Domain name registry operator Verisign (NASDAQ:VRSN) reported results in line with analysts' expectations in Q2 FY2023, with revenue up 5.71% year on year to $372 million. VeriSign made a GAAP profit of $185.7 million, improving from its profit of $167.3 million in the same quarter last year.

Is now the time to buy VeriSign? Find out by accessing our full research report free of charge.

VeriSign (VRSN) Q2 FY2023 Highlights:

- Revenue: $372 million vs analyst estimates of $373.1 million (small miss)

- EPS: $1.79 vs analyst estimates of $1.75 (2.08% beat)

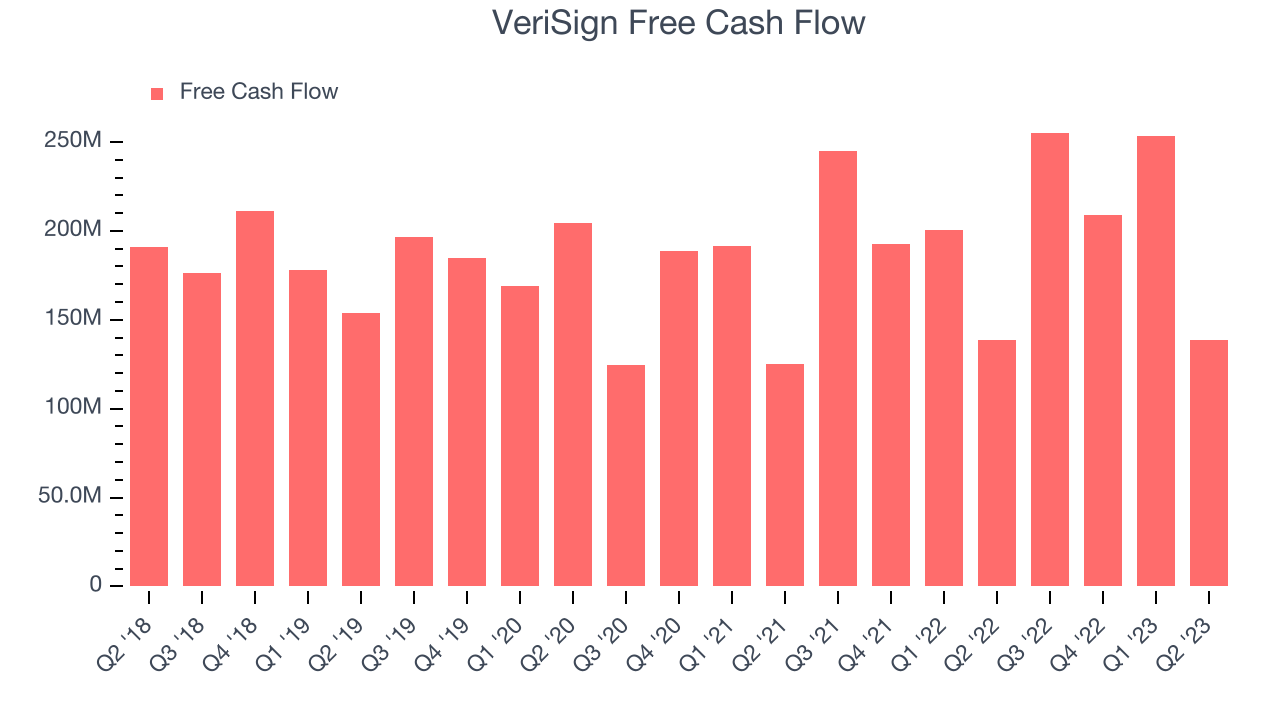

- Free cash flow of $138.8 million, down 45.2% from the previous quarter

- Gross Margin (GAAP): 86.5%, in line with the same quarter last year

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

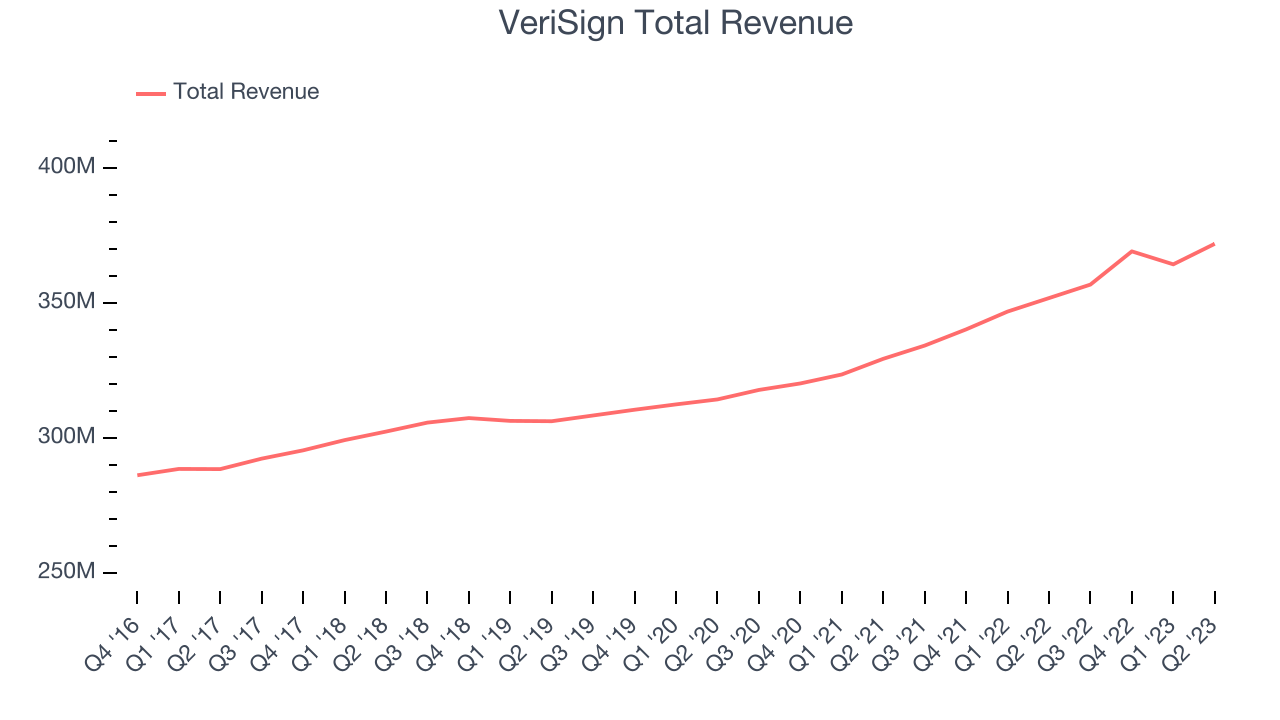

As you can see below, VeriSign's revenue growth has been over the last two years, growing from $329.4 million in Q2 FY2021 to $372 million this quarter.

VeriSign's quarterly revenue was only up 5.71% year on year, which isn't particularly great. However, its revenue increased $7.6 million quarter on quarter, a strong improvement from the $4.8 million decrease in Q1 2023. This is a sign of acceleration of growth and very nice to see indeed.

Ahead of the earnings results announcement, the analysts covering the company were expecting sales to grow 7.5% over the next 12 months.

In volatile times like these, we look for robust businesses with strong pricing power. Overlooked by most investors, this company is one of the highest-quality software companies in the world, and its software products have been the gold standard in critical industries for decades. The result is an impressive business that's up an incredible 18,000%+ since its IPO. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. VeriSign's free cash flow came in at $138.8 million in Q2, roughly the same as last year.

VeriSign has generated $856.6 million in free cash flow over the last 12 months, an eye-popping 58.8% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from VeriSign's Q2 Results

With a market capitalization of $21.9 billion, a $935.6 million cash balance, and positive free cash flow over the last 12 months, we're confident that VeriSign has the resources needed to pursue a high-growth business strategy.

It was unfortunate that VeriSign's revenue slightly missed analysts' expectations. On the other hand free cash flow was still strong and in line with last year. Overall, this was a mixed quarter for VeriSign. The company is down 2.09% on the results and currently trades at $205 per share.

VeriSign may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, and what's happened in the latest quarter. We cover this and more in our full company report, and it's free.

Looking for more investment opportunities? One way to find them is to watch for paradigm shifts, just like how every company in the world is slowly becoming a technology company and facing increasing cybersecurity risks. This company is leading the charge in cyber defense with its cloud-native cybersecurity solutions while generating best-in-class revenue growth and SaaS performance metrics. It should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.