Pet-focused retailer Petco (NASDAQ:WOOF) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 6.1% year on year to $1.67 billion. On the other hand, next quarter's revenue guidance of $1.5 billion was less impressive, coming in 3.3% below analysts' estimates. It made a non-GAAP profit of $0.02 per share, down from its profit of $0.20 per share in the same quarter last year.

Petco (WOOF) Q4 FY2023 Highlights:

- Revenue: $1.67 billion vs analyst estimates of $1.63 billion (2.6% beat)

- EPS (non-GAAP): $0.02 vs analyst expectations of $0.02 (roughly in line)

- Revenue Guidance for Q1 2024 is $1.5 billion at the midpoint, below analyst estimates of $1.55 billion

- EPS (non-GAAP) Guidance for Q1 2024 is -$0.06 at the midpoint, below analyst estimates of -$0.02

- Gross Margin (GAAP): 36.2%, down from 39.3% in the same quarter last year

- Free Cash Flow was -$2.04 million, down from $70.59 million in the same quarter last year

- Same-Store Sales were down 0.9% year on year (beat vs. expectations of down 2.1% year on year)

- Market Capitalization: $687.3 million

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ:WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Since its 1965 founding, the company has evolved from largely a place where consumers could buy or adopt pets such as dogs and fish to a one-stop shop for current and potential pet owners. A cat owner can buy Merrick cat food made from natural ingredients, a dog owner can buy Frontline flea and tick collars, and an aquarium owner can buy Tetra water filters. Additionally, services are available at Petco. Cats can be groomed, dogs can undergo parasite treatments, and small pets such as rabbits can undergo diagnostic tests.

Petco store sizes can vary, but most are 10,000 to 20,000 square feet. They tend to be located in shopping centers and retail plazas that get regular foot traffic. Most stores tend to dedicate the largest percentage of floor space to pet food and supplies such as toys and grooming products, separated by type of animal. There are then special aquatic sections with fish tanks and service areas for pets to be groomed and treated for minor ailments. Most Petco stores partner with local animal shelters or rescue organizations to facilitate adoptions of various animal types.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that offer pet products and services include Chewy (NYSE:CHWY), Tractor Supply Company (NASDAQ:TSCO), and Academy Sports and Outdoors (NASDAQ:ASO) as well as private companies such as PetSmart.Sales Growth

Petco is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

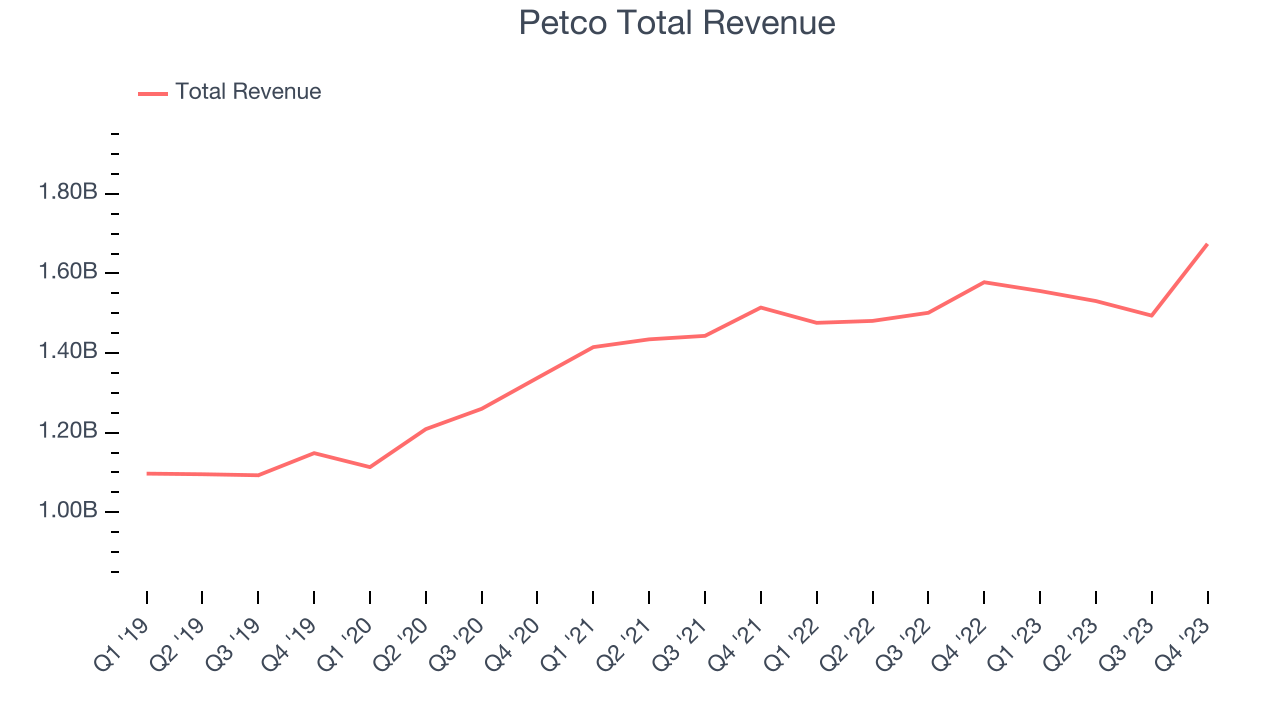

As you can see below, the company's annualized revenue growth rate of 9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre despite closing stores, implying that growth was driven by higher sales at existing, established stores.

This quarter, Petco reported solid year-on-year revenue growth of 6.1%, and its $1.67 billion in revenue outperformed Wall Street's estimates by 2.6%. The company is guiding for a 3.6% year-on-year revenue decline next quarter to $1.5 billion, a reversal from the 5.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 1% over the next 12 months, a deceleration from this quarter.

Same-Store Sales

Petco's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 3.2% year on year. Given its declining store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores, which is sometimes a side effect of reducing the total number of stores.

In the latest quarter, Petco's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 5.3% year-on-year increase it posted 12 months ago. We'll be watching Petco closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

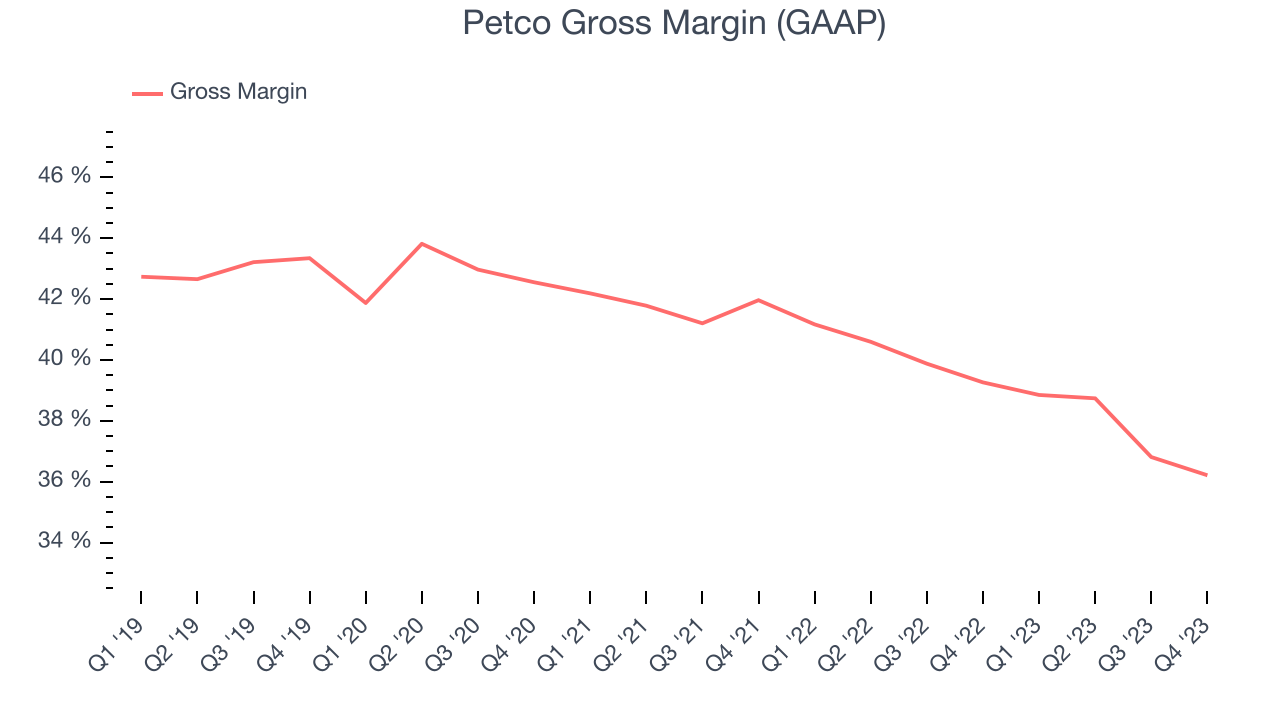

Petco has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it's averaged a healthy 38.9% gross margin over the last two years. This means the company makes $0.39 for every $1 in revenue before accounting for its operating expenses.

Petco produced a 36.2% gross profit margin in Q4, marking a 3.1 percentage point decrease from 39.3% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

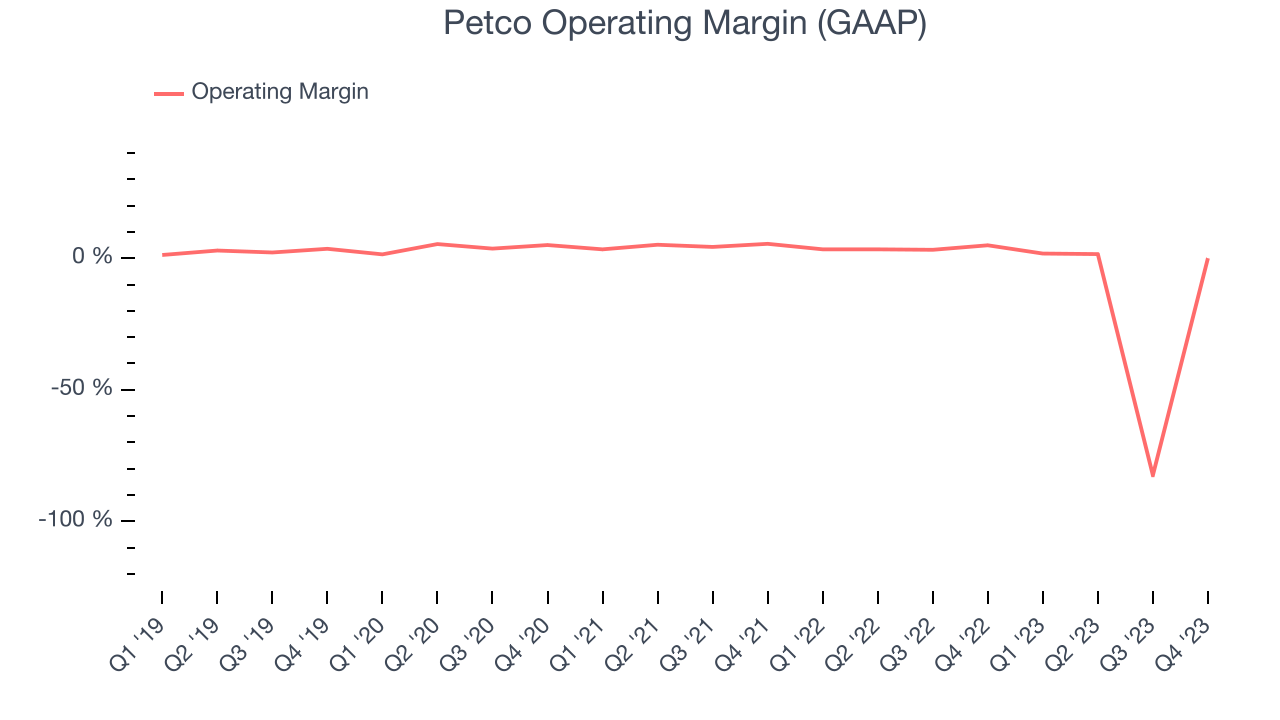

In Q4, Petco generated an operating profit margin of 0%, down 4.9 percentage points year on year. We can infer Petco was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Although Petco was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 7.8% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer retail sector. On top of that, Petco's margin has declined, on average, by 22.6 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Note that last quarter, GAP operating margin was unusually low because of a $1.2 billion non-recurring impairment charge.

EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

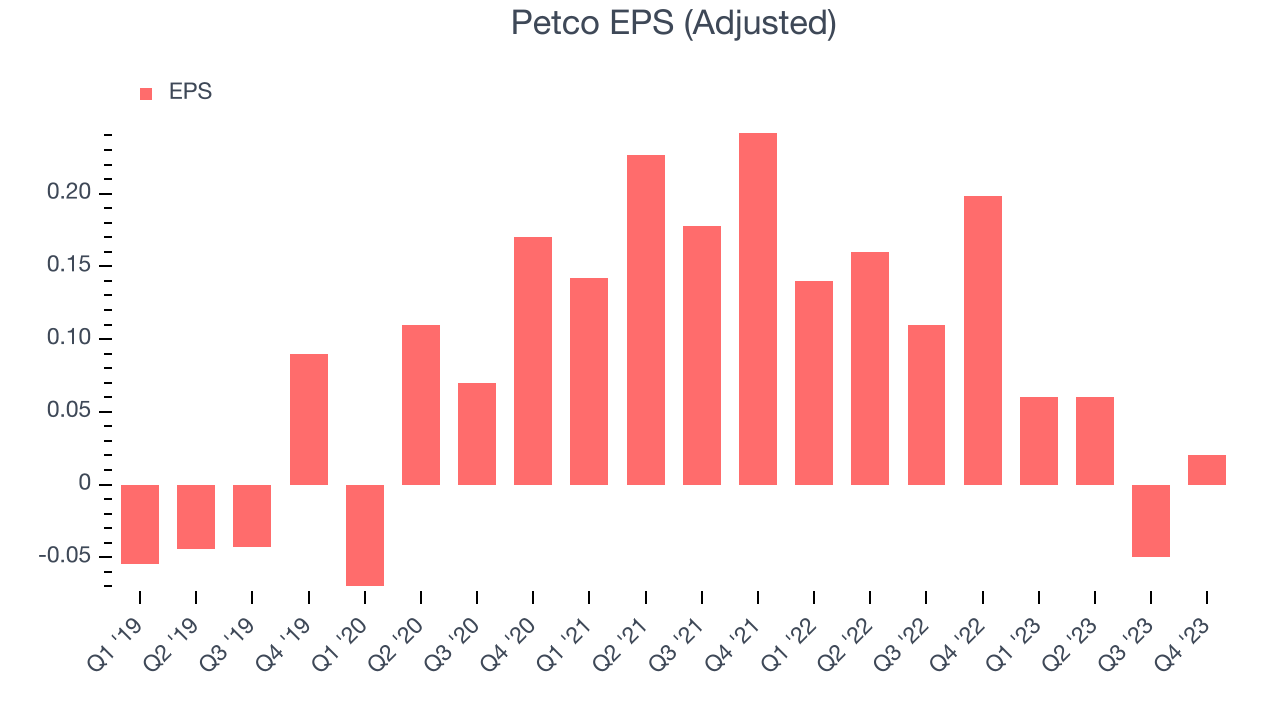

In Q4, Petco reported EPS at $0.02, down from $0.20 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, Petco's adjusted diluted EPS grew 272%, translating into a remarkable 38.9% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 30.7% year-on-year decline in EPS.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

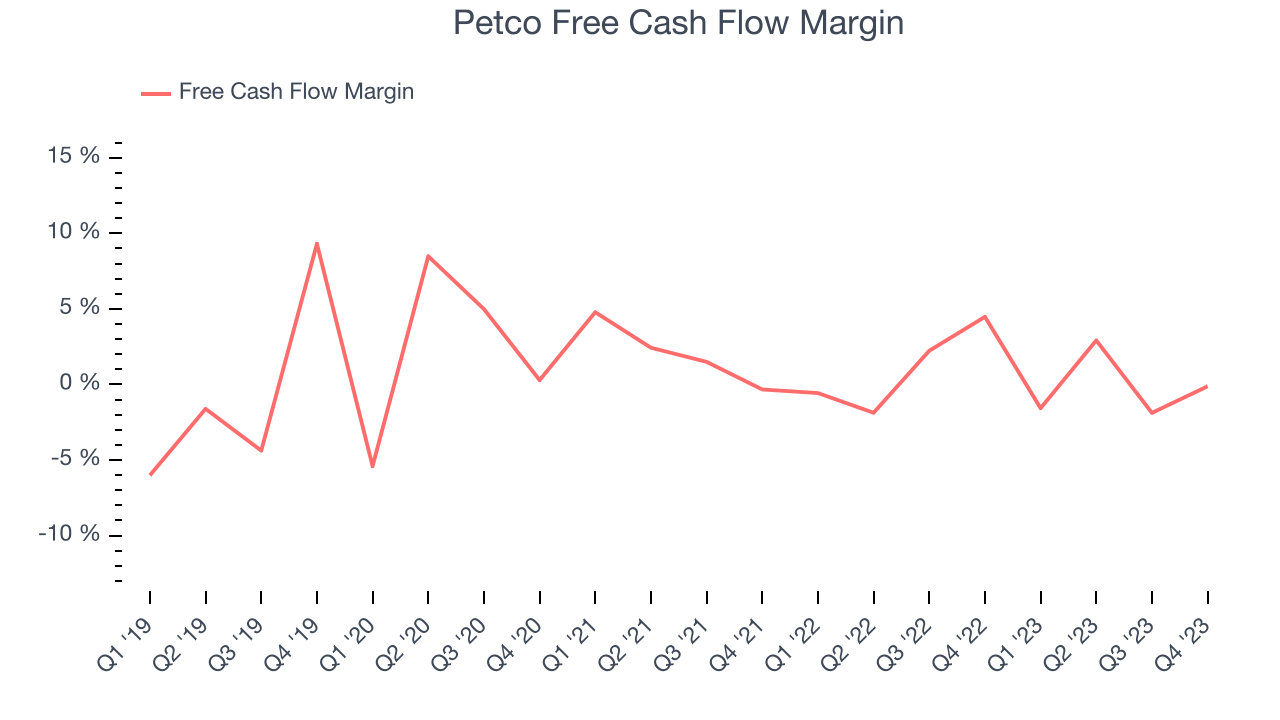

Petco broke even from a free cash flow perspective in Q4. The company's margin regressed this quarter as it was 4.6 percentage points lower than in the same period last year.

Over the last eight quarters, Petco has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 0.5%, subpar for a consumer retail business. Furthermore, its margin has averaged year-on-year declines of 1.3 percentage points.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Petco's five-year average ROIC was 0.1%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Petco's ROIC over the last two years averaged 19.1 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Petco's Q4 Results

We enjoyed seeing Petco exceed analysts' revenue expectations this quarter. On the other hand, its earnings forecast for next quarter missed analysts' expectations and its revenue guidance for next quarter missed Wall Street's estimates. Overall, the results could have been better. The stock is up 3.5% after reporting and currently trades at $2.65 per share.

Is Now The Time?

Petco may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Petco, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last four years, and analysts expect growth to deteriorate from here. And while its EPS growth over the last four years has significantly beat its peer group average, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its operating margins reveal poor profitability compared to other retailers.

Petco's price-to-earnings ratio based on the next 12 months is 41.0x. While we've no doubt one can find things to like about Petco, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $3.74 per share right before these results (compared to the current share price of $2.65).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.