Restaurant company Texas Roadhouse (NASDAQ:TXRH) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 12.5% year on year to $1.32 billion. It made a GAAP profit of $1.69 per share, improving from its profit of $1.28 per share in the same quarter last year.

Texas Roadhouse (TXRH) Q1 CY2024 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.32 billion (small miss)

- EPS: $1.69 vs analyst estimates of $1.61 (4.8% beat)

- The company reiterated full year guidance for sales and other items

- Gross Margin (GAAP): 17.8%, up from 16.4% in the same quarter last year

- Free Cash Flow of $165.8 million, up 133% from the previous quarter

- Same-Store Sales were up 8.4% year on year

- Store Locations: 753 at quarter end, increasing by 49 over the last 12 months

- Market Capitalization: $10.5 billion

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ:TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

The company operates under the Texas Roadhouse, Bubba's 33, and Jaggers banners. Across its different brands, Texas Roadhouse is known for its hand-cut steaks, fall-off-the-bone ribs, made-from-scratch sides, and fresh-baked bread. Portions tend to be hearty, giving customers a good bang for their buck.

Texas Roadhouse primarily targets suburban and rural families seeking high-quality comfort food. Given the sit-down nature of the dining experience, the target customer will certainly spend more at Texas Roadhouse than a typical fast-food joint. However, prices also are meaningfully cheaper than fine dining experiences at stuffier “white tablecloth” establishments.

Restaurants are typically 6,000 to 7,500 square feet and located in high-traffic areas of suburban and rural cities and towns. Locations feature a rustic ambiance and sometimes feature nostalgic Southern memorabilia and even line dancing performances. Open kitchens allow customers to witness the preparation of their meals.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Multi-brand full-service restaurant competitors include Bloomin’ Brands (NASDAQ:BLMN), Brinker International (NYSE:EAT), Darden Restaurants (NYSE:DRI), Dine Brands (NYSE:DIN), and The Cheesecake Factory (NASDAQ:CAKE).Sales Growth

Texas Roadhouse is one of the larger restaurant chains in the industry and benefits from a strong brand, giving it customer mindshare and influence over purchasing decisions.

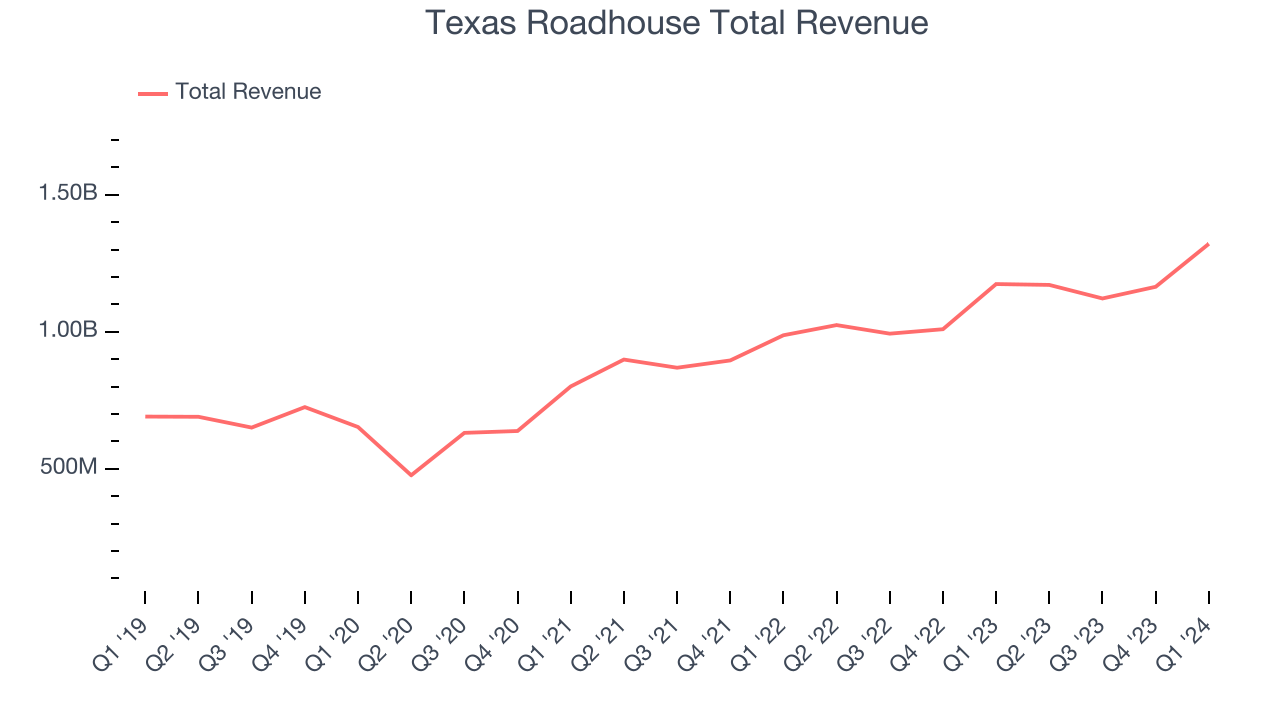

As you can see below, the company's annualized revenue growth rate of 13.6% over the last five years was impressive as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Texas Roadhouse's revenue grew 12.5% year on year to $1.32 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 12.9% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

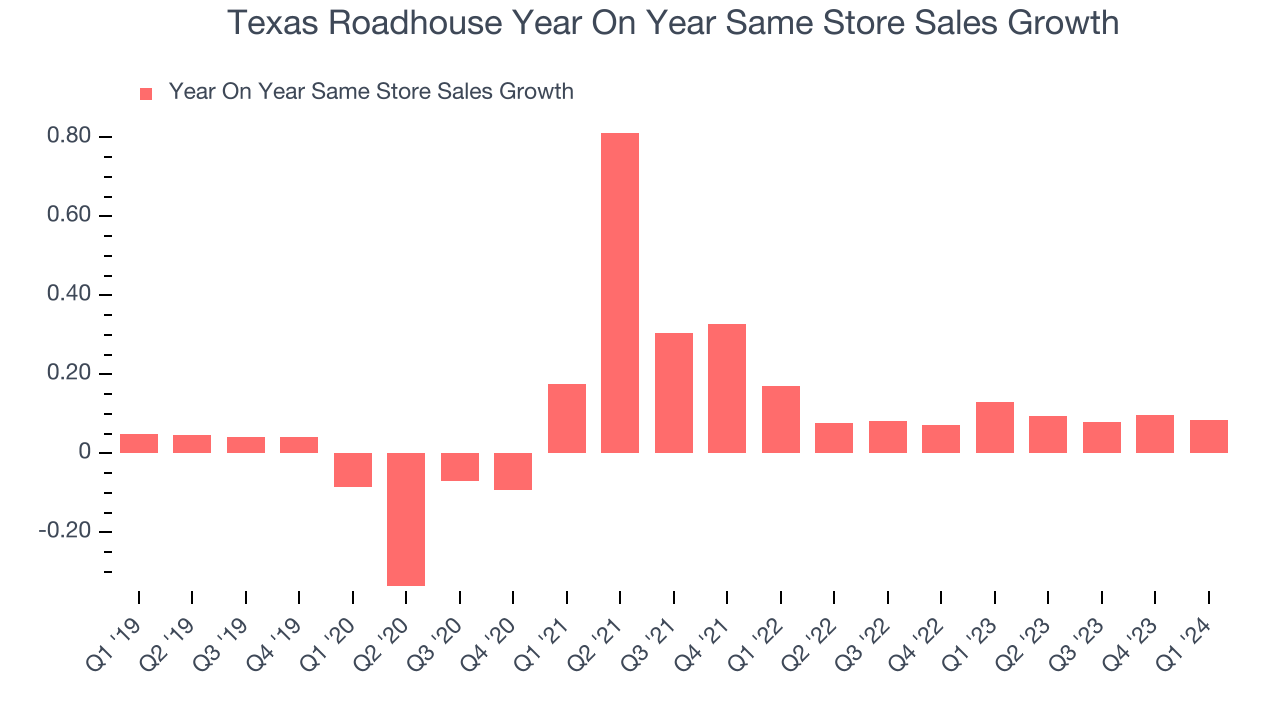

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Texas Roadhouse's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 8.9% year on year. With positive same-store sales growth amid an increasing number of restaurants, Texas Roadhouse is reaching more diners and growing sales.

In the latest quarter, Texas Roadhouse's same-store sales rose 8.4% year on year. This growth was a deceleration from the 12.9% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Number of Stores

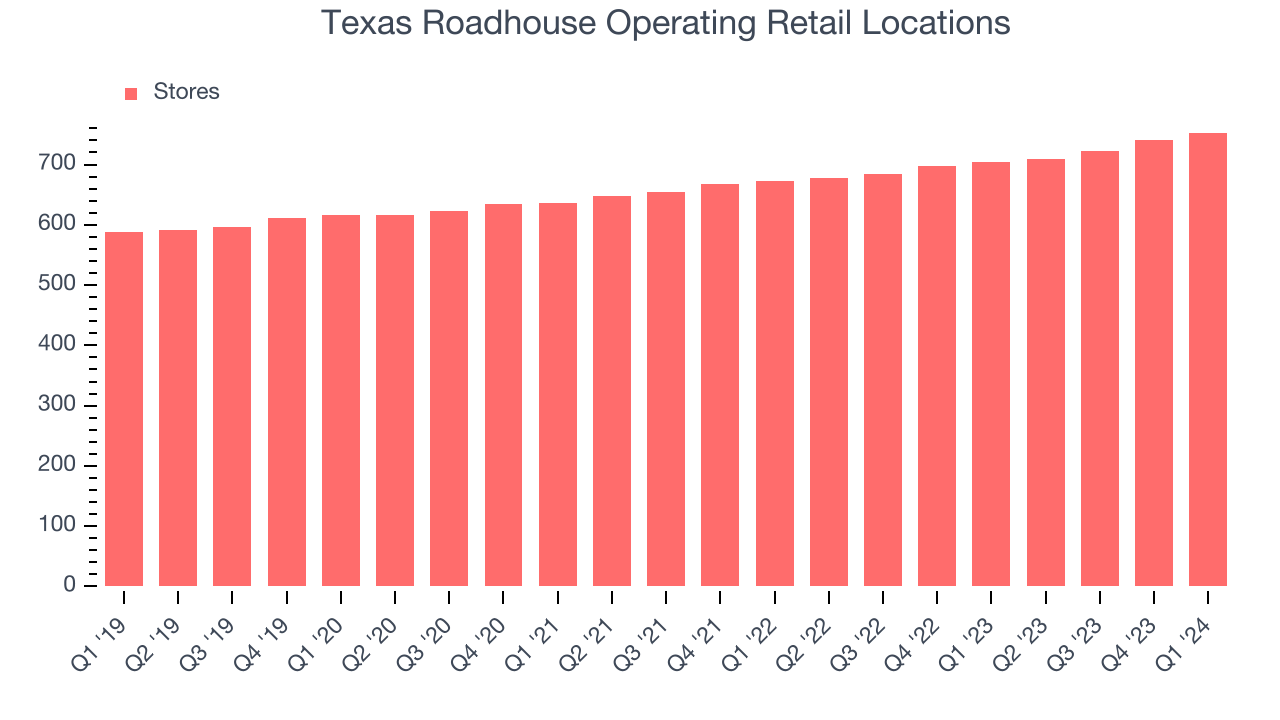

A restaurant chain's total number of dining locations is a crucial factor influencing how much it can sell and how quickly company-level sales can grow.

When a chain like Texas Roadhouse is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Texas Roadhouse's restaurant count increased by 49, or 7%, over the last 12 months to 753 locations in the most recently reported quarter.

Taking a step back, Texas Roadhouse has rapidly opened new restaurants over the last eight quarters, averaging 5.3% annual increases in new locations. This growth is much higher than other restaurant businesses. Analyzing a restaurant's location growth is important because expansion means Texas Roadhouse has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

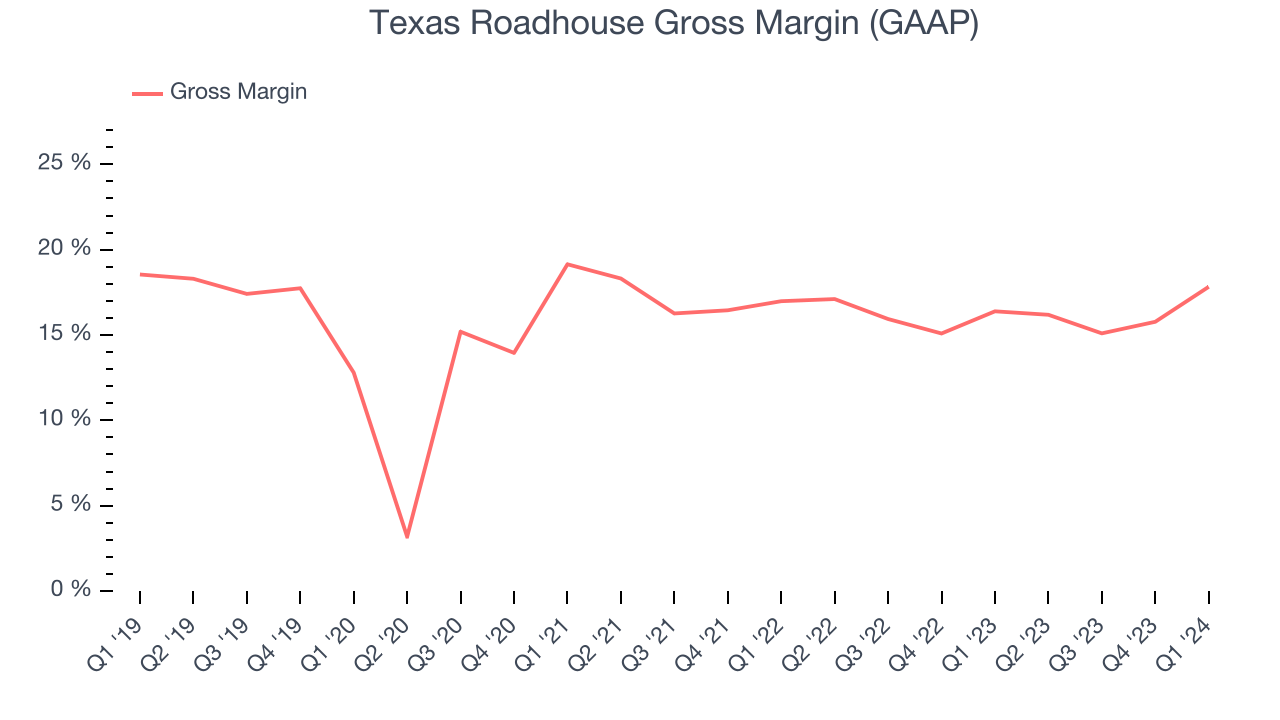

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells.

Texas Roadhouse's gross profit margin came in at 17.8% this quarter. up 1.4 percentage points year on year. This means the company makes $0.16 for every $1 in revenue before accounting for its operating expenses.

Texas Roadhouse has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 16.2% gross margin over the last two years. Its margin has also been consistent over the last year, suggesting it will take a fundamental shift in the business to change meaningfully.

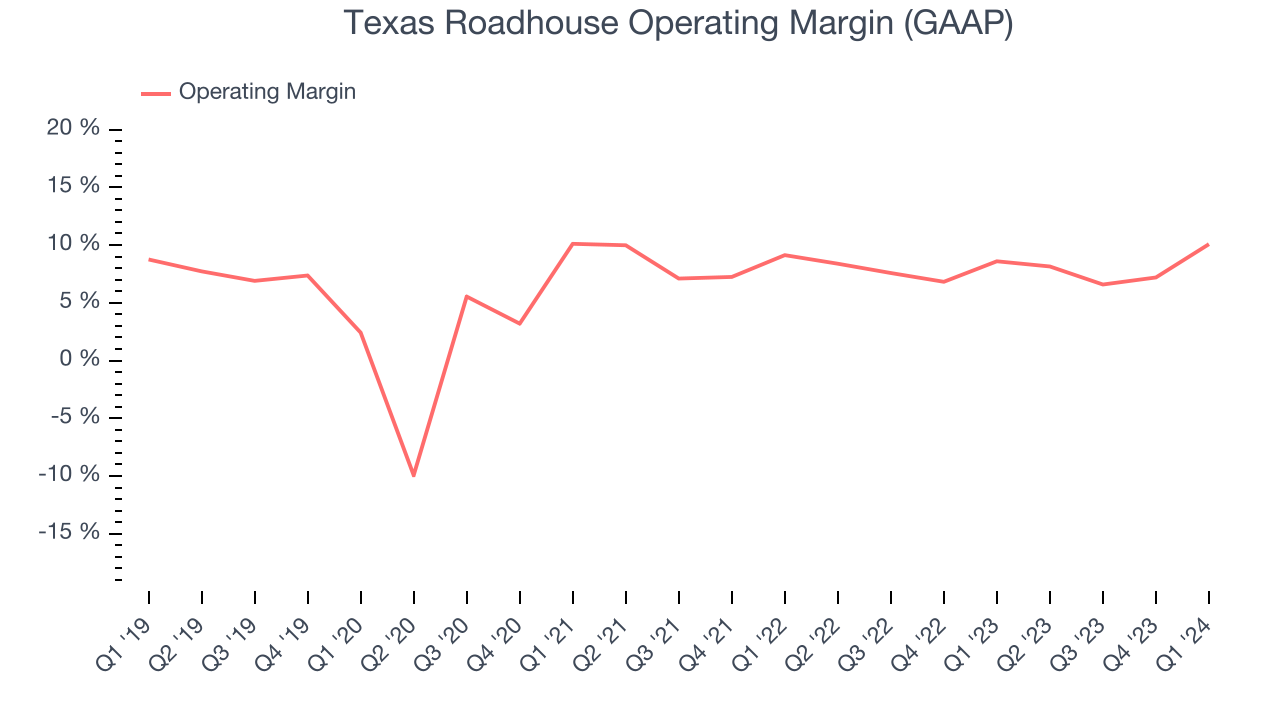

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Texas Roadhouse generated an operating profit margin of 10.1%, up 1.5 percentage points year on year. This increase was encouraging, and we can infer Texas Roadhouse was more disciplined with its expenses or gained leverage on its fixed costs because its operating margin expanded more than its gross margin.

Zooming out, Texas Roadhouse was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 8%. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, Texas Roadhouse was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 8%. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

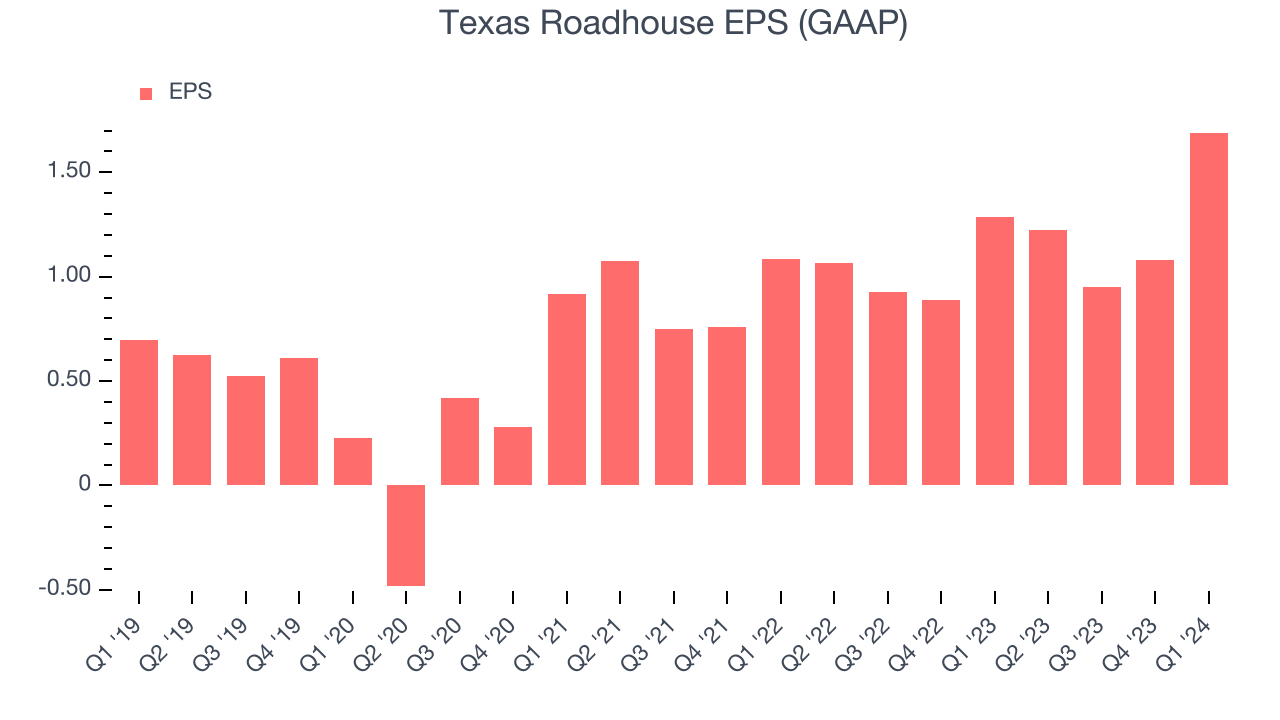

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Texas Roadhouse reported EPS at $1.69, up from $1.28 in the same quarter a year ago. This print beat Wall Street's estimates by 4.8%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 17.3% year-on-year increase in EPS.

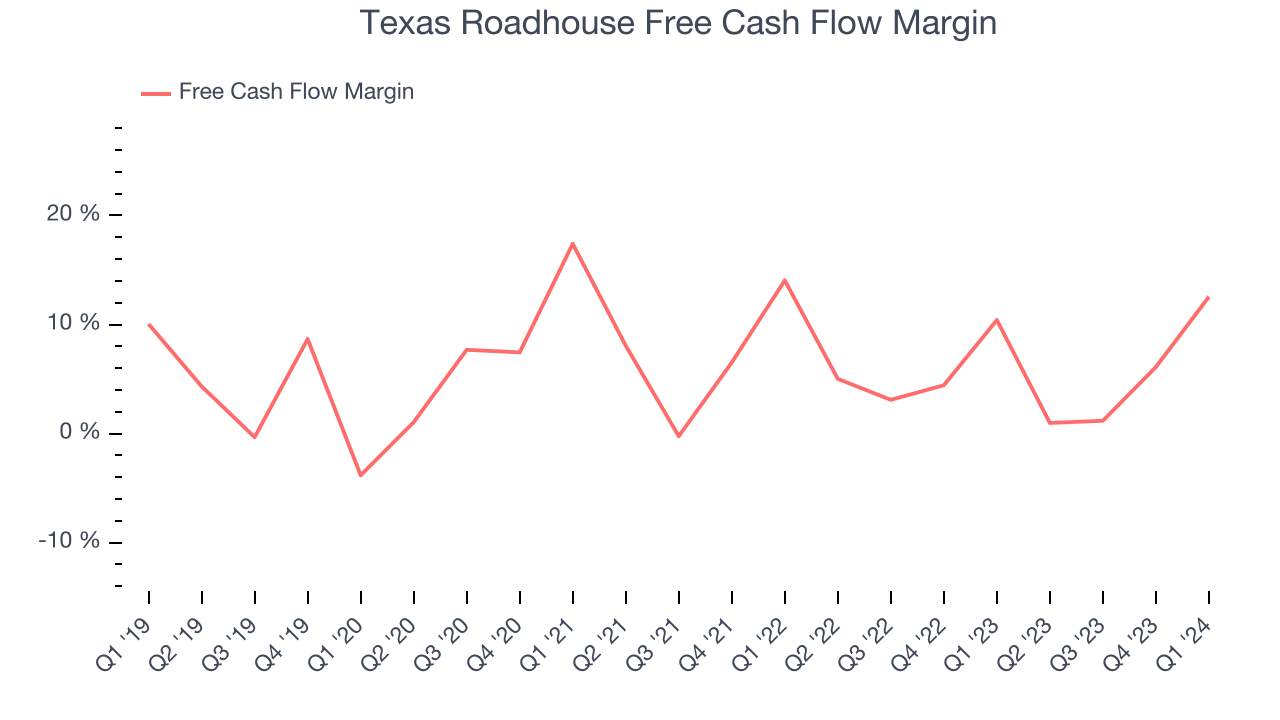

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Texas Roadhouse's free cash flow came in at $165.8 million in Q1, up 35.6% year on year. This result represents a 12.5% margin.

Over the last two years, Texas Roadhouse has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 5.7%, slightly better than the broader restaurant sector. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

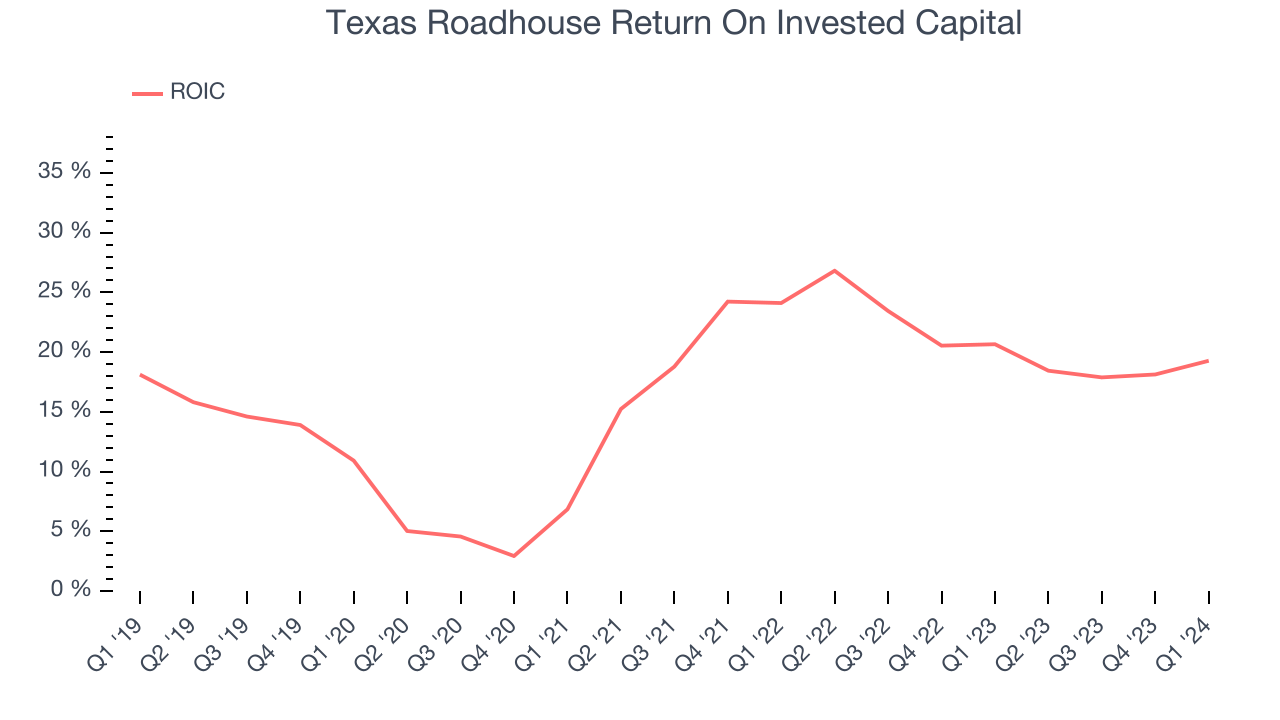

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Texas Roadhouse's five-year average ROIC was 16.4%, beating other restaurant companies by a wide margin. Just as you’d like your investment dollars to generate returns, Texas Roadhouse's invested capital has produced robust profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Texas Roadhouse's ROIC averaged 11.1 percentage point increases. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Texas Roadhouse reported $213.4 million of cash and $766.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $544.6 million of EBITDA over the last 12 months, we view Texas Roadhouse's 1.0x net-debt-to-EBITDA ratio as safe. We also see its $3.15 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Texas Roadhouse's Q1 Results

We enjoyed seeing Texas Roadhouse exceed analysts' same store sales estimates this quarter, although revenue still missed slightly. Guidance for the full year was maintained, showing the company is staying on track. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 3.2% after reporting and currently trades at $162.99 per share.

Is Now The Time?

Texas Roadhouse may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Texas Roadhouse is a solid business. First off, its revenue growth has been good over the last five years. And while its gross margins make it more challenging to reach positive operating profits compared to other restaurant businesses, its new restaurant openings have increased its brand equity. On top of that, its market-beating ROIC suggests it has been a well-managed company historically.

Texas Roadhouse's price-to-earnings ratio based on the next 12 months is 27.0x. There are definitely things to like about Texas Roadhouse, and looking at the consumer landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $155.18 per share right before these results (compared to the current share price of $162.99).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.