Personal wellness company WeightWatchers (NASDAQ:WW) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 10.2% year on year to $192.9 million. On the other hand, the company’s full-year revenue guidance of $770 million at the midpoint came in slightly below analysts’ estimates. Its GAAP loss of $4.67 per share was 5,068% below analysts’ consensus estimates.

Is now the time to buy WeightWatchers? Find out by accessing our full research report, it’s free.

WeightWatchers (WW) Q3 CY2024 Highlights:

- Revenue: $192.9 million vs analyst estimates of $193.4 million (in line)

- EPS: -$4.67 vs analyst estimates of $0.09 (-$4.76 miss due to a large, one-time impairment charge that will not recur)

- The company reconfirmed its revenue guidance for the full year of $770 million at the midpoint

- EBITDA guidance for the full year is $150 million at the midpoint, above analyst estimates of $144.1 million

- Gross Margin (GAAP): 67.1%, in line with the same quarter last year

- Operating Margin: 0%, down from 14.2% in the same quarter last year due to a large, one-time impairment charge that will not recur

- Free Cash Flow Margin: 8.6%, down from 11.9% in the same quarter last year

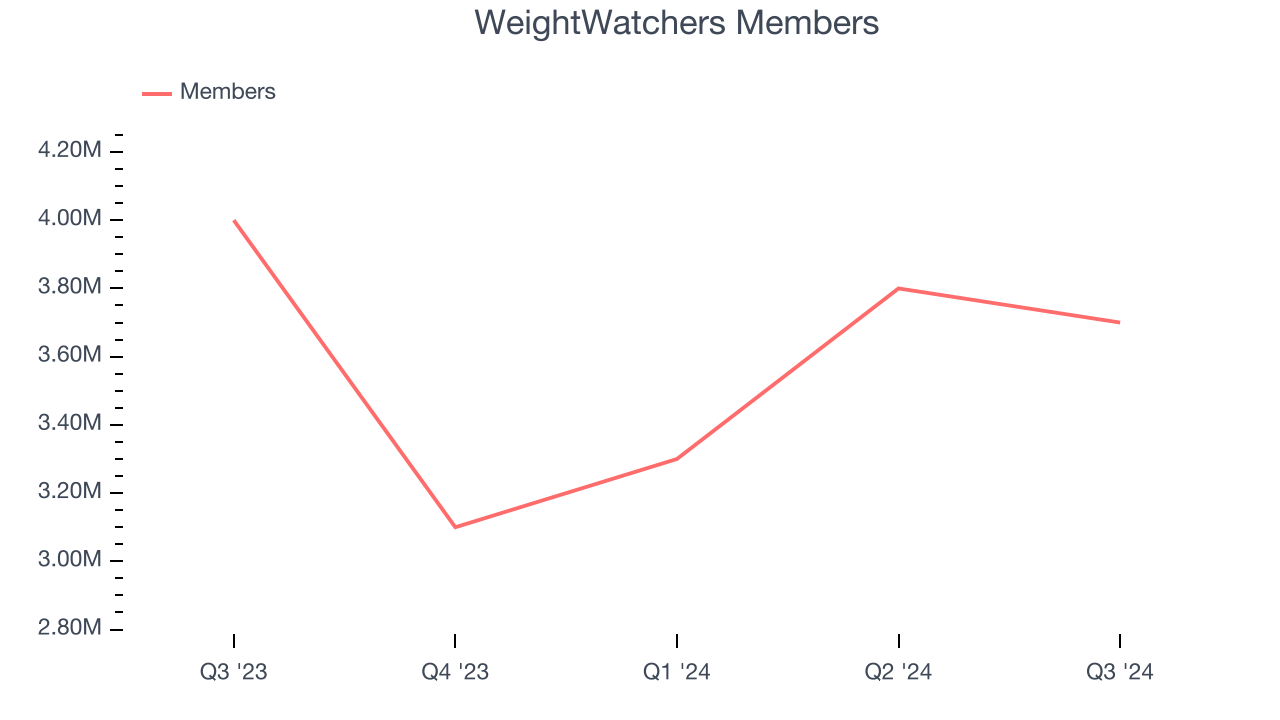

- Members: 3.7 million, down 300,000 year on year

- Market Capitalization: $92.49 million

“For over six decades, WeightWatchers has been the trusted leader in weight management, offering a full spectrum of science-backed, proven weight management solutions. With our expanded clinical offering, iconic trusted brand, and global community of members, we are well-equipped to succeed in today’s rapidly evolving market,” said Tara Comonte, Interim CEO.

Company Overview

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

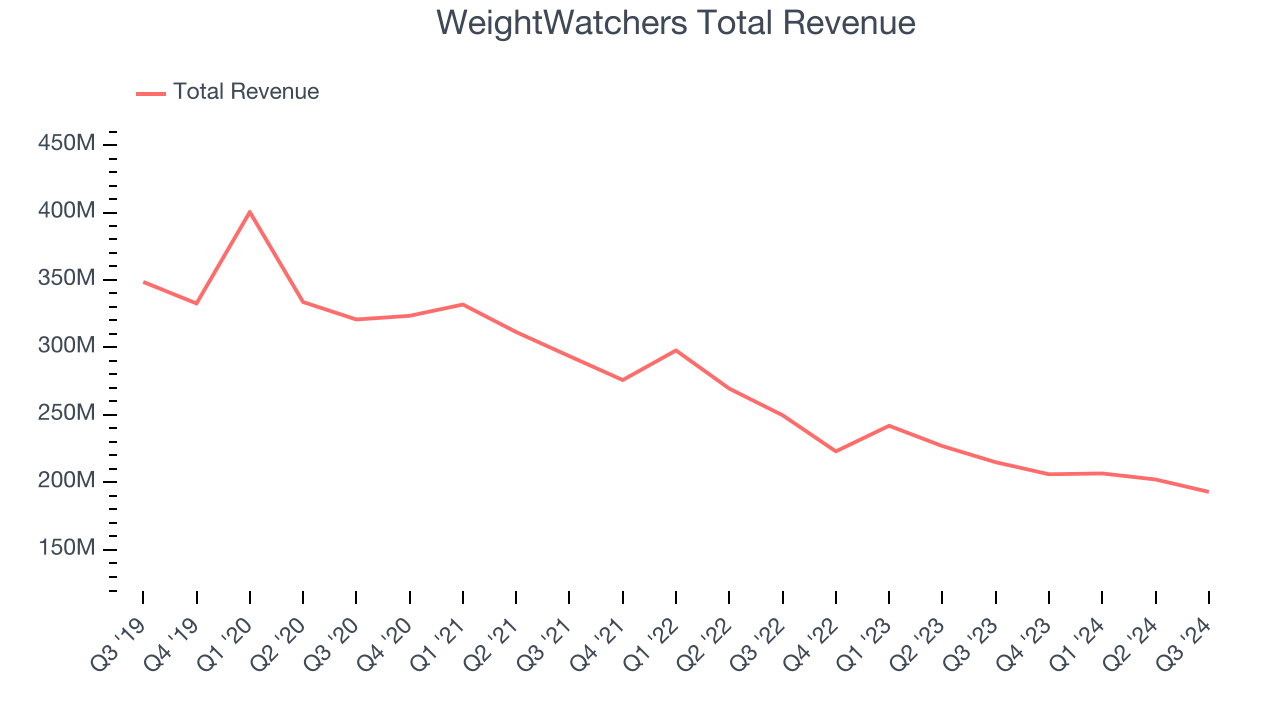

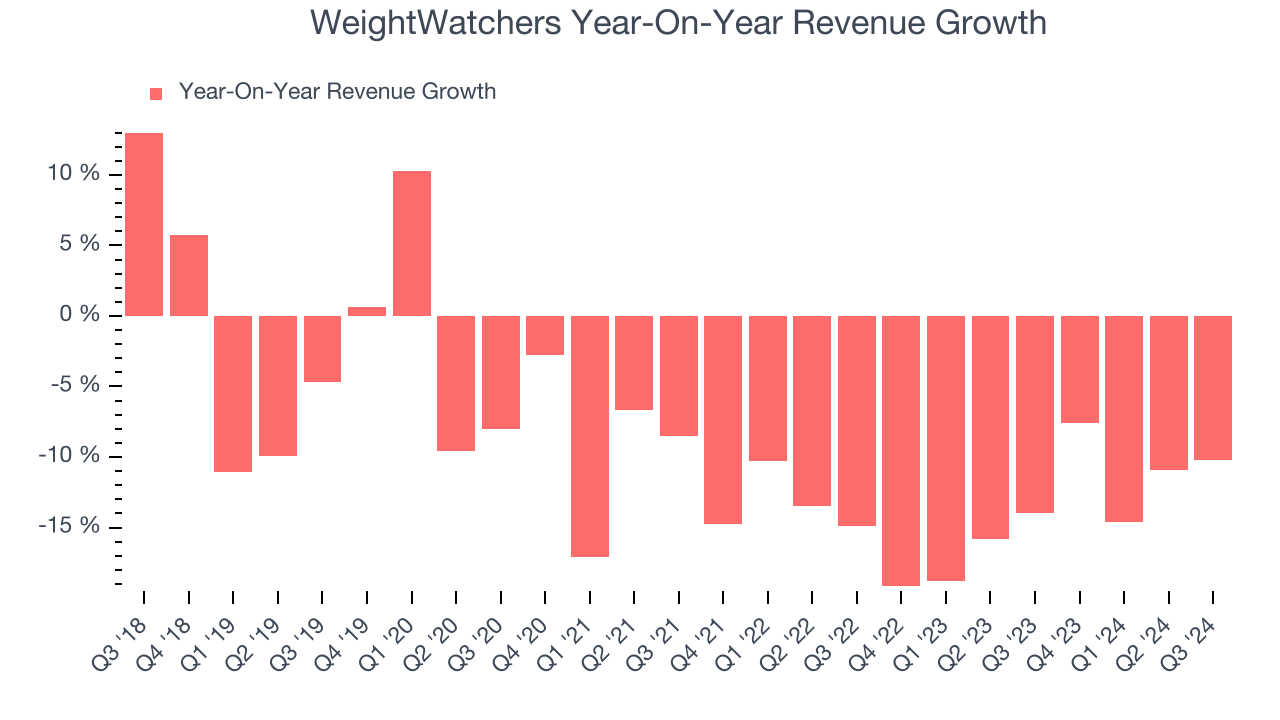

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, WeightWatchers’s revenue declined by 10.6% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. WeightWatchers’s recent history shows its demand has stayed suppressed as its revenue has declined by 14% annually over the last two years.

WeightWatchers also discloses its number of members, which reached 3.7 million in the latest quarter. Over the last two years, WeightWatchers’s members averaged 7.5% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, WeightWatchers reported a rather uninspiring 10.2% year-on-year revenue decline to $192.9 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline 12% over the next 12 months. While this projection is better than its two-year trend it's tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

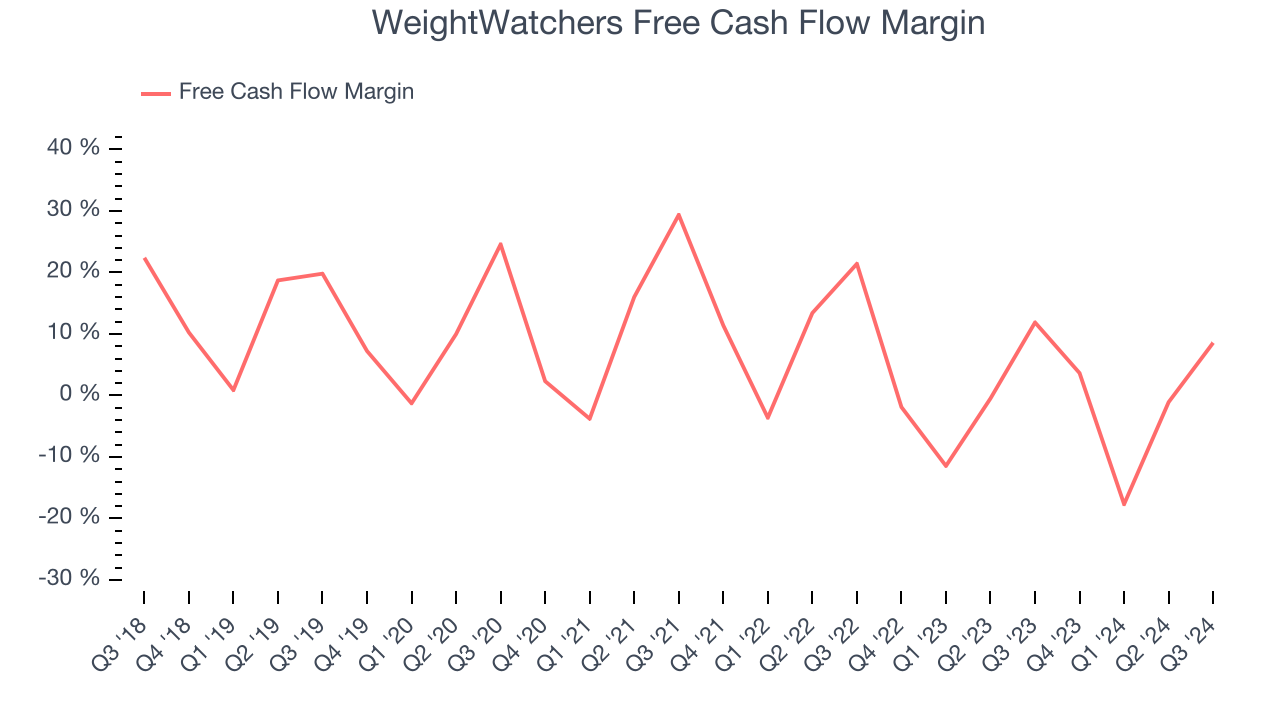

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While WeightWatchers posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, WeightWatchers’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.29 of cash on fire for every $100 in revenue.

WeightWatchers’s free cash flow clocked in at $16.53 million in Q3, equivalent to a 8.6% margin. The company’s cash profitability regressed as it was 3.3 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts’ consensus estimates show they’re expecting WeightWatchers’s free cash flow margin of negative 1.8% for the last 12 months to remain the same. Hopefully the company’s cash profitability will rise soon.

Key Takeaways from WeightWatchers’s Q3 Results

We enjoyed seeing WeightWatchers beat analysts’ full-year EBITDA guidance expectations. That the company reconfirmed previously-given revenue guidance means the topline is on track as well. As for the quarter, revenue was in line and EPS only missed because of a large, one-time impairment charge. Overall, this quarter was solid, especially considering the company's uneven quarterly performance historically. The stock traded up 2.6% to $1.18 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.