The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Universal Logistics (NASDAQ:ULH) and the rest of the ground transportation stocks fared in Q2.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 16 ground transportation stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1%.

Stocks--especially those trading at higher multiples--had a strong end of 2023, but this year has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and ground transportation stocks have had a rough stretch. On average, share prices are down 7.7% since the latest earnings results.

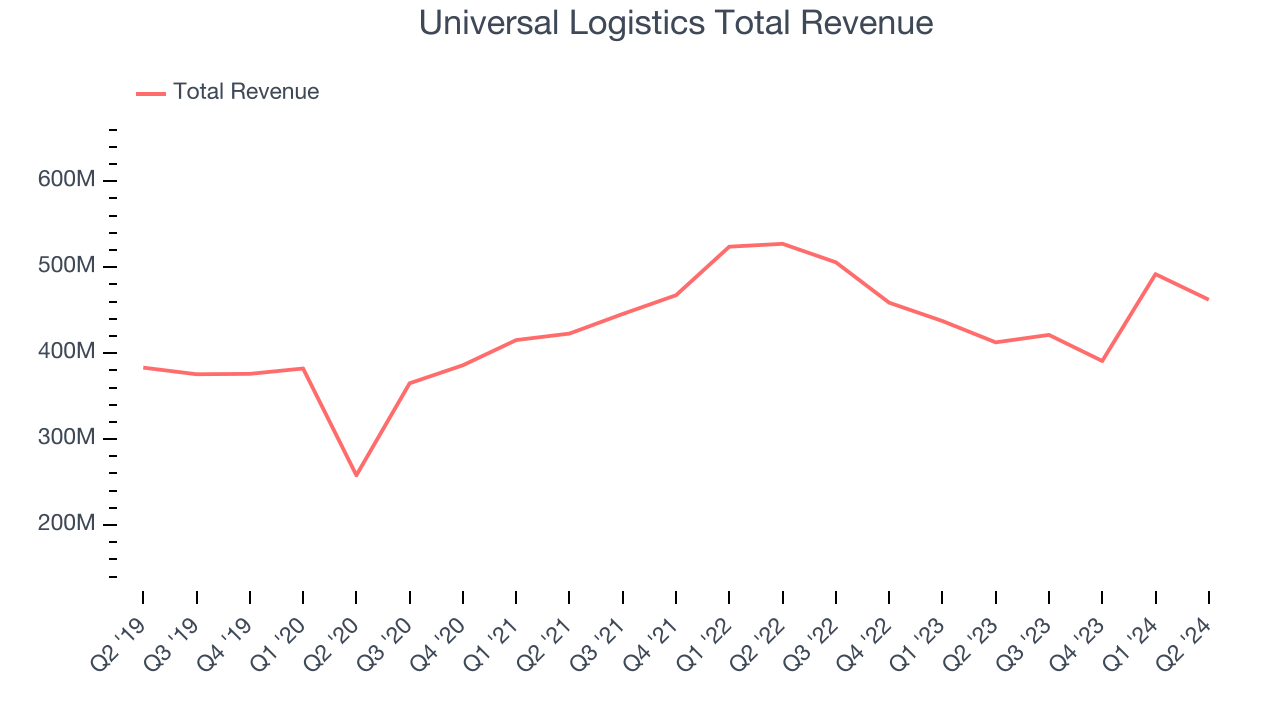

Universal Logistics (NASDAQ:ULH)

Founded in 1932, Universal Logistics (NASDAQ:ULH) is a provider of customized transportation and logistics solutions operating throughout the United States and in Mexico, Canada, and Colombia.

Universal Logistics reported revenues of $462.2 million, up 12% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ earnings estimates.

"Once again Universal delivered exceptional results in an otherwise turbulent transportation and logistics environment," stated Universal's CEO Tim Phillips.

Unsurprisingly, the stock is down 10.9% since reporting and currently trades at $40.11.

Is now the time to buy Universal Logistics? Access our full analysis of the earnings results here, it’s free.

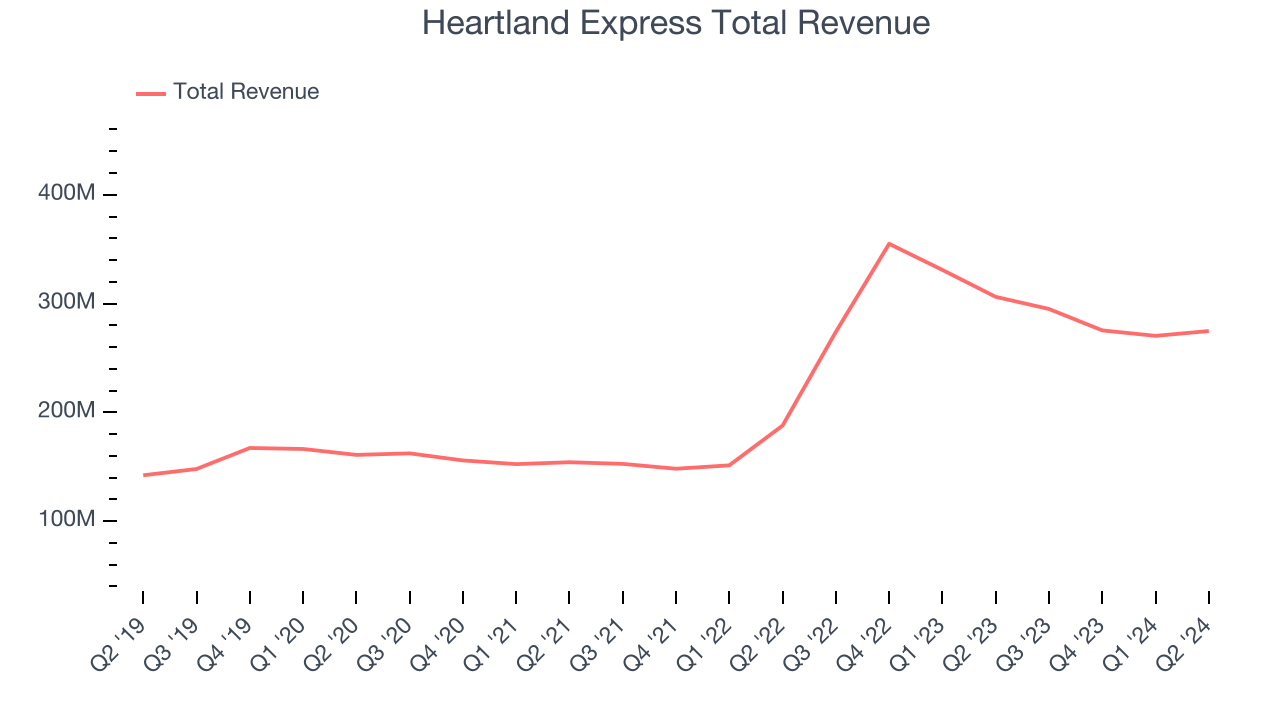

Best Q2: Heartland Express (NASDAQ:HTLD)

Founded by the son of a trucker, Heartland Express (NASDAQ:HTLD) offers full-truckload deliveries across the United States and Mexico.

Heartland Express reported revenues of $274.8 million, down 10.3% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ earnings and operating margin estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.4% since reporting. It currently trades at $11.54.

Is now the time to buy Heartland Express? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Hertz (NASDAQ:HTZ)

Started with a dozen Model T Fords, Hertz (NASDAQ:HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Hertz reported revenues of $2.35 billion, down 3.4% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a miss of analysts’ operating margin and earnings estimates.

Hertz delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 35.5% since the results and currently trades at $2.64.

Read our full analysis of Hertz’s results here.

RXO (NYSE:RXO)

With access to millions of trucks, RXO (NYSE:RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

RXO reported revenues of $930 million, down 3.4% year on year. This print was in line with analysts’ expectations. It was a very strong quarter as it also put up an impressive beat of analysts’ volume and operating margin estimates.

The stock is down 13% since reporting and currently trades at $25.99.

Read our full, actionable report on RXO here, it’s free.

Old Dominion Freight Line (NASDAQ:ODFL)

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ:ODFL) delivers less-than-truckload (LTL) and full-container load freight.

Old Dominion Freight Line reported revenues of $1.50 billion, up 6.1% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it failed to impress in other areas of the business.

The stock is up 2% since reporting and currently trades at $197.80.

Read our full, actionable report on Old Dominion Freight Line here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.