Online education platform, 2U (NASDAQ:TWOU) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue down 16.8% year on year to $198.4 million. On the other hand, next quarter's revenue guidance of $192.5 million was less impressive, coming in 1.6% below analysts' estimates. It made a non-GAAP loss of $0.22 per share, down from its loss of $0.10 per share in the same quarter last year.

2U (TWOU) Q1 CY2024 Highlights:

- Revenue: $198.4 million vs analyst estimates of $195.9 million (1.3% beat)

- EPS (non-GAAP): -$0.22 vs analyst estimates of -$0.34 (35.8% beat)

- Revenue Guidance for Q2 CY2024 is $192.5 million at the midpoint, below analyst estimates of $195.7 million

- The company reconfirmed its revenue guidance for the full year of $810 million at the midpoint

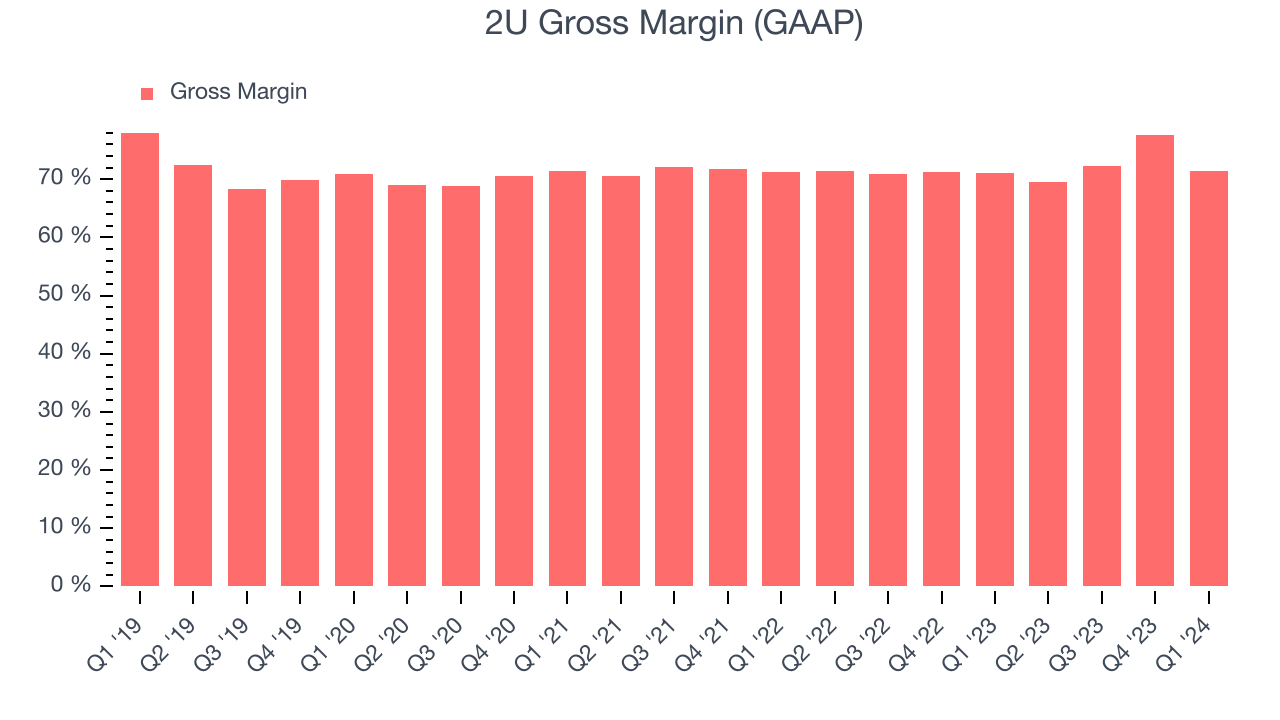

- Gross Margin (GAAP): 71.5%, in line with the same quarter last year

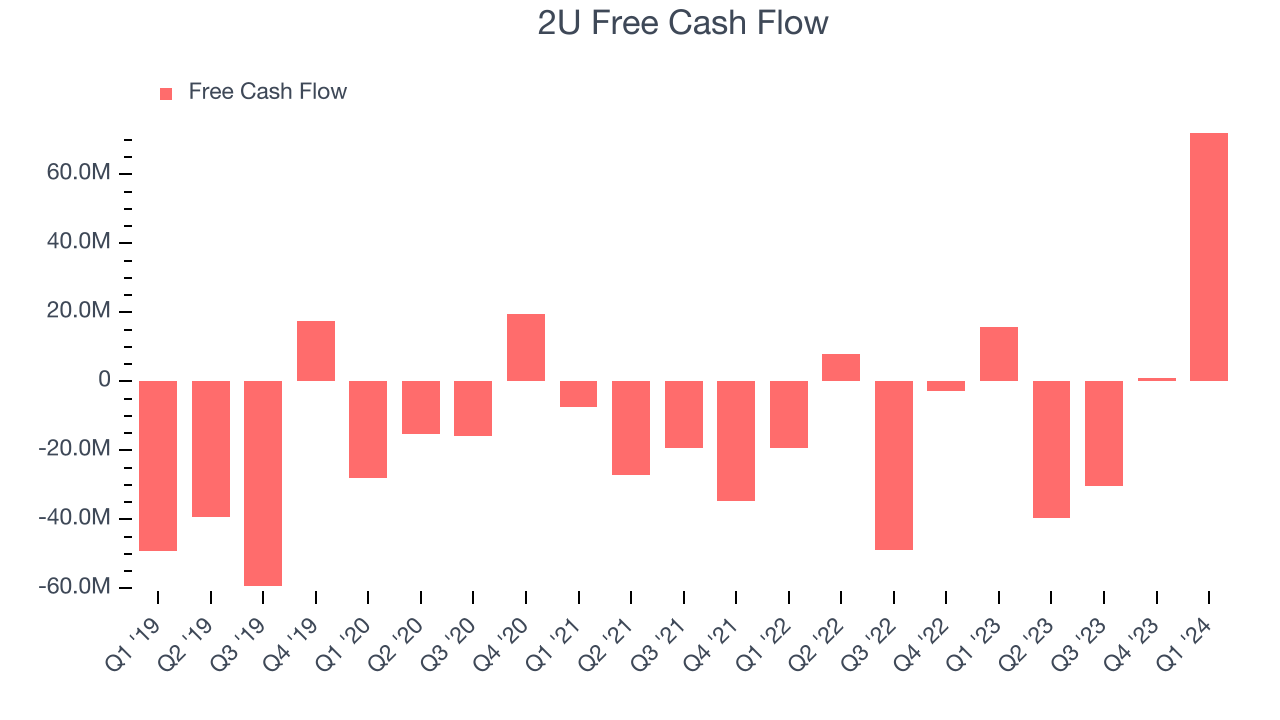

- Free Cash Flow of $72.07 million, up from $835,000 in the previous quarter

- Market Capitalization: $20.6 million

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

There is a growing demand for online courses; however, the poor completion rate of online classes shows that creating a successful online course is hard and requires more effort than just uploading a recording of the lecture online.

While universities are experts in teaching, they struggle to create engaging online courses. As the COVID pandemic makes it difficult for students to learn on-campus, there is a need for platforms that make it possible to replicate the offline learning experience.

2U provides schools with software as a service that helps them create online courses that are engaging and successful with students. The cloud-based software works as an operating system that the whole course runs on and includes all the user-facing technology for students to engage with their courses and behind the scenes infrastructure to host and administer engaging video content.

Using the software, schools can create instructor-led live classes, track student engagement and learning outcomes, and also provide a social network to connect students and other faculty. 2U also offers expert services to train universities on how to create engaging classes and insights on courses that are most likely to perform well.

Courses are available on the web and mobile platforms, which means they can be accessed from any location at all times. 2U generates revenue by taking a cut from tuition paid by students to schools. While it started by enabling some of the world’s top universities such as UC Berkeley and Yale to offer degree programs, it has since expanded into delivering boot camps, short courses, and professional programs to people trying to advance their careers.

Education Software

The overwhelming trend of moving work, life and consumption of content online is starting to catch up with the education sector that has until recently stuck to providing courses and degrees in the same way as they did decades ago - in person. The COVID pandemic massively accelerated adoption of online education and has forced institutions to invest in creating digital courses, which drives demand for the software that enables it.

Competitors in the online learning space include Stride (NYSE:LRN), Adtalem Global Education (NYSE:ATGE), Arco Platform (NASDAQ:ARCE), Strategic Education (NASDAQ:STRA), and schools that develop their online courses in-house.

Sales Growth

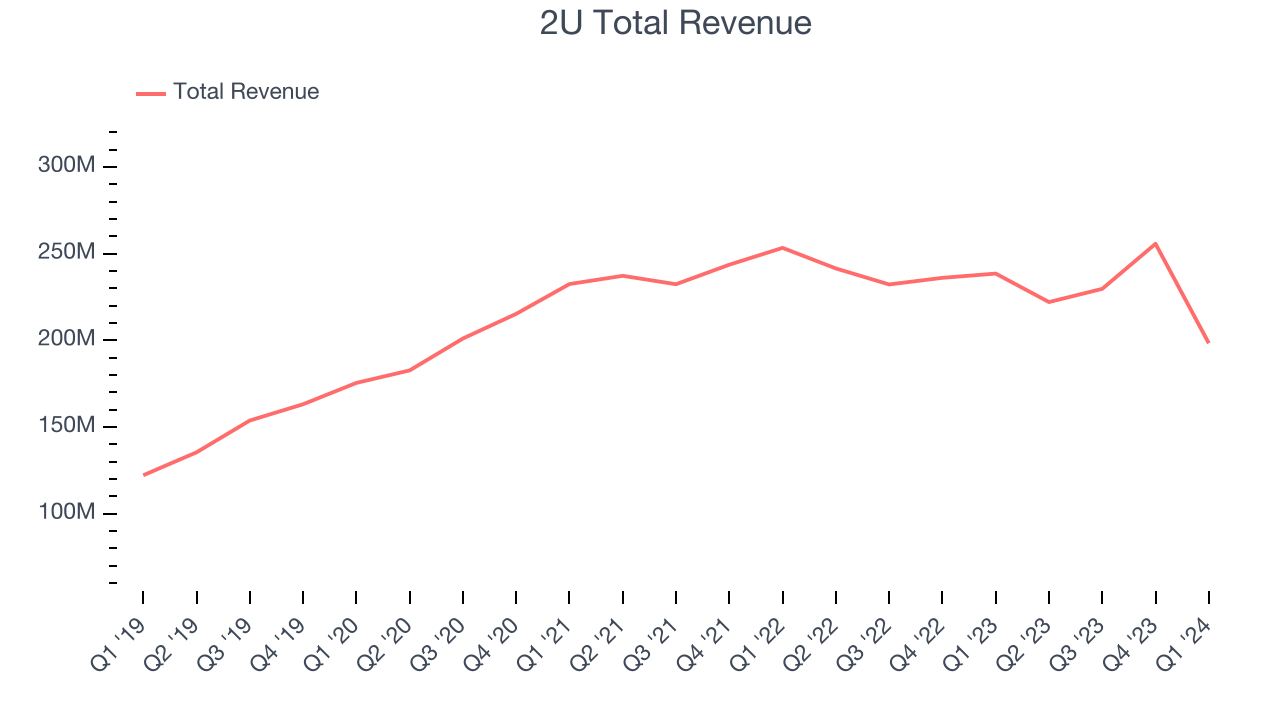

As you can see below, 2U's revenue growth has been unimpressive over the last three years, growing from $232.5 million in Q1 2021 to $198.4 million this quarter.

This quarter, 2U's revenue was down 16.8% year on year, which might disappointment some shareholders.

Next quarter, 2U is guiding for a 13.3% year-on-year revenue decline to $192.5 million, a further deceleration from the 8% year-on-year decrease it recorded in the same quarter last year.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. 2U's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.5% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. 2U's gross margin is lower than that of a typical SaaS businesses and its decline over the last year is putting it in an even deeper hole. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. 2U's free cash flow came in at $72.07 million in Q1, up 360% year on year.

2U broke even from a free cash flow perspective over the last 12 months. This below-average FCF margin stems from 2U's need to reinvest in its business to penetrate the market.

Key Takeaways from 2U's Q1 Results

We were happy to see 2U's revenue and EPS outperform Wall Street's expectations this quarter. On the other hand, its gross margin shrunk and revenue guidance for next quarter missed analysts' expectations. Overall, we think it was a decent quarter. The stock is up 3.2% after reporting and currently trades at $0.28 per share.

Is Now The Time?

When considering an investment in 2U, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of 2U, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. And while its efficient customer acquisition hints at the potential for strong profitability, unfortunately, its low free cash flow margins give it little breathing room.

While we've no doubt one can find things to like about 2U, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $1.13 right before these results (compared to the current share price of $0.28).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.