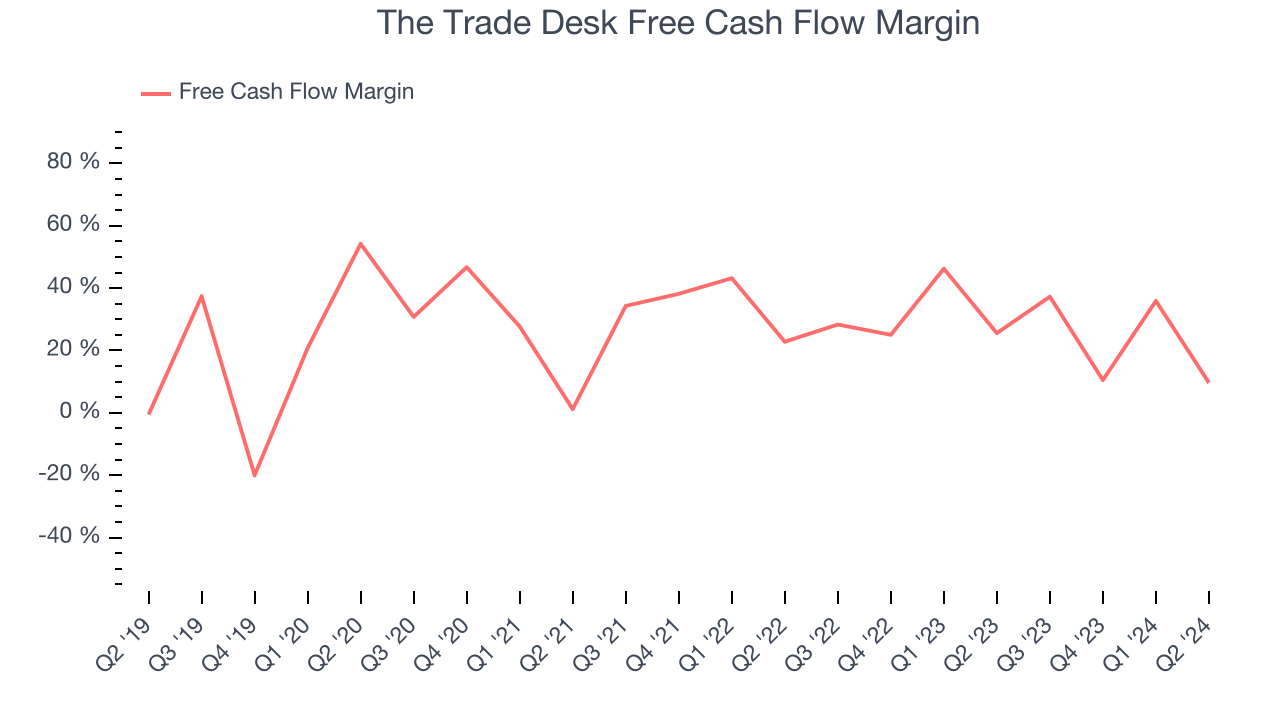

The Trade Desk has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company's free cash flow margin averaged 22.1% over the last year, quite impressive for a software business.

The Trade Desk's free cash flow clocked in at $56.68 million in Q2, equivalent to a 9.7% margin. The company's cash profitability regressed as it was 15.9 percentage points lower than in the same quarter last year, but we wouldn't put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict The Trade Desk's cash conversion will improve. Their consensus estimates imply its free cash flow margin of 22.1% for the last 12 months will increase to 28.6%, giving it more money to invest.

Key Takeaways from The Trade Desk's Q2 Results

It was great to see The Trade Desk improve its gross margin this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this quarter was mixed but with some key positives. The stock traded up 5.8% to $93.30 immediately after reporting.

The Trade Desk may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.