Pet-focused retailer Petco (NASDAQ:WOOF) missed analysts' expectations in Q3 FY2023, with revenue flat year on year at $1.49 billion. The company's full-year revenue guidance of $6.21 billion at the midpoint also came in 0.6% below analysts' estimates. It made a GAAP loss of $4.63 per share, down from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy Petco? Find out by accessing our full research report, it's free.

Petco (WOOF) Q3 FY2023 Highlights:

- Revenue: $1.49 billion vs analyst estimates of $1.51 billion (1.3% miss)

- EPS: -$4.63 vs analyst estimates of -$0.03 (-$4.60 miss)

- The company reconfirmed its revenue guidance for the full year of $6.21 billion at the midpoint

- Free Cash Flow was -$28.08 million, down from $33.49 million in the same quarter last year

- Gross Margin (GAAP): 36.8%, down from 39.9% in the same quarter last year

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ:WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

Petco is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

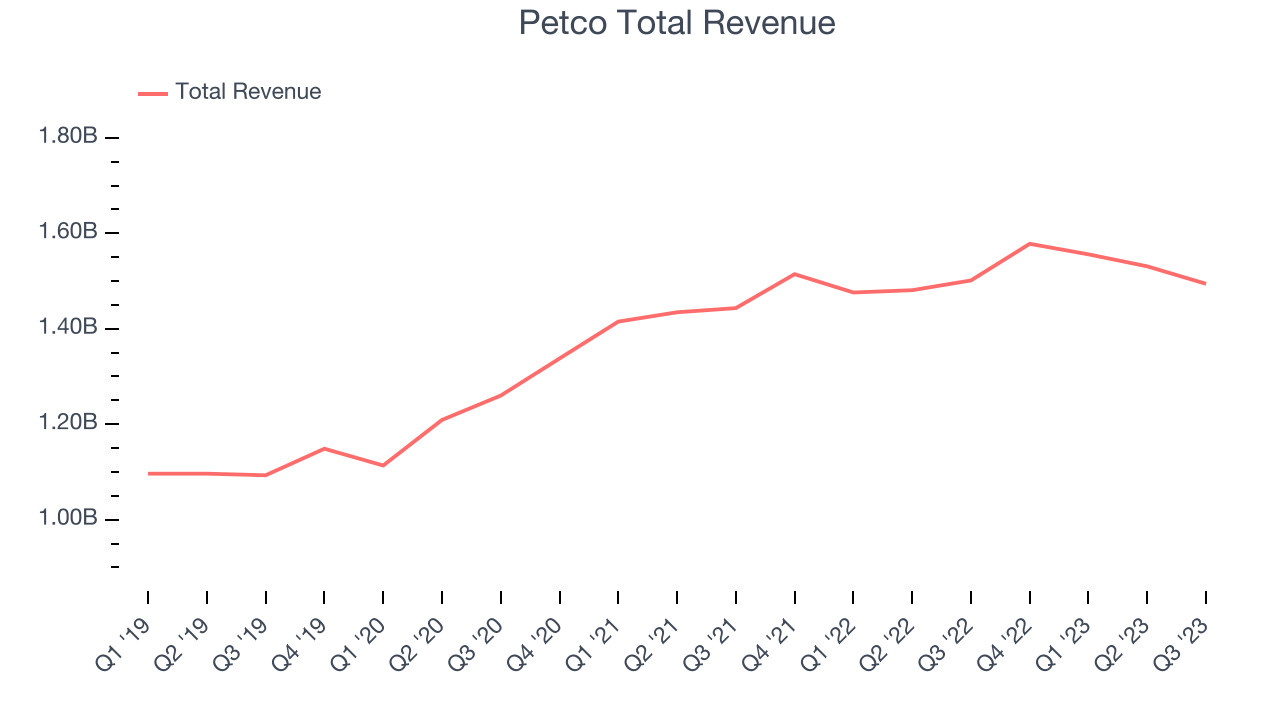

As you can see below, the company's annualized revenue growth rate of 8.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent .

This quarter, Petco reported a rather uninspiring 0.5% year-on-year revenue decline, missing Wall Street's expectations. Looking ahead, analysts expect sales to grow 3.7% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

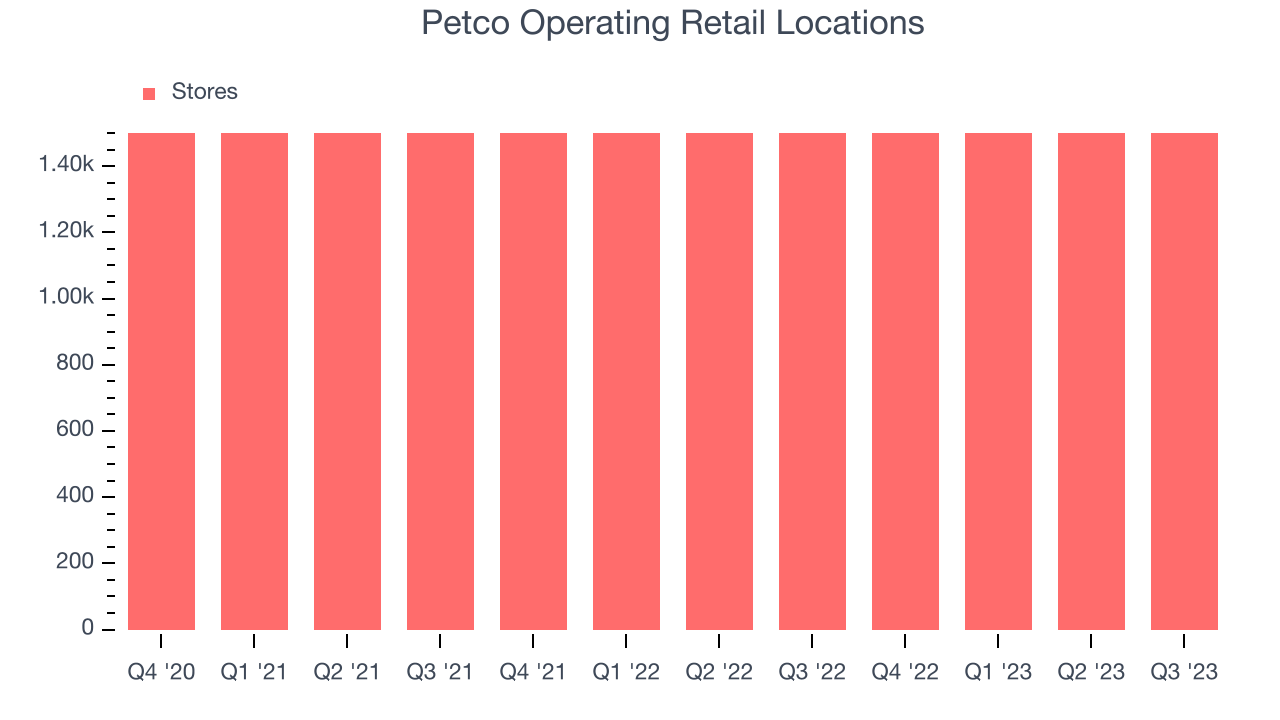

When a retailer like Petco keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Petco operated 1,500 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

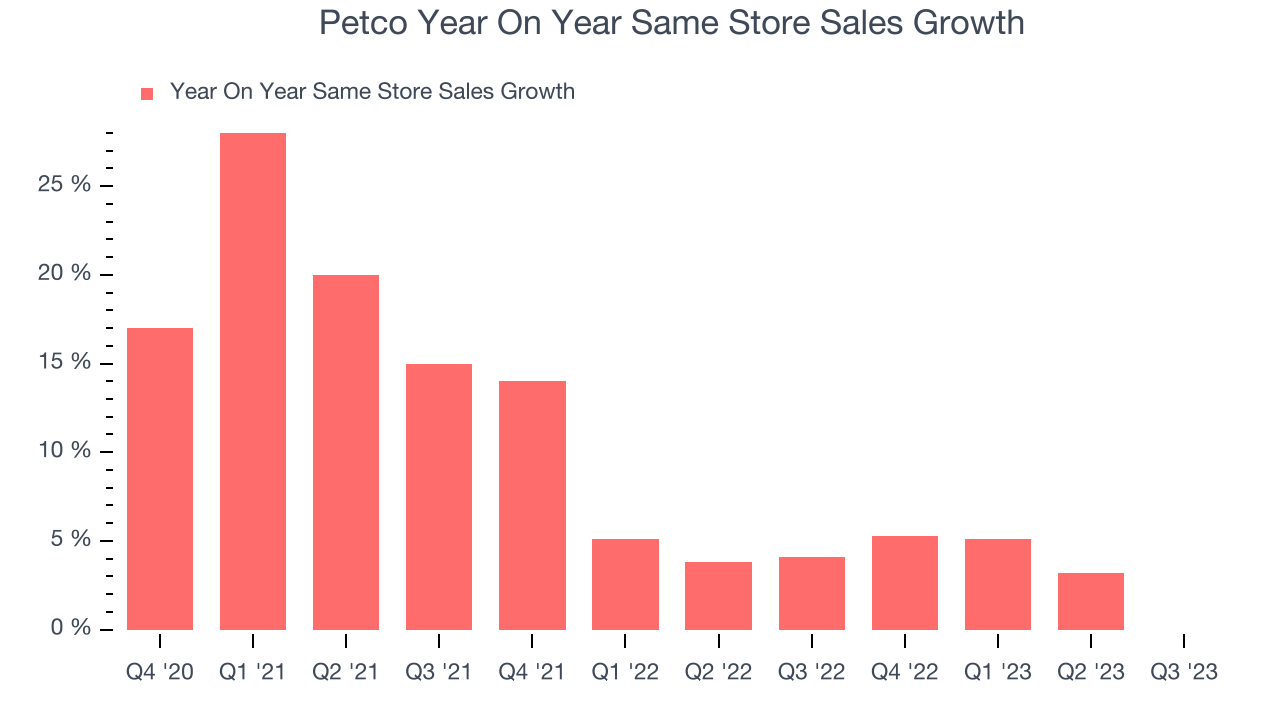

Petco's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 5.1% year on year. Given its flat store count over the same period, this performance stems from increased foot traffic at existing stores or higher e-commerce sales as the company shifts demand from in-store to online.

In the latest quarter, Petco's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 4.1% year-on-year increase it posted 12 months ago. We'll be watching Petco closely to see if it can reaccelerate growth.

Key Takeaways from Petco's Q3 Results

Sporting a market capitalization of $1.03 billion, Petco is among smaller companies, but its more than $139.8 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We struggled to find many strong positives in these results. It missed analyst expectations on nearly every key metric we track: revenue growth, gross margin, adjusted EBITDA, EPS, and free cash flow. We note its steep drop in GAAP operating income and EPS was thanks to a one-time $1.22 billion goodwill impairment charge. Even when adjusting for the non-recurring expense, this was still a bad quarter for Petco. The company is down 12.6% on the results and currently trades at $3.35 per share.

Petco may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.