Finance and HR software company Workday (NASDAQ:WDAY) reported results in line with analysts’ expectations in Q2 CY2024, with revenue up 16.7% year on year to $2.09 billion. It made a non-GAAP profit of $1.75 per share, improving from its profit of $1.43 per share in the same quarter last year.

Is now the time to buy Workday? Find out by accessing our full research report, it’s free.

Workday (WDAY) Q2 CY2024 Highlights:

- Revenue: $2.09 billion vs analyst estimates of $2.07 billion (small beat)

- Adjusted Operating Income: $518 million vs analyst estimates of $510.1 million (1.5% beat)

- EPS (non-GAAP): $1.75 vs analyst estimates of $1.65 (6% beat)

- "We see a macroeconomic environment consistent with last quarter and are reiterating our full-year FY25 subscription revenue guidance while slightly raising our expectation for FY25 non-GAAP operating margin."

- Gross Margin (GAAP): 75.5%, in line with the same quarter last year

- Free Cash Flow Margin: 24.7%, up from 14.6% in the previous quarter

- Billings: $2.08 billion at quarter end, up 11.5% year on year

- Market Capitalization: $61.95 billion

"Workday delivered a solid quarter of growth and operating margin expansion, as businesses of all sizes and industries around the world increasingly turn to Workday as their trusted partner in navigating the future of work," said Carl Eschenbach, CEO, Workday.

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

Sales Growth

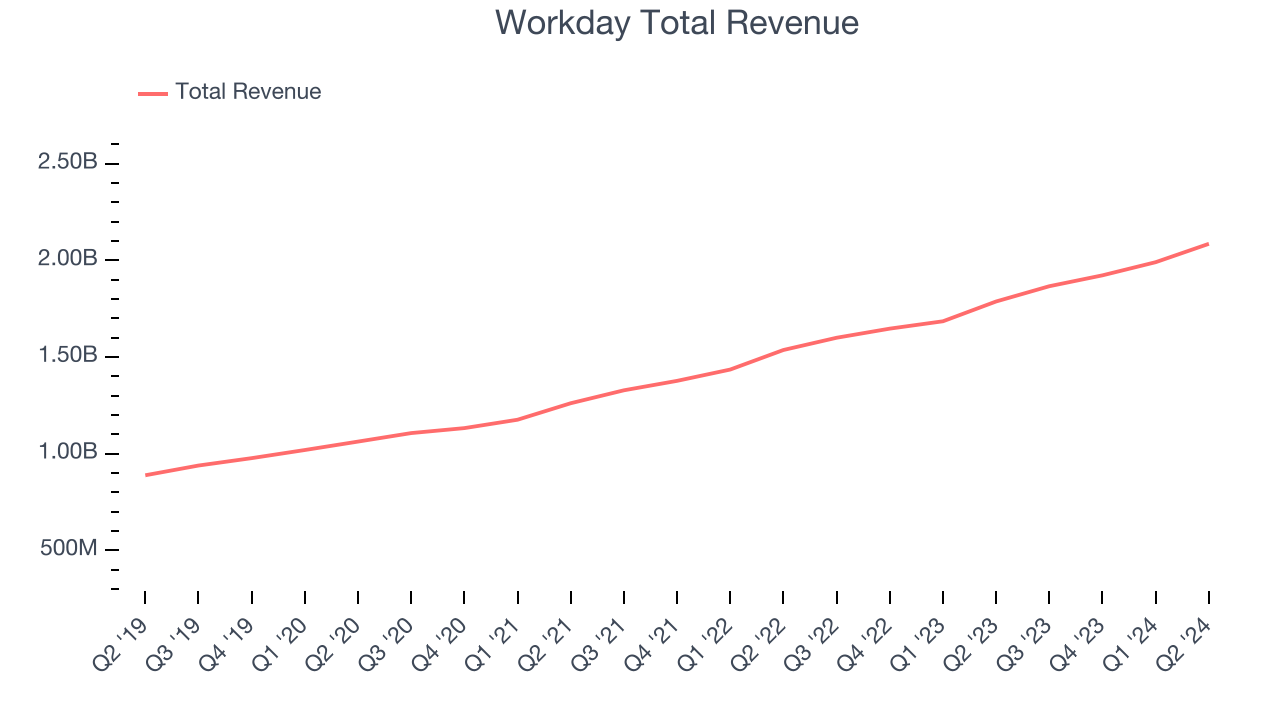

As you can see below, Workday’s 18.9% annualized revenue growth over the last three years has been mediocre, and its sales came in at $2.09 billion this quarter.

This quarter, Workday’s quarterly revenue was once again up 16.7% year on year. We can see that Workday’s revenue increased by $95 million quarter on quarter, which is a solid improvement from the $68 million increase in Q1 CY2024. This re-acceleration of growth was a great sign.

Looking ahead, analysts covering the company were expecting sales to grow 14% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

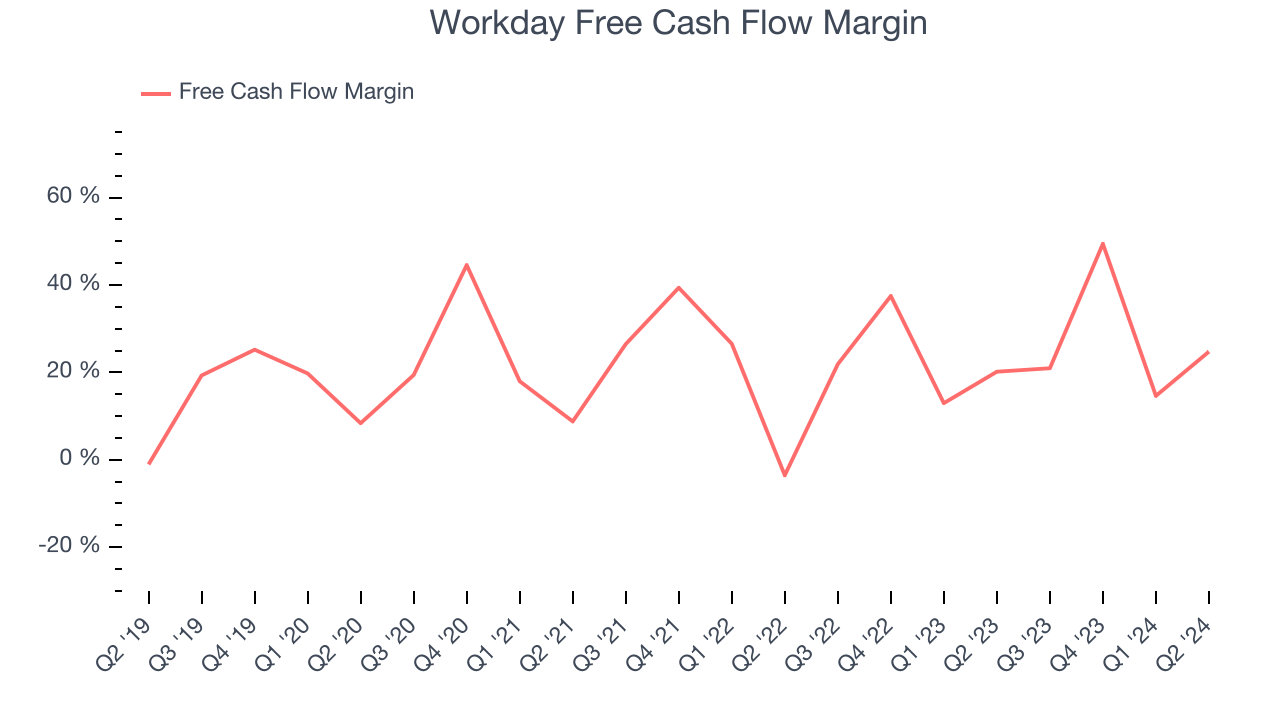

Workday has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging 27.3% over the last year.

Workday’s free cash flow clocked in at $516 million in Q2, equivalent to a 24.7% margin. This quarter’s result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we note it was lower than its one-year cash profitability. Nevertheless, we wouldn’t read too much into a single quarter because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict Workday’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 27.3% for the last 12 months will decrease to 24.8%.

Key Takeaways from Workday’s Q2 Results

Results beat across the board. Workday says it sees a macroeconomic environment consistent with last quarter and are reiterating full-year FY25 subscription revenue guidance while slightly raising its full-year operating margin outlook. Overall, this was a solid quarter without many surprises, which is often comforting for the market. The stock remained flat at $230 immediately following the results.

Workday may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.