Advertising software maker The Trade Desk (NASDAQ:TTD) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 28.3% year on year to $491.3 million. Guidance for next quarter's revenue was also better than expected at $575 million at the midpoint, 1.4% above analysts' estimates. It made a non-GAAP profit of $0.26 per share, improving from its profit of $0.02 per share in the same quarter last year.

The Trade Desk (TTD) Q1 CY2024 Highlights:

- Revenue: $491.3 million vs analyst estimates of $480.5 million (2.2% beat)

- EPS (non-GAAP): $0.26 vs analyst estimates of $0.22 (20.7% beat)

- Revenue Guidance for Q2 CY2024 is $575 million at the midpoint, above analyst estimates of $567.1 million

- Gross Margin (GAAP): 78.9%, up from 77.8% in the same quarter last year

- Free Cash Flow of $176.3 million, up 176% from the previous quarter

- Market Capitalization: $43.81 billion

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

Digital advertising is a massive industry and while large platforms like Google and Facebook provide tools for buyers of ads, it is still in their interest to sell as many ads for as much money as possible. The Trade Desk is providing online marketing agencies with an independent platform that helps them optimize ad campaigns to be more cost-efficient.

The platform integrates the data advertisers have about their potential customers with all the other data The Trade Desk has available, and automatically makes suggestions about who is the highest-value audience, when to reach them, and how. Once the campaign is running, The Trade Desk scans millions of available ad slots in real-time and automatically makes bids for placements when they are likely to yield the results the advertiser is looking for. Interestingly, to keep its incentives aligned with its customers, The Trade Desk is selling the ad slots at cost and not making any money from them. Instead it charges its customers a subscription fee for using its product that is based on a percentage of the overall ad spend.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The Trade Desk is mainly competing with tools for ad buyers provided by ad sellers like Google (NASDAQ:GOOGL) or Facebook (NASDAQ:FB) and divisions of companies like AT&T (NYSE:T) and Adobe (NASDAQ:ADBE).

Sales Growth

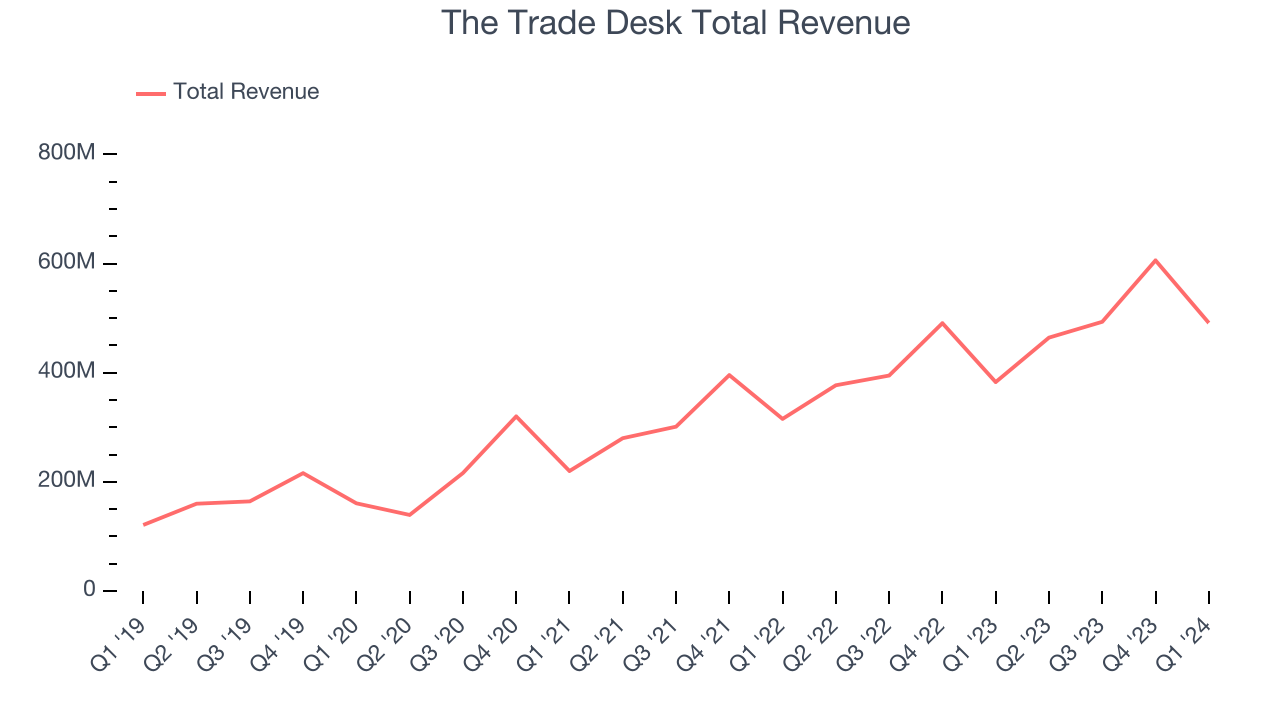

As you can see below, The Trade Desk's revenue growth has been very strong over the last three years, growing from $219.8 million in Q1 2021 to $491.3 million this quarter.

This quarter, The Trade Desk's quarterly revenue was once again up a very solid 28.3% year on year. However, the company's revenue actually decreased by $114.5 million in Q1 compared to the $112.5 million increase in Q4 CY2023. Regardless, we aren't too concerned because The Trade Desk's sales seem to follow a seasonal pattern and management is guiding for revenue to rebound in the coming quarter.

Next quarter's guidance suggests that The Trade Desk is expecting revenue to grow 23.9% year on year to $575 million, in line with the 23.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 21.2% over the next 12 months before the earnings results announcement.

Profitability

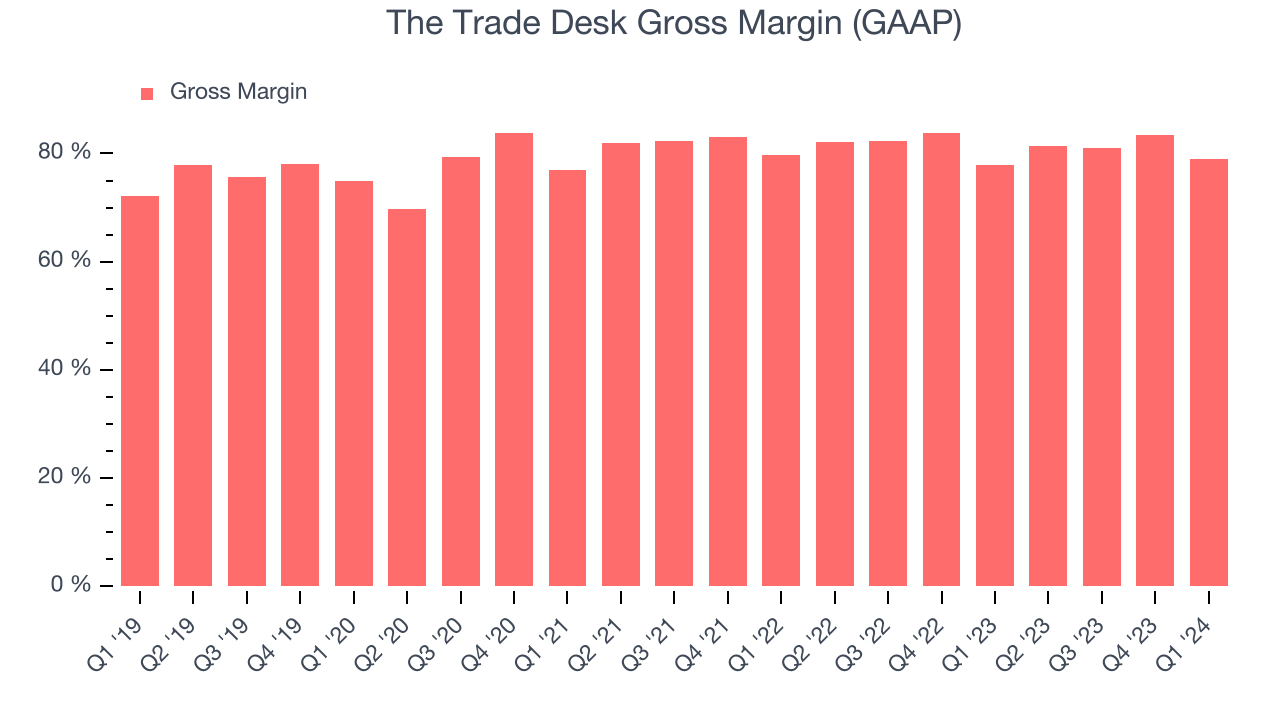

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. The Trade Desk's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 78.9% in Q1.

That means that for every $1 in revenue the company had $0.79 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite the recent drop, The Trade Desk still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

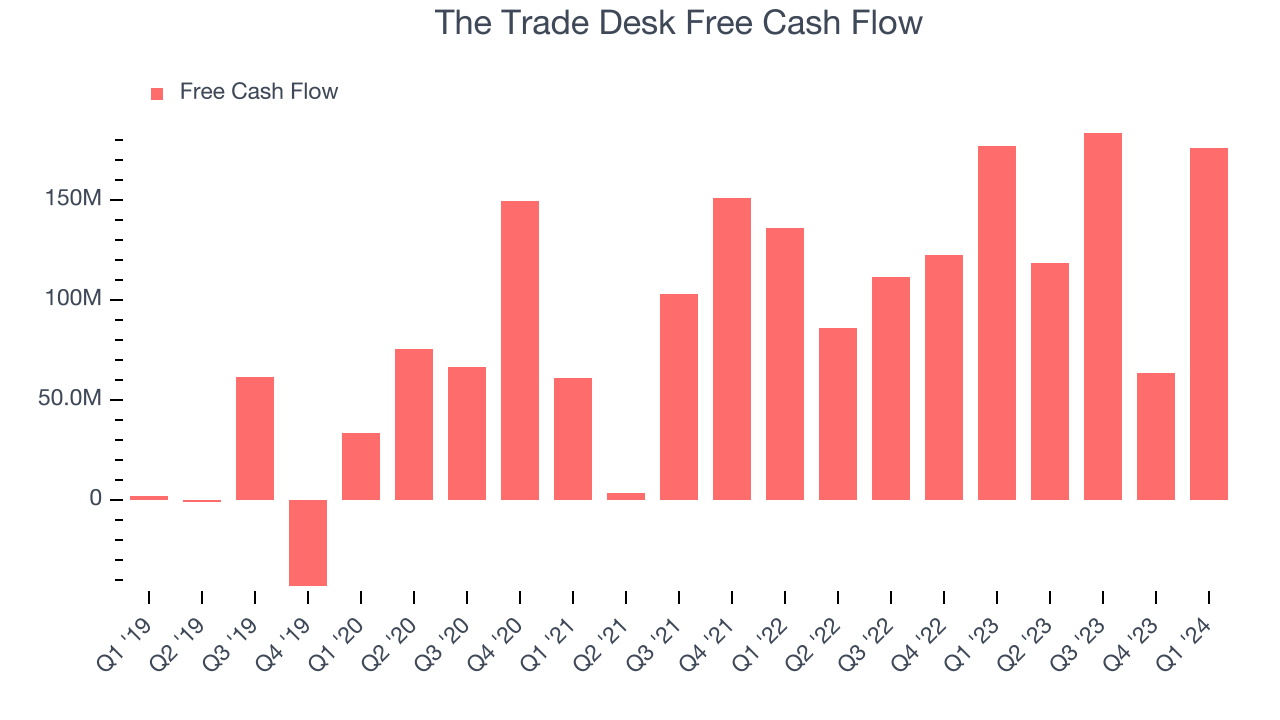

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. The Trade Desk's free cash flow came in at $176.3 million in Q1, roughly the same as last year.

The Trade Desk has generated $542.6 million in free cash flow over the last 12 months, an eye-popping 26.4% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from The Trade Desk's Q1 Results

It was encouraging to see The Trade Desk beat analysts' revenue guidance expectations. We were also glad its revenue this quarter outperformed Wall Street's estimates. On the other hand, its gross margin declined. Zooming out, we think this was still a decent quarter, showing that the company is staying on track. The stock is up 1.4% after reporting and currently trades at $87.3 per share.

Is Now The Time?

When considering an investment in The Trade Desk, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think The Trade Desk is one of the best software as service companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been strong over the last three years. Additionally, its efficient customer acquisition hints at the potential for strong profitability, and its bountiful generation of free cash flow empowers it to invest in growth initiatives.

There's no doubt the market is optimistic about The Trade Desk's growth prospects, as its 17.2x price-to-sales ratio based on the next 12 months would suggest. Looking at the tech landscape today, The Trade Desk's qualities as one of the best businesses really stand out and there's no doubt it's a bit of a market darling. We don't mind paying a premium for a premium business and would argue that it's often wise to hold on to quality businesses long term, even when expectations are high, but we do want to mention that there seems to be a lot optimism priced in at the moment.

Wall Street analysts covering the company had a one-year price target of $95.51 right before these results (compared to the current share price of $87.30).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.