Global entertainment and media company Warner Bros. Discovery (NASDAQ:WBD) missed analysts' expectations in Q4 FY2023, with revenue down 6.6% year on year to $10.28 billion. It made a GAAP loss of $0.16 per share, improving from its loss of $0.57 per share in the same quarter last year.

Is now the time to buy Warner Bros. Discovery? Find out by accessing our full research report, it's free.

Warner Bros. Discovery (WBD) Q4 FY2023 Highlights:

- Revenue: $10.28 billion vs analyst estimates of $10.42 billion (1.3% miss)

- EPS: -$0.16 vs analyst estimates of -$0.06 (-$0.10 miss)

- Free Cash Flow of $3.31 billion, up 60.8% from the previous quarter

- Gross Margin (GAAP): 42.7%, up from 37.3% in the same quarter last year

- Market Capitalization: $23.31 billion

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

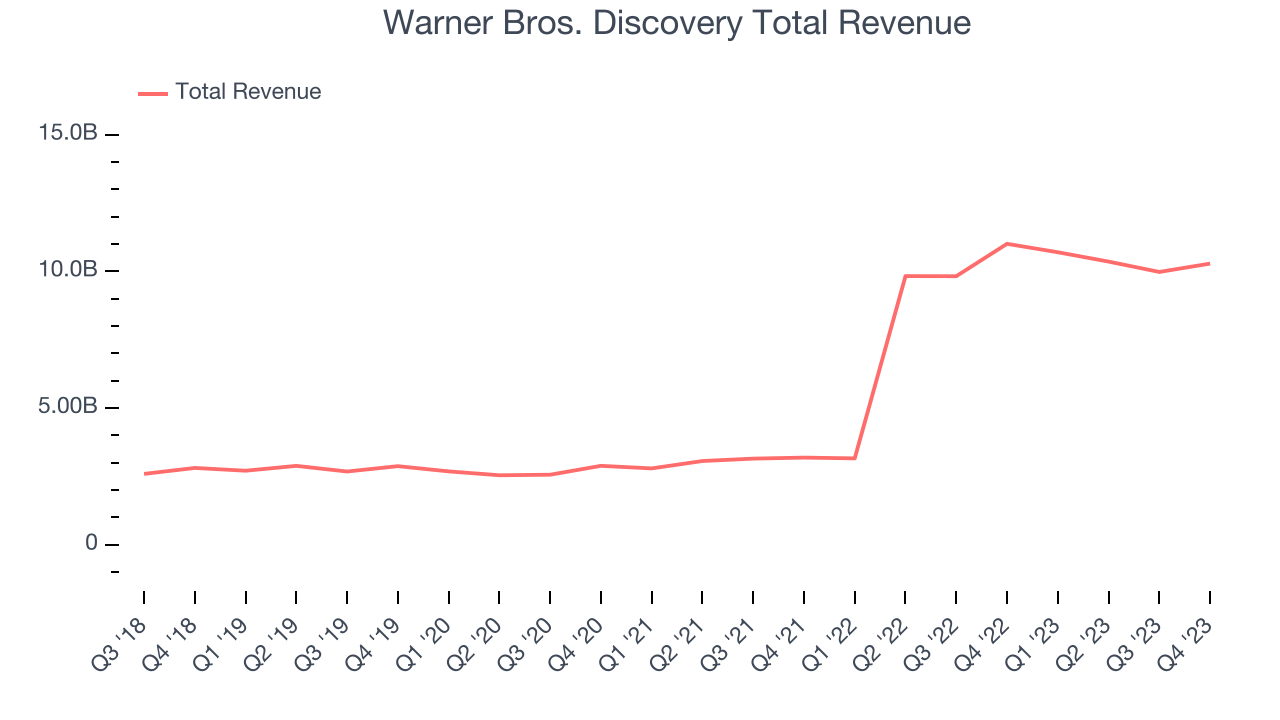

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Warner Bros. Discovery's annualized revenue growth rate of 31.4% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Warner Bros. Discovery's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 4.5% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Warner Bros. Discovery's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 4.5% over the last two years.

We can dig even further into the company's revenue dynamics by analyzing its three largest segments: Distribution, Advertising, and Content, which are 47.8%, 20.3%, and 28.8% of revenue. Over the last two years, Warner Bros. Discovery's revenues in all three segments declined.Distribution revenue (licensing fees) averaged year-on-year decreases of 1.3% while Advertising (digital ads) and Content (films, streaming, games) averaged drops of 9.3% and 6.6%.

This quarter, Warner Bros. Discovery missed Wall Street's estimates and reported a rather uninspiring 6.6% year-on-year revenue decline, generating $10.28 billion of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

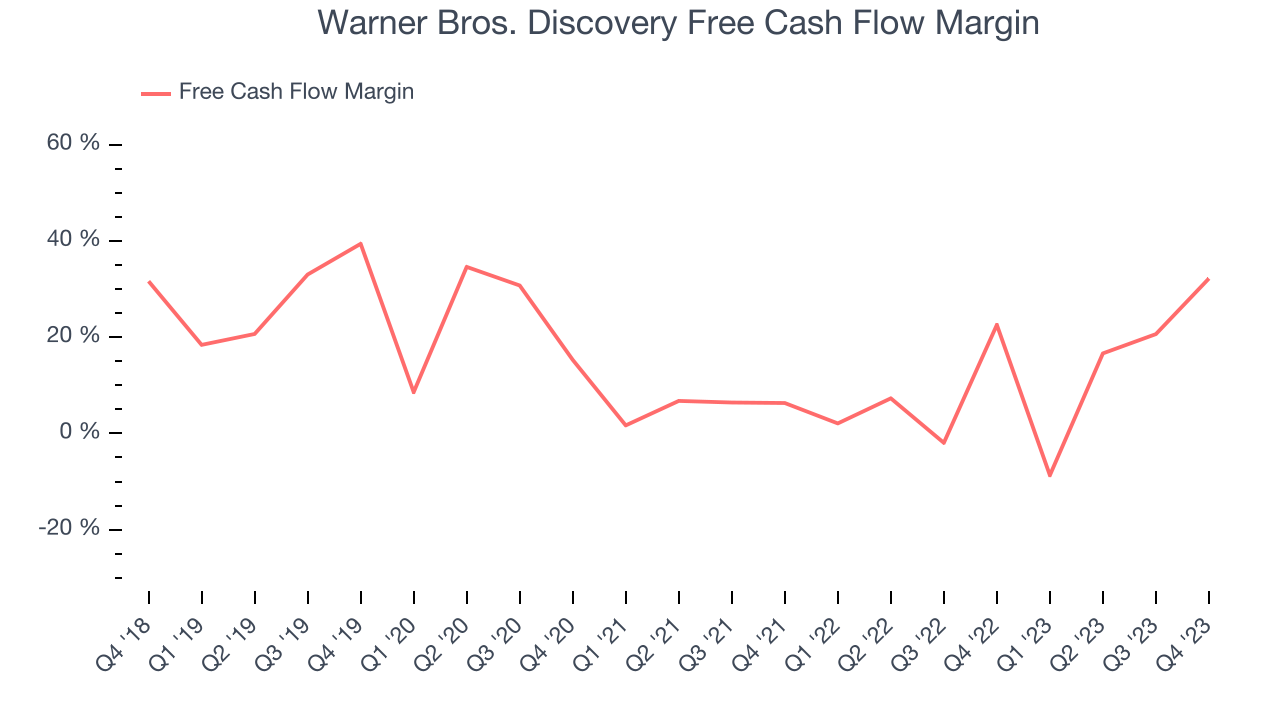

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Warner Bros. Discovery has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 11.2%, slightly better than the broader consumer discretionary sector.

Warner Bros. Discovery's free cash flow came in at $3.31 billion in Q4, equivalent to a 32.2% margin and up 33.4% year on year. Over the next year, analysts predict Warner Bros. Discovery's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 14.9% will decrease to 12.6%.

Key Takeaways from Warner Bros. Discovery's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates, driven by weak performance in its Studio segment (revenue dropped 17% year on year and significantly missed estimates). Its Network segment also saw a 9% drop, but its results were in line with analysts' expectations.

The only segment that grew was its Direct-to-Consumer (DTC) business (3% year-on-year growth). That was thanks to a 51% increase in DTC advertising revenue, which mostly came from Max's (formerly known as HBO Max) ad-supported tier. Overall, the results could have been better. The stock is flat after reporting and currently trades at $9.56 per share.

So should you invest in Warner Bros. Discovery right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.