As Q4 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the e-commerce software stocks, including Wix (NASDAQ:WIX) and its peers.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 6 e-commerce software stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 1.38%, while on average next quarter revenue guidance was 0.52% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows, but e-commerce software stocks held their ground better than others, with the share prices up 0.64% since the previous earnings results, on average.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

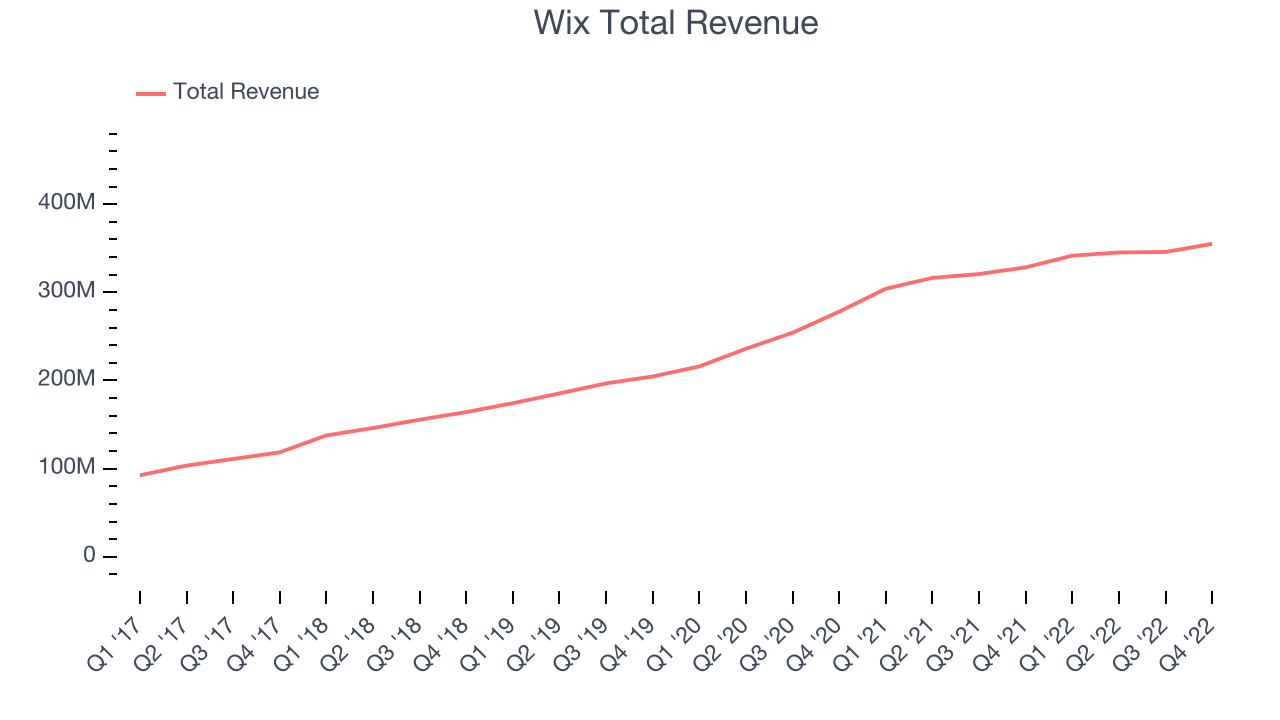

Wix reported revenues of $355 million, up 8.13% year on year, in line with analyst expectations. It was a decent quarter for the company, with very strong guidance for the next year but slow revenue growth.

"In the face of a dynamic macroeconomic environment this year, we shifted our focus toward tightening spending and becoming more efficient in the execution of our priorities. Through all of this, we continued to lead through innovation. We released hundreds of new products and features throughout 2022 to improve our platform for self creators and partners. Among the most notable releases this year were Wix Blocks for developers, our new Wix Editor, Wix Portfolio and our new AI Text Creator," said Avishai Abrahami, Wix Co-founder and CEO.

The stock is up 15.6% since the results and currently trades at $93.41.

Is now the time to buy Wix? Access our full analysis of the earnings results here, it's free.

Best Q4: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.73 billion, up 25.7% year on year, beating analyst expectations by 5.11%. It was a strong quarter for the company, with a decent beat of analyst estimates and solid revenue growth.

Shopify achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 15.3% since the results and currently trades at $45.22.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it's free.

Weakest Q4: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $72.4 million, up 11.6% year on year, missing analyst expectations by 1.24%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

BigCommerce had the weakest performance against analyst estimates and weakest full year guidance update in the group. The stock is down 26.8% since the results and currently trades at $8.3.

Read our full analysis of BigCommerce's results here.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.04 billion, up 2.02% year on year, missing analyst expectations by 0.31%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

GoDaddy had the slowest revenue growth among the peers. The stock is down 5.59% since the results and currently trades at $76.51.

Read our full, actionable report on GoDaddy here, it's free.

VeriSign (NASDAQ:VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $369.2 million, up 8.49% year on year, in line with analyst expectations. It was a weaker quarter for the company, with slow revenue growth.

The stock is up 1.05% since the results and currently trades at $210.22.

Read our full, actionable report on VeriSign here, it's free.

The author has no position in any of the stocks mentioned