Analog chip manufacturer Texas Instruments (NASDAQ:TXN) fell short of analysts' expectations in Q3 FY2023, with revenue down 13.5% year on year to $4.53 billion. Turning to EPS, Texas Instruments made a GAAP profit of $1.85 per share, down from its profit of $2.47 per share in the same quarter last year.

Is now the time to buy Texas Instruments? Find out by accessing our full research report, it's free.

Texas Instruments (TXN) Q3 FY2023 Highlights:

- Revenue: $4.53 billion vs analyst estimates of $4.59 billion (1.22% miss)

- EPS: $1.85 vs analyst estimates of $1.82 (1.88% beat)

- Revenue Guidance for Q4 2023 is $4.1 billion at the midpoint, below analyst estimates of $4.5 billion

- Free Cash Flow of $442 million is up from -$47 million in the previous quarter

- Inventory Days Outstanding: 207, down from 209 in the previous quarter

- Gross Margin (GAAP): 62.1%, down from 69% in the same quarter last year

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ:TXN) is the world’s largest producer of analog semiconductors.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

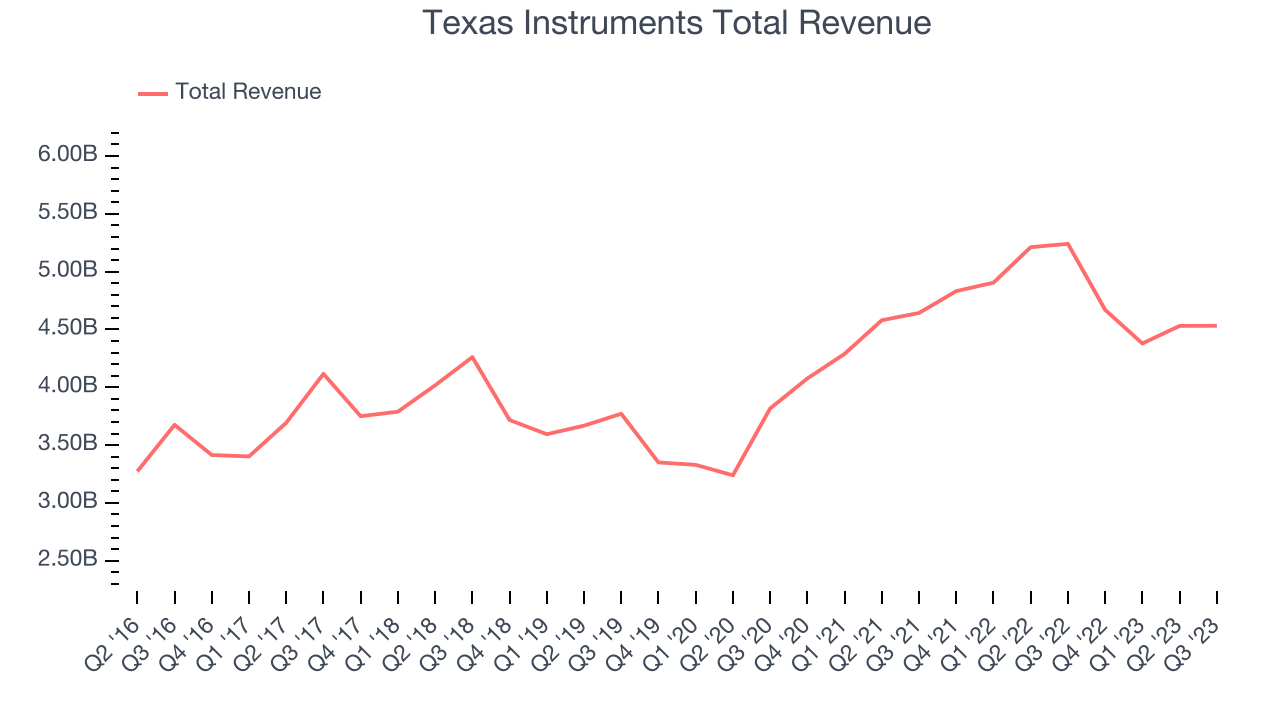

Sales Growth

Texas Instruments's revenue growth over the last three years has been unremarkable, averaging 11% annually. This quarter, its revenue declined from $5.24 billion in the same quarter last year to $4.53 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Texas Instruments had a difficult quarter as revenue dropped 13.5% year on year, missing analysts' estimates by 1.22%. This could mean that the current downcycle is deepening.

Texas Instruments's revenue growth has slowed over the last three quarters and its management team projects growth to turn negative next quarter. As such, the company is guiding for a 12.2% year-on-year revenue decline, but Wall Street thinks there will be a recovery next year. Analysts' estimates call for 3.46% growth over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

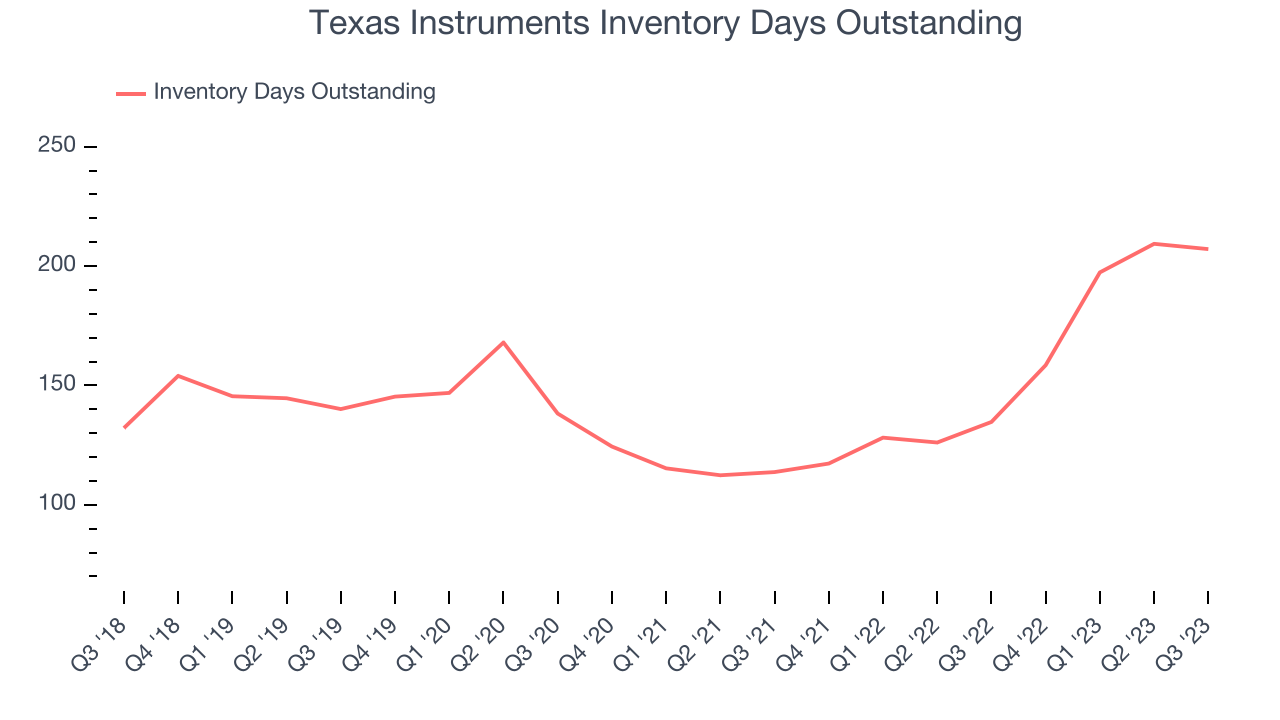

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Texas Instruments's DIO came in at 207, which is 61 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Texas Instruments's Q3 Results

Sporting a market capitalization of $133 billion, more than $8.95 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Texas Instruments is attractively positioned to invest in growth.

We struggled to find many strong positives in these results. Its revenue missed and revenue guidance for next quarter underwhelmed. Additionally, while EPS this quarter beat by a bit, EPS guidance for next quarter missed Wall Street's estimates. Overall, the results could have been better. The company is down 4.3% on the results and currently trades at $140.6 per share.

Texas Instruments may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.