Global music entertainment company Warner Music Group (NASDAQ:WMG) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 2.8% year on year to $1.63 billion. Its GAAP profit of $0.08 per share was 71.1% below analysts’ consensus estimates.

Is now the time to buy Warner Music Group? Find out by accessing our full research report, it’s free.

Warner Music Group (WMG) Q3 CY2024 Highlights:

- Revenue: $1.63 billion vs analyst estimates of $1.60 billion (2.8% year-on-year growth, 2% beat)

- Adjusted EPS: $0.08 vs analyst expectations of $0.28 (71.1% miss)

- Adjusted EBITDA: $353 million vs analyst estimates of $349 million (21.7% margin, 1.1% beat)

- Operating Margin: 8.8%, down from 13.4% in the same quarter last year

- Free Cash Flow Margin: 16.6%, down from 18.9% in the same quarter last year

- Market Capitalization: $17.44 billion

Company Overview

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ:WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

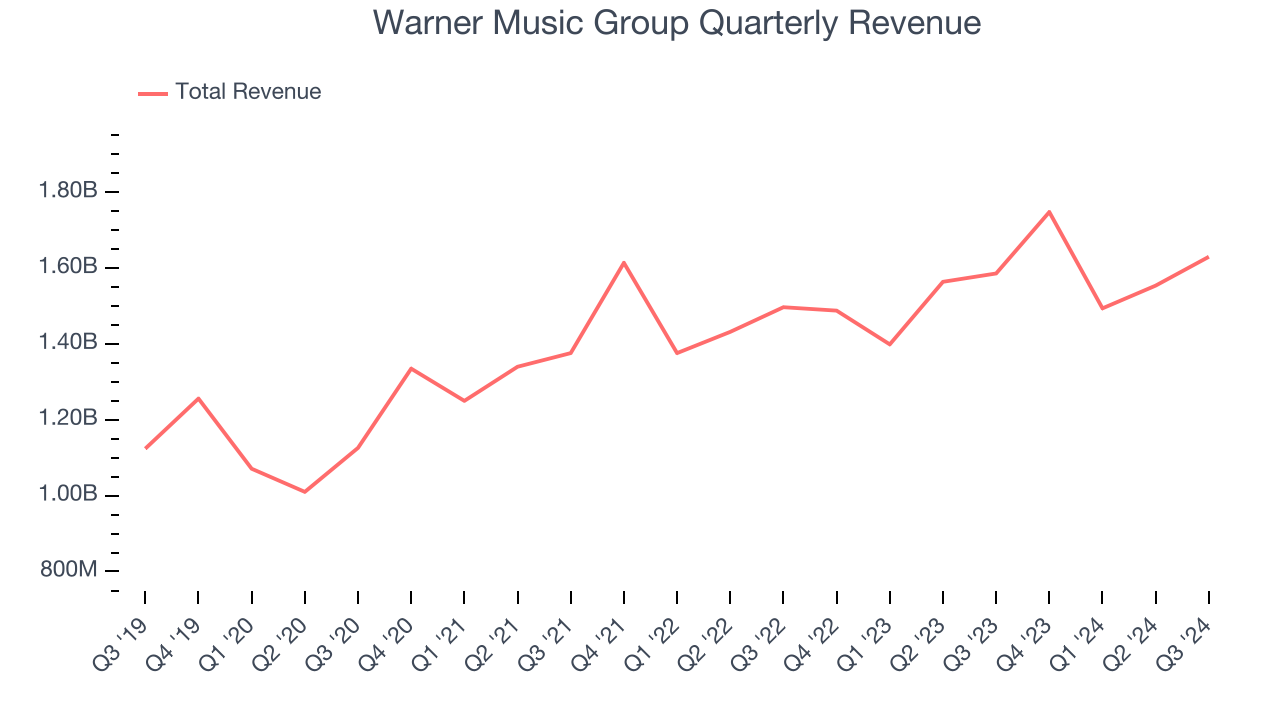

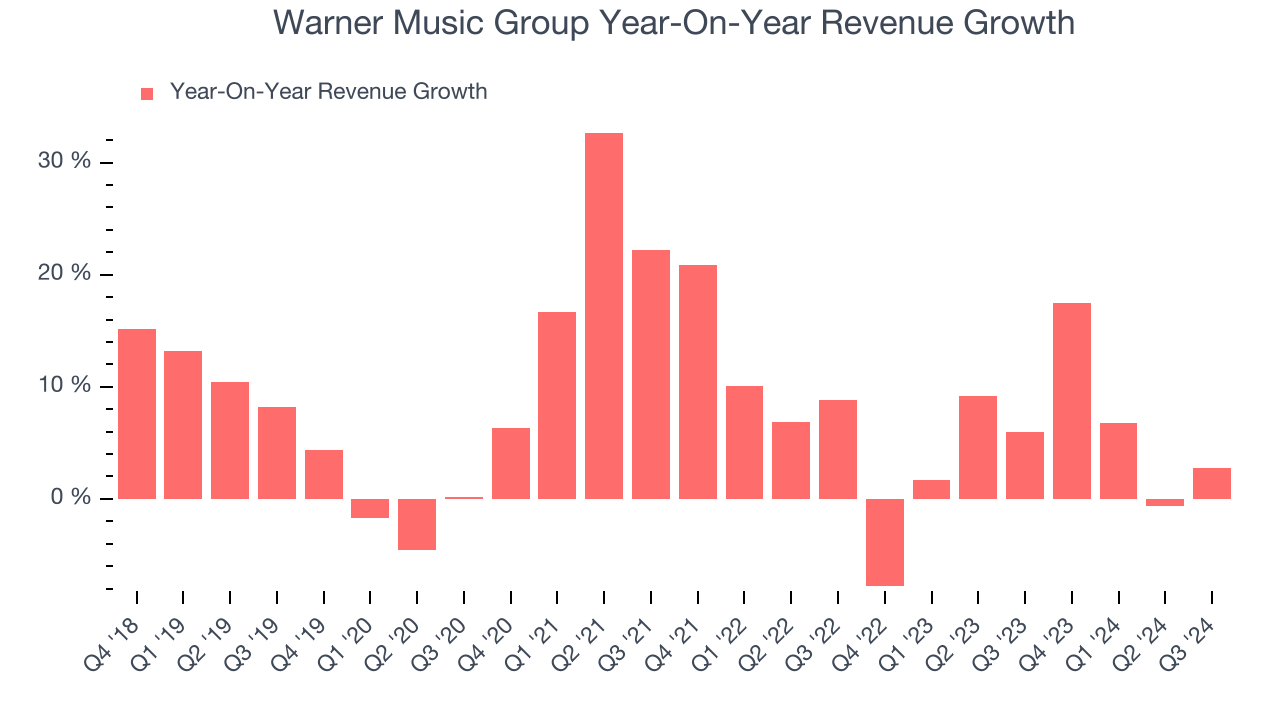

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Warner Music Group’s sales grew at a sluggish 7.5% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Warner Music Group’s recent history shows its demand slowed as its annualized revenue growth of 4.2% over the last two years is below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Recorded Music and Music Publishing, which are 82.1% and 18.1% of revenue. Over the last two years, Warner Music Group’s Recorded Music revenue (new music production) averaged 2.8% year-on-year growth while its Music Publishing revenue (royalties from catalog music) averaged 12.6% growth.

This quarter, Warner Music Group reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

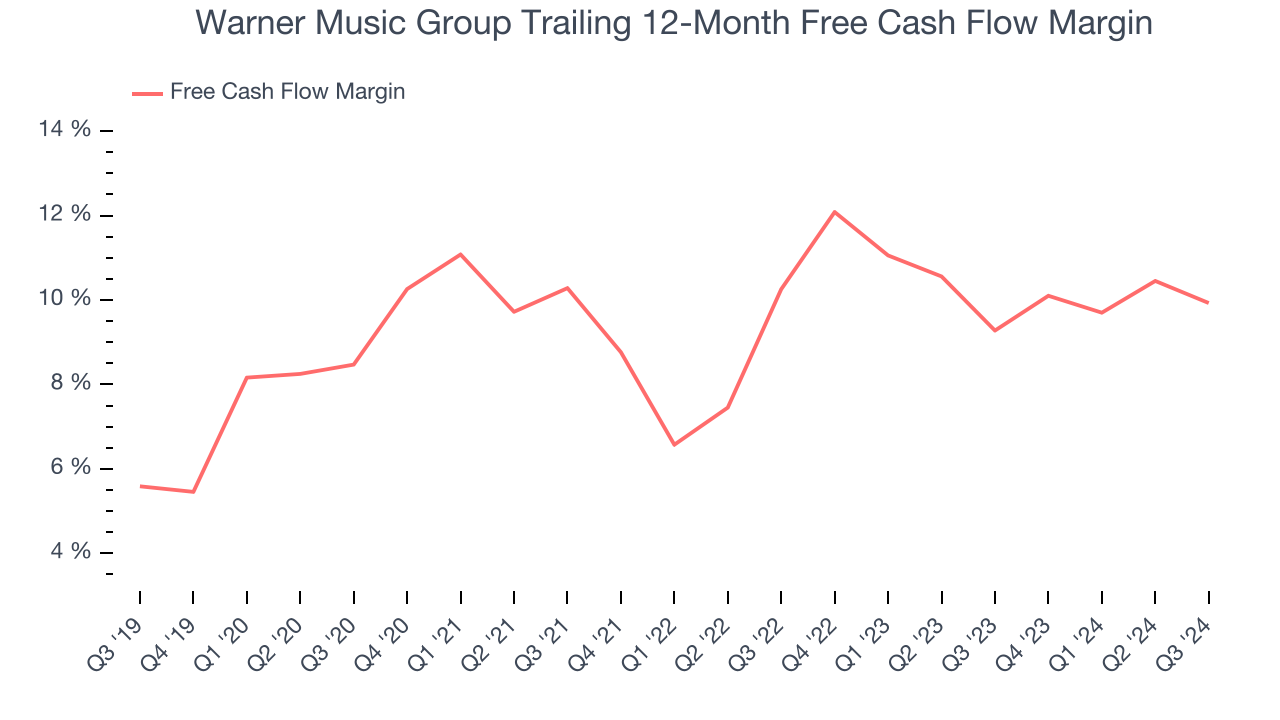

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Warner Music Group has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.6%, subpar for a consumer discretionary business.

Warner Music Group’s free cash flow clocked in at $271 million in Q3, equivalent to a 16.6% margin. The company’s cash profitability regressed as it was 2.3 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Warner Music Group’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 9.9% for the last 12 months will increase to 11.9%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Warner Music Group’s Q3 Results

It was encouraging to see Warner Music Group beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed significantly and its Recorded Music revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.3% to $31.50 immediately after reporting.

Warner Music Group underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.