Fast-food chain Wingstop (NASDAQ:WING) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 38.8% year on year to $162.5 million. Its GAAP profit of $0.88 per share was 7.6% below analysts’ consensus estimates.

Is now the time to buy Wingstop? Find out by accessing our full research report, it’s free.

Wingstop (WING) Q3 CY2024 Highlights:

- Revenue: $162.5 million vs analyst estimates of $159.9 million (1.6% beat)

- EPS: $0.88 vs analyst expectations of $0.95 (7.6% miss)

- EBITDA: $53.67 million vs analyst estimates of $53.1 million (1.1% beat)

- Guiding for Full-Year Same-Store Sales Growth of 20% (vs analyst estimates of 21.6%)

- Gross Margin (GAAP): 47.5%, down from 48.8% in the same quarter last year

- Operating Margin: 24.5%, down from 26.2% in the same quarter last year

- EBITDA Margin: 33%, up from 30.2% in the same quarter last year

- Locations: 2,458 at quarter end, up from 2,099 in the same quarter last year

- Same-Store Sales rose 20.9% year on year (15.3% in the same quarter last year)

- Market Capitalization: $10.81 billion

"Our third quarter results demonstrated the staying power of our multi-year strategies we are executing against, delivering 20.9% same store sales growth, primarily driven by transaction growth," said Michael Skipworth, President and Chief Executive Officer.

Company Overview

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Wingstop is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new restaurants.

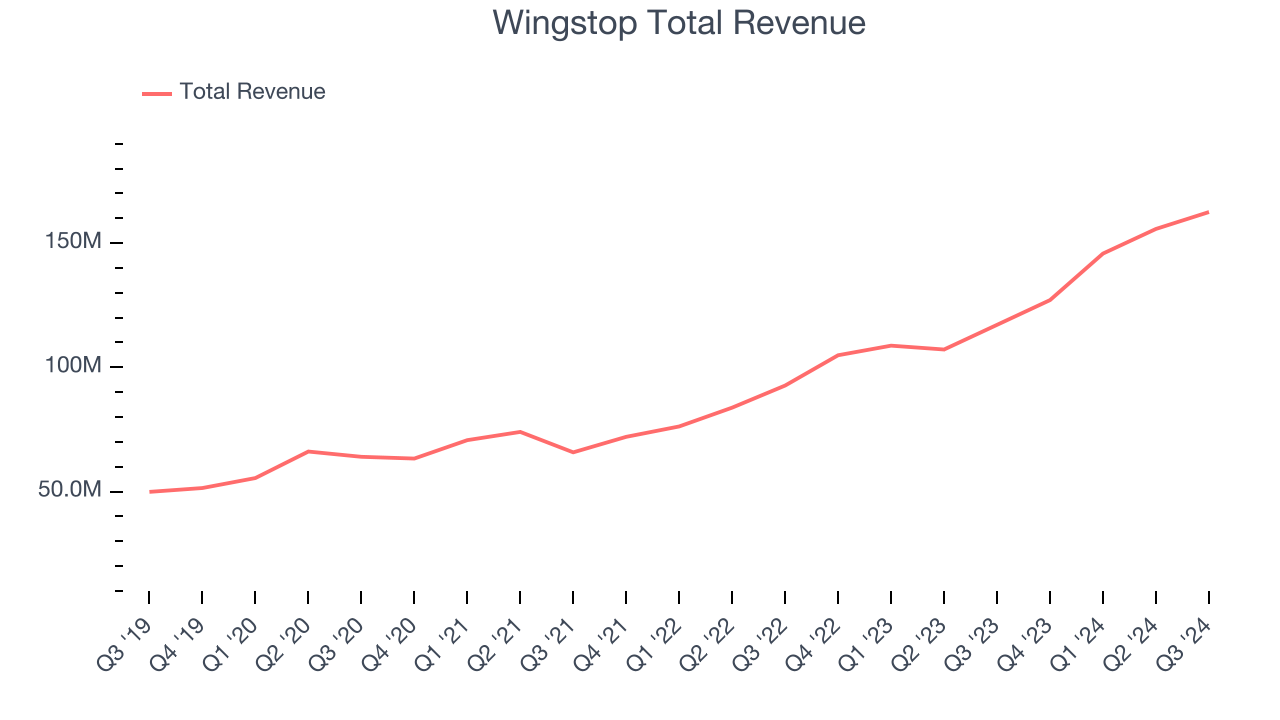

As you can see below, Wingstop’s 25.9% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Wingstop reported wonderful year-on-year revenue growth of 38.8%, and its $162.5 million of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 20.4% over the next 12 months. Still, this projection is commendable and indicates the market is baking in success for its offerings.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Wingstop operated 2,458 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years and averaged 13.1% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Wingstop provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations. Same-store sales provides a deeper understanding of this issue because it measures organic growth for restaurants open for at least a year.

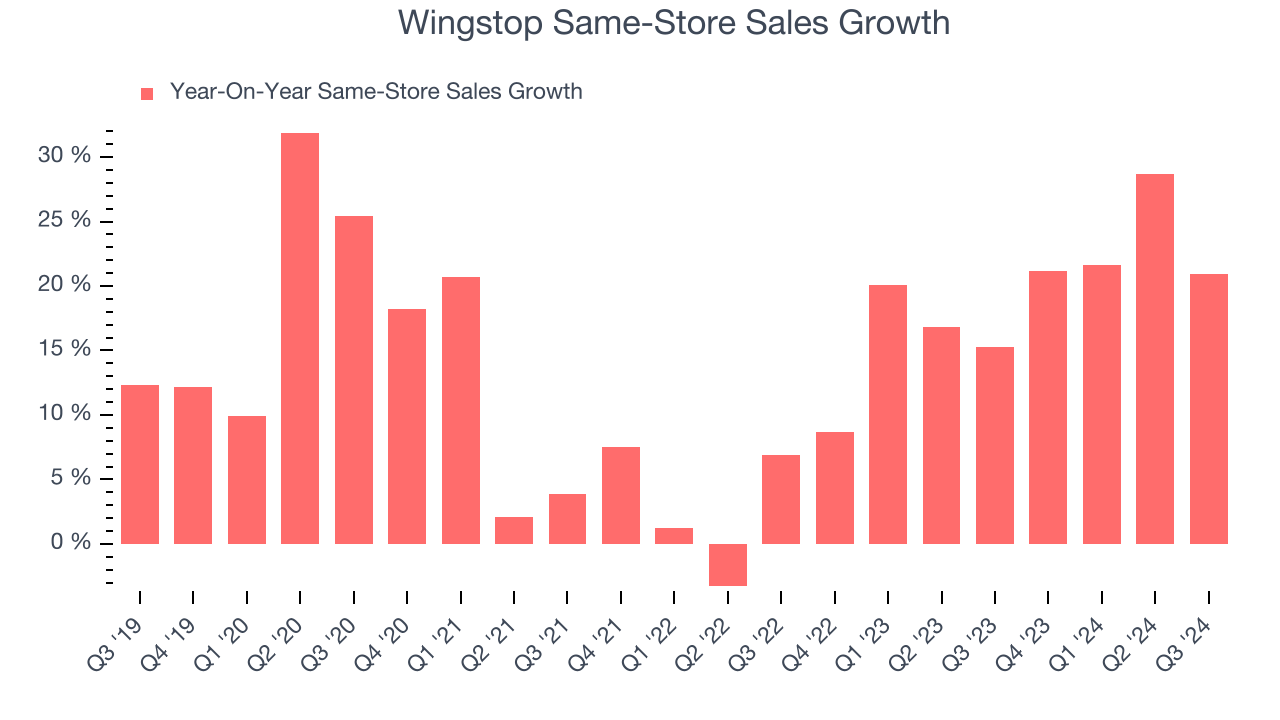

Wingstop has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 19.2%. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Wingstop’s same-store sales rose 20.9% annually. This growth was an acceleration from the 15.3% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Wingstop’s Q3 Results

We enjoyed seeing Wingstop exceed analysts’ revenue and EBITDA expectations this quarter. On the other hand, its EPS missed and its full-year same-store sales guidance of 20% fell slightly short of Wall Street's projections. Overall, this quarter had some key positives, but with the stock trading north of 80x P/E, the stock was priced for perfection (the market was likely pricing in a "beat and raise" quarter). Shares traded down 15.8% to $310.99 immediately after reporting.

Is Wingstop an attractive investment opportunity right now?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.