Business automation software provider Upland Software (NASDAQ: UPLD) announced better-than-expected results in Q1 CY2024, with revenue down 8.2% year on year to $70.74 million. On the other hand, the company expects next quarter's revenue to be around $67.4 million, slightly below analysts' estimates. It made a non-GAAP profit of $0.19 per share, down from its profit of $0.28 per share in the same quarter last year.

Upland (UPLD) Q1 CY2024 Highlights:

- Revenue: $70.74 million vs analyst estimates of $68.33 million (3.5% beat)

- EPS (non-GAAP): $0.19 vs analyst estimates of $0.14 (39.7% beat)

- Revenue Guidance for Q2 CY2024 is $67.4 million at the midpoint, below analyst estimates of $67.74 million

- The company lifted its revenue guidance for the full year from $271 million to $273.7 million at the midpoint, a 1% increase

- Gross Margin (GAAP): 70.2%, up from 66.9% in the same quarter last year

- Free Cash Flow of $4.94 million, down 42.6% from the previous quarter

- Market Capitalization: $57.11 million

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Businesses of all sizes are driving digital transformations as a means of increasing revenue, reducing costs, and improving productivity. Increasingly this means adopting cloud based applications across different business functions: accounting and finance, sales and marketing, legal and HR, and so on. When possible, small and medium businesses prefer to get as much functionality as possible from one provider.

Upland Software has a unique business approach. The company has grown its portfolio through dozens of acquisitions to create a broad product catalog of complementary software across seven functions: marketing, sales, contact center, project management, IT, business operations, and HR and legal. Historically, the focus has been on acquiring small software companies from venture investors who are seeking exits. Upland will then integrate the acquisitions on its UplandOne platform, which both greatly increases their profitability to Upland by removing legacy infrastructure, while also making the software easily accessible to Upland’s customer base.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Upland Software has a wide range of competitors given its wide breadth of offering. Common rivals are Qualtrics (NASDAQ:XM), Oracle’s Netsuite (NYSE:ORCL), OpenText (NASDAQ:OTEX), Docusign (NASDAQ:DOCU), and Adobe (NASDAQ:ADBE).

Sales Growth

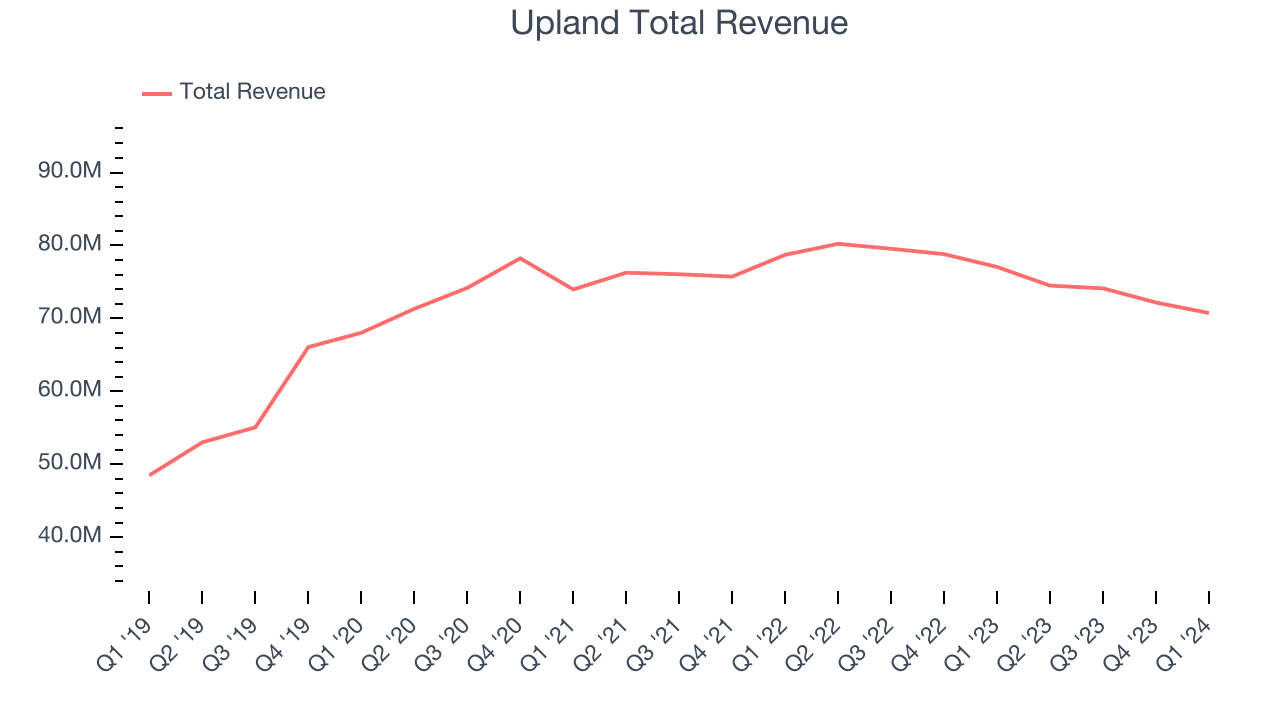

As you can see below, Upland's revenue has been flat over the last three years, coming in at $70.74 million this quarter compared to $73.97 million in Q1 2021.

Upland's revenue was down again this quarter, falling 8.2% year on year.

Next quarter, Upland is guiding for a 9.5% year-on-year revenue decline to $67.4 million, a further deceleration from the 7.1% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street was expecting revenue to decline 6.2% over the next 12 months before the earnings results announcement.

Profitability

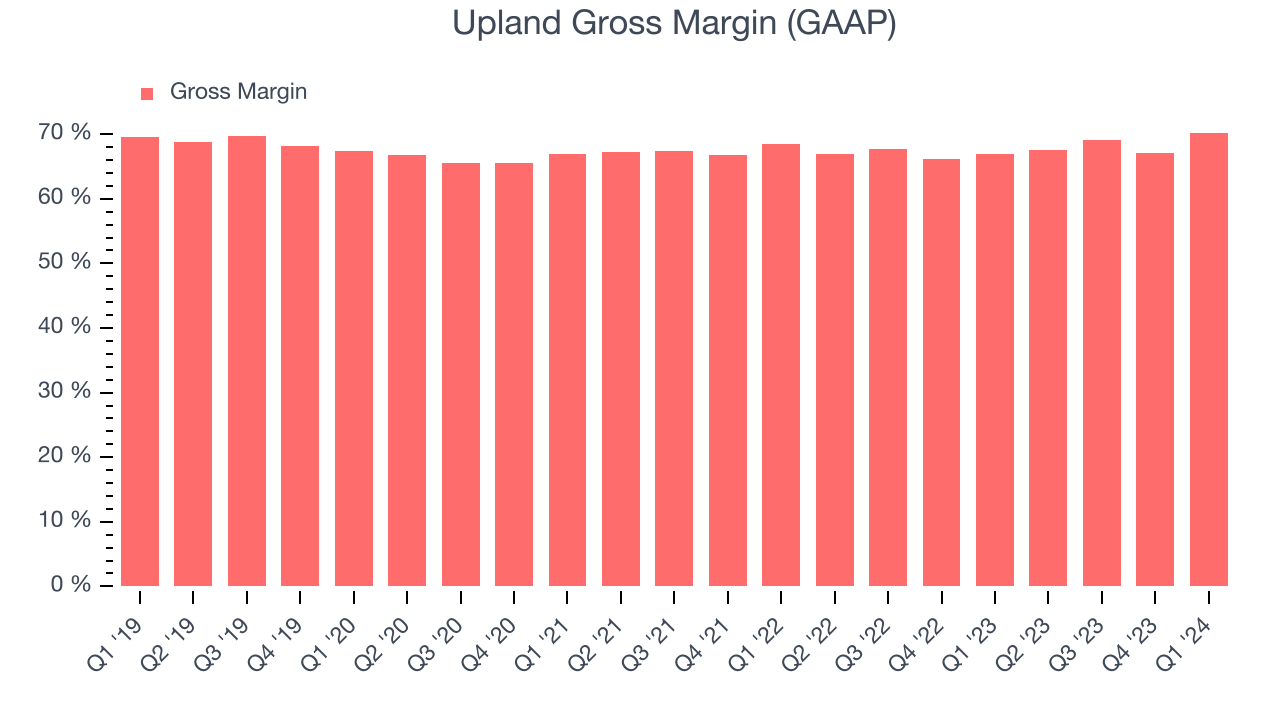

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Upland's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 70.2% in Q1.

That means that for every $1 in revenue the company had $0.70 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, Upland's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

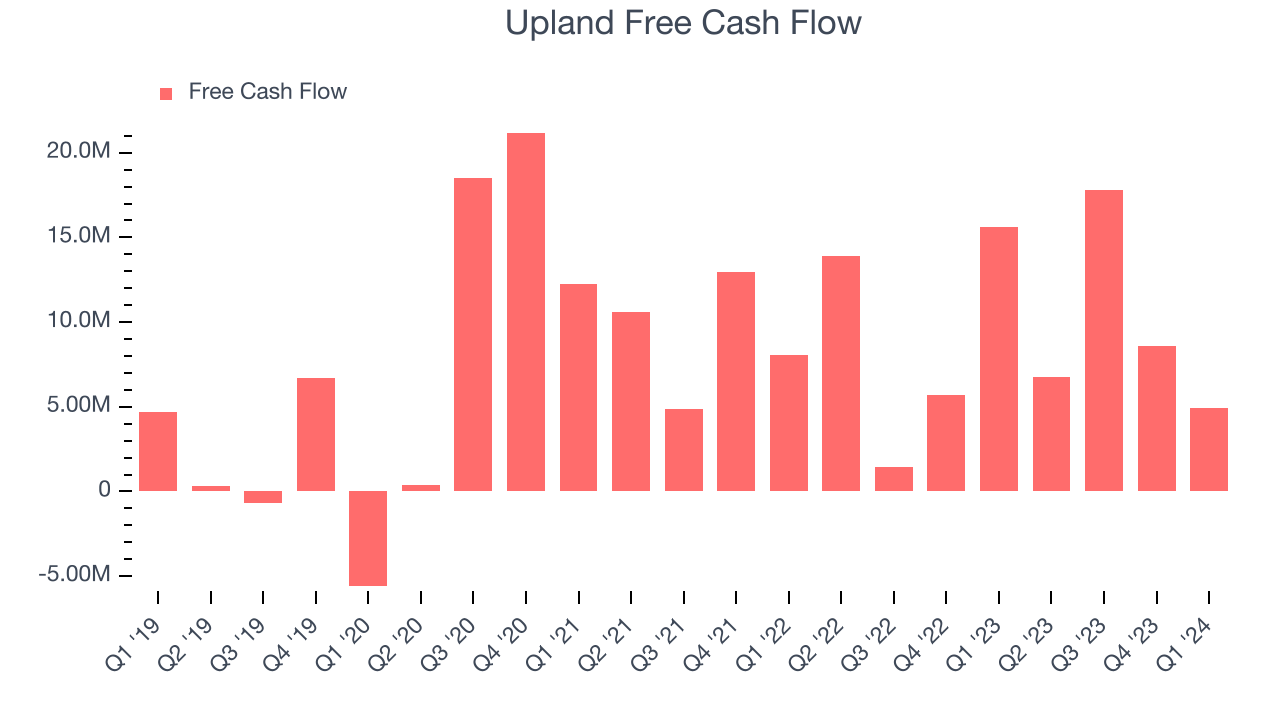

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Upland's free cash flow came in at $4.94 million in Q1, down 68.4% year on year.

Upland has generated $38.05 million in free cash flow over the last 12 months, a decent 13.1% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Upland's Q1 Results

We were impressed by Upland's strong gross margin improvement this quarter. We were also glad its revenue and EPS outperformed Wall Street's estimates. On the other hand, its revenue guidance for the next quarter missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $2.02 per share.

Is Now The Time?

When considering an investment in Upland, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Upland, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins aren't as good as other tech businesses we look at.

While we've no doubt one can find things to like about Upland, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.67 right before these results (compared to the current share price of $2.02).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.