Household products company WD-40 (NASDAQ:WDFC) announced better-than-expected revenue in Q4 CY2024, with sales up 9.3% year on year to $153.5 million. On the other hand, the company’s full-year revenue guidance of $615 million at the midpoint came in 1.3% below analysts’ estimates. Its GAAP profit of $1.39 per share was 10.3% above analysts’ consensus estimates.

Is now the time to buy WD-40? Find out by accessing our full research report, it’s free.

WD-40 (WDFC) Q4 CY2024 Highlights:

- Revenue: $153.5 million vs analyst estimates of $147.4 million (9.3% year-on-year growth, 4.1% beat)

- Adjusted EPS: $1.39 vs analyst estimates of $1.26 (10.3% beat)

- The company reconfirmed its revenue guidance for the full year of $615 million at the midpoint

- EPS (GAAP) guidance for the full year is $5.33 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 16.4%, in line with the same quarter last year

- Free Cash Flow Margin: 9.3%, down from 18.6% in the same quarter last year

- Market Capitalization: $3.23 billion

“In the first quarter, we executed well against our strategic priorities, with strong growth across multiple regions including the United States, Latin America, and EIMEA,” said Steve Brass, WD-40 Company's president and chief executive officer.

Company Overview

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

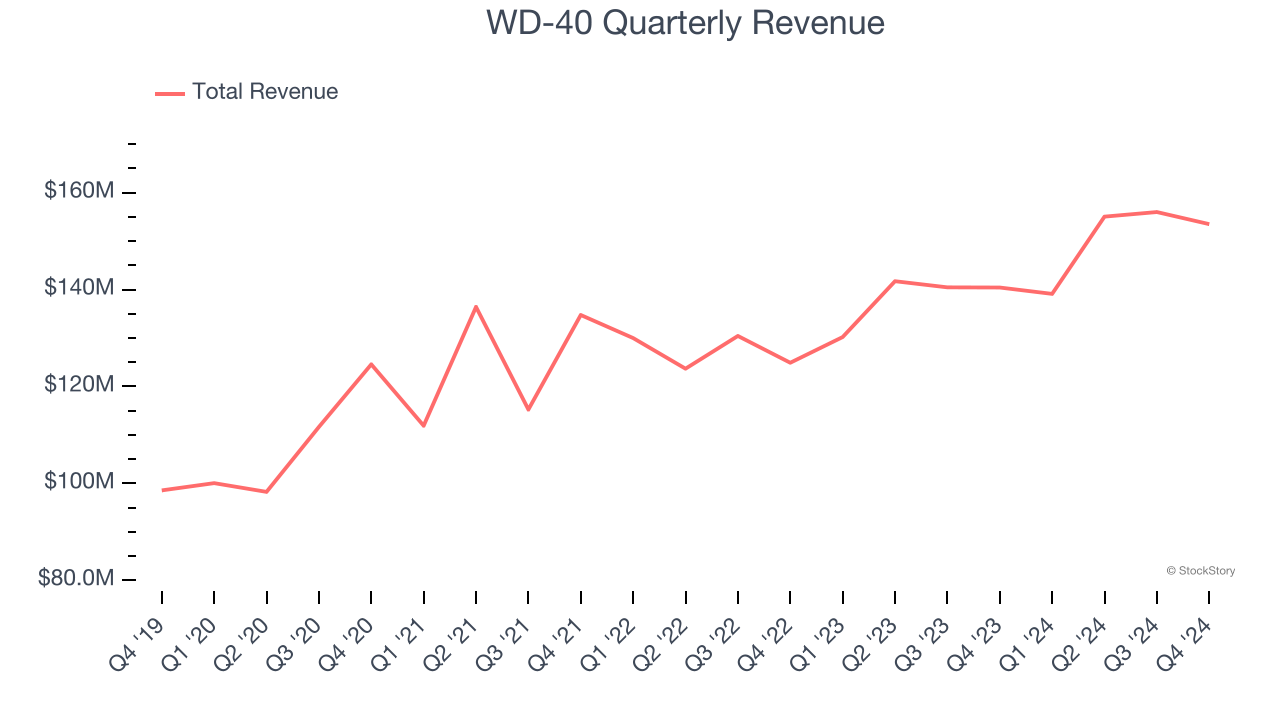

As you can see below, WD-40’s 6.6% annualized revenue growth over the last three years was mediocre. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

This quarter, WD-40 reported year-on-year revenue growth of 9.3%, and its $153.5 million of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

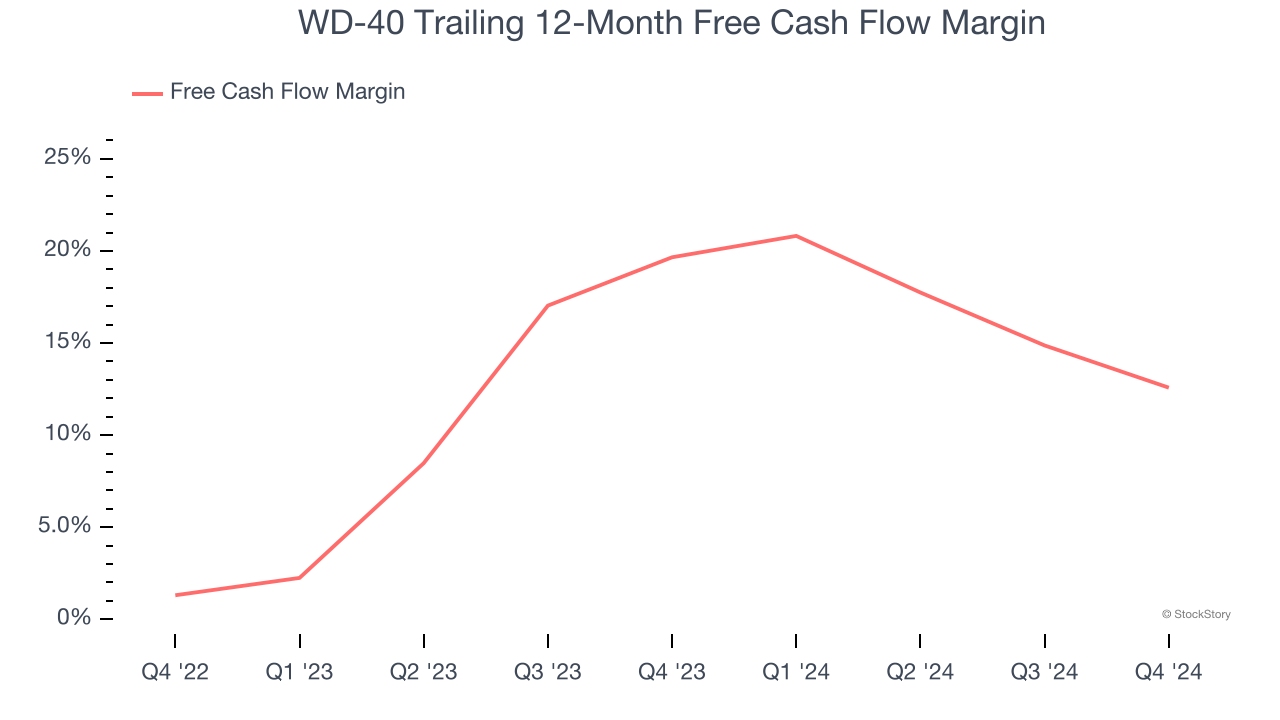

WD-40 has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 16% over the last two years.

Taking a step back, we can see that WD-40’s margin dropped by 7.1 percentage points over the last year. If its declines continue, it could signal higher capital intensity.

WD-40’s free cash flow clocked in at $14.24 million in Q4, equivalent to a 9.3% margin. The company’s cash profitability regressed as it was 9.3 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from WD-40’s Q4 Results

We enjoyed seeing WD-40 exceed analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Overall, this quarter had some key positives. The stock traded up 5% to $253 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.