As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today we are looking at the vertical software stocks, starting with 2U (NASDAQ:TWOU).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 11 vertical software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.53%, while on average next quarter revenue guidance was 2.08% under consensus. Technology stocks have been hit hard on fears of higher interest rates, but vertical software stocks held their ground better than others, with share price down 3.03% since earnings, on average.

2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

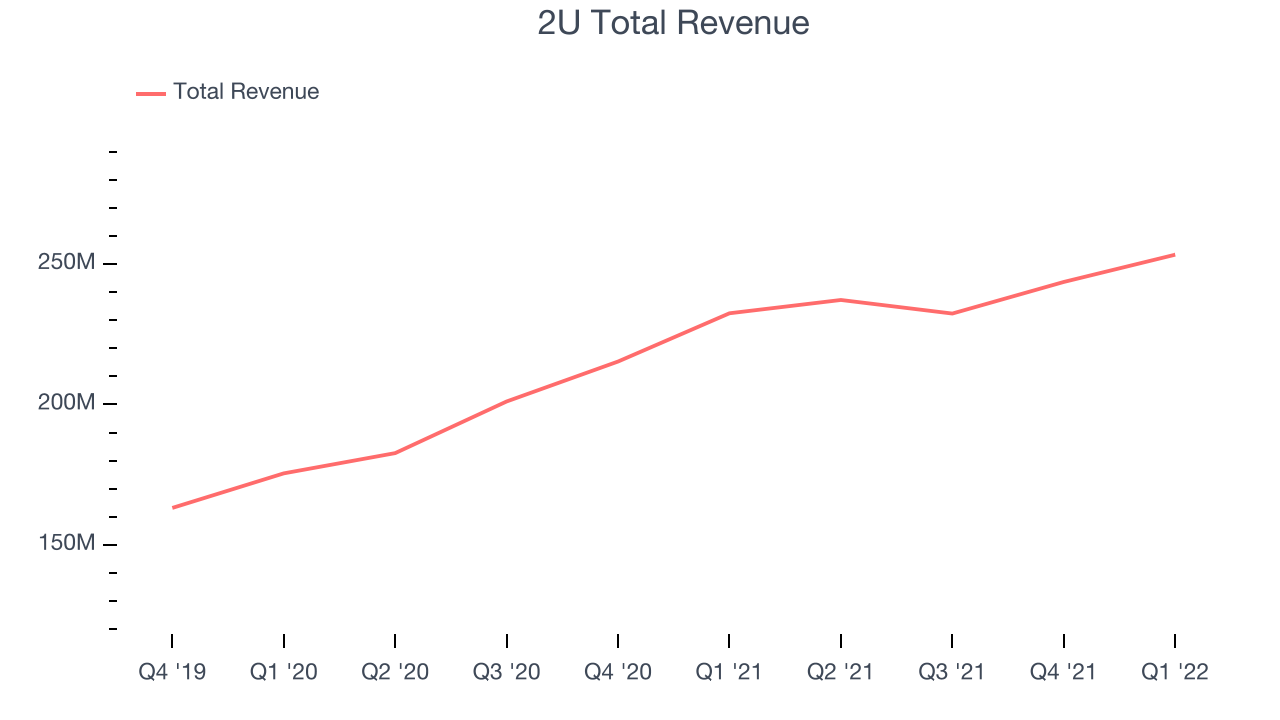

2U reported revenues of $253.3 million, up 8.97% year on year, in line with analyst expectations. It was a weaker quarter for the company, with a slow revenue growth and a decline in gross margin.

"Today, 2U's mission is not just about showing it's possible to create high-quality online programs at scale, but also increasing access to high-quality education for everyone, everywhere, at every stage of life," said Christopher "Chip" Paucek, Co-Founder and CEO of 2U. "As we transition to a platform company under the edX brand, our partnerships help make institutions sustainable and help individuals unlock the livelihoods they want now and in the future.

2U delivered the slowest revenue growth of the whole group. The stock is up 19.2% since the results and currently trades at $11.16.

Read our full report on 2U here, it's free.

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

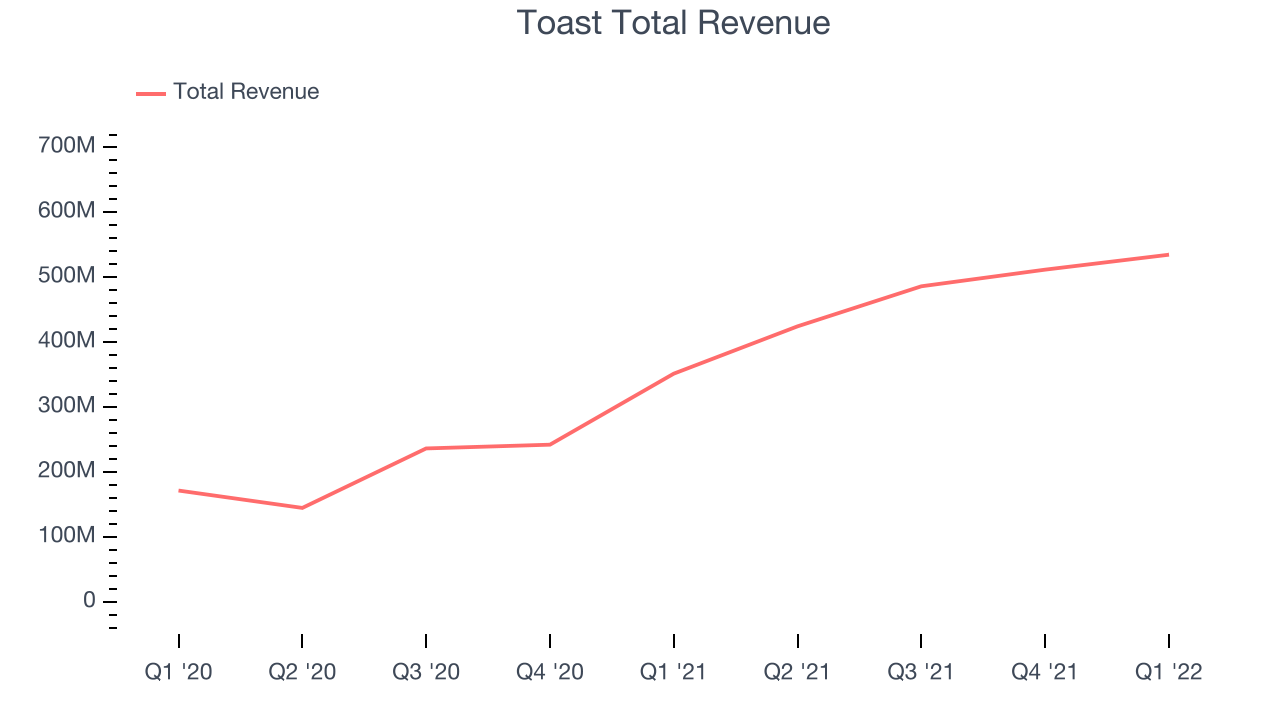

Toast reported revenues of $535 million, up 52% year on year, beating analyst expectations by 9.07%. It was an incredible quarter for the company, with a significant improvement in gross margin and a very optimistic guidance for the next quarter.

Toast pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 4.62% since the results and currently trades at $13.60.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $320.1 million, up 36.3% year on year, missing analyst expectations by 0.31%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year below analysts' estimates.

Unity had the weakest performance against analyst estimates in the group. The company added 31 enterprise customers paying more than $100,000 annually to a total of 1,083. The stock is down 15.3% since the results and currently trades at $40.72.

Read our full analysis of Unity's results here.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $4.38 billion, up 14.3% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year below analysts' estimates.

The stock is up 3.85% since the results and currently trades at $380.

Read our full, actionable report on Adobe here, it's free.

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $505.1 million, up 16.4% year on year, beating analyst expectations by 1.85%. It was a mixed quarter for the company, with a decent beat of analyst estimates but a slow revenue growth.

The stock is up 22.4% since the results and currently trades at $205.52.

Read our full, actionable report on Veeva Systems here, it's free.

The author has no position in any of the stocks mentioned