VeriSign trades at $194.92 per share and has stayed right on track with the overall market, gaining 9.4% over the last six months. At the same time, the S&P 500 has returned 10.3%.

Is there a buying opportunity in VeriSign, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in VeriSign. Here are two reasons why we avoid VRSN and a stock we'd rather own.

Why Is VeriSign Not Exciting?

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

1. Long-Term Revenue Growth Disappoints

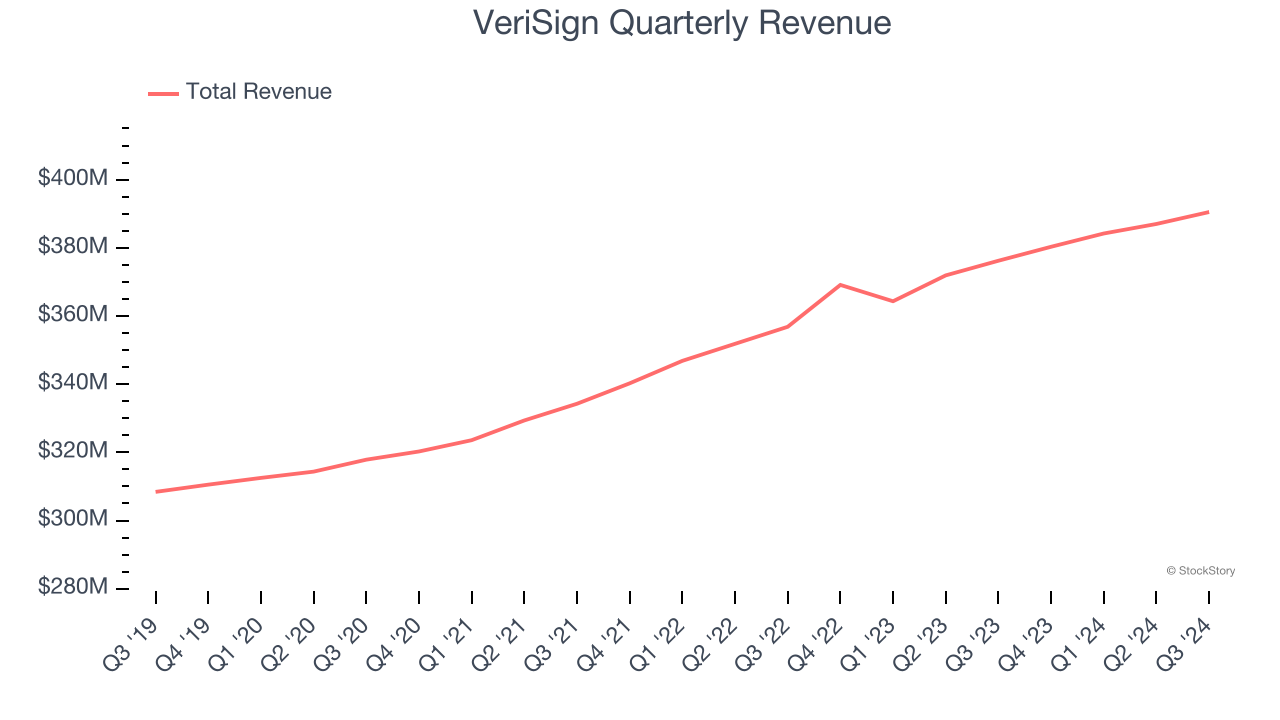

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, VeriSign’s sales grew at a weak 5.7% compounded annual growth rate over the last three years. This fell short of our benchmark for the software sector.

2. Weak Billings Point to Soft Demand

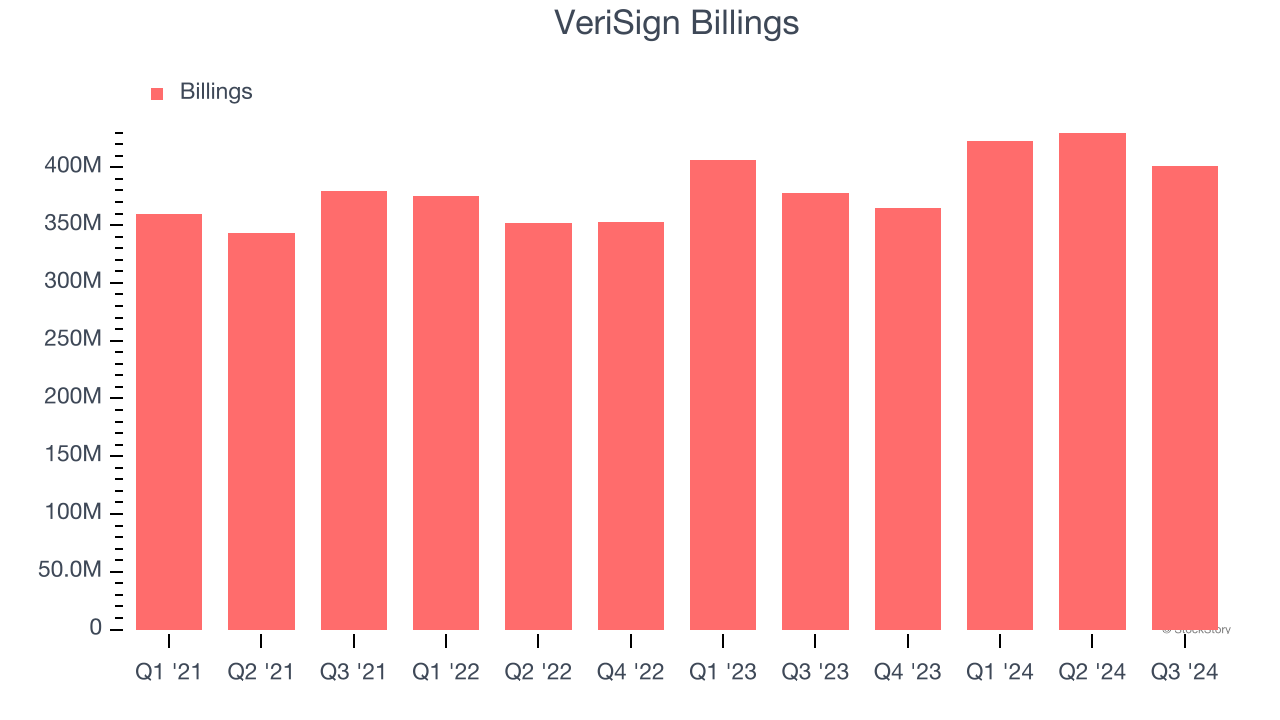

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

VeriSign’s billings came in at $400.9 million in Q3, and over the last four quarters, its year-on-year growth averaged 4.5%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

VeriSign isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 11.9× forward price-to-sales (or $194.92 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at Meta, a top digital advertising platform riding the creator economy.

Stocks We Like More Than VeriSign

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.