As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the semiconductors stocks, starting with Western Digital (NASDAQ:WDC).

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 24 semiconductors stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.36%, while on average next quarter revenue guidance was 4.34% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but semiconductors stocks held their ground better than others, with the share prices up 13.8% since the previous earnings results, on average.

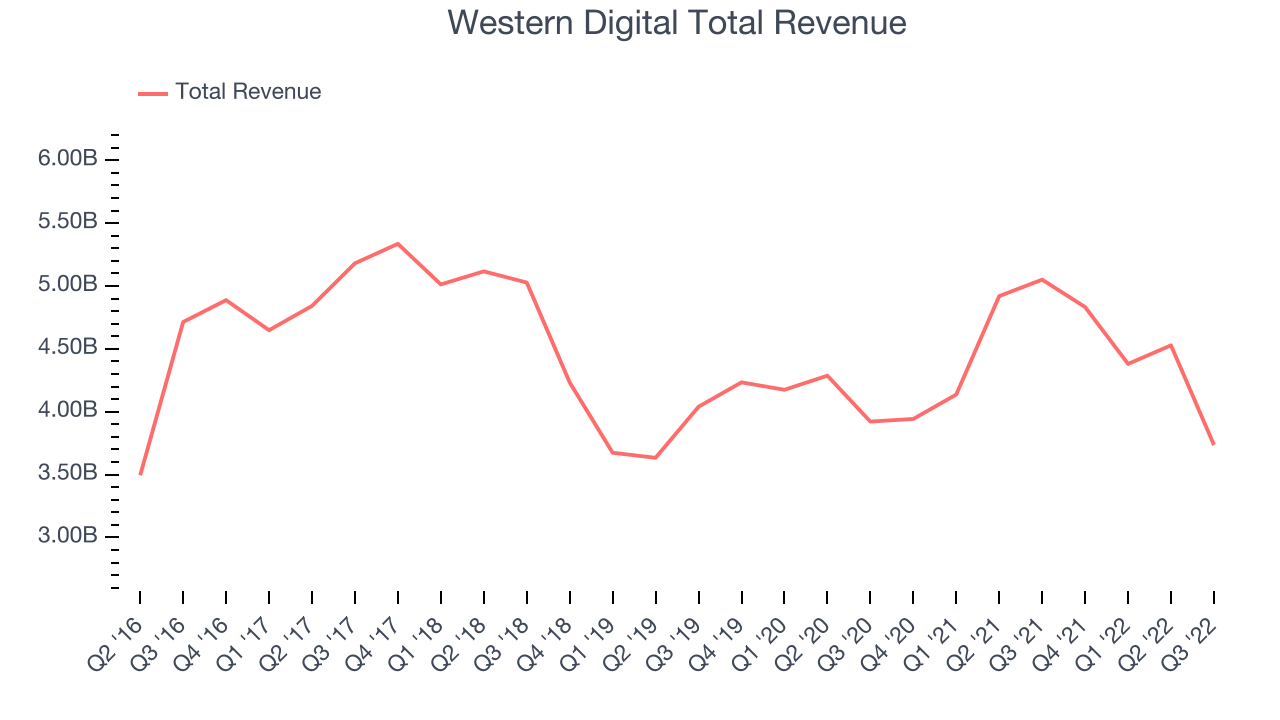

Western Digital (NASDAQ:WDC)

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

Western Digital reported revenues of $3.73 billion, down 26% year on year, beating analyst expectations by 3.41%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

“I am pleased to see the Western Digital team work together to deliver revenue at the upper half of the guidance range and operating income at the upper half as implied by the midpoints of our guidance, in the midst of an incredibly dynamic and challenging macroeconomic environment,” said David Goeckeler, Western Digital CEO.

The stock is up 4.84% since the results and currently trades at $37.00.

Read our full report on Western Digital here, it's free.

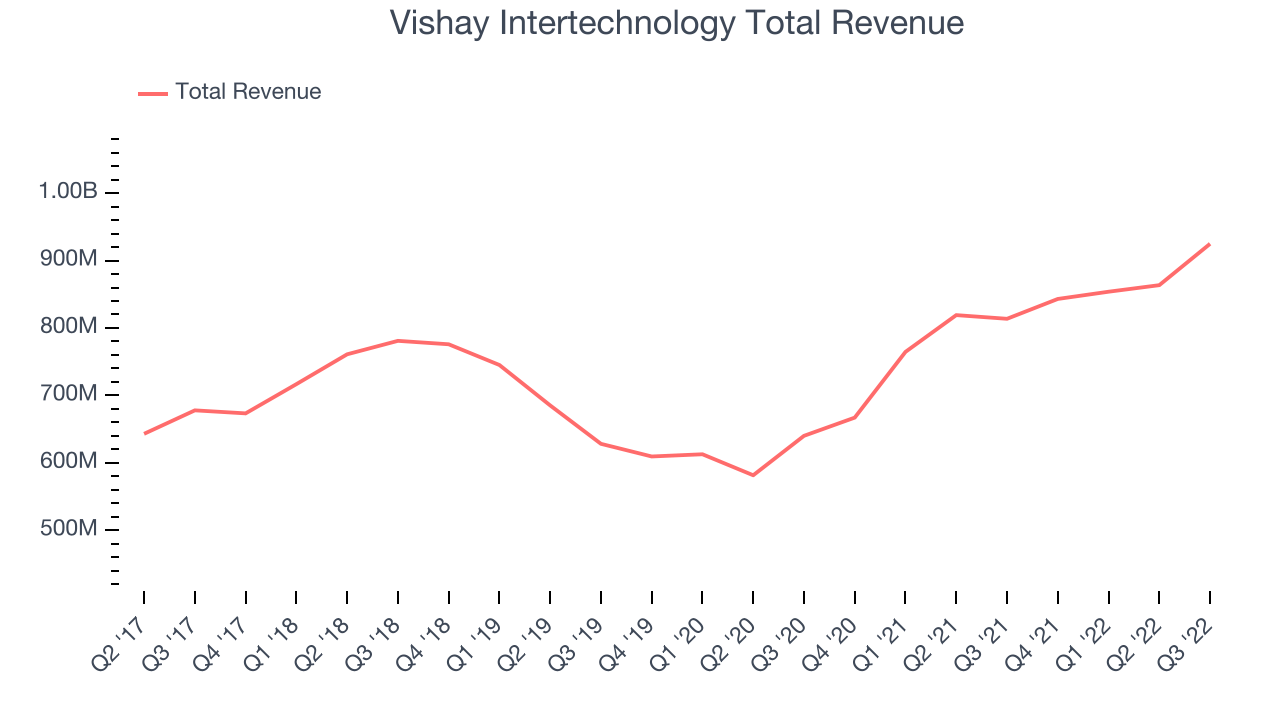

Best Q3: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $924.7 million, up 13.6% year on year, in line with analyst expectations. It was an impressive quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

The stock is up 7.39% since the results and currently trades at $22.96.

Is now the time to buy Vishay Intertechnology? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.03 billion, down 34.6% year on year, missing analyst expectations by 3.36%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

Seagate Technology had the weakest performance against analyst estimates in the group. The stock is down 1.65% since the results and currently trades at $57.01.

Read our full analysis of Seagate Technology's results here.

Broadcom (NASDAQ:AVGO)

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

Broadcom reported revenues of $8.93 billion, up 20.5% year on year, in line with analyst expectations. It was a decent quarter for the company, with a significant improvement in inventory levels.

The stock is up 8.03% since the results and currently trades at $574.20.

Read our full, actionable report on Broadcom here, it's free.

Skyworks Solutions (NASDAQ:SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.4 billion, up 7.33% year on year, in line with analyst expectations. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is up 23.4% since the results and currently trades at $101.55.

Read our full, actionable report on Skyworks Solutions here, it's free.

The author has no position in any of the stocks mentioned