Earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Wix (NASDAQ:WIX) and the rest of the e-commerce software stocks fared in Q2.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of the retail industry still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still susceptible to online disruption. There are still large areas of the retail market where e-commerce has not broken through and that drives the demand for various e-commerce software solutions.

The 4 e-commerce software stocks we track reported a a decent Q2; on average, revenues beat analyst consensus estimates by 3.11%, while on average next quarter revenue guidance was 2.78% above consensus. But the market had higher expectations and on average the share price was down 11.7% the day after the earnings.

Weakest Q2: Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $316.4 million, up 34% year on year, beating analyst expectations by 1.52%. It was a weak quarter for the company, with underwhelming full year guidance missing analysts' expectations.

"As the story of the pandemic continues to evolve, there is an uncertainty whether we are at the end of it, or if there is a massive new wave coming again. For our users, this uncertainty means that they don't know if they should create new online or offline stores, services and events. The result of this uncertainty, for us, is a mild slowdown in the creation of new web presences, which is reflected in our financials, where we came in at the low end of our expectations," said Avishai Abrahami, Co-founder and CEO of Wix.

The stock is down 28.6% since the results and currently trades at $185.

Read our full report on Wix here, it's free.

Best Q2: BigCommerce (NASDAQ:BIGC)

Founded in 2009, BigCommerce provides software for businesses to easily create online stores.

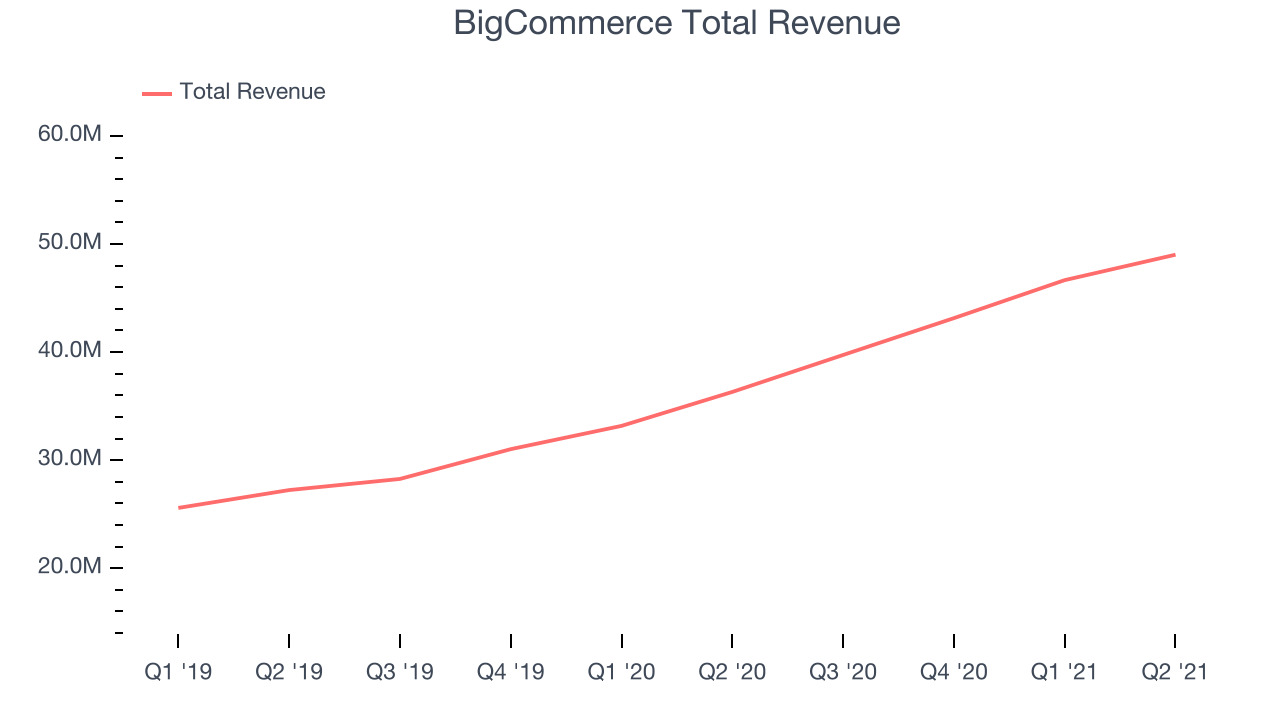

BigCommerce reported revenues of $49 million, up 34.9% year on year, beating analyst expectations by 4.71%. It was a strong quarter for the company, with a very optimistic guidance for the next quarter and a full year guidance beating analysts' expectations.

BigCommerce delivered the highest full year guidance raise among its peers. The company added 477 enterprise customers paying more than $2,000 annually to a total of 10,986. The stock is down 28.4% since the results and currently trades at $51.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

GoDaddy (NYSE:GDDY)

Founded in 1997, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $931.3 million, up 15.4% year on year, beating analyst expectations by 1.19%. It was a weaker quarter for the company, with next quarter's top line guidance missing analysts' expectations.

The stock is down 16.2% since the results and currently trades at $69.90.

Read our full analysis of GoDaddy's results here.

Olo (NYSE:OLO)

Founded in 2005, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $35.8 million, up 47.6% year on year, beating analyst expectations by 5.03%. It was a strong quarter for the company, with an exceptional revenue growth, although it did slow down from the previous quarters.

The stock is down 24.6% since the results and currently trades at $28.20.

Read our full, actionable report on Olo here, it's free.

The author has no position in any of the stocks mentioned