Data protection and security software company Varonis (NASDAQ:VRNS) reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 8.1% year on year to $154.1 million. On the other hand, next quarter's revenue guidance of $113 million was less impressive, coming in 3.3% below analysts' estimates. It made a non-GAAP profit of $0.27 per share, improving from its profit of $0.21 per share in the same quarter last year.

Varonis (VRNS) Q4 FY2023 Highlights:

- Revenue: $154.1 million vs analyst estimates of $151.7 million (1.6% beat)

- EPS (non-GAAP): $0.27 vs analyst estimates of $0.23 (18.5% beat)

- Revenue Guidance for Q1 2024 is $113 million at the midpoint, below analyst estimates of $116.8 million

- Management's revenue guidance for the upcoming financial year 2024 is $541 million at the midpoint, missing analyst estimates by 0.8% and implying 8.4% growth (vs 5.6% in FY2023)

- Free Cash Flow of $8.30 million, up 38.5% from the previous quarter

- Gross Margin (GAAP): 87.4%, in line with the same quarter last year

- Market Capitalization: $4.95 billion

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ:VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

The company's key product is the Varonis Data Security platform. It provides features including real-time threat detection, data classification/governance, and compliance reporting. Threat detection tells an organization if a rogue employee is moving large amounts of data. Data classification/governance helps organize data by levels of sensitivity and can automatically apply access and security measures based on this. Compliance reporting ensures that an organization’s data practices comply with regulations that may govern where consumer demographic data is stored, for example.

Without proper tools, organizations are generally better equipped to create data than protect it, and data breaches can have significant financial and reputational consequences. For example, international email marketing company Epsilon suffered a database hack in 2011 that affected 75 clients and was estimated to cost the company $3-4bn when factoring in direct costs, forensic audits, litigation, and lost business.

The company’s customers are of various industries but tend to be larger enterprises rather than small or medium-sized businesses with few employees and simple IT architectures. Varonis generates revenue through software licensing and maintenance fees. The company also offers professional services such as implementation and training to ensure customer success.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Competitors offering data protection and security software providers include Qualys (NASDAQ:QLYS), Rapid7 (NASDAQ:RPD), and F5 (NASDAQ:FFIV).Sales Growth

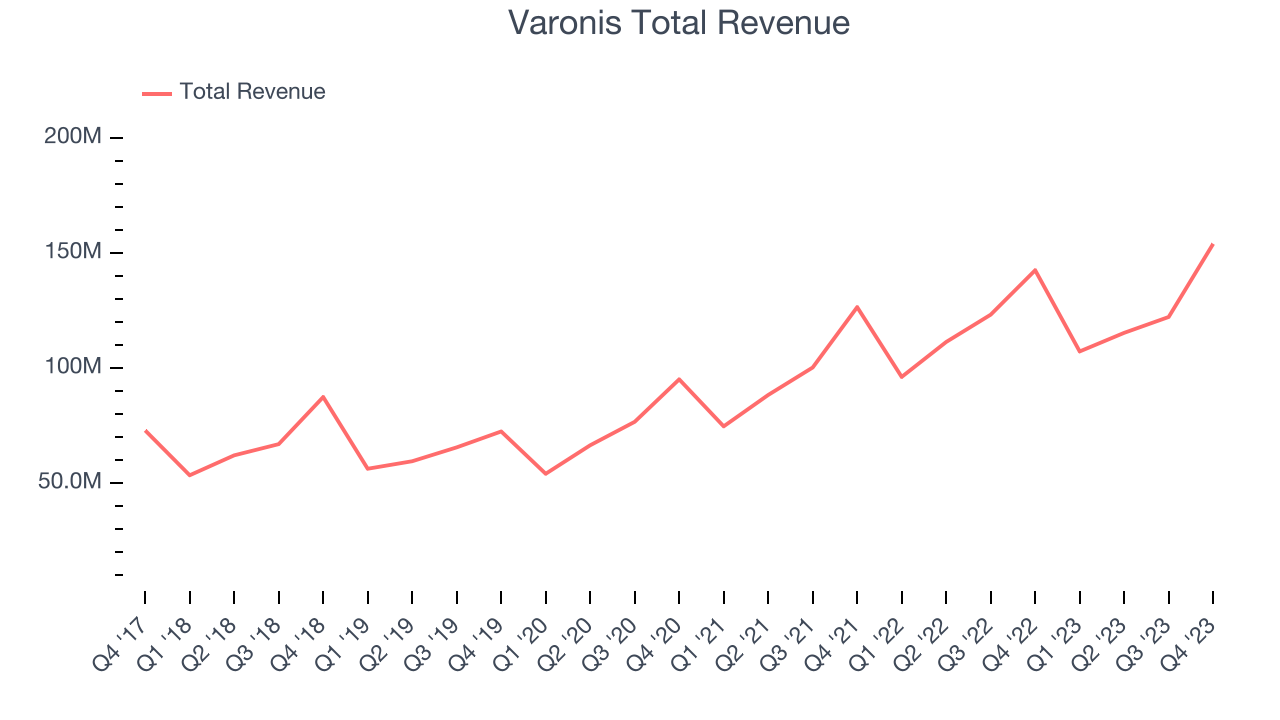

As you can see below, Varonis's revenue growth has been mediocre over the last two years, growing from $126.6 million in Q4 FY2021 to $154.1 million this quarter.

Varonis's quarterly revenue was only up 8.1% year on year. However, we can see that the company's revenue grew by $31.79 million quarter on quarter, accelerating from $6.89 million in Q3 2023.

Next quarter's guidance suggests that Varonis is expecting revenue to grow 5.3% year on year to $113 million, slowing down from the 11.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $541 million at the midpoint, growing 8.4% year on year compared to the 5.4% increase in FY2023.

Profitability

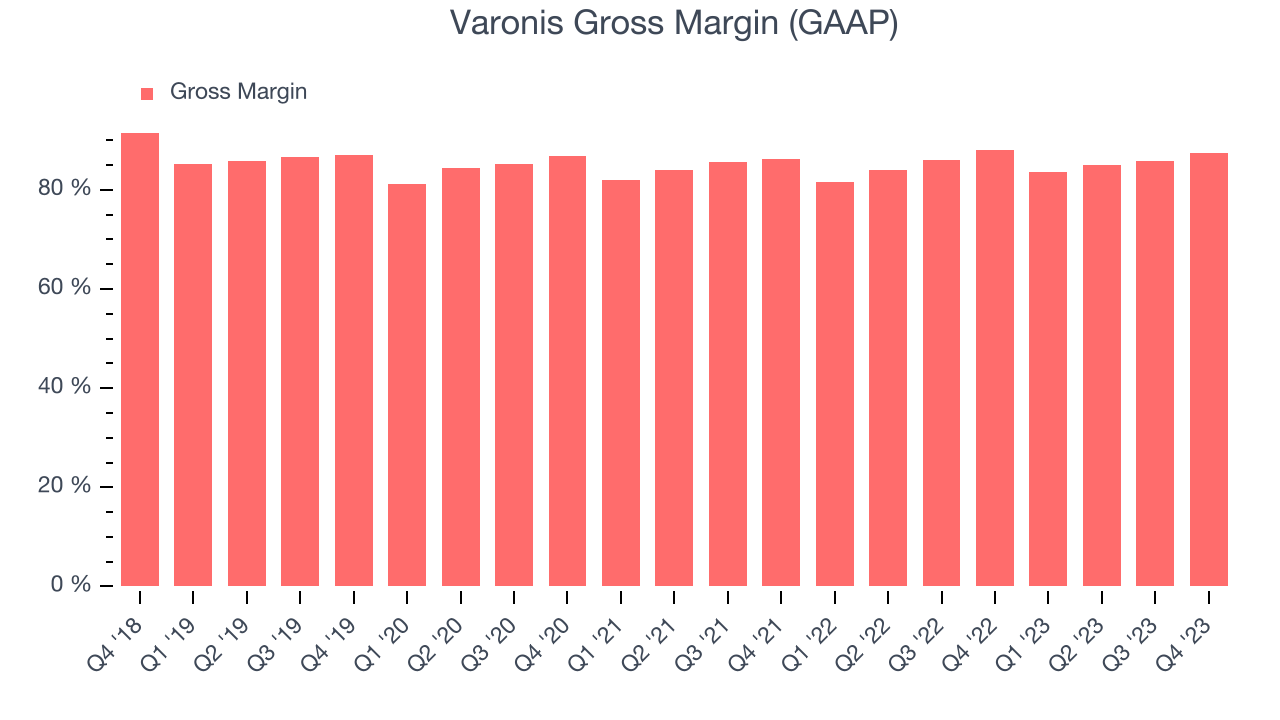

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Varonis's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 87.4% in Q4.

That means that for every $1 in revenue the company had $0.87 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Varonis's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

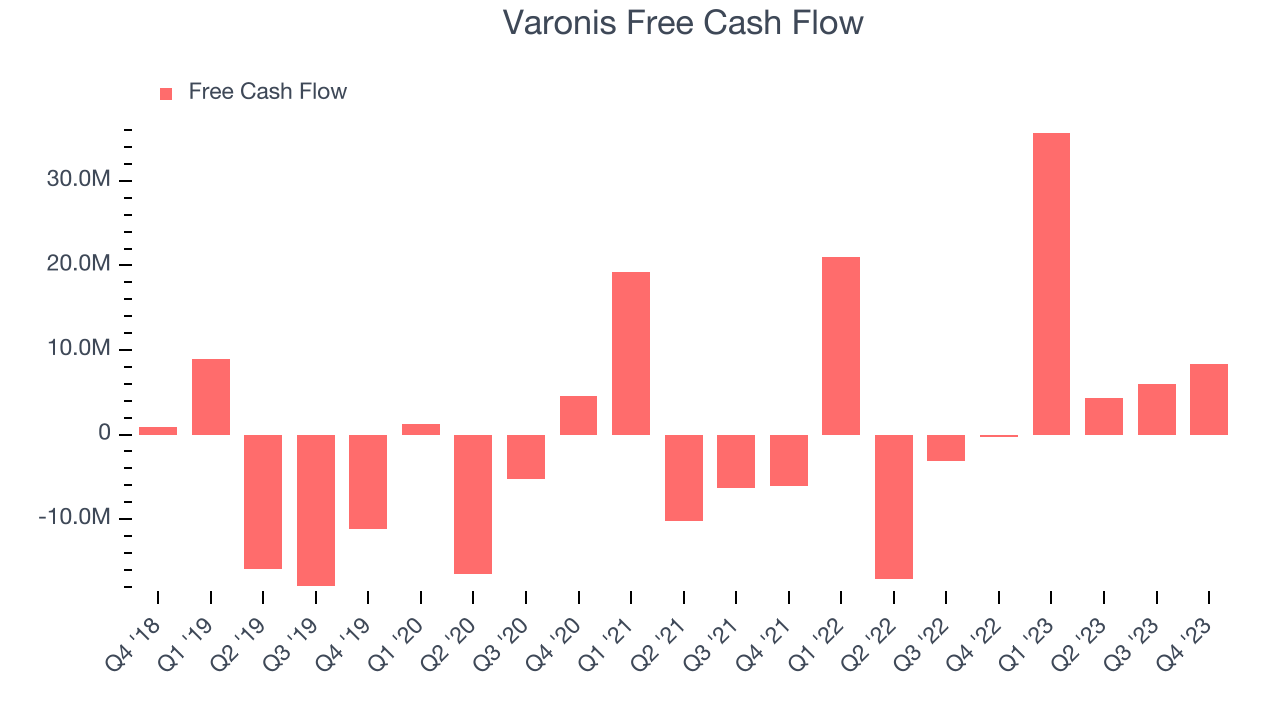

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Varonis's free cash flow came in at $8.30 million in Q4, turning positive over the last year.

Varonis has generated $54.32 million in free cash flow over the last 12 months, a solid 11.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Varonis's Q4 Results

It was great to see Varonis expecting revenue growth to accelerate next year. We were also glad exceeded EPS and revenue expectations this quarter. On the other hand, despite the improvement its full-year revenue guidance missed Wall Street's estimates. Overall, this was a mixed quarter for Varonis. The stock is up 2.7% after reporting and currently trades at $46.75 per share.

Is Now The Time?

Varonis may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Varonis is a good business. Although its revenue growth has been uninspiring over the last two years with analysts expecting growth to slow from here, its impressive gross margins indicate excellent business economics.

The market is certainly expecting long-term growth from Varonis given its price-to-sales ratio based on the next 12 months is 9.1x. There's definitely a lot of things to like about Varonis and looking at the tech landscape right now, it seems that the company trades at a pretty interesting price point.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.