Domain name registry operator Verisign (NASDAQ:VRSN) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5.5% year on year to $384.3 million. It made a GAAP profit of $1.92 per share, improving from its profit of $1.70 per share in the same quarter last year.

VeriSign (VRSN) Q1 CY2024 Highlights:

- Revenue: $384.3 million vs analyst estimates of $381.8 million (small beat)

- EPS: $1.92 vs analyst estimates of $1.86 (3.3% beat)

- Gross Margin (GAAP): 87.2%, up from 86.3% in the same quarter last year

- Free Cash Flow of $253.5 million, up 27.3% from the previous quarter

- Market Capitalization: $18.58 billion

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

The company manages well over 100 million domain names. Its specific role entails maintaining the master database of domain names and other information associated with them as well as providing services such as domain name registration, renewal, and management to registrars (like GoDaddy, who sells domains to end users). Lastly, Verisign is responsible for implementing cybersecurity measures to protect against threats and attacks.

Individuals, businesses, and organizations alike need a reliable and secure online presence so others can digitally view the classes offered at a gym, place an e-commerce order, or find out when a museum opens. This starts with a domain name that is easy to remember, represents a brand or identity, and can be accessed anywhere with an internet connection.

When a customer such as a small business registers a .com or .net domain name, the registrar they purchase the domain from (GoDaddy or Wix, for example) pays Verisign a fee for the registration and maintenance of that domain. Verisign generates revenue primarily through the registration and renewal of these domain names, as well as through the provision of internet security services.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Competitors offering registry services include Alphabet (NASDAQ:GOOGL), GoDaddy (NYSE:GDDY) and China Internet Network Information Center.Sales Growth

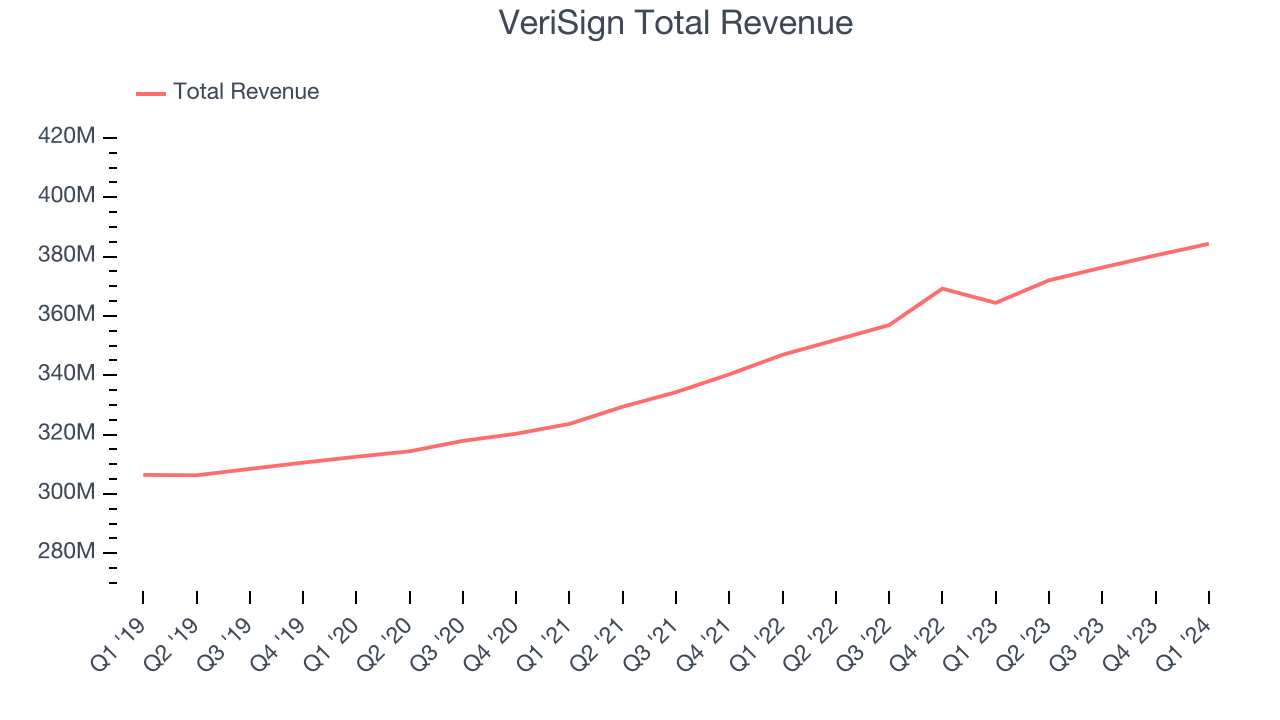

As you can see below, VeriSign's revenue growth has been unimpressive over the last three years, growing from $323.6 million in Q1 2021 to $384.3 million this quarter.

VeriSign's quarterly revenue was only up 5.5% year on year, which might disappoint some shareholders. We can see that revenue increased by $3.9 million in Q1, which was roughly the same as in Q4 CY2023.

Looking ahead, analysts covering the company were expecting sales to grow 5.9% over the next 12 months before the earnings results announcement.

Profitability

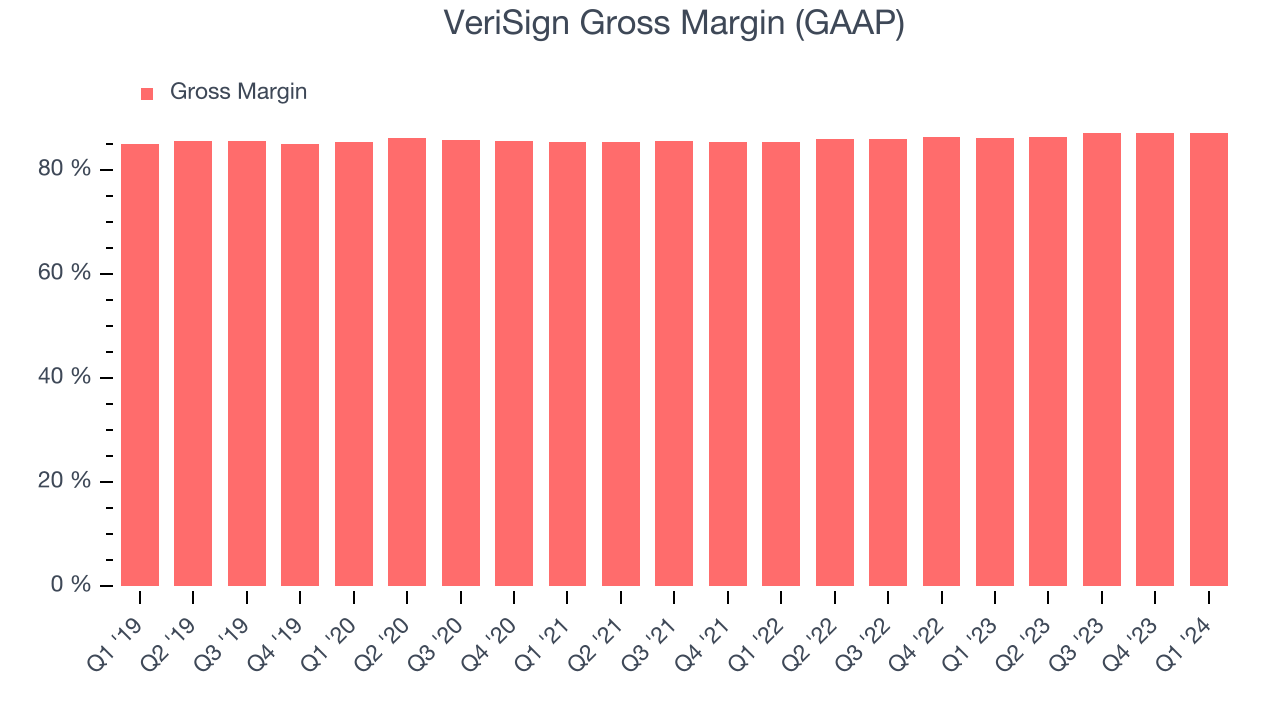

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. VeriSign's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 87.2% in Q1.

That means that for every $1 in revenue the company had $0.87 left to spend on developing new products, sales and marketing, and general administrative overhead. VeriSign's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that VeriSign is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

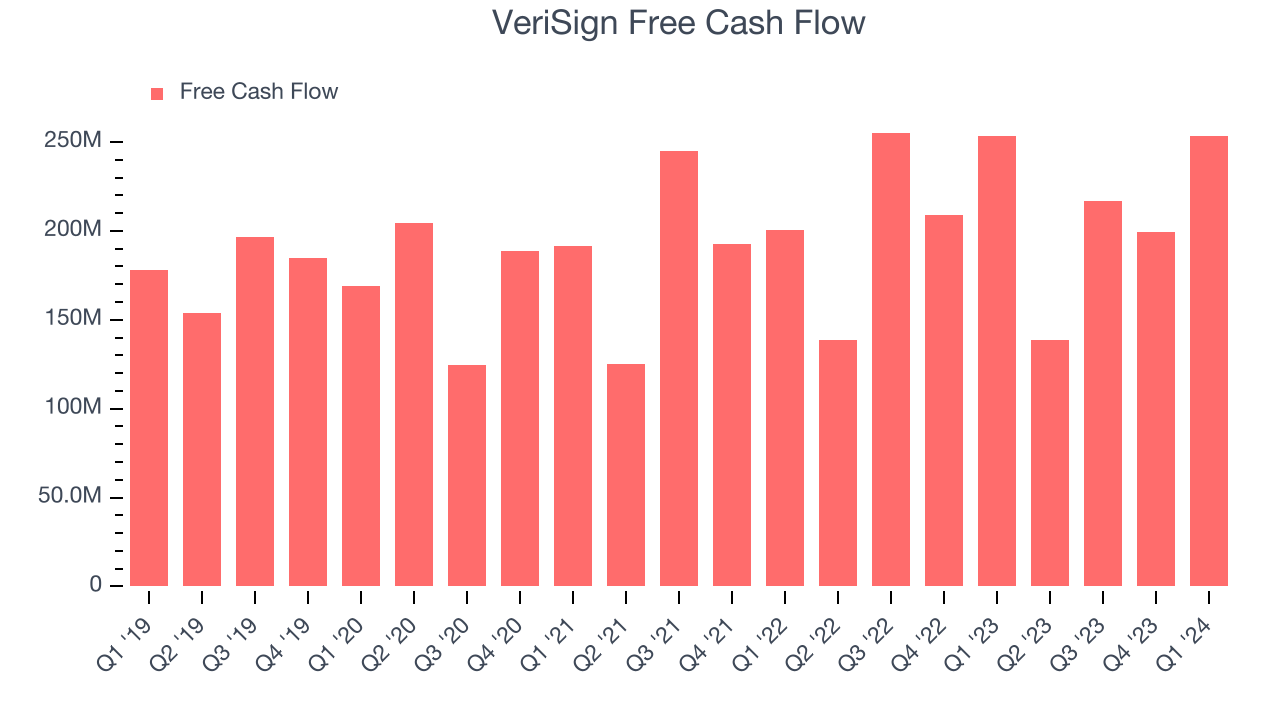

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. VeriSign's free cash flow came in at $253.5 million in Q1, roughly the same as last year.

VeriSign has generated $808.2 million in free cash flow over the last 12 months, an eye-popping 53.4% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Key Takeaways from VeriSign's Q1 Results

It was good to see VeriSign beat analysts' revenue and EPS estimates this quarter as it processed 9.5 million new domain name registrations. Overall, we think this was a decent quarter, showing that the company is staying on target. The stock is up 1.8% after reporting and currently trades at $185.97 per share.

Is Now The Time?

When considering an investment in VeriSign, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that VeriSign isn't a bad business. Although its revenue growth has been weak over the last three years with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

VeriSign's price-to-sales ratio of 11.5x based on the next 12 months indicates the market is definitely optimistic about its growth prospects. There are things to like about VeriSign, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $222.90 right before these results (compared to the current share price of $185.97).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.