Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ:ULTA) fell short of analysts’ expectations in Q2 CY2024, with revenue flat year on year at $2.55 billion. The company’s full-year revenue guidance of $11.1 billion at the midpoint also came in 3.4% below analysts’ estimates. It made a GAAP profit of $5.30 per share, down from its profit of $6.02 per share in the same quarter last year.

Is now the time to buy Ulta? Find out by accessing our full research report, it’s free.

Ulta (ULTA) Q2 CY2024 Highlights:

- Revenue: $2.55 billion vs analyst estimates of $2.61 billion (2.3% miss)

- EPS: $5.30 vs analyst expectations of $5.45 (2.7% miss)

- The company dropped its revenue guidance for the full year to $11.1 billion at the midpoint from $11.55 billion, a 3.9% decrease

- EPS (GAAP) guidance for the full year is $23.05 at the midpoint, missing analyst estimates by 8.8%

- Gross Margin (GAAP): 38.3%, in line with the same quarter last year

- EBITDA Margin: 15.1%, down from 17.9% in the same quarter last year

- Free Cash Flow Margin: 4.1%, up from 1.1% in the same quarter last year

- Locations: 1,411 at quarter end, up from 1,362 in the same quarter last year

- Same-Store Sales fell 1.2% year on year (8% in the same quarter last year) (miss vs expectations of 1.2% growth)

- Market Capitalization: $17.5 billion

“While we are encouraged by many positive indicators across our business, our second quarter performance did not meet our expectations, driven primarily by a decline in comparable store sales. We are clear about the factors that adversely impacted our store performance, and we have actions underway to address the trends,” said Dave Kimbell, chief executive officer.

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

Ulta is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

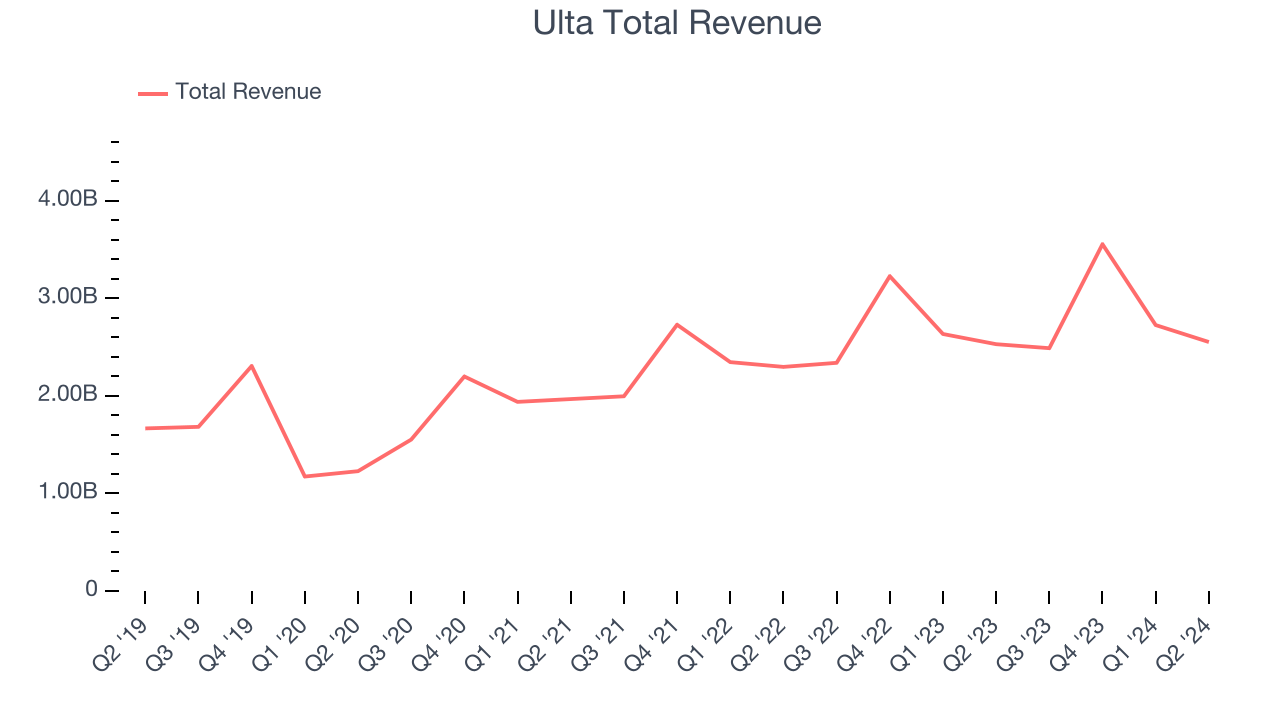

As you can see below, the company’s annualized revenue growth rate of 9.8% over the last five years was mediocre as it opened new stores and grew sales at existing, established stores.

This quarter, Ulta’s revenue grew 0.9% year on year to $2.55 billion, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 4.2% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

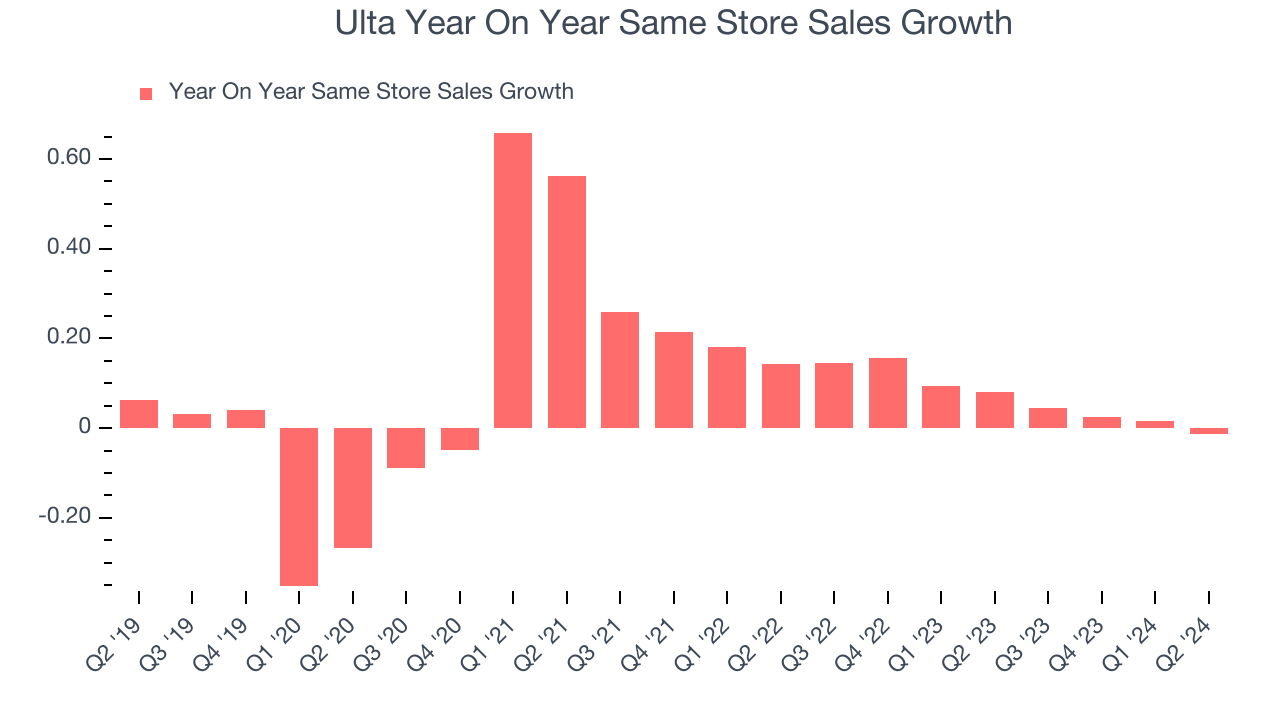

Ulta’s demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company’s same-store sales have grown by 6.9% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Ulta is reaching more customers and growing sales.

In the latest quarter, Ulta’s same-store sales fell 1.2% year on year. This decline was a reversal from the 8% year-on-year increase it posted 12 months ago. We’ll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Ulta’s Q2 Results

We struggled to find many strong positives in these results. Its same-store sales growth missed, leading to revenue below expectations. Full-year revenue and earnings guidance were both lowered and missed analysts’ expectations. Overall, this quarter could have been better. The stock traded down 6.9% to $342.29 immediately after reporting.

Ulta may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.