Household products company WD-40 (NASDAQGS:WDFC) reported results ahead of analysts' expectations in Q1 FY2024, with revenue up 12.4% year on year to $140.4 million. The company's full-year revenue guidance of $585 million at the midpoint also came in 1.8% above analysts' estimates. It made a GAAP profit of $1.28 per share, improving from its profit of $1.02 per share in the same quarter last year.

Is now the time to buy WD-40? Find out by accessing our full research report, it's free.

WD-40 (WDFC) Q1 FY2024 Highlights:

- Market Capitalization: $3.22 billion

- Revenue: $140.4 million vs analyst estimates of $134.4 million (4.5% beat)

- EPS: $1.28 vs analyst estimates of $1 (28% beat)

- Guidance reiterated for fiscal year 2024

- Free Cash Flow of $26.13 million, down 35.6% from the previous quarter

- Gross Margin (GAAP): 53.8%, up from 51.4% in the same quarter last year

“We have started fiscal year 2024 firing on all cylinders, with significant volume-related sales growth across all three trade blocs,” said Steve Brass, WD-40 Company’s president and chief executive officer.

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQGS:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

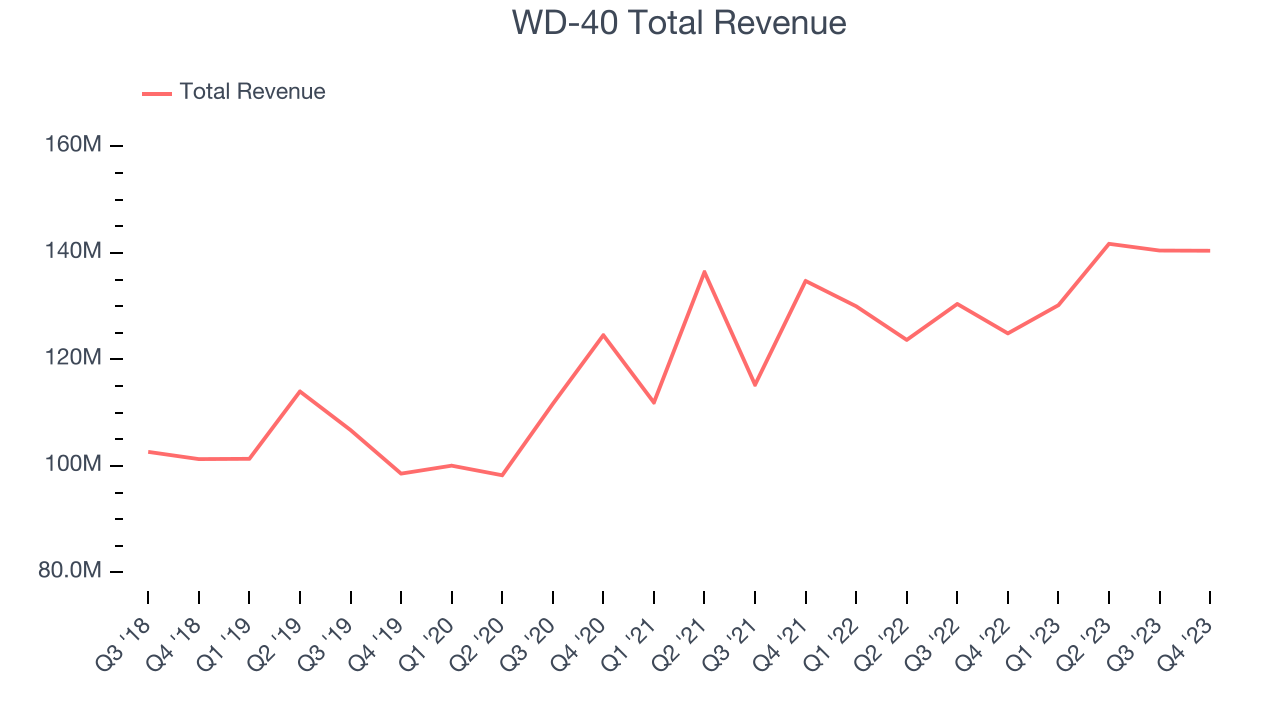

As you can see below, the company's annualized revenue growth rate of 8.4% over the last three years was decent for a consumer staples business.

This quarter, WD-40 reported robust year-on-year revenue growth of 12.4%, and its $140.4 million in revenue exceeded Wall Street's estimates by 4.5%. Looking ahead, Wall Street expects sales to grow 5% over the next 12 months, a deceleration from this quarter.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Key Takeaways from WD-40's Q1 Results

We enjoyed seeing WD-40 exceed analysts' revenue expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. That the company reiterated its previous outlook for fiscal 2024 shows that WD-40 is staying on track. Zooming out, we think this was a solid quarter that should please shareholders. The stock is up 5.6% after reporting and currently trades at $250 per share.

WD-40 may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.