Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Upland Software (NASDAQ:UPLD), and the best and worst performers in the sales and marketing software group.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 2.37%, while on average next quarter revenue guidance was only 0.05% above consensus. Technology stocks have been hit hard on fears of higher interest rates , but sales and marketing software stocks held their ground better than others, with share price down 7.29% since earnings, on average.

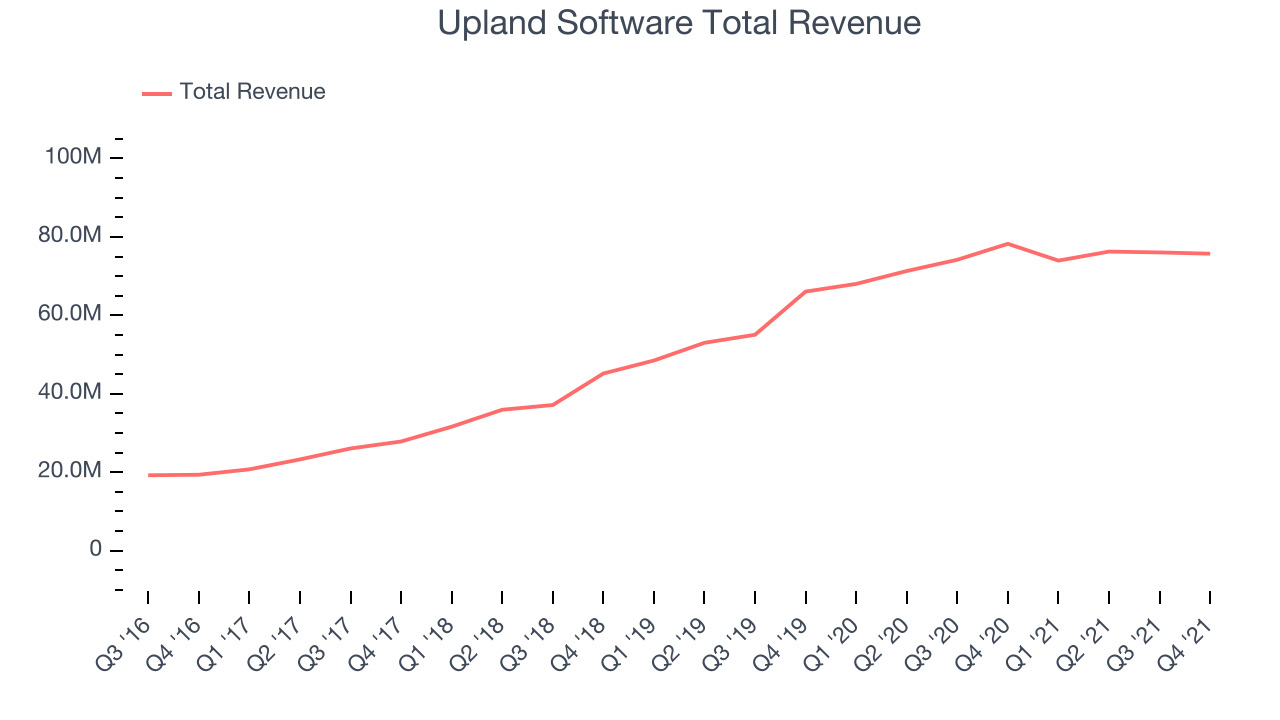

Upland Software (NASDAQ:UPLD)

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Upland Software reported revenues of $75.7 million, down 3.22% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a very strong guidance for the next year but a slow revenue growth.

“We are pleased to share strong Q4 results and announce the acquisition of BA Insight,” said Jack McDonald, Upland's chairman and chief executive officer.

Upland Software delivered the slowest revenue growth of the whole group. The stock is down 10.4% since the results and currently trades at $15.47.

Is now the time to buy Upland Software? Access our full analysis of the earnings results here, it's free.

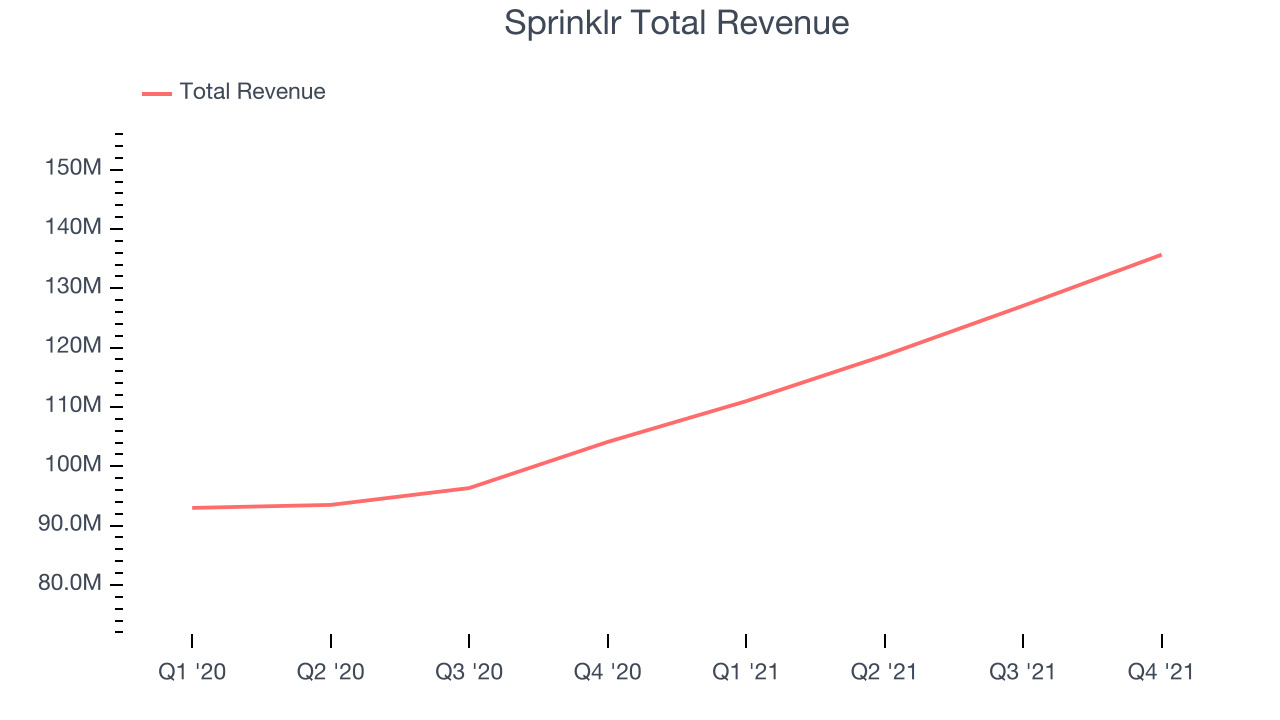

Best Q4: Sprinklr (NYSE:CXM)

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Sprinklr reported revenues of $135.6 million, up 30.3% year on year, beating analyst expectations by 4.05%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Sprinklr scored the highest full year guidance raise among its peers. The company added 2 enterprise customers paying more than $1m annually to a total of 82. The stock is up 18% since the results and currently trades at $13.42.

Is now the time to buy Sprinklr? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $100.9 million, up 9.47% year on year, missing analyst expectations by 0.1%. It was a weak quarter for the company, with slower customer growth and underwhelming guidance for the next year.

The stock is up 1.18% since the results and currently trades at $6.

Read our full analysis of Yext's results here.

Zendesk (NYSE:ZEN)

Founded in 2006 by three Danish friends who got tired of implementing complex old-school solutions, Zendesk (NYSE:ZEN) is a software as a service platform that makes it easier for companies to provide help and support to their customers.

Zendesk reported revenues of $375.3 million, up 32.4% year on year, beating analyst expectations by 1.5%. It was a decent quarter for the company, with a strong top line growth and revenue guidance for the next quarter roughly in line with analysts' expectations.

The stock is up 10.9% since the results and currently trades at $126.70.

Read our full, actionable report on Zendesk here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $207.4 million, up 20.3% year on year, in line with analyst expectations. It was a weaker quarter for the company, with the guidance for both the next quarter and the full year missing analyst estimates.

The stock is down 0.52% since the results and currently trades at $22.58.

Read our full, actionable report on Squarespace here, it's free.

The author has no position in any of the stocks mentioned