The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how the sit-down dining stocks have fared in Q3, starting with Texas Roadhouse (NASDAQ:TXRH).

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 14 sit-down dining stocks we track reported a mixed Q3; on average, revenues missed analyst consensus estimates by 0.8% Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but sit-down dining stocks held their ground better than others, with the share prices up 12% on average since the previous earnings results.

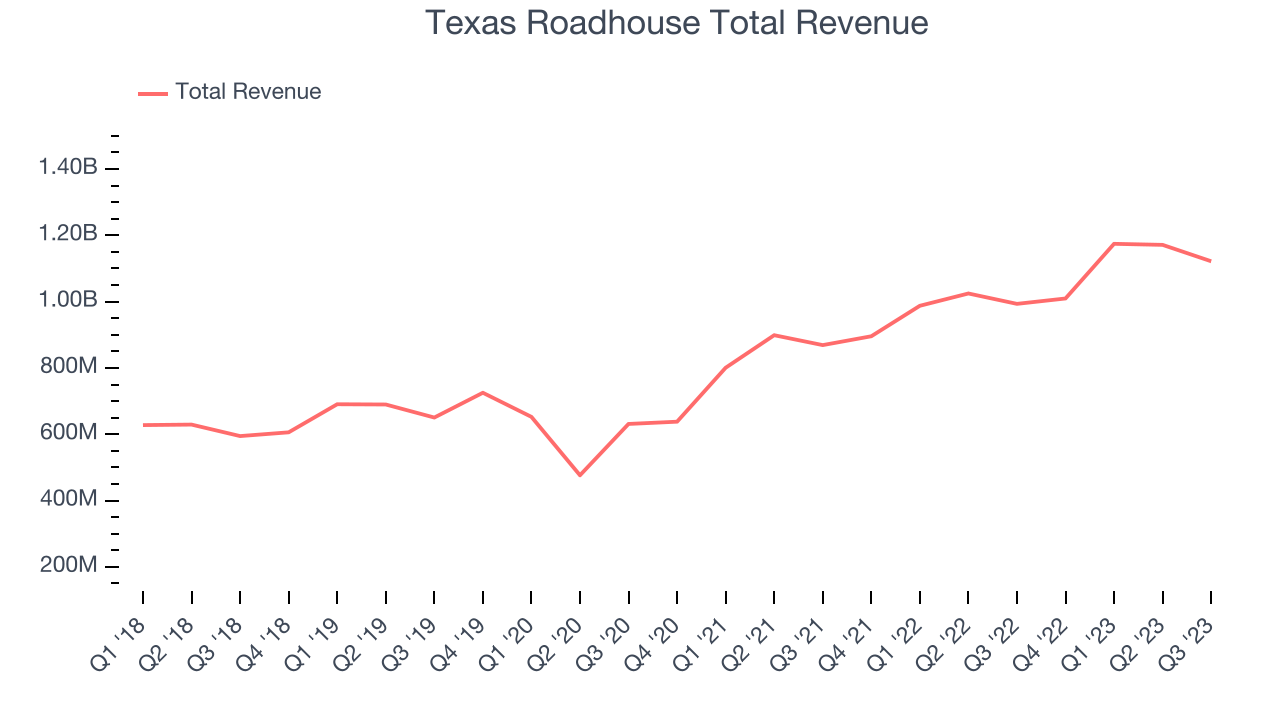

Texas Roadhouse (NASDAQ:TXRH)

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ:TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

Texas Roadhouse reported revenues of $1.12 billion, up 12.9% year on year, falling short of analyst expectations by 0.1%. It was a mixed quarter for the company. Same store sales beat expectations although revenue was roughly in line. On the other hand, both gross and operating margin missed analysts' expectations and its EPS also missed Wall Street's estimates.

Jerry Morgan, Chief Executive Officer of Texas Roadhouse, Inc. commented, “We are pleased to report another quarter of double-digit sales growth, highlighted by increased guest counts, which has continued through the October period. Our operators are clearly providing a legendary experience that is resonating with our guests.”

The stock is up 26.8% since the results and currently trades at $119.98.

Is now the time to buy Texas Roadhouse? Access our full analysis of the earnings results here, it's free.

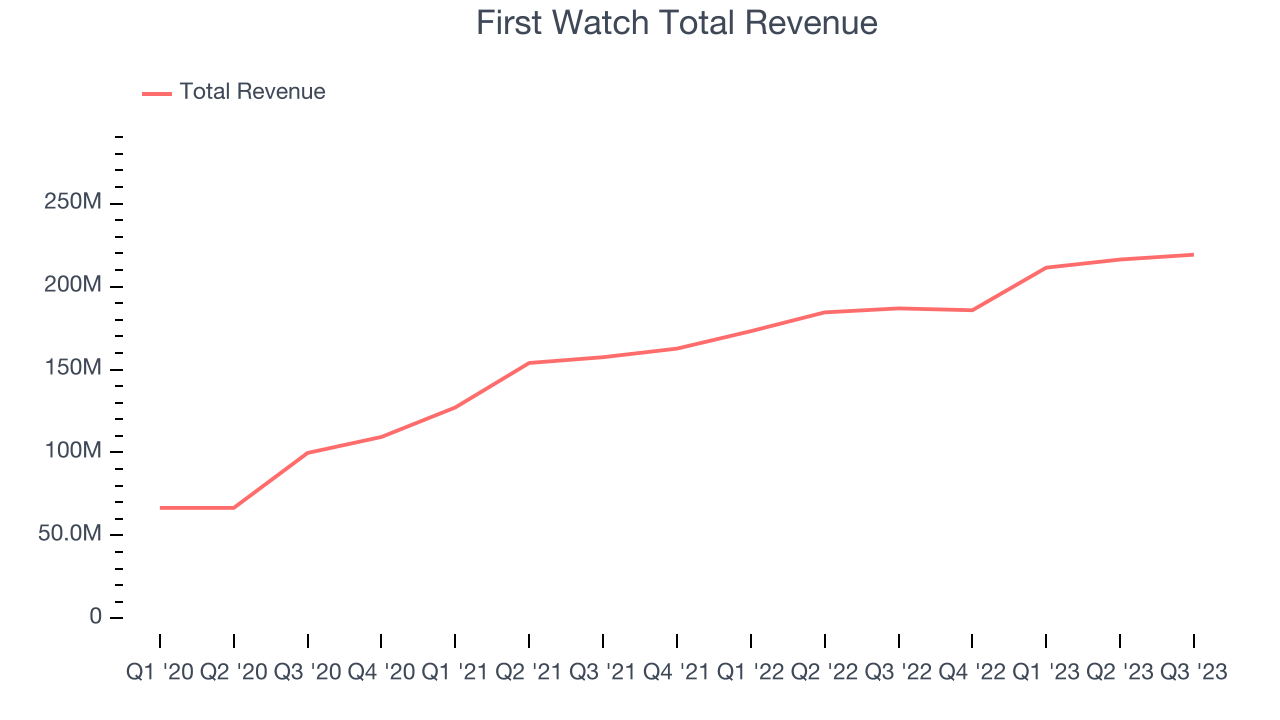

Best Q3: First Watch (NASDAQ:FWRG)

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

First Watch reported revenues of $219.2 million, up 17.3% year on year, outperforming analyst expectations by 1.2%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 16.8% since the results and currently trades at $19.53.

Is now the time to buy First Watch? Access our full analysis of the earnings results here, it's free.

Weakest Q3: The ONE Group (NASDAQ:STKS)

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

The ONE Group reported revenues of $76.88 million, up 5.3% year on year, falling short of analyst expectations by 7.7%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

The ONE Group had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is up 2% since the results and currently trades at $4.66.

Read our full analysis of The ONE Group's results here.

Bloomin' Brands (NASDAQ:BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ:BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Bloomin' Brands reported revenues of $1.08 billion, up 2.3% year on year, falling short of analyst expectations by 0.2%. It was a slower quarter for the company, with underwhelming earnings guidance for the full year.

The stock is up 7.5% since the results and currently trades at $25.34.

Read our full, actionable report on Bloomin' Brands here, it's free.

BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $318.6 million, up 2.3% year on year, falling short of analyst expectations by 2.2%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 35.7% since the results and currently trades at $32.

Read our full, actionable report on BJ's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned