AI lending platform Upstart (NASDAQ:UPST) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 24.2% year on year to $127.8 million. On the other hand, next quarter's revenue guidance of $125 million was less impressive, coming in 12.8% below analysts' estimates. It made a non-GAAP loss of $0.31 per share, improving from its loss of $1.58 per share in the same quarter last year.

Upstart (UPST) Q1 CY2024 Highlights:

- Revenue: $127.8 million vs analyst estimates of $124.8 million (2.4% beat)

- EPS (non-GAAP): -$0.31 vs analyst estimates of -$0.39

- Revenue Guidance for Q2 CY2024 is $125 million at the midpoint, below analyst estimates of $143.3 million

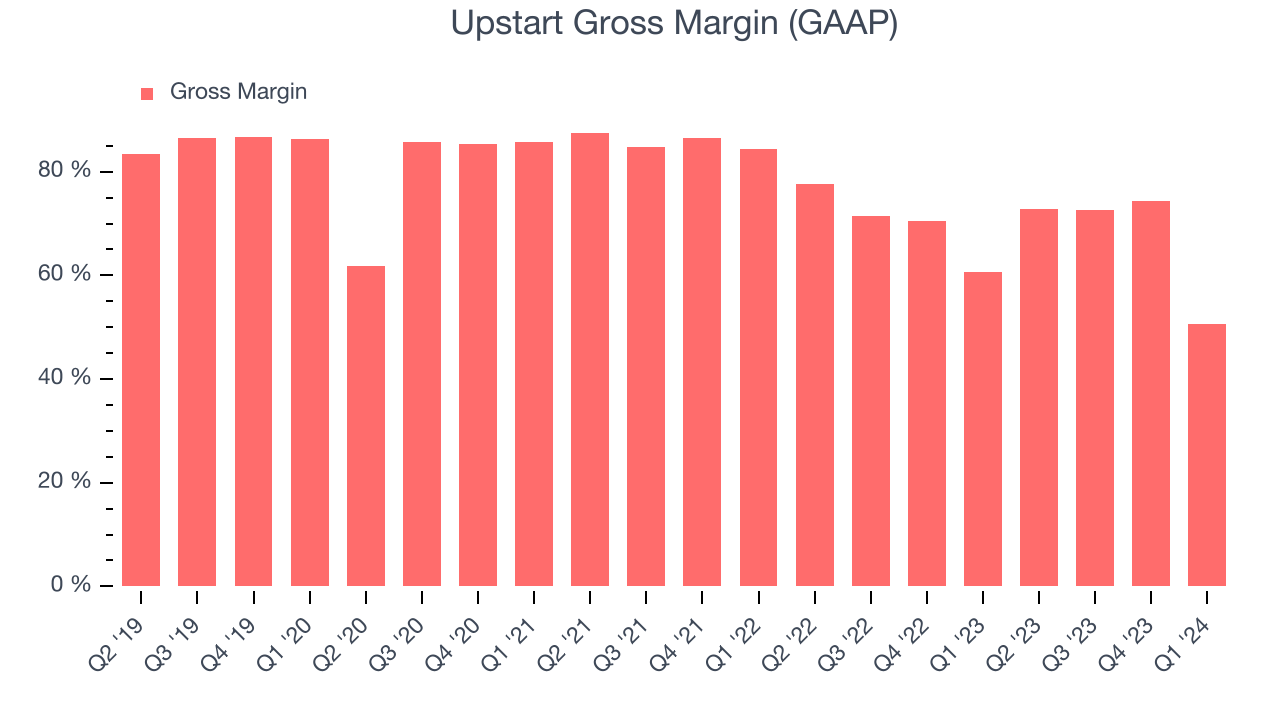

- Gross Margin (GAAP): 50.6%, down from 60.6% in the same quarter last year

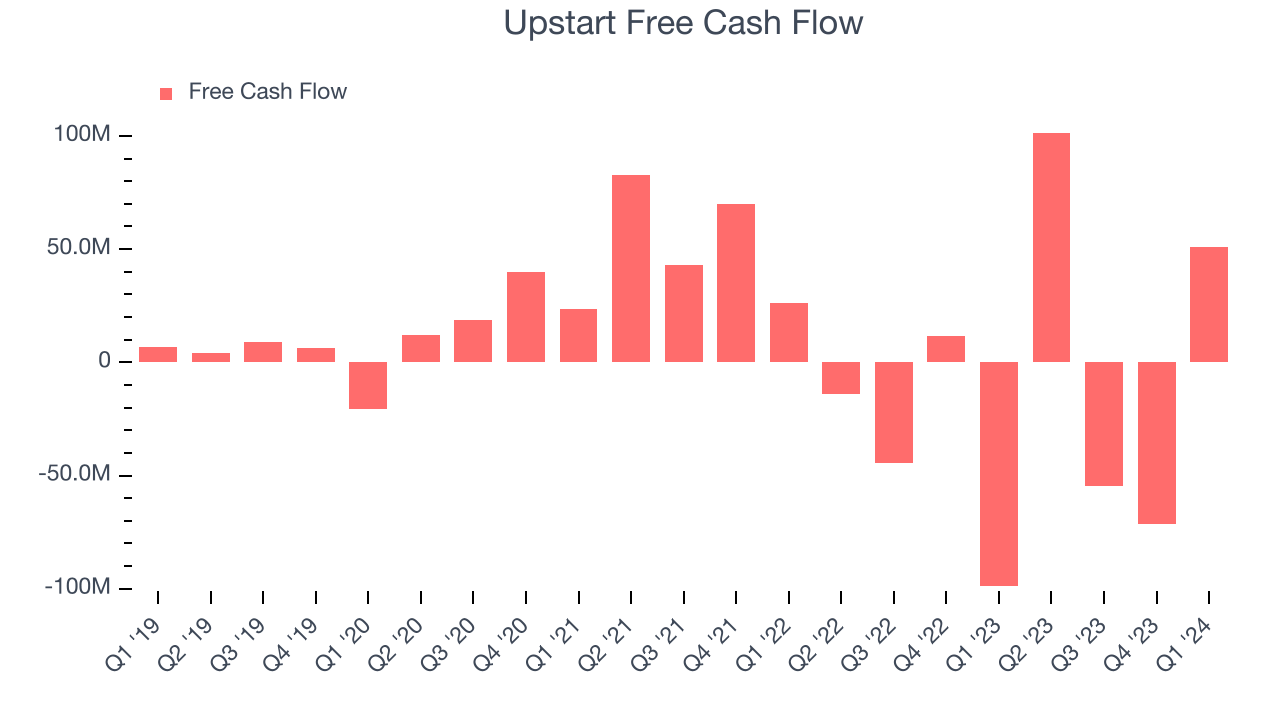

- Free Cash Flow of $50.87 million is up from -$71.44 million in the previous quarter

- Market Capitalization: $2.26 billion

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

After a successful stint at Google where he started what later became Google Cloud, Dave Girouard founded Upstart together with his former colleague Anna Counselman and data scientist Paul Gu.

The ways lenders determine credit approvals in the US have not really changed in over 30 years and still rely mainly on FICO and simplistic rules-based systems. As a result, millions of creditworthy individuals who don’t fit into the precise brackets are either not approved for loans at all, or pay too much to borrow money. Upstart instead uses cloud-computing and machine learning to evaluate more than 1,000 data-points for each loan applicant, allowing them to estimate the risk of default on a loan more precisely, and for more people. For consumers, it means higher approval rates and lower interest rates and for banks it means access to new customers and lower fraud and loss rates. Because the decision is now made by software, it also means all-digital, automated experience from start to end.

Upstart provides their technology to banks and for some customers serves as an intermediary, but itself bears no credit risk and just simply charges the banks a fee for every provided loan. The company has started by evaluating applicants for personal loans, but their target market also includes auto loans, credit cards and mortgages.

Lending Software

Businesses have come to use data driven insights to stratify their customers into more granular buckets that enable more personalized (and profitable) offerings. Lending software is a prime example of fintech democratizing access to loans in a still-profitable manner for financial institutions.

Upstart’s main competitor would be FICO (NYSE:FICO), others somewhat related might include alternative lenders like Lending Tree (NASDAQ:TREE).

Sales Growth

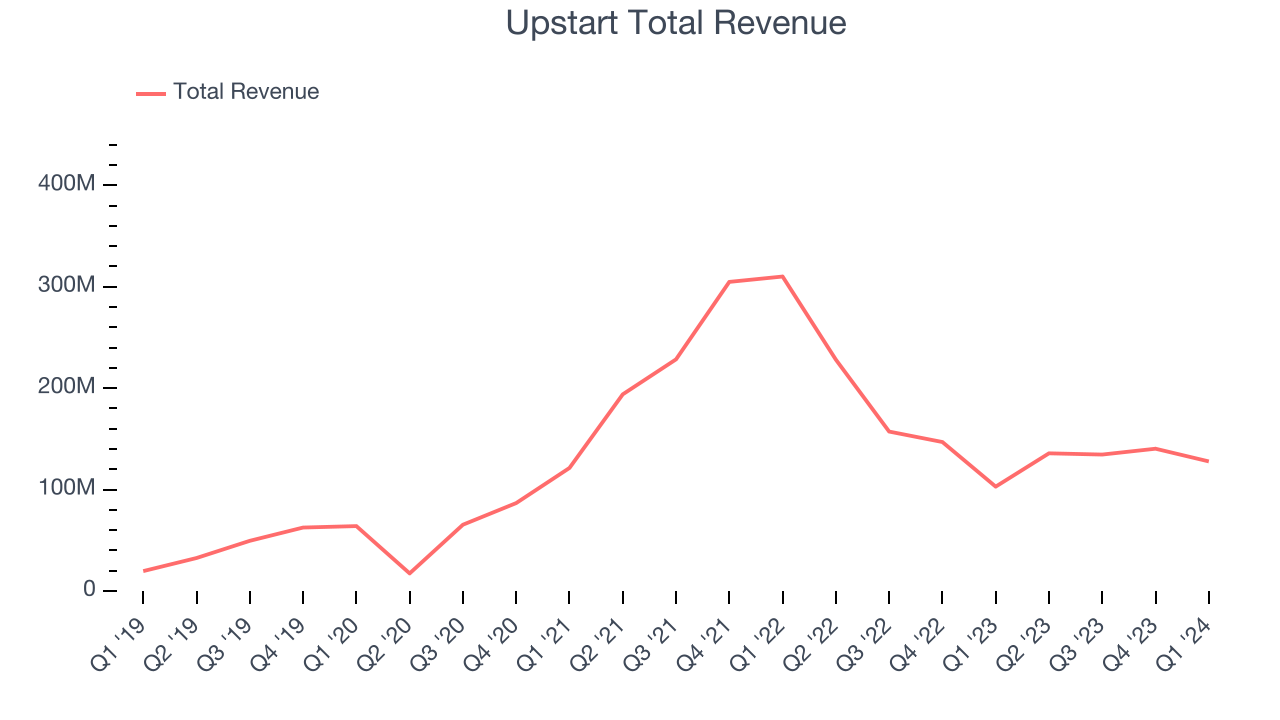

As you can see below, Upstart's revenue growth has been volatile over the last three years, growing from $121.3 million in Q1 2021 to $127.8 million this quarter.

This quarter, Upstart's quarterly revenue was once again up a very solid 24.2% year on year. However, the company's revenue actually decreased by $12.52 million in Q1 compared to the $5.76 million increase in Q4 CY2023. Taking a closer look we can a similar revenue decline in the same quarter last year, which could suggest that the business has seasonal elements. Regardless, this situation is worth monitoring as management is guiding for a further revenue drop in the next quarter.

Next quarter, Upstart is guiding for a 7.9% year-on-year revenue decline to $125 million, an improvement on the 40.5% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Upstart's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 50.6% in Q1.

That means that for every $1 in revenue the company had $0.51 left to spend on developing new products, sales and marketing, and general administrative overhead. Upstart's gross margin is poor for a SaaS business and it's dropped significantly since the previous quarter. This is probably the exact opposite of what shareholders would like to see.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Upstart's free cash flow came in at $50.87 million in Q1, turning positive over the last year.

Upstart has generated $26.17 million in free cash flow over the last 12 months, or 4.9% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Upstart's Q1 Results

It was good to see Upstart beat analysts' revenue expectations this quarter and produce free cash flow. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its gross margin shrunk. Overall, the results could have been better. The stock is flat after reporting and currently trades at $24.5 per share.

Is Now The Time?

When considering an investment in Upstart, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Upstart, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its customer acquisition is less efficient than many comparable companies and its gross margins aren't as good as other tech businesses we look at.

Upstart's price-to-sales ratio based on the next 12 months is 3.4x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. While there are some things to like about Upstart and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $19.88 right before these results (compared to the current share price of $24.50), implying they didn't see much short-term potential in Upstart.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.