As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today we are looking at the consumer subscription stocks, starting with Udemy (NASDAQ:UDMY).

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to or what movie they watch, or finding a date, online consumer businesses today are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have increased usage and stickiness of many online consumer services.

The 7 consumer subscription stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 2.2%, while on average next quarter revenue guidance was 1.84% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but consumer subscription stocks held their ground better than others, with the share prices up 11.6% since the previous earnings results, on average.

Udemy (NASDAQ:UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ:UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

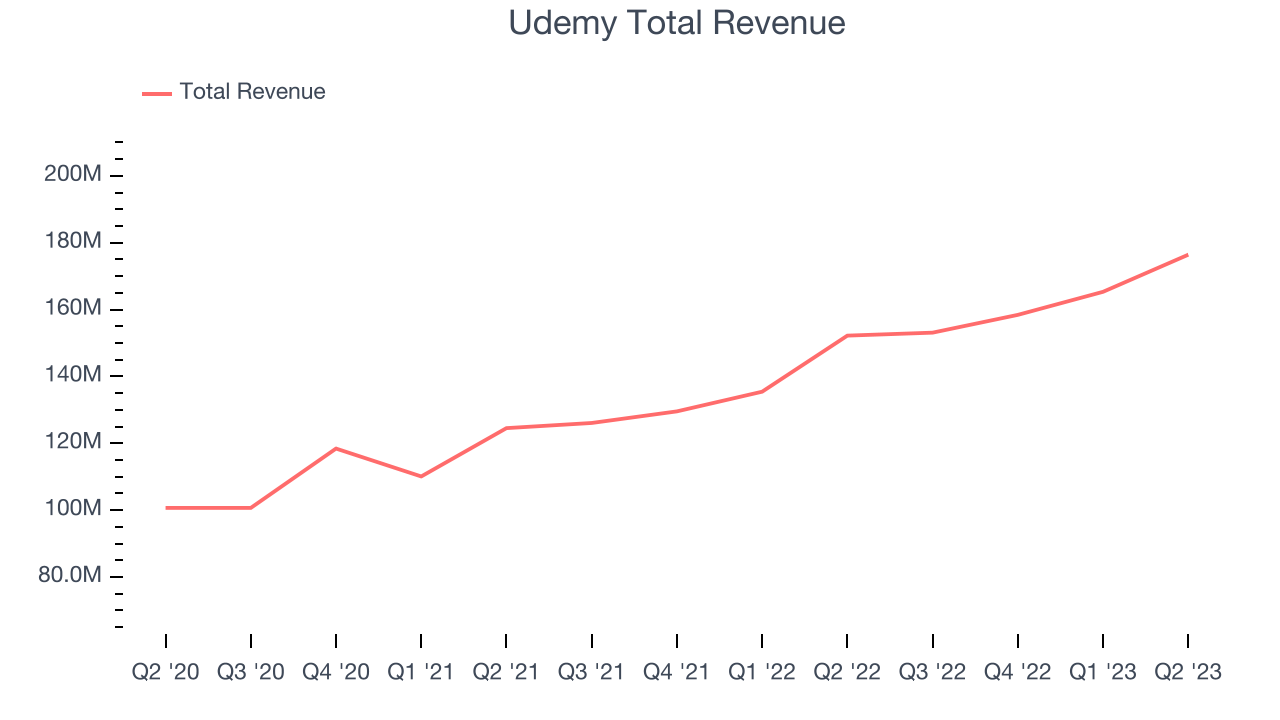

Udemy reported revenues of $176.4 million, up 15.9% year on year, beating analyst expectations by 3.21%. Despite exceeding topline expectations, the company had a weaker quarter, with slow user growth and underwhelming revenue guidance for the full year.

“Udemy started the year off strong as we exceeded expectations for both revenue and adjusted EBITDA margin,” said Greg Brown, Udemy’s President and CEO.

Udemy delivered the weakest full year guidance update of the whole group. The company reported 1.39 million active buyers, up 0.51% year on year. The stock is up 21.2% since the results and currently trades at $10.5.

Read our full report on Udemy here, it's free.

Best Q1: Coursera (NYSE:COUR)

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

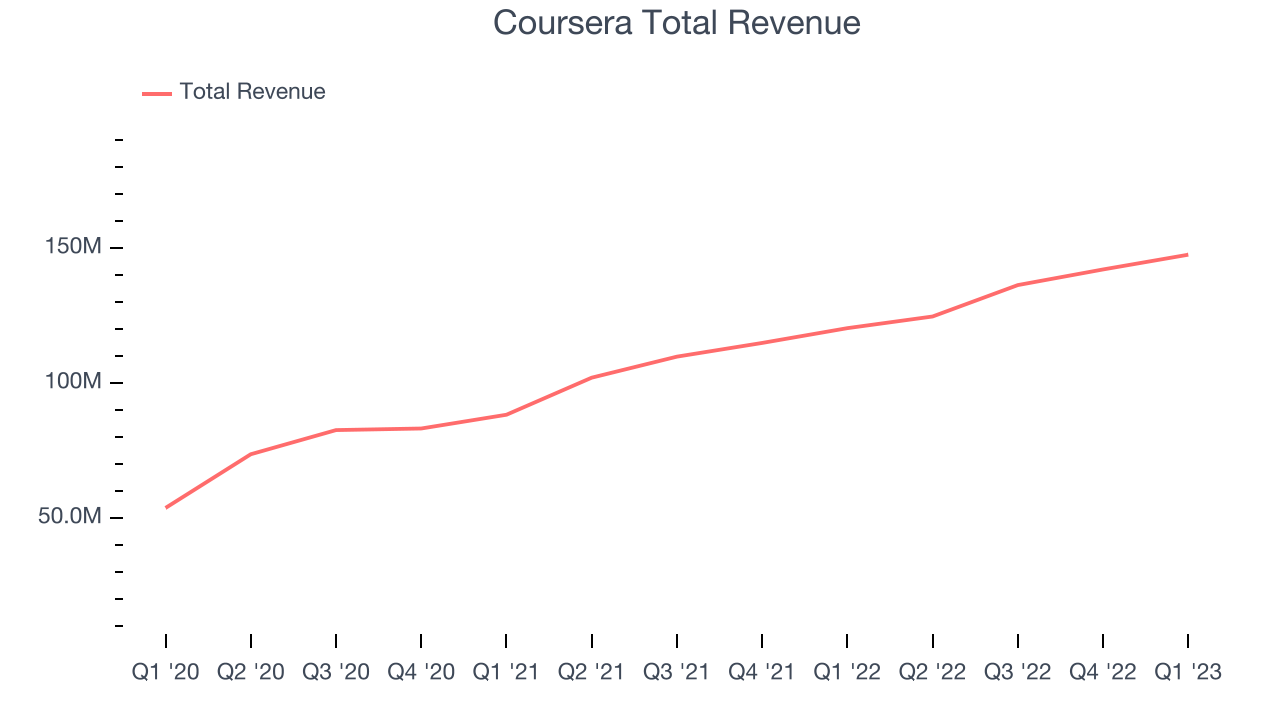

Coursera reported revenues of $147.6 million, up 22.6% year on year, beating analyst expectations by 6.39%. It was a strong quarter for the company, with a solid beat of analyst estimates and a growing number of users.

Coursera pulled off the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company reported 124 million paying users, up 21.6% year on year. The stock is up 24.7% since the results and currently trades at $13.06.

Is now the time to buy Coursera? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Match (NASDAQ:MTCH)

Match.com was an early innovator in dating apps and was actually launched as a dial-up service before widespread internet adoption. Match (NASDAQ:MTCH) today has a portfolio of apps including Tinder, OkCupid, Match.com, and Hinge.

Match reported revenues of $787.1 million, down 1.44% year on year, missing analyst expectations by 0.87%. It was a weak quarter for the company, with slow revenue growth and underwhelming guidance for the next quarter.

Match had the weakest performance against analyst estimates in the group. The company reported 15.9 million paying users, down 2.45% year on year. The stock is up 23.6% since the results and currently trades at $42.74.

Read our full analysis of Match's results here.

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $741 million, flat year on year, beating analyst expectations by 4.72%. It was a decent quarter for the company, with revenue guidance for the next quarter roughly in line with expectations.

The company reported 71.6 million monthly active users, up 16.8% year on year. The stock is up 24.7% since the results and currently trades at $70.49.

Read our full, actionable report on Roku here, it's free.

Bumble (NASDAQ:BMBL)

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ: BMBL) is a leading dating app built with women at the center.

Bumble reported revenues of $242.9 million, up 15% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a growing number of users but slow revenue growth. Revenue and adjusted EBITDA guidance for the next quarter also came in below Consensus.

The company reported 3.46 million active buyers, up 15.1% year on year. The stock is up 1.36% since the results and currently trades at $17.88.

Read our full, actionable report on Bumble here, it's free.

The author has no position in any of the stocks mentioned