Analog chip manufacturer Texas Instruments (NASDAQ:TXN) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 16.4% year on year to $3.66 billion. Guidance for next quarter's revenue was also better than expected at $3.8 billion at the midpoint, 1% above analysts' estimates. It made a GAAP profit of $1.20 per share, down from its profit of $1.85 per share in the same quarter last year.

Texas Instruments (TXN) Q1 CY2024 Highlights:

- Revenue: $3.66 billion vs analyst estimates of $3.61 billion (1.4% beat)

- EPS: $1.20 vs analyst estimates of $1.07 (12.4% beat)

- Revenue Guidance for Q2 CY2024 is $3.8 billion at the midpoint, above analyst estimates of $3.76 billion

- Gross Margin (GAAP): 57.2%, down from 65.4% in the same quarter last year

- Inventory Days Outstanding: 237, up from 221 in the previous quarter

- Market Capitalization: $148.7 billion

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ:TXN) is the world’s largest producer of analog semiconductors.

One of the oldest US-based technology companies, Texas Instruments created the first commercial silicon transistor and the transistor radio in 1954, the first handheld calculator in 1967, and the first microcontroller in 1970. Texas Instruments has long been the largest manufacturer and seller of analog chips, and serves one of the widest customer bases of

Its breadth of products is matched by its breadth of manufacturing, it runs 14 manufacturing sites around the world, from Germany to China to Japan and throughout Southeast Asia.

While personal electronics and industrial (manufacturing) end markets have long been TXN’s largest end markets, it also serves customers in automotive, communications, and enterprise computing.

Texas Instruments’ peers and competitors include Analog Devices (NASDAQ:ADI), Skyworks (NASDAQ:SWKS), Infineon (XTRA:IFX), NXP Semiconductors NV (NASDAQ:NXPI), ON Semi (NASDAQ:ON), and Microchip (NASDAQ:MCHP).Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

Sales Growth

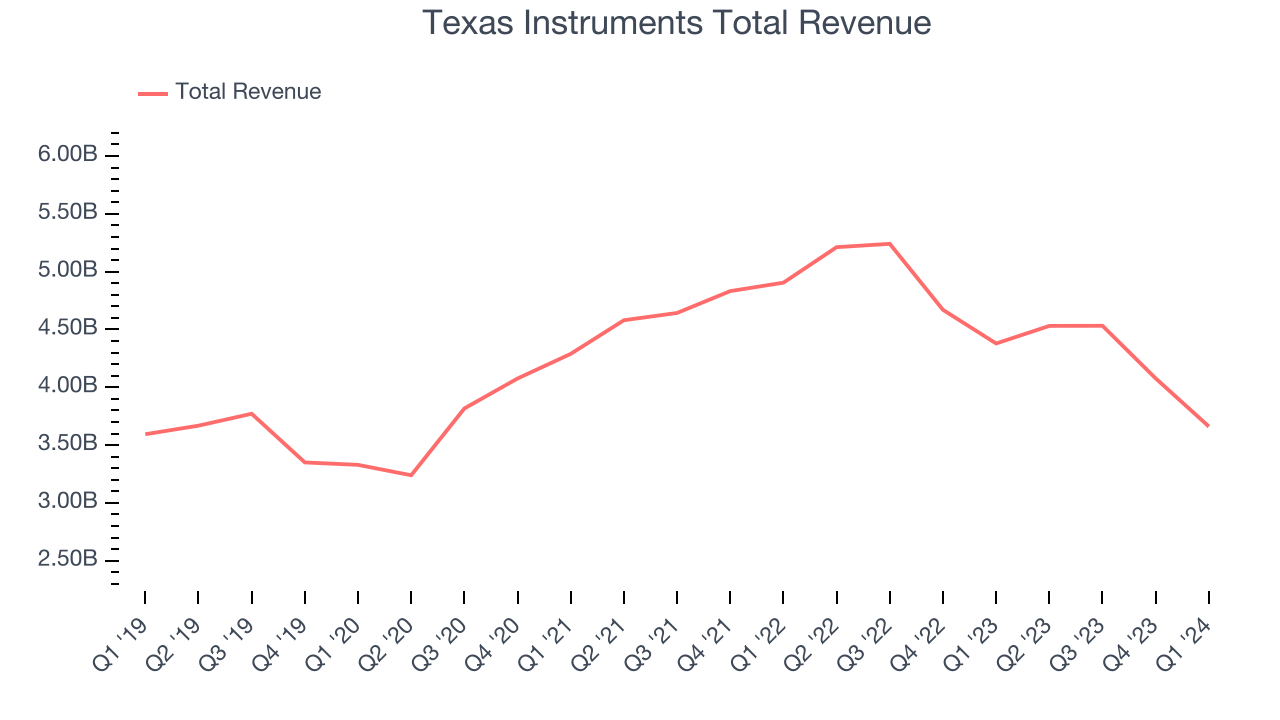

Texas Instruments's revenue growth over the last three years has been unimpressive, averaging 4.4% annually. This quarter, its revenue declined from $4.38 billion in the same quarter last year to $3.66 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Texas Instruments surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 16.4% year on year. This could mean that the current downcycle is deepening.

Texas Instruments looks like it's headed into the trough of the semiconductor cycle, as it's guiding for a year-on-year revenue decline of 16.1% next quarter. Analysts are also estimating a 2.8% decline over the next 12 months.

Product Demand & Outstanding Inventory

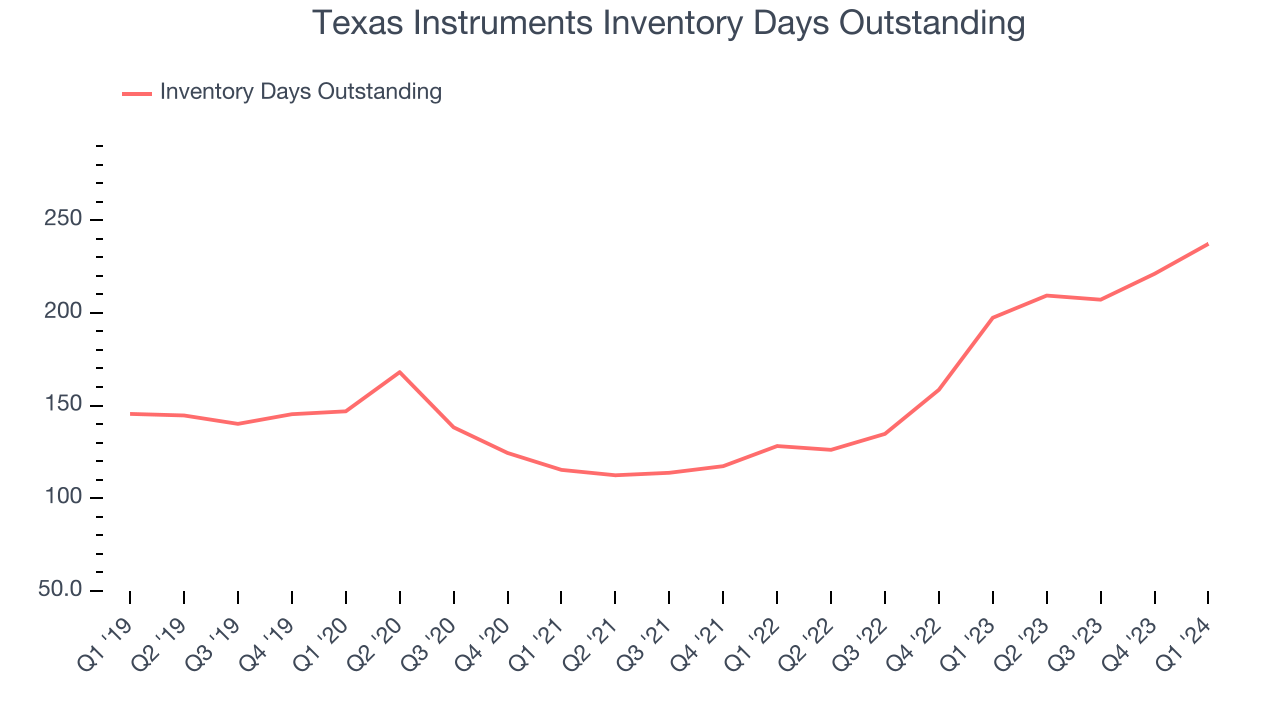

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Texas Instruments's DIO came in at 237, which is 83 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Pricing Power

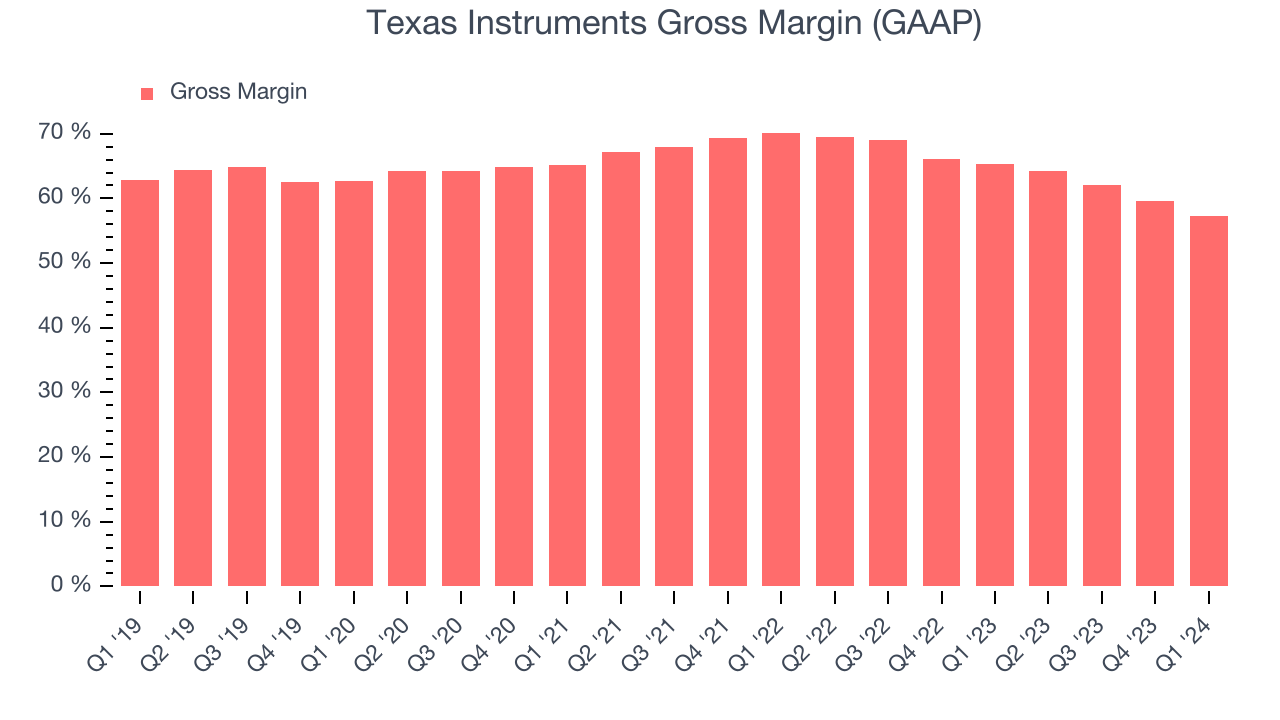

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Texas Instruments's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 57.2% in Q1, down 8.2 percentage points year on year.

Despite declining over the past year, Texas Instruments still retains robust gross margins, averaging 61%. These attractive unit economics point to its potent and competitive product offering, pricing power, and efficient inventory management.

Return on Invested Capital (ROIC)

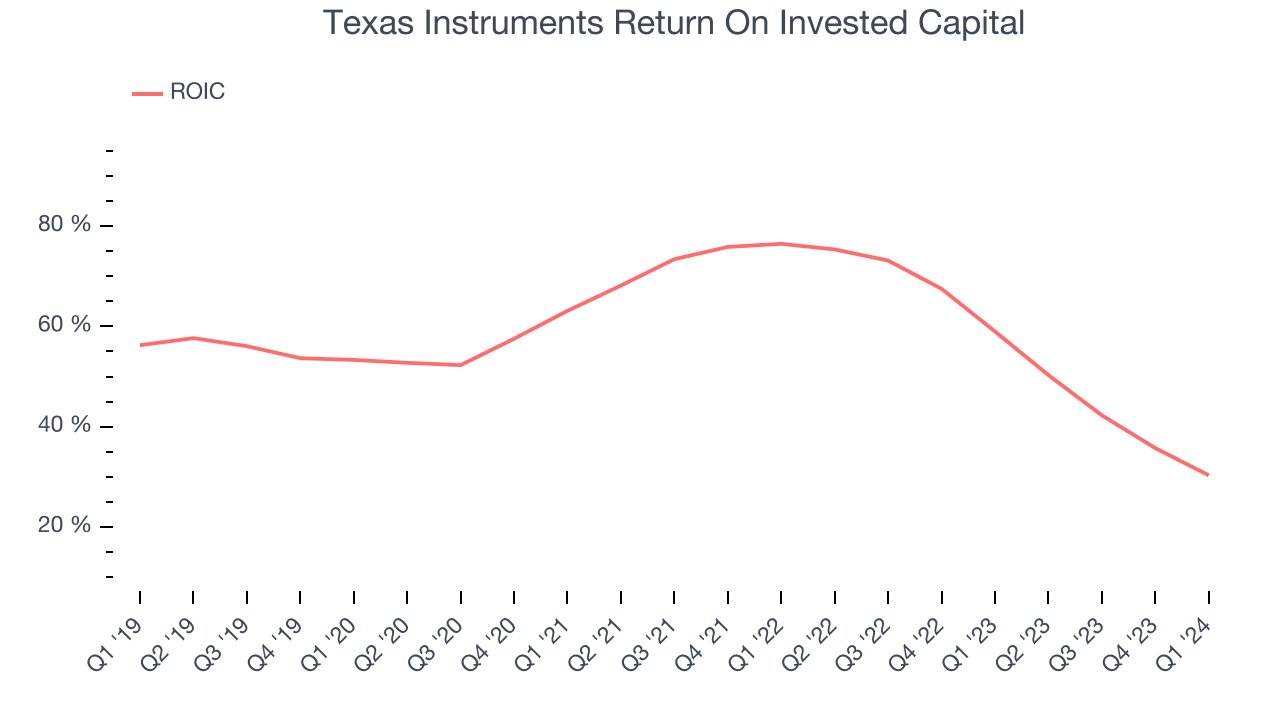

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Texas Instruments's five-year average ROIC was 56.4%, placing it among the best semiconductor companies. Just as you’d like your investment dollars to generate returns, Texas Instruments's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Texas Instruments's ROIC averaged 13.5 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Texas Instruments's Q1 Results

It was encouraging to see Texas Instruments' top analysts' revenue and EPS expectations this quarter, driven by strong performance in its analog segment. We were also glad next quarter's revenue guidance was above Wall Street's estimates. On the other hand, its gross margin fell and its inventory levels increased. Overall, this was a decent quarter for Texas Instruments. The stock is up 5.5% after reporting and currently trades at $174.5 per share.

Is Now The Time?

Texas Instruments may have had an average quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Texas Instruments isn't a bad business. Although its revenue growth has been weak over the last three years with analysts expecting growth to slow from here, its stellar ROIC suggests it has been a well-run company historically. Investors should still be cautious, however, as its low free cash flow margins give it little breathing room.

Texas Instruments's price-to-earnings ratio based on the next 12 months is 30.0x. In the end, beauty is in the eye of the beholder. While Texas Instruments wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $169.74 per share right before these results (compared to the current share price of $174.50).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.