Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q2 now behind us, let’s have a look at Workday (NASDAQ:WDAY) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 16 finance and HR software stocks we track reported a decent Q2; on average, revenues beat analyst consensus estimates by 4.24%, while on average next quarter revenue guidance was 2.63% above consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but finance and HR software stocks held their ground better than others, with the share prices up 0.58% since the previous earnings results, on average.

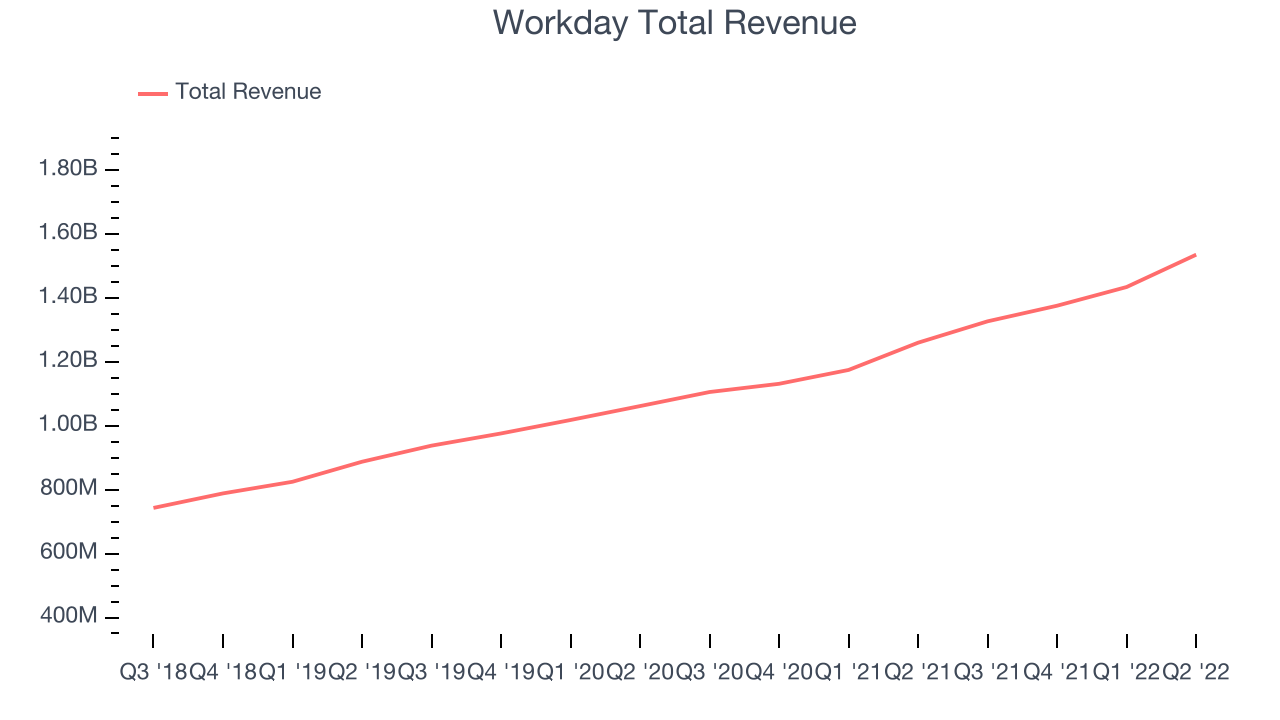

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.53 billion, up 21.8% year on year, beating analyst expectations by 1.11%. It was a decent quarter for the company, with topline results surpassing expectations.

"We continue to see a strong global demand for our products, underscoring how organizations are continuing to drive digital transformation across finance and HR to support the changing world of work," said Aneel Bhusri, co-founder, co-CEO, and chairman, Workday.

The stock is down 0.69% since the results and currently trades at $161.28.

Is now the time to buy Workday? Access our full analysis of the earnings results here, it's free.

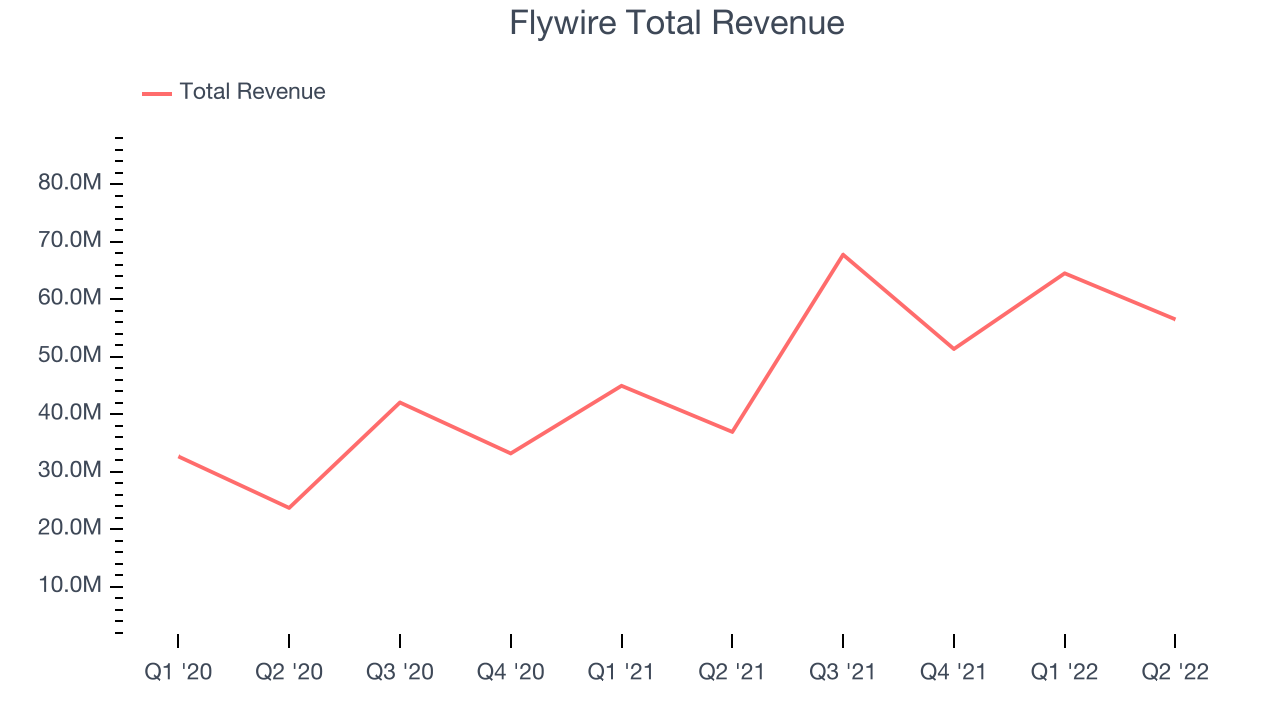

Best Q2: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $56.5 million, up 52.9% year on year, beating analyst expectations by 18.7%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Flywire pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is up 5.25% since the results and currently trades at $24.84.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $2.41 billion, down 5.74% year on year, beating analyst expectations by 3.61%. It was a weak quarter for the company, with an underwhelming guidance for the next year and a slow revenue growth.

Intuit had the slowest revenue growth in the group. The stock is down 7.83% since the results and currently trades at $414.16.

Read our full analysis of Intuit's results here.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio Paycor (NASDAQ: PYCR), provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $110.9 million, up 26.1% year on year, beating analyst expectations by 7.26%. It was a very strong quarter for the company, with a full year guidance beating analysts' expectations.

The stock is up 7.53% since the results and currently trades at $33.25.

Read our full, actionable report on Paycor here, it's free.

Avalara (NYSE:AVLR)

Founded by Scott McFarlane in 2004, Avalara (NYSE:AVLR) offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance.

Avalara reported revenues of $208.5 million, up 23.3% year on year, a slight miss on analyst expectations. It was a weaker quarter for the company, with a miss of the top line analyst estimates and a decline in net revenue retention rate.

Avalara had the weakest performance against analyst estimates among the peers. The company added 950 customers to a total of 20,110. The stock is down 3.37% since the results and currently trades at $92.50.

Avalara has agreed to be acquired by Vista Equity Partners in an all-cash transaction that values Avalara at $8.4 billion.

Read our full, actionable report on Avalara here, it's free.

The author has no position in any of the stocks mentioned