Video game publisher Take Two (NASDAQ:TTWO) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 4.2% year on year to $1.34 billion. On the other hand, next quarter's revenue guidance of $1.32 billion was less impressive, coming in 6.4% below analysts' estimates. It made a GAAP loss of $1.52 per share, down from its loss of $1.20 per share in the same quarter last year.

Is now the time to buy Take-Two? Find out by accessing our full research report, it's free.

Take-Two (TTWO) Q2 CY2024 Highlights:

- Revenue: $1.34 billion vs analyst estimates of $1.32 billion (1.5% beat)

- EPS: -$1.52 vs analyst expectations of -$1.37 (11.2% miss)

- Revenue Guidance for Q3 CY2024 is $1.32 billion at the midpoint, below analyst estimates of $1.41 billion

- The company reconfirmed its revenue guidance for the full year of $5.62 billion at the midpoint

- EPS (GAAP) guidance for Q3 CY2024 is -$2.22 at the midpoint, missing analyst estimates by 137%

- EPS (GAAP) guidance for the full year is -$4.14 at the midpoint, missing analyst estimates by 28.9%

- EBITDA guidance for the full year is $392.5 million at the midpoint, below analyst estimates of $802.3 million

- Gross Margin (GAAP): 57.6%, up from 54.3% in the same quarter last year

- EBITDA Margin: 1.9%, down from 8% in the same quarter last year

- Free Cash Flow was -$226.1 million compared to -$55.1 million in the previous quarter

- Market Capitalization: $23.78 billion

“We achieved solid first quarter results by engaging our players with exciting new game releases and content updates, while also maintaining our focus on efficiency. Our management team remains confident in our path forward and we are reiterating our Net Bookings outlook for the year of $5.55 to $5.65 billion,” said Strauss Zelnick, Chairman and CEO of Take-Two Interactive.

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

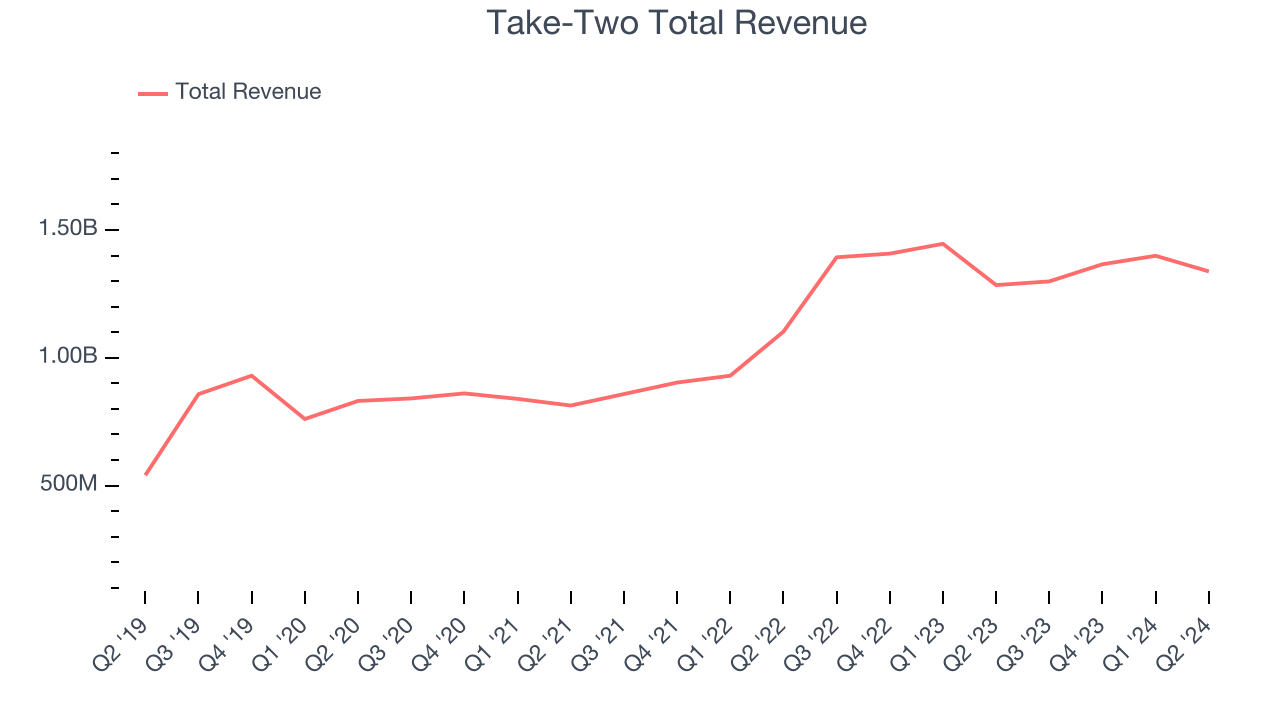

Take-Two's revenue growth over the last three years has been solid, averaging 19.6% annually. This quarter, Take-Two beat analysts' estimates but reported lacklustre 4.2% year-on-year revenue growth.

Guidance for the next quarter indicates Take-Two is expecting revenue to grow 1.2% year on year to $1.32 billion, improving from the 6.8% year-on-year decline it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 5.5% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Key Takeaways from Take-Two's Q2 Results

It was good to see Take-Two narrowly top analysts' revenue expectations this quarter. On the other hand, its EBITDA and EPS guidance for the full year missed analysts' expectations. Overall, this was a mixed quarter for Take-Two. The stock traded up 4.3% to $144.70 immediately after reporting.

So should you invest in Take-Two right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.