The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the e-commerce software stocks have fared in Q1, starting with Wix (NASDAQ:WIX).

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 4 e-commerce software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.66%, while on average next quarter revenue guidance was 1.05% under consensus. The whole tech sector has been facing a sell-off since late last year, but e-commerce software stocks held their ground better than others, with the share price up 2.97% since earnings, on average.

Weakest Q1: Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $341.5 million, up 12.3% year on year, in line with analyst expectations. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

"Wix has remained focused on executing on our long-term opportunities, our product and marketing roadmaps, and concentrating on what we can control despite the recent months of instability and volatility," said Avishai Abrahami, Wix co-founder and CEO.

Wix delivered the weakest performance against analyst estimates of the whole group. The stock is down 8.18% since the results and currently trades at $65.40.

Read our full report on Wix here, it's free.

Best Q1: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

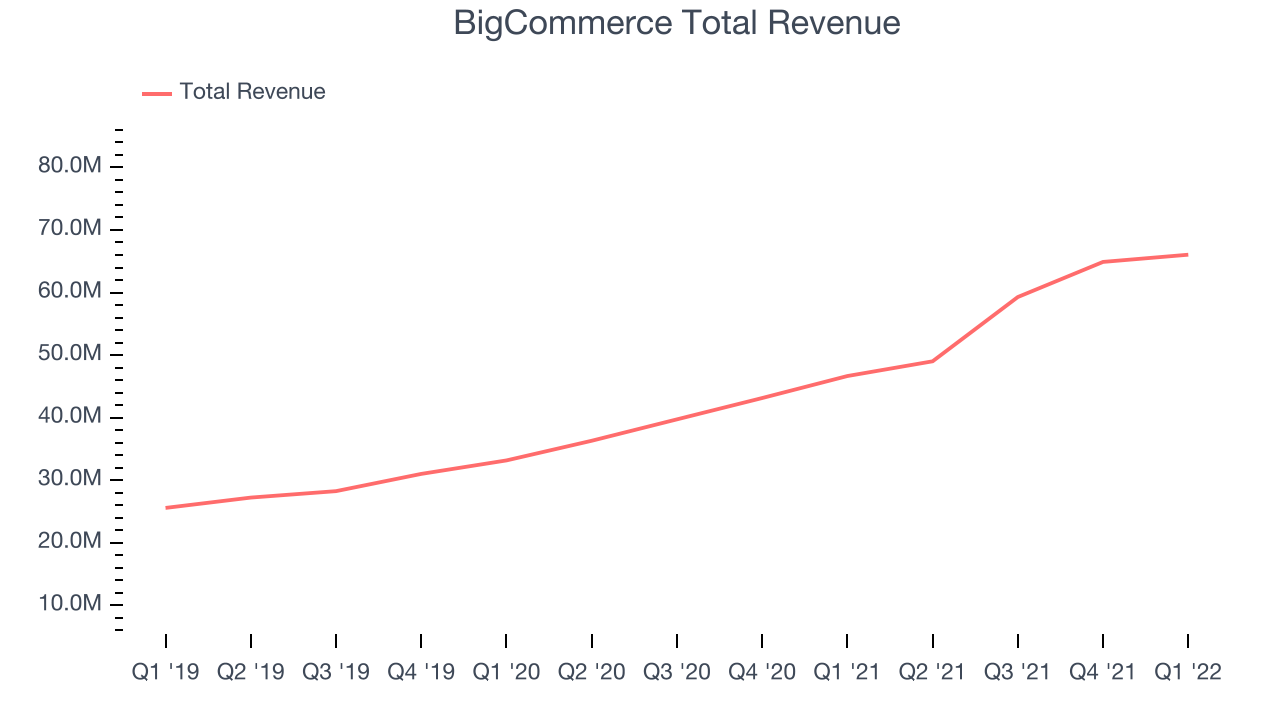

BigCommerce reported revenues of $66 million, up 41.5% year on year, beating analyst expectations by 3.46%. It was a mixed quarter for the company, with an exceptional revenue growth but decelerating growth in large customers.

BigCommerce pulled off the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 218 enterprise customers paying more than $2,000 annually to a total of 12,972. The stock is down 9.47% since the results and currently trades at $17.01.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $207.7 million, up 15.6% year on year, beating analyst expectations by 1.48%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

The stock is up 44.9% since the results and currently trades at $20.92.

Read our full analysis of Squarespace's results here.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1 billion, up 11.2% year on year, beating analyst expectations by 1.36%. It was a weaker quarter for the company, with a slow revenue growth and a full year guidance missing analysts' expectations.

GoDaddy had the slowest revenue growth and weakest full year guidance update among the peers. The stock is down 15.3% since the results and currently trades at $69.56.

Read our full, actionable report on GoDaddy here, it's free.

The author has no position in any of the stocks mentioned