Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at WalkMe (NASDAQ:WKME), and the best and worst performers in the sales and marketing software group.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 25 sales and marketing software stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.54%, while on average next quarter revenue guidance was 2.49% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again, but sales and marketing software stocks held their ground better than others, with the share prices up 18.7% since the previous earnings results, on average.

WalkMe (NASDAQ:WKME)

Founded in Israel in 2011, WalkMe (NASDAQ:WKME) is software that teaches users how to get the most out of new applications.

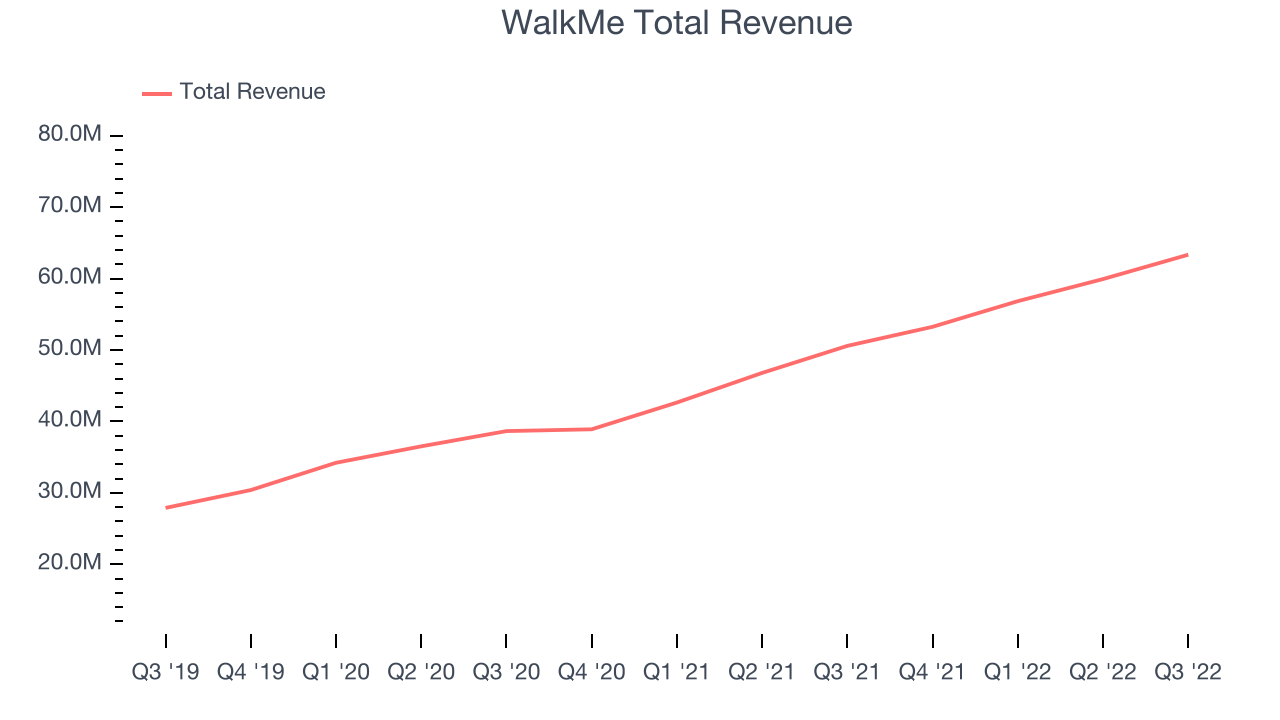

WalkMe reported revenues of $63.3 million, up 25.2% year on year, in line with analyst expectations. It was a weaker quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

"I'm pleased to see as we continue to transition our business to focus on large organizations with complex business processes that our customers are not pausing their efforts to optimize their organizations," said Dan Adika, CEO of WalkMe.

The stock is up 44.8% since the results and currently trades at $11.18.

Read our full report on WalkMe here, it's free.

Best Q3: Zeta (NYSE:ZETA)

Co-Founded by former Apple CEO, John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

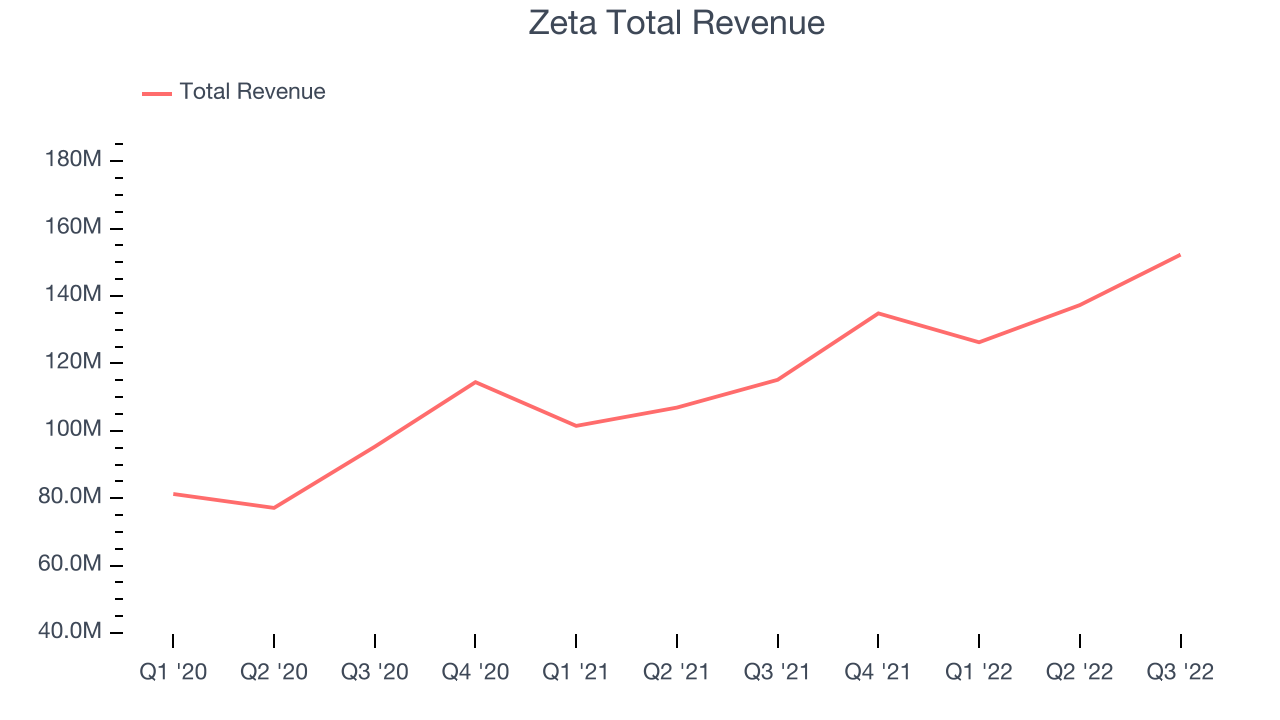

Zeta reported revenues of $152.2 million, up 32.2% year on year, beating analyst expectations by 7.94%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and solid top line growth.

Zeta scored the strongest analyst estimates beat and highest full year guidance raise among its peers. The company added 16 enterprise customers paying more than $100,000 annually to a total of 389. The stock is up 8.58% since the results and currently trades at $9.11.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it's free.

Slowest Q3: AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

AppLovin reported revenues of $713 million, down 1.9% year on year, missing analyst expectations by 2.07%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations.

The stock is down 12.3% since the results and currently trades at $12.03.

Read our full analysis of AppLovin's results here.

PubMatic (NASDAQ:PUBM)

Founded in 2006, as an online ad platform focused on ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $64.5 million, up 11% year on year, missing analyst expectations by 3.71%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

PubMatic had the weakest performance against analyst estimates and weakest full year guidance update among the peers. The stock is down 8.95% since the results and currently trades at $14.75.

Read our full, actionable report on PubMatic here, it's free.

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) provides software as a service that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $147 million, up 15.5% year on year, beating analyst expectations by 2.6%. It was a decent quarter for the company, with accelerating customer growth but a decline in net revenue retention rate.

The company added 2 enterprise customers paying more than $1m annually to a total of 92. The stock is up 68.1% since the results and currently trades at $26.24.

Read our full, actionable report on LiveRamp here, it's free.

The author has no position in any of the stocks mentioned