Household products company WD-40 (NASDAQGS:WDFC) missed analysts' expectations in Q1 CY2024, with revenue up 6.8% year on year to $139.1 million. On the other hand, the company's full-year revenue guidance of $585 million at the midpoint came in 1.2% above analysts' estimates. It made a GAAP profit of $1.14 per share, down from its profit of $1.21 per share in the same quarter last year.

WD-40 (WDFC) Q1 CY2024 Highlights:

- Revenue: $139.1 million vs analyst estimates of $140.3 million (0.8% miss)

- EPS: $1.14 vs analyst estimates of $1.13 (small beat)

- The company reconfirmed its revenue guidance for the full year of $585 million at the midpoint

- Gross Margin (GAAP): 52.4%, up from 50.8% in the same quarter last year

- Free Cash Flow of $16.67 million, down 36.2% from the previous quarter

- Market Capitalization: $3.51 billion

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQGS:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

The company was founded in 1953 as the fledgling Rocket Chemical Co., and its three-person team set out to create a line of rust-prevention solvents and degreasers for use in the aerospace industry. Its first major customer was Convair, an aerospace contractor, who used WD-40 Multi-Use Product to protect the outer skin of its Atlas Missile from rust and corrosion.

The product worked so well that several Convair employees snuck some cans out of its facility to use at home. Since then, WD-40 has evolved into a consumer staple and its products can be found in an astounding four out of five American households. Beyond its famous blue and yellow can, WD-40 owns a portfolio of brands including Carpet Fresh for carpet cleaners, Lava for heavy-duty hand cleaners, and X-14 for toilet bowl cleaners.

WD-40’s products are available in more than 176 countries, making it a truly global company. Whether it be fixing squeaky hinges and loosening stubborn bolts or cleaning up after messes, the company’s reputation for helping users perform tasks more efficiently has earned it the trust of people worldwide.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Major competitors include Clorox (NYSE:CLX), Procter & Gamble (NYSE:PG), and Unilever (NYSE:UL).Sales Growth

WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

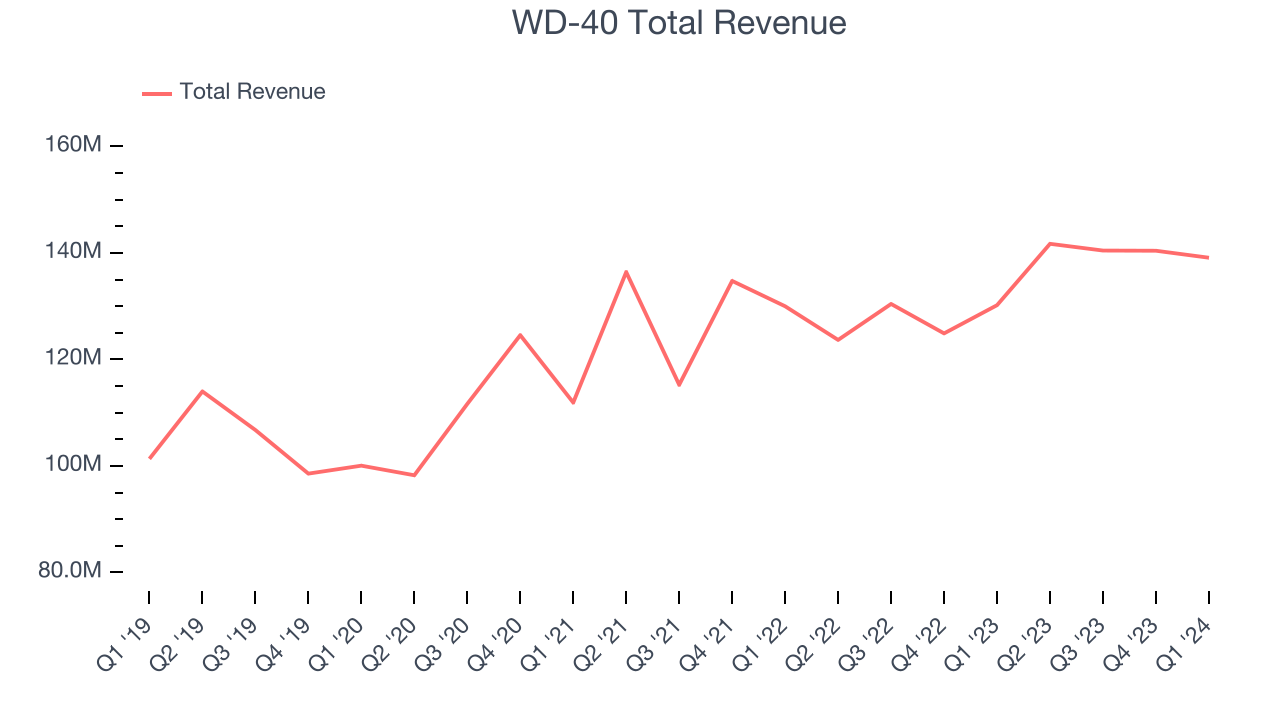

As you can see below, the company's annualized revenue growth rate of 8% over the last three years was decent for a consumer staples business.

This quarter, WD-40's revenue grew 6.8% year on year to $139.1 million, missing Wall Street's estimates.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

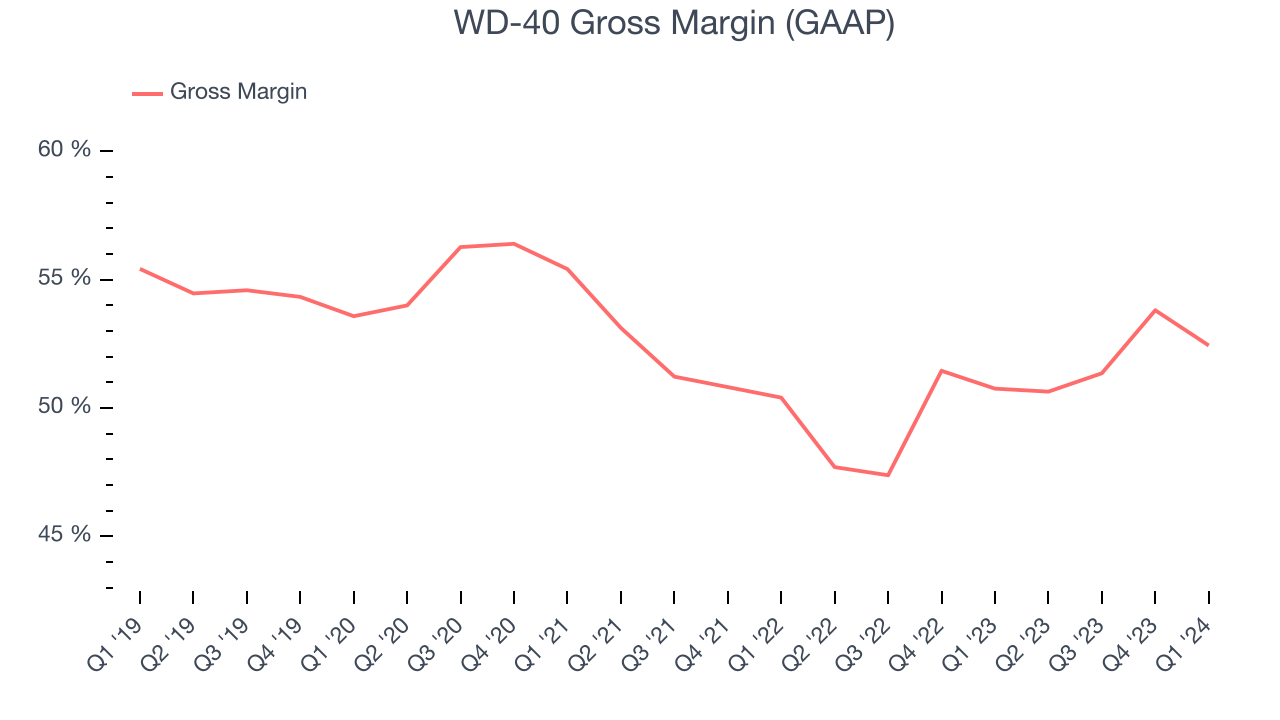

This quarter, WD-40's gross profit margin was 52.4%, up 1.7 percentage points year on year. That means for every $1 in revenue, $0.48 went towards paying for raw materials, production of goods, and distribution expenses.

WD-40 has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 50.8% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 5.6% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

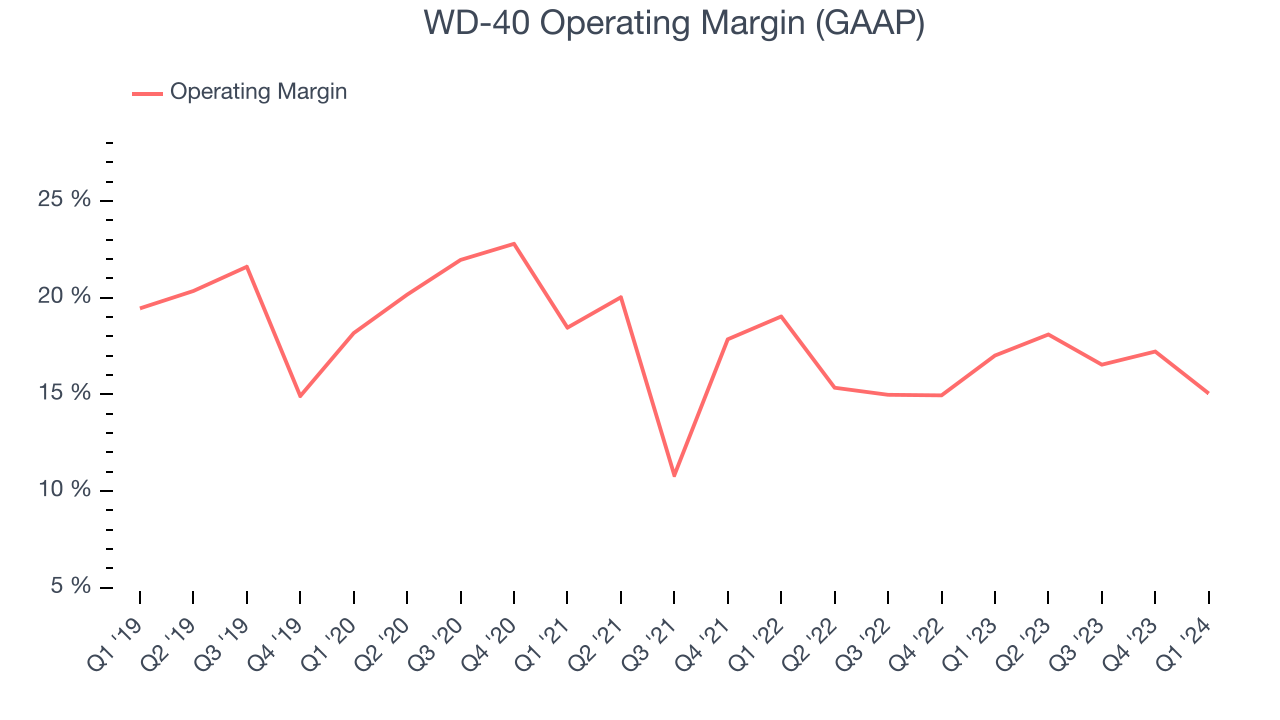

This quarter, WD-40 generated an operating profit margin of 15.1%, down 2 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, WD-40 has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer staples business, producing an average operating margin of 16.2%. On top of that, its margin has risen by 1.2 percentage points on average over the last year, showing the company is improving its fundamentals.

Zooming out, WD-40 has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer staples business, producing an average operating margin of 16.2%. On top of that, its margin has risen by 1.2 percentage points on average over the last year, showing the company is improving its fundamentals. EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

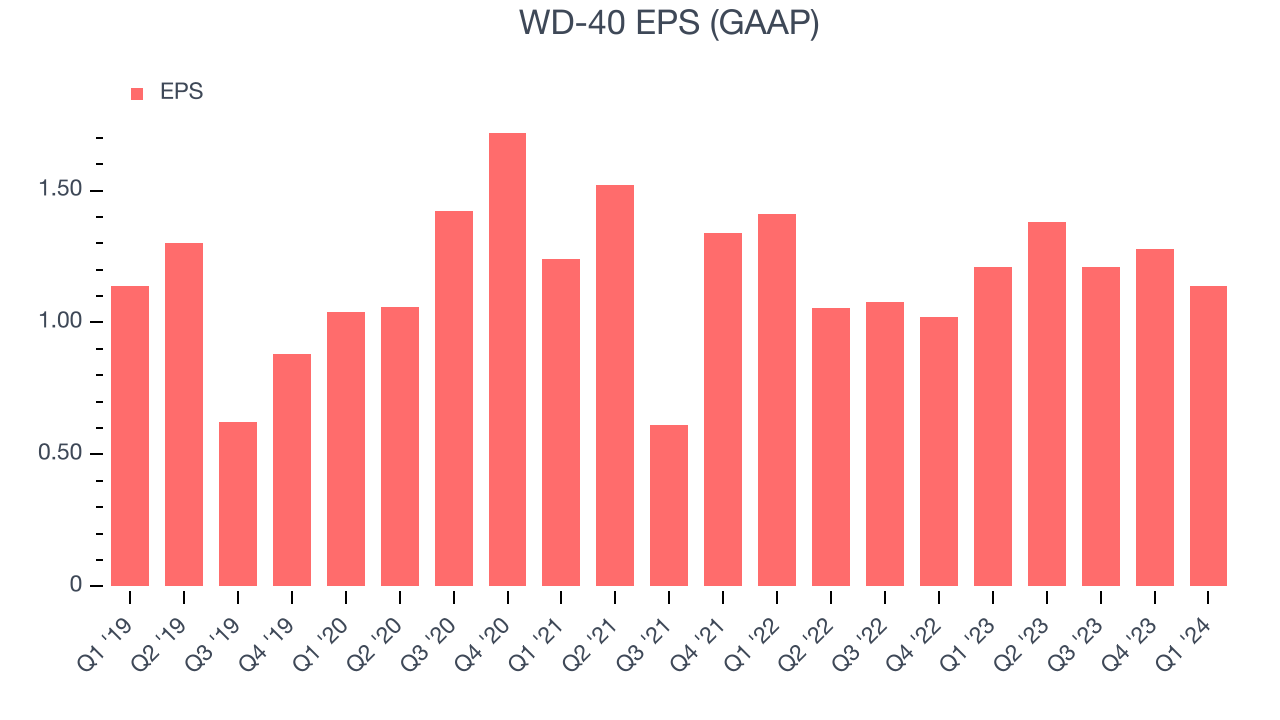

In Q1, WD-40 reported EPS at $1.14, down from $1.21 in the same quarter a year ago. This print was close to Wall Street's estimates, meaning the result was likely already priced into the stock because investors were aware of expectations and traded accordingly.

Between FY2021 and FY2024, WD-40's EPS dropped 7.9%, translating into 2.7% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 7.3% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

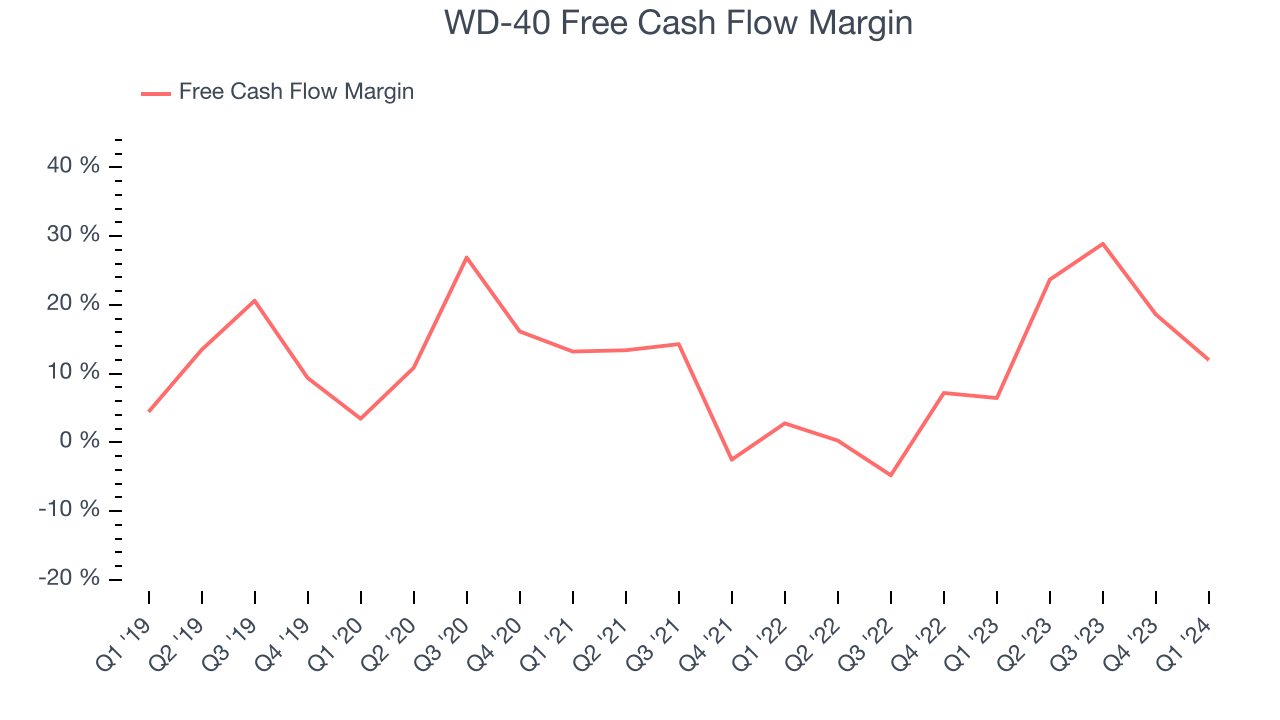

WD-40's free cash flow came in at $16.67 million in Q1, up 98.5% year on year. This result represents a 12% margin.

Over the last two years, WD-40 has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 12%, quite impressive for a consumer staples business. Furthermore, its margin has averaged year-on-year increases of 18.6 percentage points over the last 12 months. Shareholders should be excited as this will certainly help WD-40 achieve its strategic long-term plans.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

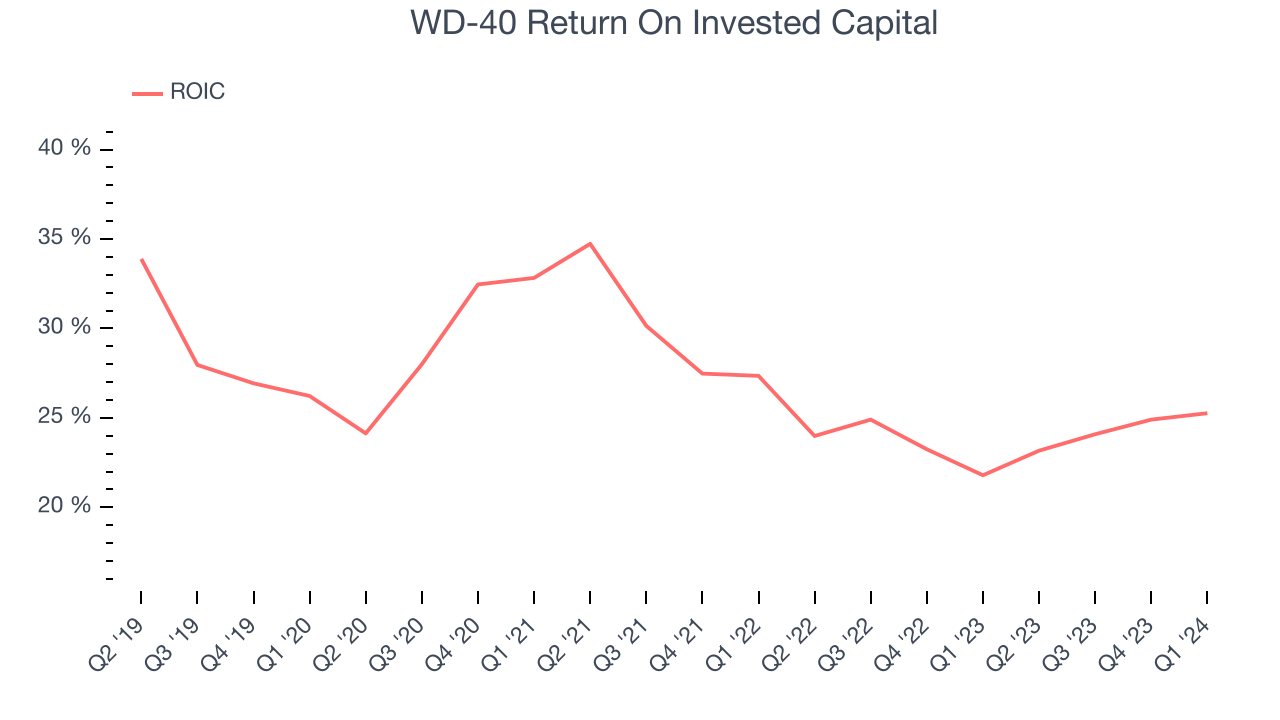

WD-40's five-year average ROIC was 26.7%, placing it among the best consumer staples companies. Just as you’d like your investment dollars to generate returns, WD-40's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, WD-40's ROIC averaged 6 percentage point decreases over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Key Takeaways from WD-40's Q1 Results

It was good to see WD-40's full-year revenue forecast beat analysts' expectations. We were also happy its gross margin narrowly outperformed Wall Street's estimates. On the other hand, this quarter's revenue and operating margin unfortunately missed. Furthermore, even though it raised its full-year EPS guidance, that forecast missed analysts' estimates as well.

During the quarter, the company announced the acquisition of a Brazilian marketing distributor. Today, it also announced its intentions to divest its U.S. and U.K. Homecare and Cleaning Products segments. WD-40's goal with these strategic moves is to focus on its core, higher-margin maintenance products.

Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The market was likely expecting more, and the stock is down 4% after reporting, trading at $245 per share.

Is Now The Time?

WD-40 may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think WD-40 is a good business. First off, its revenue growth has been decent over the last three years. And while its brand caters to a niche market, its stellar ROIC suggests it has been a well-run company historically. On top of that, its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cash cushion.

There are definitely a lot of things to like about WD-40, and looking at the consumer staples landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $280.57 per share right before these results (compared to the current share price of $245), implying they saw upside in buying WD-40 in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.