Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ:ULTA) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 10.2% year on year to $3.55 billion. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $11.75 billion at the midpoint. It made a GAAP profit of $8.08 per share, improving from its profit of $6.68 per share in the same quarter last year.

Ulta (ULTA) Q4 FY2023 Highlights:

- Revenue: $3.55 billion vs analyst estimates of $3.53 billion (small beat)

- EPS: $8.08 vs analyst estimates of $7.54 (7.2% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $11.75 billion at the midpoint, in line with analyst expectations and implying 4.8% growth (vs 9.7% in FY2023)

- Management's EPS guidance for the upcoming financial year 2024 is $26.60 at the midpoint, below analyst expectations of $27.03

- Gross Margin (GAAP): 37.7%, in line with the same quarter last year

- Free Cash Flow of $994 million, up 24.2% from the same quarter last year

- Same-Store Sales were up 2.5% year on year (beat vs. expectations of up 2.0% year on year)

- Store Locations: 1,385 at quarter end, increasing by 30 over the last 12 months

- Market Capitalization: $27.54 billion

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Given its variety in both price point as well as product, Ulta serves as a one-stop-shop for beauty. The core customer is a middle to higher-income woman across a variety of ages. This customer has specific needs or tastes in beauty that may not be served by the narrower selection of a department store or mass merchandise retailer.

A typical store is around 10,000 square feet. Key sections include fragrance, makeup, skincare, and haircare. The makeup section tends to be the largest, and most sections allow customers to try out a variety of products before purchasing. In addition to these sections, stores may also offer salon and spa services, where customers can receive professional haircuts, color treatments, and waxing. Ulta also has an e-commerce presence, featuring not just products but reviews and tutorials, that the company has been investing in since 2008.

The brand selection in Ulta stores is diverse and constantly evolving based on customer tastes and broader trends in beauty. MAC, Clinique, and Urban Decay are globally-recognized brands that can be found in stores, for example. Additionally, there are brands exclusive to Ulta as well as emerging ones like Fourth Ray Beauty.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Retailers specializing in beauty products include Sally Beauty (NYSE:SBH) and Bath & Body Works while department stores such as Kohl’s (NYSE:KSS) and Macy’s (NYSE:M) typically feature large cosmetics and fragrance sections.Sales Growth

Ulta is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

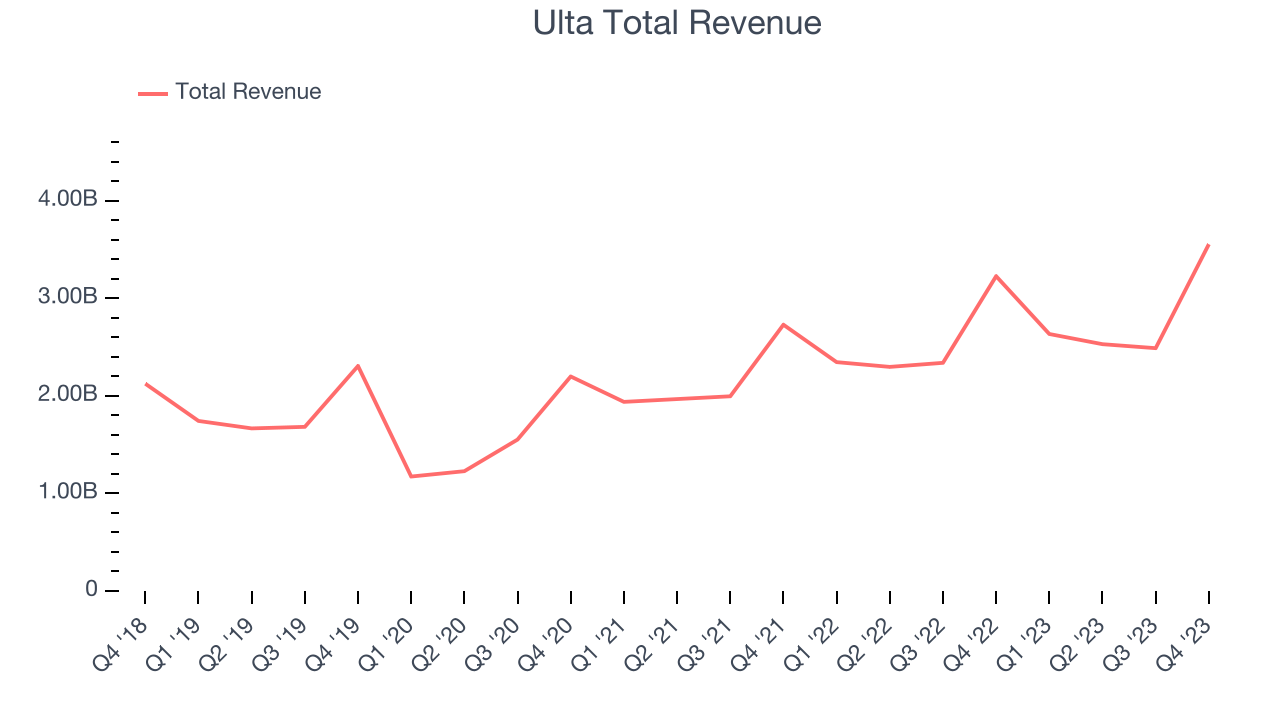

As you can see below, the company's annualized revenue growth rate of 10.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Ulta's year-on-year revenue growth clocked in at 10.2%, and its $3.55 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.9% over the next 12 months, a deceleration from this quarter.

Number of Stores

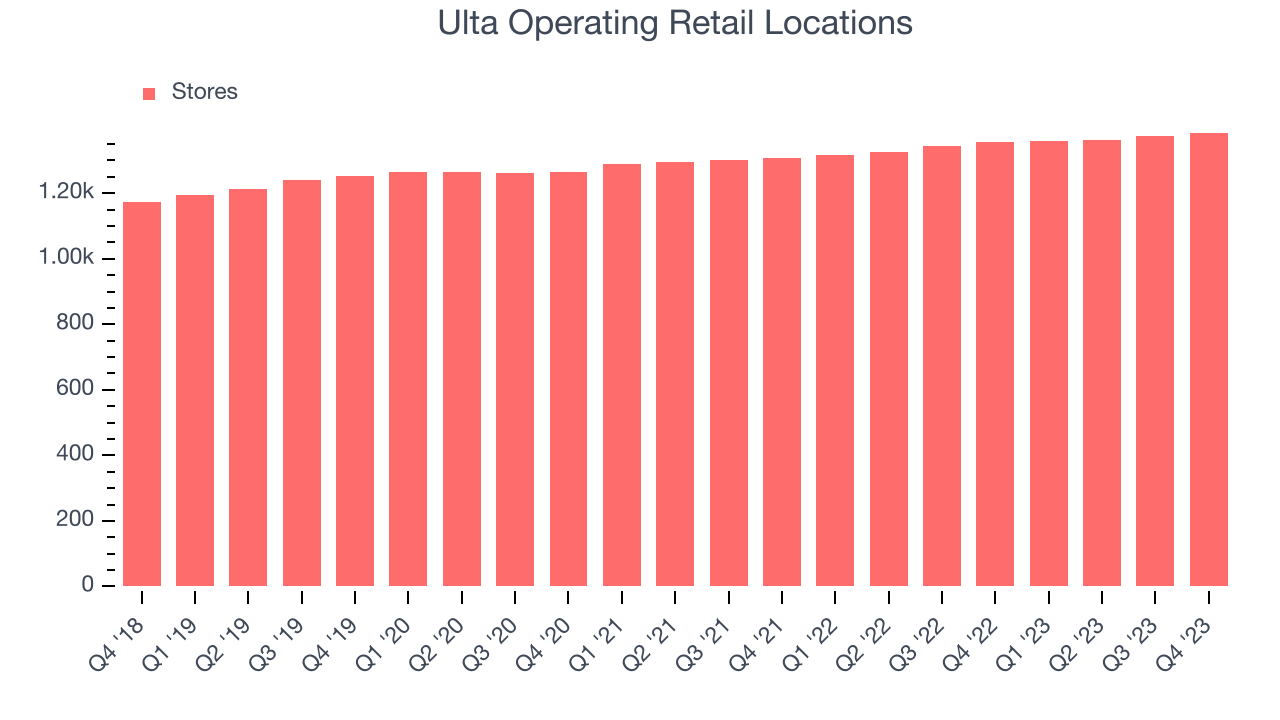

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Ulta is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Ulta's store count increased by 30 locations, or 2.2%, to 1,385 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 2.7% annual growth in its physical footprint. This is decent store growth and in line with other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

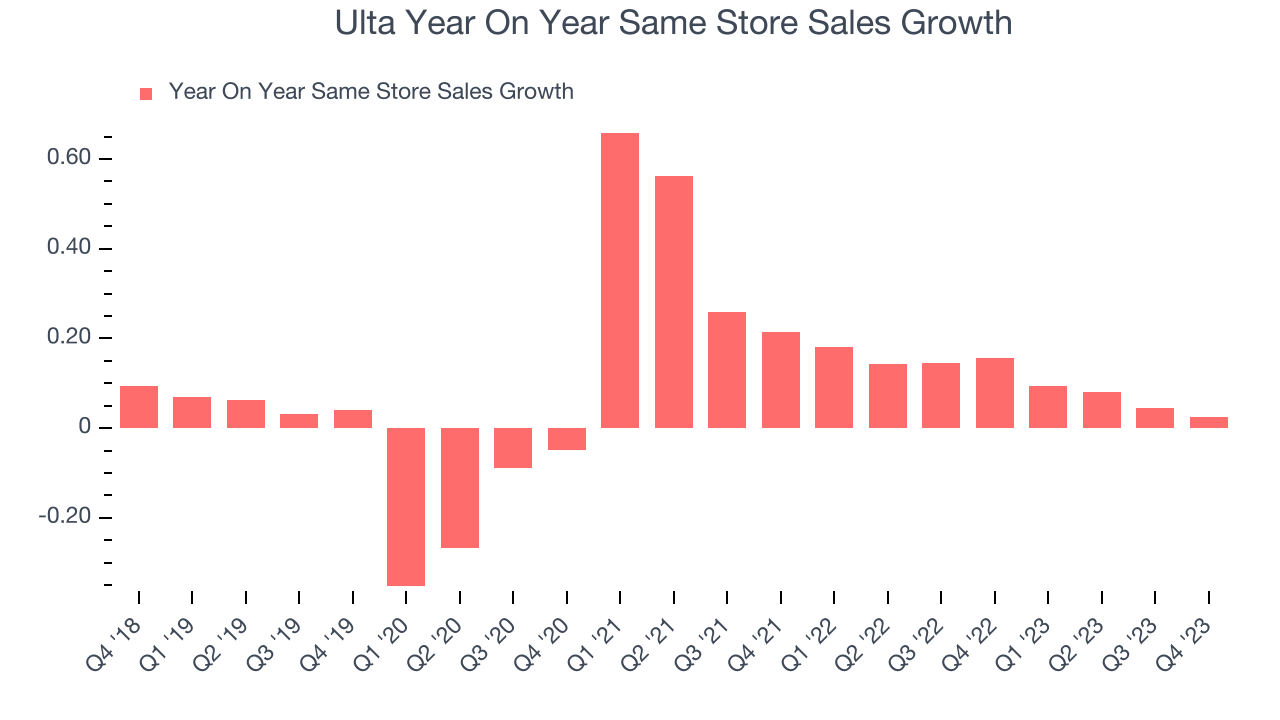

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Ulta has generated solid demand for its products over the last two years. On average, the company's same-store sales have grown by a healthy 10.9% year on year. This performance suggests that its steady rollout of new stores could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its products.

In the latest quarter, Ulta's same-store sales rose 2.5% year on year. By the company's standards, this growth was a meaningful deceleration from the 15.6% year-on-year increase it posted 12 months ago. We'll be watching Ulta closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

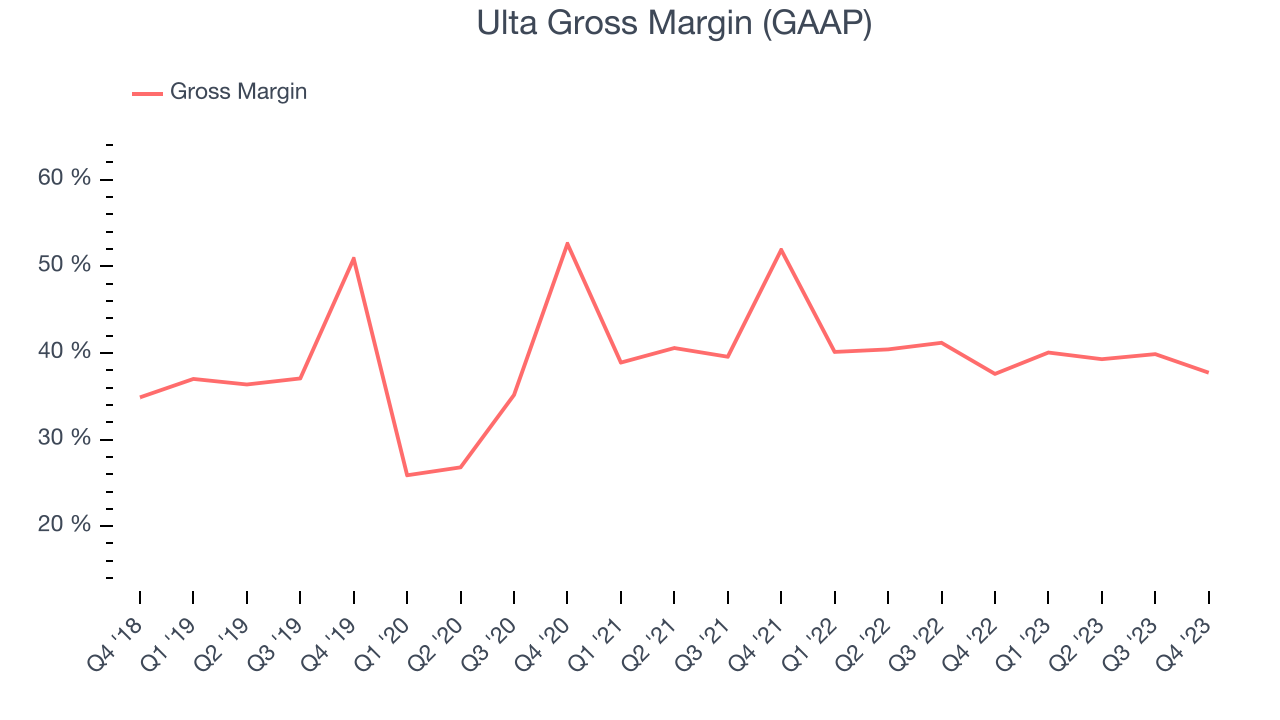

Gross profit margins are an important measure of a retailer's pricing power, product differentiation, and negotiating leverage.

Ulta has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it's averaged a healthy 39.3% gross margin over the last two years. This means the company makes $0.39 for every $1 in revenue before accounting for its operating expenses.

Ulta's gross profit margin came in at 37.7% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

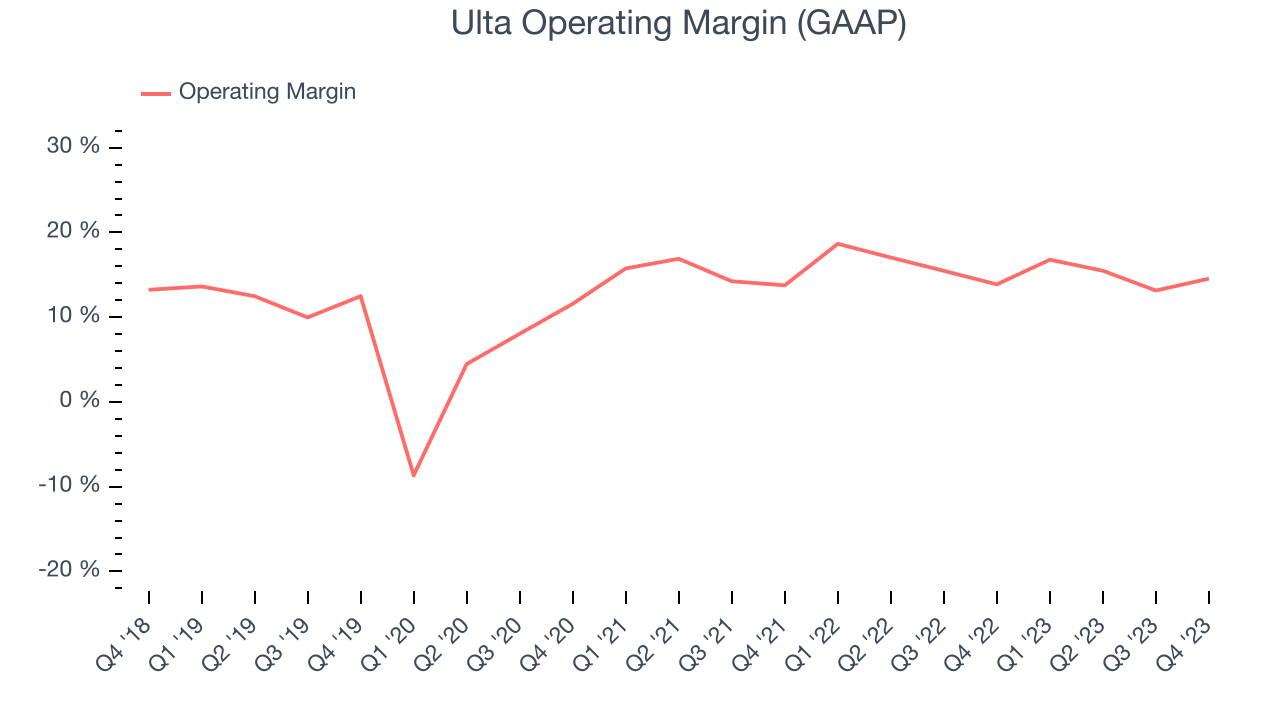

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, Ulta generated an operating profit margin of 14.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Ulta has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 15.5%. However, Ulta's margin has slightly declined by 1.1 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way.

Zooming out, Ulta has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 15.5%. However, Ulta's margin has slightly declined by 1.1 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way. EPS

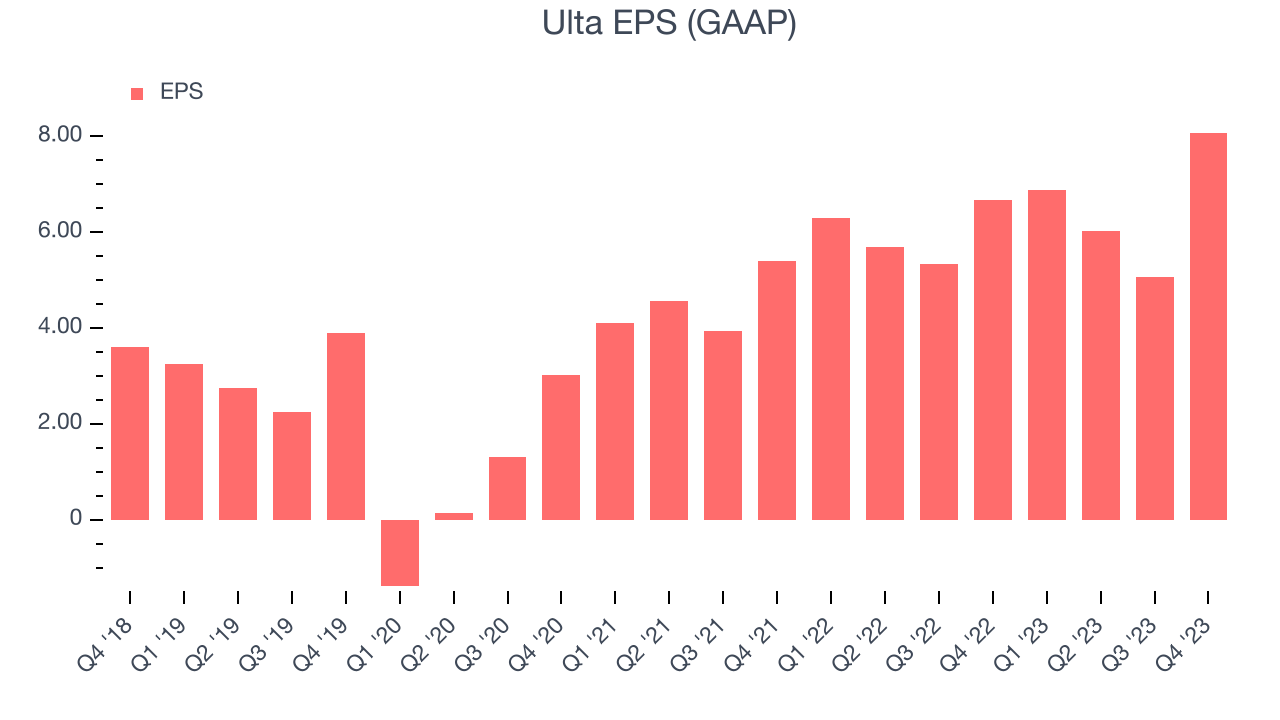

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Ulta reported EPS at $8.08, up from $6.68 in the same quarter a year ago. This print beat Wall Street's estimates by 7.2%.

Between FY2019 and FY2023, Ulta's adjusted diluted EPS grew 114%, translating into a solid 21% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 3.5% year-on-year increase in EPS.

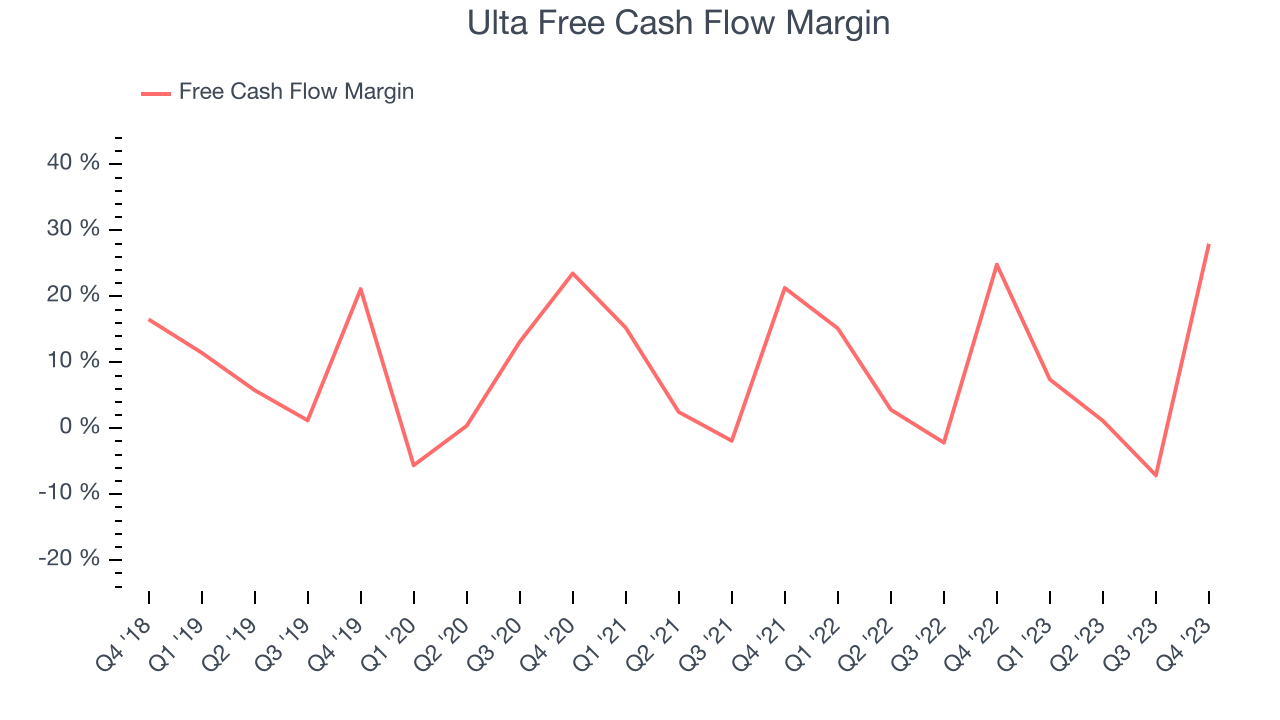

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Ulta's free cash flow came in at $994 million in Q4, up 24.2% year on year. This result represents a 28% margin.

Over the last eight quarters, Ulta has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in consumer retail, averaging 10.3%. However, its margin has averaged year-on-year declines of 2.2 percentage points. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Ulta's five-year average ROIC was 27.4%, placing it among the best retail companies. Just as you’d like your investment dollars to generate returns, Ulta's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Ulta's ROIC averaged 22.5 percentage point increases each year. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Key Takeaways from Ulta's Q4 Results

It was good to see Ulta beat analysts' same store sales, revenue, and gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. On the other hand, while full year revenue guidance was roughly in line, its full-year earnings forecast was underwhelming and missed. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 3.5% after reporting, trading at $546 per share.

Is Now The Time?

Ulta may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Ulta is a good business. First off, its revenue growth has been decent over the last four years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its stellar ROIC suggests it has been a well-run company historically.

Ulta's price-to-earnings ratio based on the next 12 months is 21.0x. There are definitely a lot of things to like about Ulta, and looking at the consumer landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $559.81 per share right before these results (compared to the current share price of $546), implying they saw upside in buying Ulta in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.