AI lending platform Upstart (NASDAQ:UPST) beat analysts' expectations in Q2 CY2024, with revenue down 6% year on year to $127.6 million. Guidance for next quarter's revenue was also optimistic at $150 million at the midpoint, 10.8% above analysts' estimates. It made a non-GAAP loss of $0.17 per share, improving from its loss of $0.34 per share in the same quarter last year.

Is now the time to buy Upstart? Find out by accessing our full research report, it's free.

Upstart (UPST) Q2 CY2024 Highlights:

- Revenue: $127.6 million vs analyst estimates of $124.5 million (2.5% beat)

- Adjusted Operating Income: -$55.49 million vs analyst estimates of -$72.99 million (24% beat)

- EPS (non-GAAP): -$0.17 vs analyst estimates of -$0.39

- Revenue Guidance for Q3 CY2024 is $150 million at the midpoint, above analyst estimates of $135.3 million

- Gross Margin (GAAP): 54.2%, down from 72.9% in the same quarter last year

- Free Cash Flow of $87.78 million, up from $26.06 million in the previous quarter

- Market Capitalization: $2.09 billion

“The guidance we released today demonstrates that we’re on track toward resuming our role as the fintech known for high growth and healthy margins,” said Dave Girouard, CEO, Upstart.

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Lending Software

Businesses have come to use data driven insights to stratify their customers into more granular buckets that enable more personalized (and profitable) offerings. Lending software is a prime example of fintech democratizing access to loans in a still-profitable manner for financial institutions.

Sales Growth

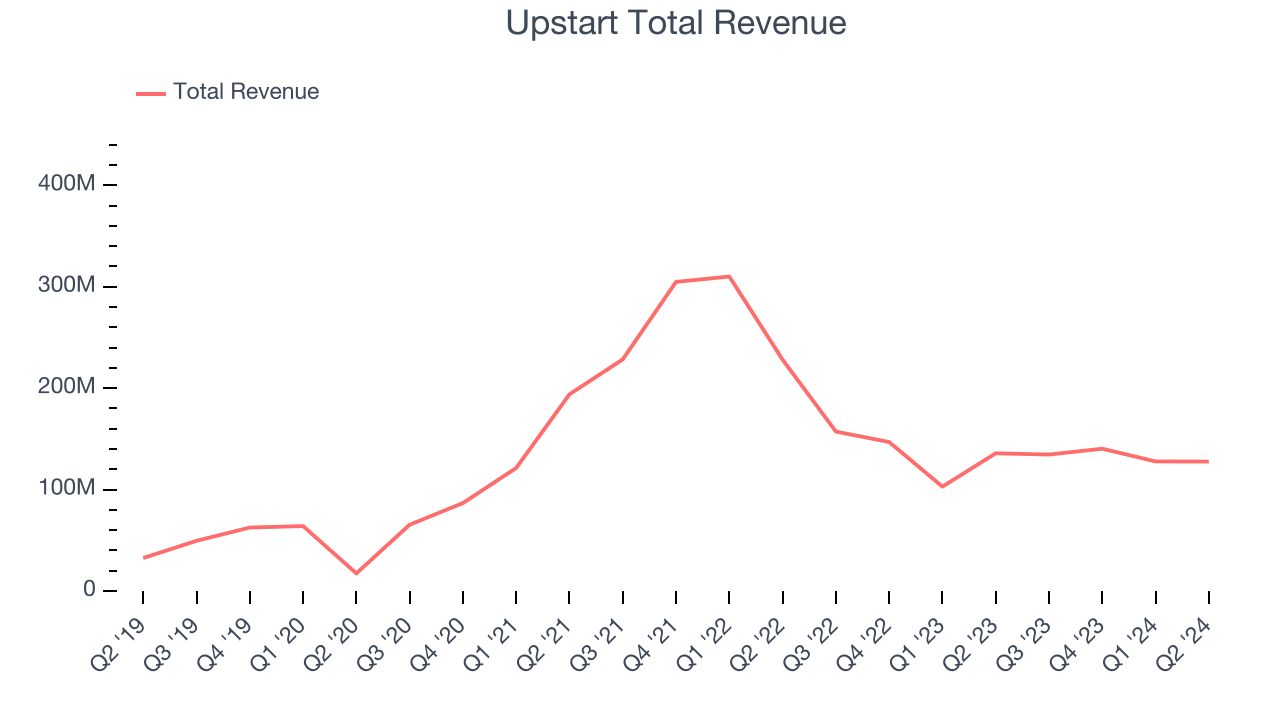

As you can see below, Upstart's revenue growth has been weak over the last three years, declining from $193.9 million in Q2 2021 to $127.6 million this quarter.

This quarter, Upstart's revenue was down 6% year on year, which might disappointment some shareholders.

Next quarter's guidance suggests that Upstart is expecting revenue to grow 11.5% year on year to $150 million, improving on the 14.4% year-on-year decline it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 15.4% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

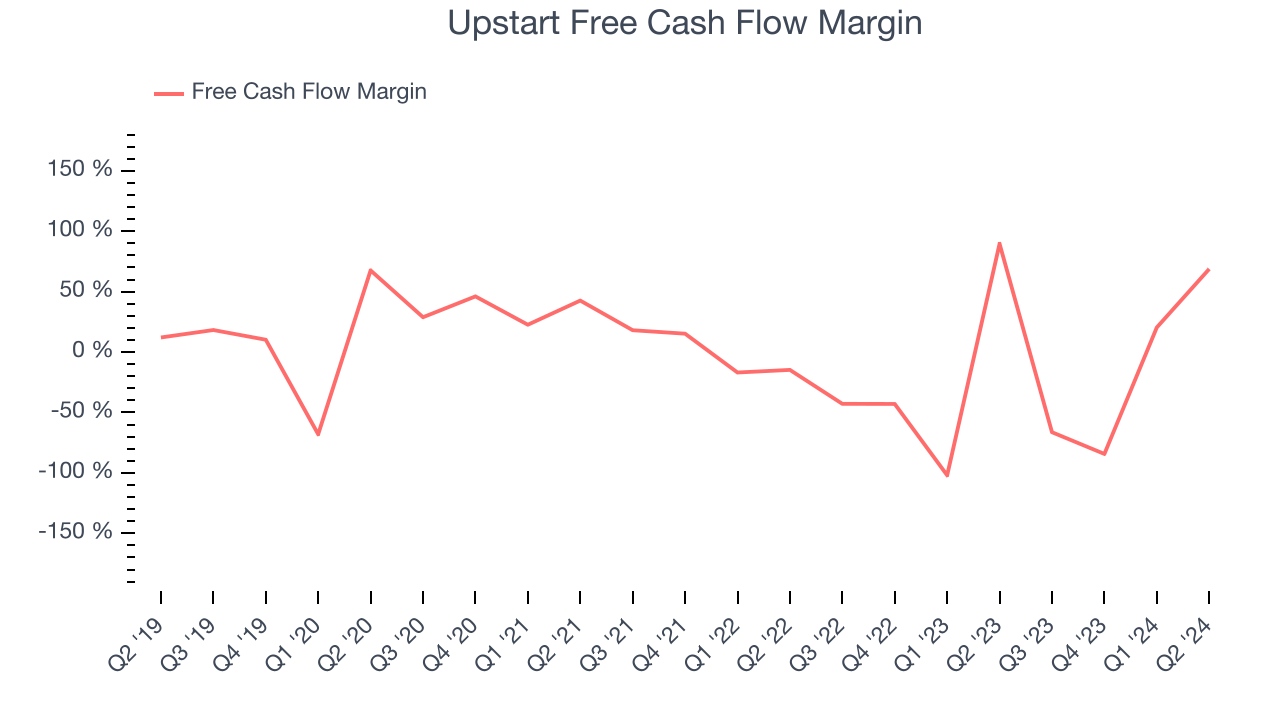

While Upstart posted positive free cash flow this quarter, the broader story hasn't been so clean. Upstart's demanding reinvestments have drained its resources over the last year. Its free cash flow margin was among the worst in the software sector, averaging negative 17.7%.

Upstart's free cash flow clocked in at $87.78 million in Q2, equivalent to a 68.8% margin. The company's cash profitability regressed as it was 20.8 percentage points lower than in the same quarter last year, but it's still above its one-year average. We wouldn't put too much weight on this quarter's decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Upstart's Q2 Results

We were impressed by Upstart's revenue guidance and rosy outlook for next quarter, which blew past analysts' expectations. Overall, we think this was a strong quarter that should satisfy shareholders. The stock traded up 19.5% to $28.52 immediately following the results.

Upstart may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.