Website design and e-commerce platform provider Wix.com (NASDAQ:WIX) reported Q1 FY2021 results beating Wall St's expectations, with revenue up 40.8% year on year to $304.1 million. Wix made a GAAP loss of $121.7 million, down on its loss of $39.1 million, in the same quarter last year.

What do these results signal for the future of Wix? Get early access our full analysis here

Wix (WIX) Q1 FY2021 Highlights:

- Revenue: $304.1 million vs analyst estimates of $295.1 million (3.02% beat)

- EPS (non-GAAP): -$0.54 vs analyst estimates of -$0.64

- Revenue guidance for Q2 2021 is $310 million at the midpoint, below analyst estimates of $312.1 million

- The company reconfirmed revenue guidance for the full year, at $1.28 billion at the midpoint

- Free cash flow of $14.6 million, down 36.8% from previous quarter

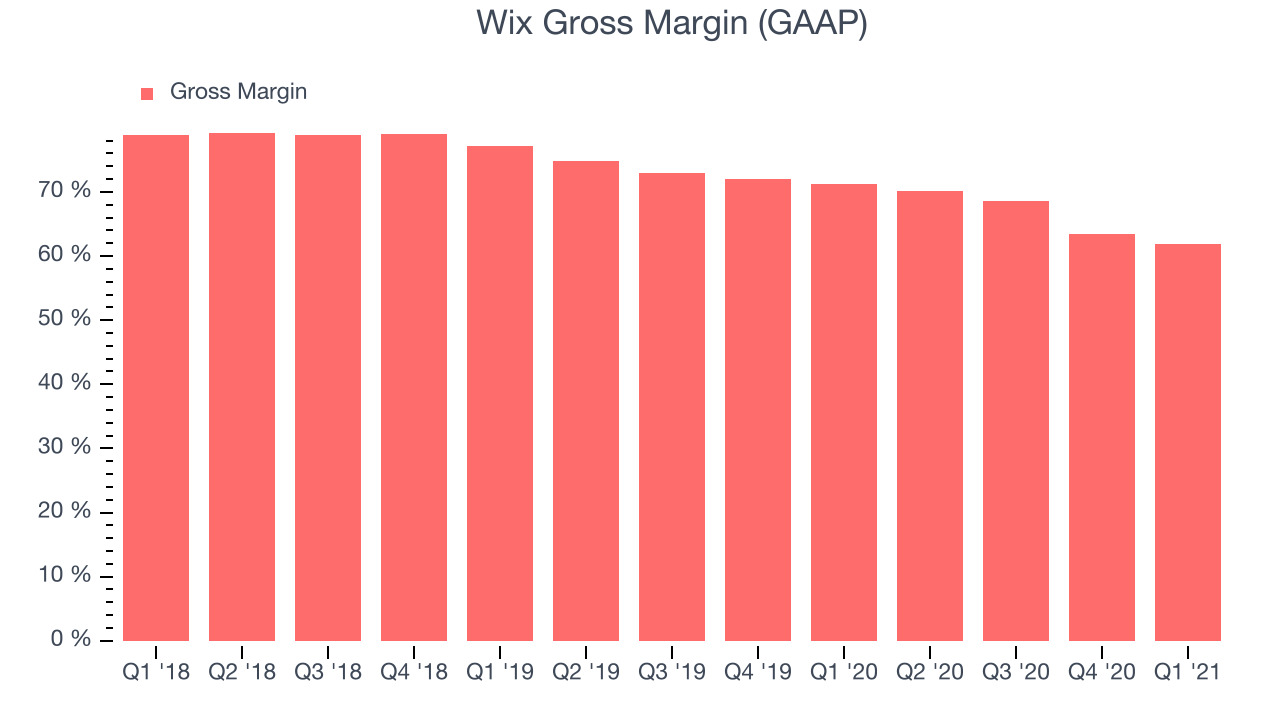

- Gross Margin (GAAP): 61.9%, down from 63.4% previous quarter

"Three months ago I stated my belief that Wix is becoming the main engine of the internet, and that in the next 5-7 years, 50% of anything new built on the internet will be done on Wix. We are starting off 2021 in a very strong position and are making strides in achieving these goals. Wix is taking a leading role in facilitating the global shift online and changing the way web presences are built," said Avishai Abrahami, Co-founder and CEO of Wix. "We strive to be a horizontal platform that offers the best solution for any type of user and any type of business to not only create but also grow and succeed online. Many types of businesses are relying on Wix today, and we expect that our diversified approach to online commerce will benefit Wix as global economies reopen."

Letting Anyone Build A Website

Brothers Avishai and Nadav Abrahami founded Wix.com in 2006 with their friend Giora Kaplan, in Tel Aviv. The founders wanted to build a website for a new start up, but were frustrated with how needlessly difficult it was to do that. This inspired them to build Wix.com, a free and easy to operate website building platform. At that time, Wix found a ready market because many businesses were building their first websites. Since then, millions have used Wix to build and manage the websites they need.

Today, businesses can use Wix.com to build just about any kind of website they need, whether it requires appointment scheduling, membership levels or even the sale of digital content like videos. Wix Business Solutions, which includes payment processing, gives Wix an opportunity to grow revenue as its customers grow revenue, by taking a small cut. Wix is essentially trying to become a one stop shop for businesses from hairdressers to hotels to set up their online presence.

Because you can do so much with Wix.com, it could be said to compete with e-commerce companies like Shopify (NYSE:SHOP), as well as website building platforms like Squarespace, Wordpress and Weebly. Ample competition means Wix will have to stay innovative and improving to grow. On the other hand, the world is still in a long term trend towards using computers and the internet for our practical (and emotional) needs. Given many employees need to interact with a company's website, often to accept bookings, it's not easy to simply change away from a platform like Wix. This puts Wix.com in a position to grow revenue for many years, but also means its revenue may be negatively impacted if its customers are struggling.

As you can see below, Wix's revenue growth has been strong over the last twelve months, growing from $215.9 million to $304.1 million.

And unsurprisingly, this was another great quarter for Wix with revenue up an absolutely stunning 40.8% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $21.5 million in Q1, compared to $28.3 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind. In investing, the past matters mostly as an indicator of the future. It is useful to know what are the analysts projecting for Wix and whether they are likely to upgrade their price targets after these results. You can easily find that out on our platform. Click here to get early access.

Not All Revenue Is Equally Profitable

When we think about Wix.com, it's important to keep in mind that part of its business is essentially a recurring subscription to a website building platform, and part of it is the business solutions where Wix.com is a payments processor. This payment processing is lower margin by nature. That's not a bad thing, per se, but it means that less profit falls to the bottom line per dollar of revenue. As this lower margin payment processing revenue makes up a bigger part of the overall revenue mix, we'd expect to see Wix's gross profit margins fall.

Wix's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 61.9% in Q1. That means that for every $1 in revenue the company had $0.61 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a low gross margin for a SaaS company and it has been going down over the last year, which is probably the opposite direction shareholders would like to see it go.

Key Takeaways from Wix's Q1 Results

Sporting a market capitalisation of $16.4 billion, more than $685.1 million in cash and operating free cash flow positive over the last twelve months, we're confident that Wix has the resources it needs to pursue a high growth business strategy.

We enjoyed seeing Wix’s impressive revenue growth this quarter. And we were also excited to see it that it outperformed analysts' revenue expectations. On the other hand, there was a deterioration in gross margin and the revenue guidance for the next quarter missed analysts' expectations. Overall, this quarter's results seemed mixed and shareholders should watch the company carefully. But Wix did look like a good growth stock before these results and nothing we have seen today has significantly changed that.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.