Website design and e-commerce platform provider Wix.com (NASDAQ:WIX) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 13.7% year on year to $403.8 million. The company expects next quarter's revenue to be around $417 million, in line with analysts' estimates. It made a non-GAAP profit of $1.22 per share, improving from its profit of $0.61 per share in the same quarter last year.

Wix (WIX) Q4 FY2023 Highlights:

- Revenue: $403.8 million vs analyst estimates of $402.6 million (small beat)

- EPS (non-GAAP): $1.22 vs analyst estimates of $0.96 (26.6% beat)

- Revenue Guidance for Q1 2024 is $417 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $1.75 billion at the midpoint, in line with analyst expectations and implying 11.7% growth (vs 12.5% in FY2023)

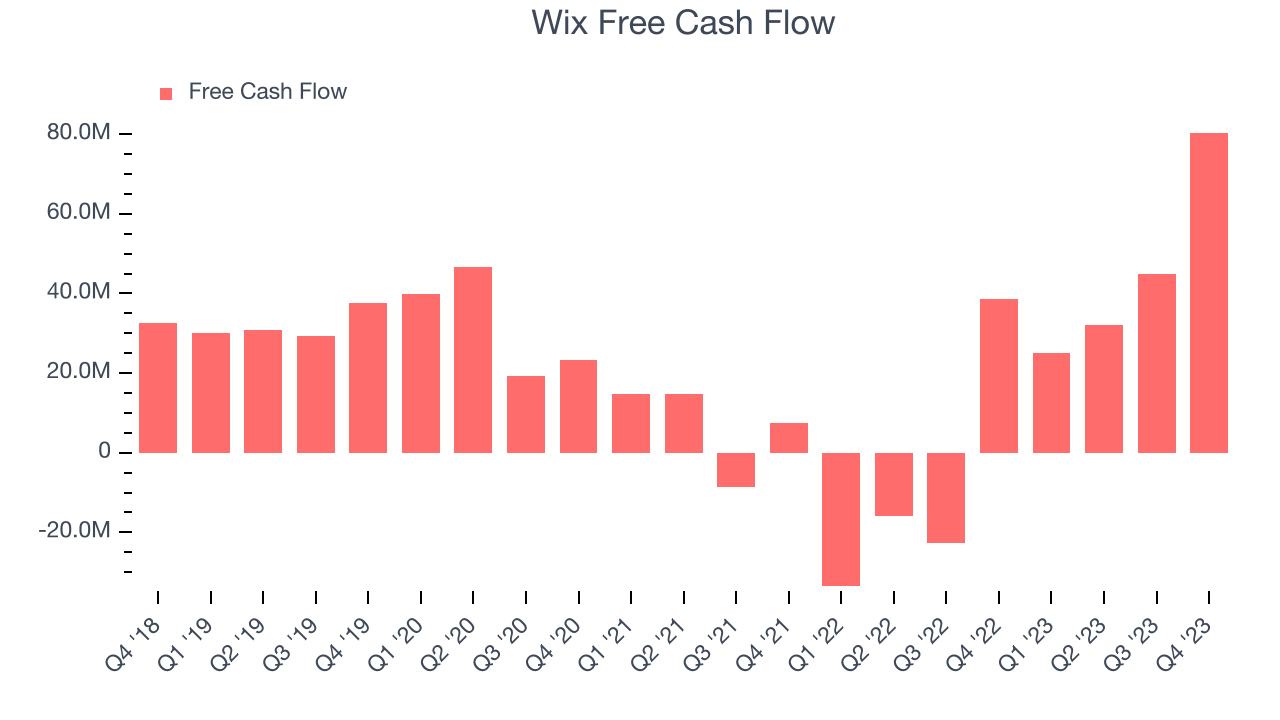

- Free Cash Flow of $80.39 million, up 79.6% from the previous quarter

- Gross Margin (GAAP): 68.8%, up from 63.7% in the same quarter last year

- Market Capitalization: $7.16 billion

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Brothers Avishai and Nadav Abrahami founded Wix.com with their friend Giora Kaplan. The founders wanted to build a website for a new start up, but were frustrated with how needlessly difficult it was to do that. At that time, Wix found a ready market because many businesses were building their first websites. Since then, millions have used Wix to build and manage the websites they need.

Today, businesses can use Wix.com to build just about any kind of website they need, whether it requires appointment scheduling, membership levels or even the sale of digital content like videos. Wix Business Solutions, which includes payment processing, gives Wix an opportunity to grow revenue as its customers grow revenue, by taking a small cut. Wix is essentially trying to become a one stop shop for businesses from hairdressers to hotels to set up their online presence.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Because you can do so much with Wix.com, it could be said to compete with e-commerce companies like Shopify (NYSE:SHOP), as well as website building platforms like Squarespace, Wordpress and Webflow.

Sales Growth

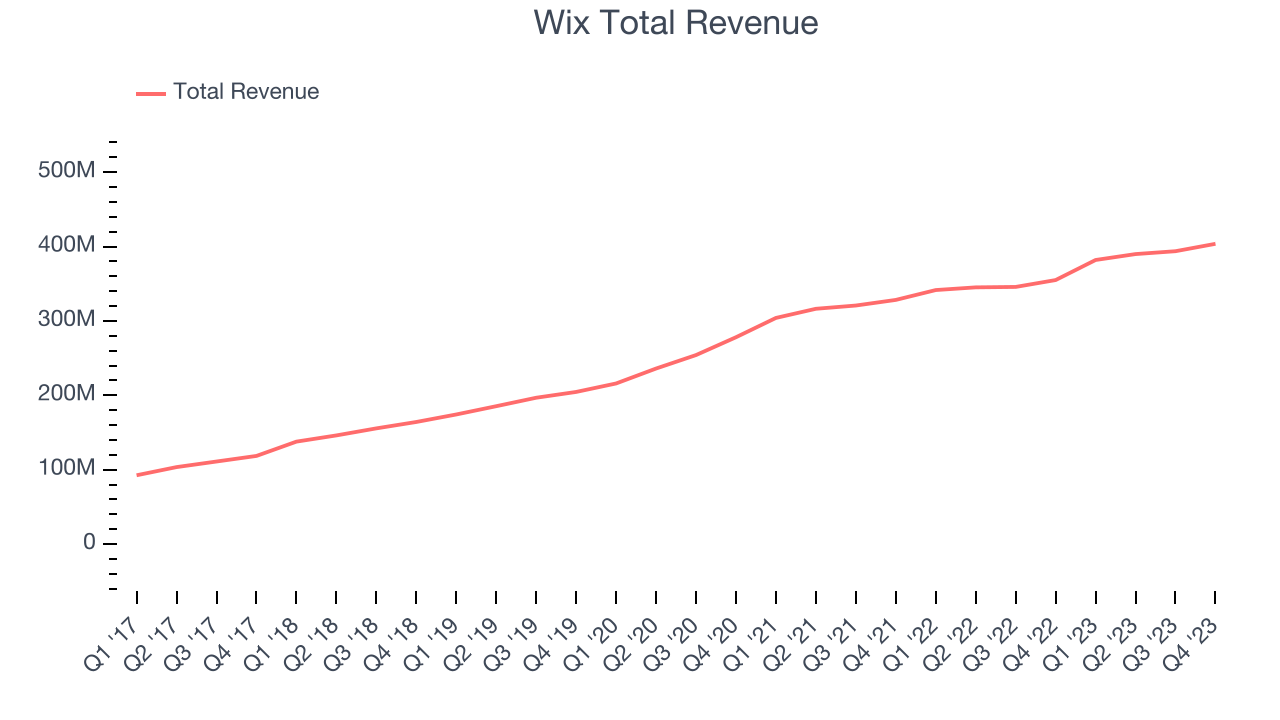

As you can see below, Wix's revenue growth has been unremarkable over the last two years, growing from $333.4 million in Q4 FY2021 to $403.8 million this quarter.

This quarter, Wix's quarterly revenue was once again up 13.7% year on year. We can see that Wix's revenue increased by $9.93 million quarter on quarter, which is a solid improvement from the $3.86 million increase in Q3 2023. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that Wix is expecting revenue to grow 11.5% year on year to $417 million, improving on the 9.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.75 billion at the midpoint, growing 11.7% year on year compared to the 12.5% increase in FY2023.

Profitability

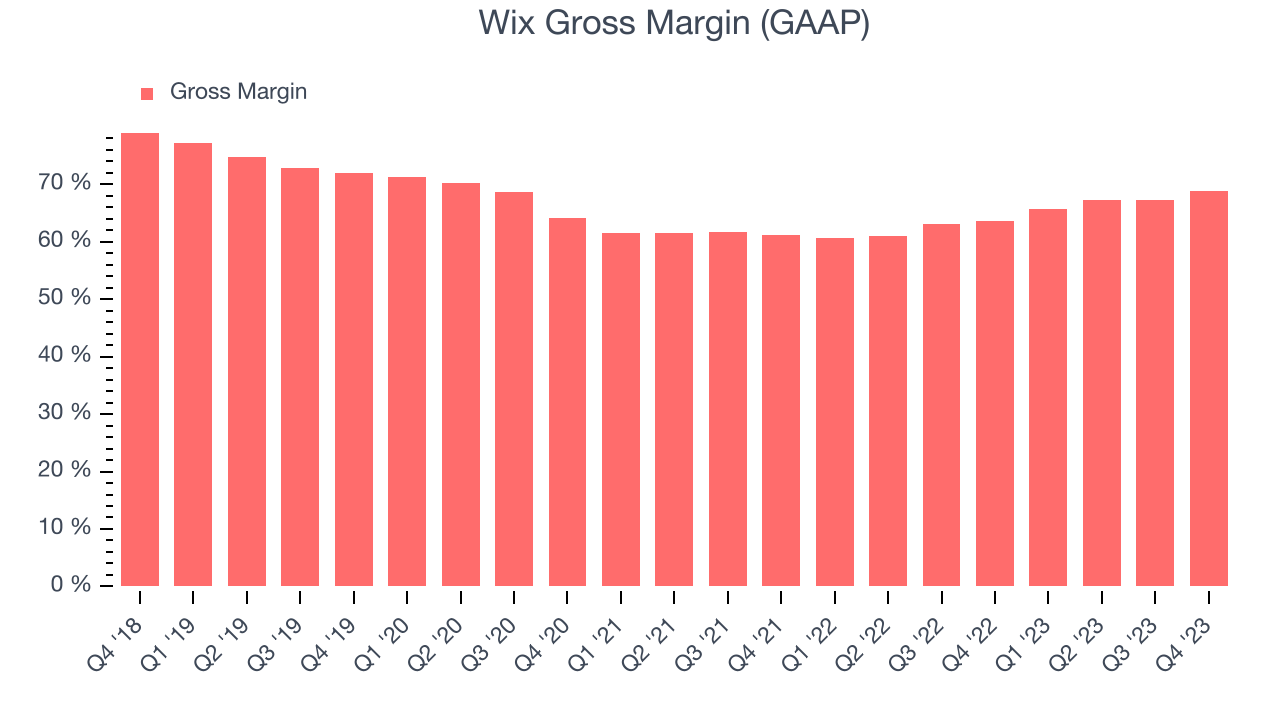

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Wix's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 68.8% in Q4.

That means that for every $1 in revenue the company had $0.69 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Wix's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Wix's free cash flow came in at $80.39 million in Q4, up 108% year on year.

Wix has generated $182.2 million in free cash flow over the last 12 months, or 11.7% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Wix's Q4 Results

We enjoyed seeing Wix's revenue guidance for next year, indicating that growth is steady. We were also glad its gross margin and free cash flow improved. The stock is flat after reporting and currently trades at $126 per share.

Is Now The Time?

When considering an investment in Wix, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Wix isn't a bad business, it probably wouldn't be one of our picks. Its , and analysts expect growth to deteriorate from here. On top of that, its gross margins aren't as good as other tech businesses we look at.

Wix's price-to-sales ratio based on the next 12 months is 4.2x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We can find things to like about Wix and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $137.56 per share right before these results (compared to the current share price of $126).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.