Heading into the new earnings season, we look at the numbers and key takeaways for the finance and HR software stocks, including Workday (NASDAQ:WDAY) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 6.37%, while on average next quarter revenue guidance was 4.1% above consensus. Tech stocks have had a rocky start in 2022 and finance and HR software stocks have not been spared, with share price down 27.6% since earnings, on average.

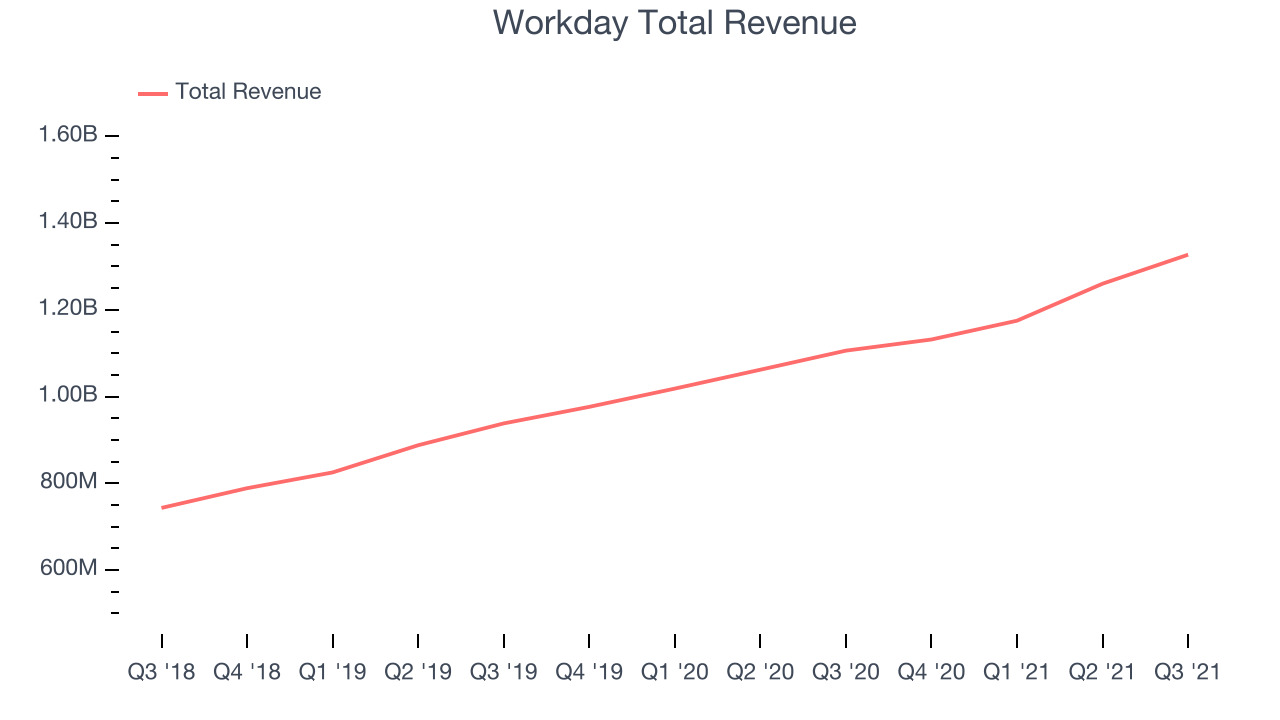

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.32 billion, up 20% year on year, beating analyst expectations by 1.19%. It was a decent quarter for the company, with revenue in line with analyst expectations.

“We delivered another strong quarter as we continue to expand our addressable market through our diverse product portfolio and multiple go-to-market levers, helping to support our sustained growth,” said Aneel Bhusri, co-founder, co-CEO, and chairman, Workday.

Workday delivered the smallest earnings surprise of the whole group. The stock is down 16.5% since the results and currently trades at $249.40.

Is now the time to buy Workday? Access our full analysis of the earnings results here, it's free.

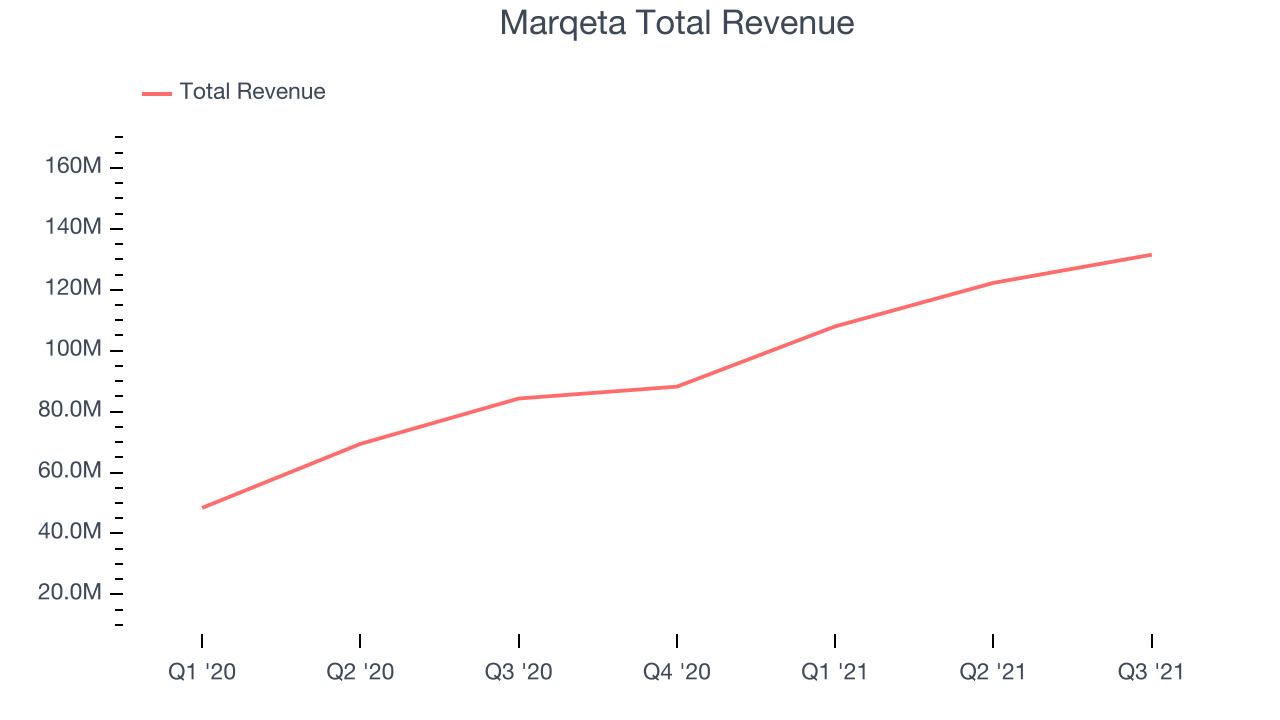

Best Q3: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $131.5 million, up 56% year on year, beating analyst expectations by 10.3%. It was an incredible quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

The stock is down 50% since the results and currently trades at $12.50.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $257.2 million, up 25.8% year on year, beating analyst expectations by 1.19%. It was a weaker quarter for the company, with a decline in gross margin and decelerating customer growth.

Ceridian had the weakest full year guidance update in the group. The company added 63 customers to a total of 5,227. The stock is down 38.1% since the results and currently trades at $79.40.

Read our full analysis of Ceridian's results here.

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $2 billion, up 51.7% year on year, beating analyst expectations by 10.6%. It was a very strong quarter for the company, with an impressive beat of analyst estimates.

The stock is down 13.2% since the results and currently trades at $547.07.

Read our full, actionable report on Intuit here, it's free.

Bill.com (NYSE:BILL)

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $116.4 million, up 151% year on year, beating analyst expectations by 10.7%. It was a stunning quarter for the company, with an impressive beat of analyst estimates.

Bill.com scored the fastest revenue growth among the peers. The company added 5,600 customers to a total of 126,800. The stock is down 43% since the results and currently trades at $167.05.

Read our full, actionable report on Bill.com here, it's free.

The author has no position in any of the stocks mentioned