Fast-food chain Wingstop (NASDAQ:WING) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 34.1% year on year to $145.8 million. It made a non-GAAP profit of $0.98 per share, improving from its profit of $0.59 per share in the same quarter last year.

Wingstop (WING) Q1 CY2024 Highlights:

- Revenue: $145.8 million vs analyst estimates of $136 million (7.2% beat)

- EPS (non-GAAP): $0.98 vs analyst estimates of $0.77 (28.1% beat)

- Gross Margin (GAAP): 48.9%, up from 48.2% in the same quarter last year

- Same-Store Sales were up 21.6% year on year

- Store Locations: 2,279 at quarter end, increasing by 283 over the last 12 months

- Market Capitalization: $11.3 billion

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

The company was founded in 1994 by Antonio Swad and Bernadette Fiaschetti, who had an unwavering focus on quality. This ethos is reflected in its wings, which use fresh, never-frozen chicken cooked with unique techniques, ensuring consistently crispy and golden exteriors.

What earned Wingstop such a loyal following was not only its affordable, high-quality wings but also its assortment of tantalizing sauces and seasonings that include flavors like original hot and hickory smoked BBQ to innovative creations like mango habanero and lemon pepper.

Wingstop's commitment to exceptional dining experiences extends beyond its mouthwatering sauce-covered wings. The company seeks to creating a welcoming and vibrant atmosphere in its restaurants, inviting customers to savor their meals in a comfortable and friendly setting. Customers typically order at a counter with a register and can enjoy their meals at tables or booths.

For those seeking convenience, Wingstop also has a mobile app and website that provide seamless online ordering, takeout, and delivery options, ensuring that customers can enjoy their favorite wings wherever and whenever they please.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Some competitors with counter service concepts include Noodles & Company (NASDAQ:NDLS), Potbelly (NASDAQ:PBPB), Shake Shack (NYSE:SHAK), and The Habit Burger Grill (owned by YUM! Brands, NYSE:YUM).Sales Growth

Wingstop is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 24.9% over the last five years was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Wingstop reported wonderful year-on-year revenue growth of 34.1%, and its $145.8 million in revenue exceeded Wall Street's estimates by 7.2%. Looking ahead, Wall Street expects sales to grow 17.2% over the next 12 months, a deceleration from this quarter.

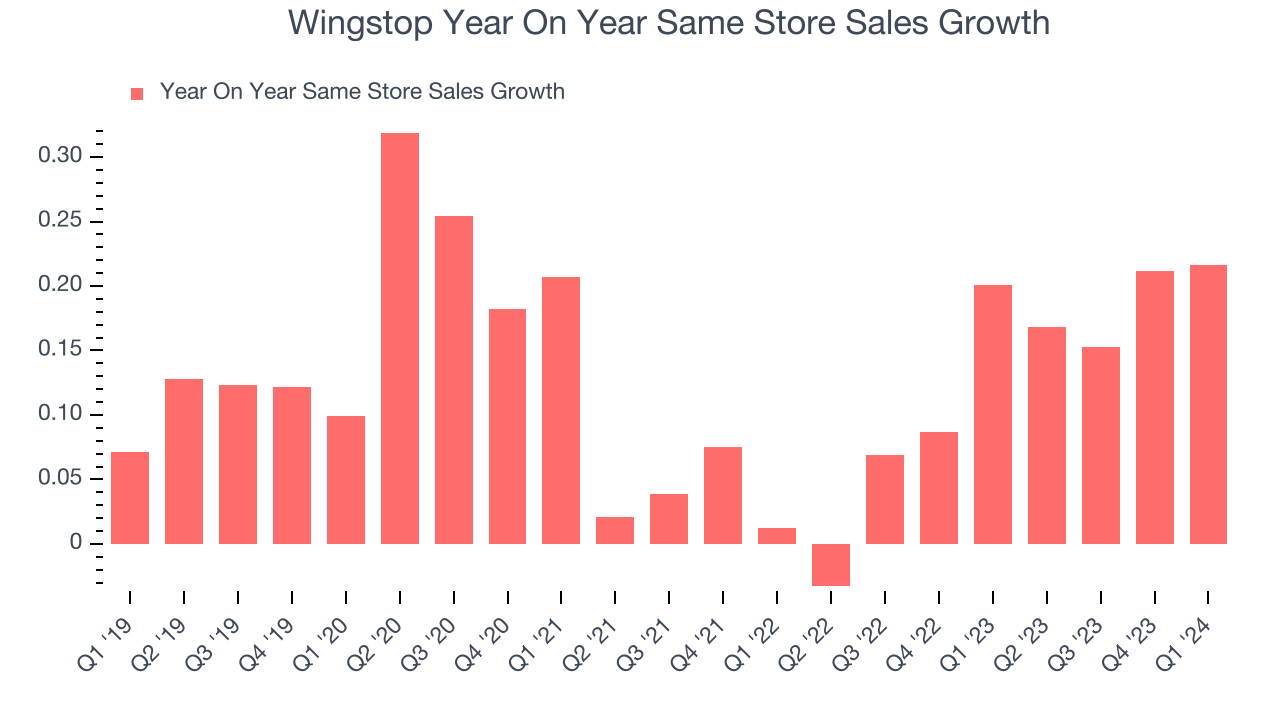

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Wingstop's demand has been spectacular for a restaurant business over the last eight quarters. On average, the company has grown its same-store sales by an impressive 13.4% year on year. This performance gives it the confidence to rapidly open new restaurants. When a company has strong demand, more locations should help it reach more customers seeking its meals and boost revenue growth.

In the latest quarter, Wingstop's same-store sales rose 21.6% year on year. This growth was in line with the 20.1% year-on-year increase it posted 12 months ago.

Number of Stores

A restaurant chain's total number of dining locations often determines how much revenue it can generate.

When a chain like Wingstop is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Wingstop's restaurant count increased by 283, or 14.2%, to 2,279 locations in the most recently reported quarter.

Over the last two years, Wingstop has rapidly opened new restaurants, averaging 12.5% annual increases in new locations. This growth is among the fastest in the restaurant sector and gives Wingstop a chance to scale towards a mid-sized company over time. Analyzing a restaurant's location growth is important because expansion means Wingstop has more opportunities to feed customers and generate sales.

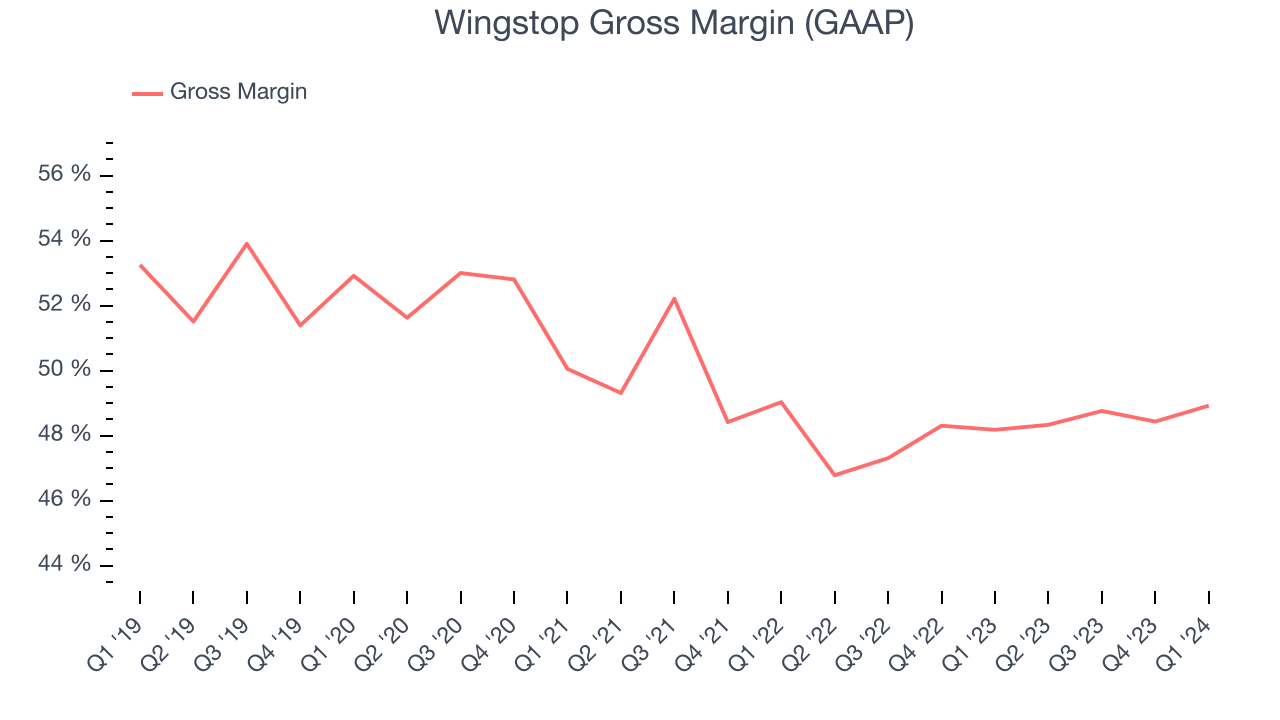

Gross Margin & Pricing Power

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells.

In Q1, Wingstop's gross profit margin was 48.9%. in line with the same quarter last year. This means the company makes $0.48 for every $1 in revenue before accounting for its operating expenses.

Wingstop has best-in-class unit economics for a restaurant company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 48.2% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

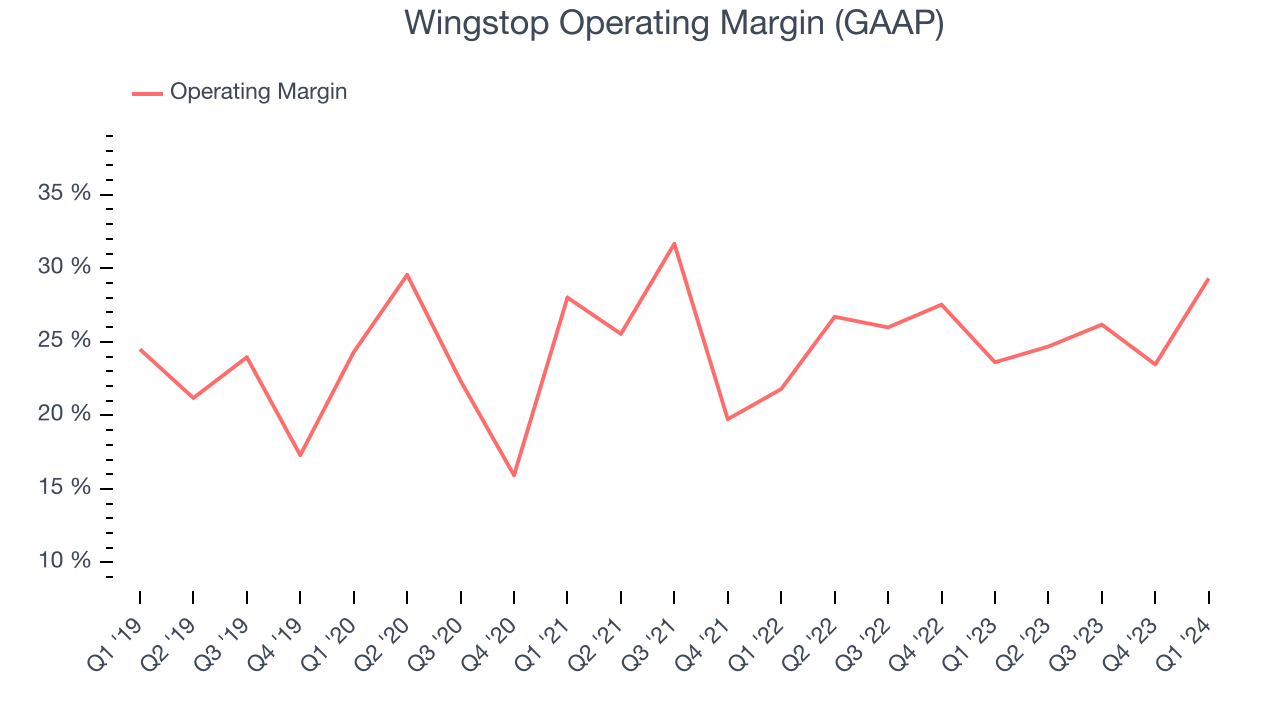

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Wingstop generated an operating profit margin of 29.3%, up 5.7 percentage points year on year. This increase was encouraging, and we can infer Wingstop was more disciplined with its expenses or gained leverage on its fixed costs because its operating margin expanded more than its gross margin.

Zooming out, Wingstop has been a well-managed company over the last two years. It's demonstrated elite profitability for a restaurant business, boasting an average operating margin of 26%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Wingstop has been a well-managed company over the last two years. It's demonstrated elite profitability for a restaurant business, boasting an average operating margin of 26%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

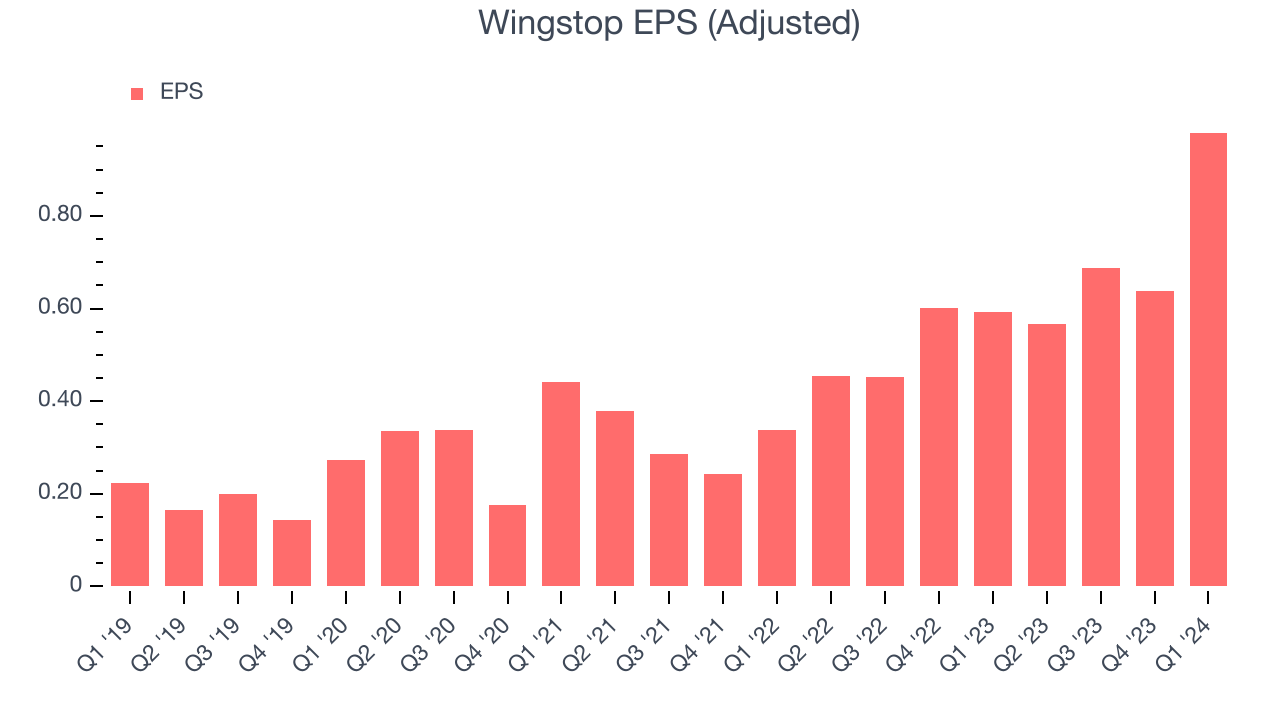

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Wingstop reported EPS at $0.98, up from $0.59 in the same quarter a year ago. This print beat Wall Street's estimates by 28.1%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 11.6% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Wingstop's five-year average ROIC was 59.3%, placing it among the best restaurant companies. Just as you’d like your investment dollars to generate returns, Wingstop's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Wingstop's ROIC averaged 9 percentage point increases. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Wingstop reported $108.3 million of cash and $712.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $150 million of EBITDA over the last 12 months, we view Wingstop's 4.0x net-debt-to-EBITDA ratio as safe. We also see its $9.11 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Wingstop's Q1 Results

We were impressed by how significantly Wingstop blew past analysts' revenue, gross margin, EBITDA, and EPS expectations this quarter. These beats were driven by its same-store sales growth of 21.6%, which crushed Wall Street's forecast of 12.7%. Management noted most of its growth came from increased transactions, not price, which is very encouraging. The company also opened more restaurants than expected in the quarter, a tailwind for its revenue growth.

Looking ahead, Wingstop's low double-digit same-store sales growth guidance for the full year also exceeded estimates, and it declared a dividend of $0.22 per share, payable on June 7, 2024 to stockholders of record as of May 17, 2024. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 2.2% after reporting and currently trades at $393.21 per share.

Is Now The Time?

Wingstop may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Wingstop is a great business. For starters, its revenue growth has been exceptional over the last five years. And while its brand caters to a niche market, its new restaurant openings have increased its brand equity. On top of that, its impressive operating margins show it has a highly efficient business model.

Wingstop's price-to-earnings ratio based on the next 12 months is 120.1x. Looking at the consumer landscape today, Wingstop's qualities as one of the best businesses really stand out, and there's no doubt it's a bit of a market darling. We don't mind paying a small premium for a high-quality business and would argue that it's often wise to hold them over the long term even if expectations are high, but we do note that there seems to be a lot of optimism priced into the stock.

Wall Street analysts covering the company had a one-year price target of $342.78 per share right before these results (compared to the current share price of $393.21).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.