As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the aerospace industry, including Woodward (NASDAQ:WWD) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate cut and future ones (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Woodward (NASDAQ:WWD)

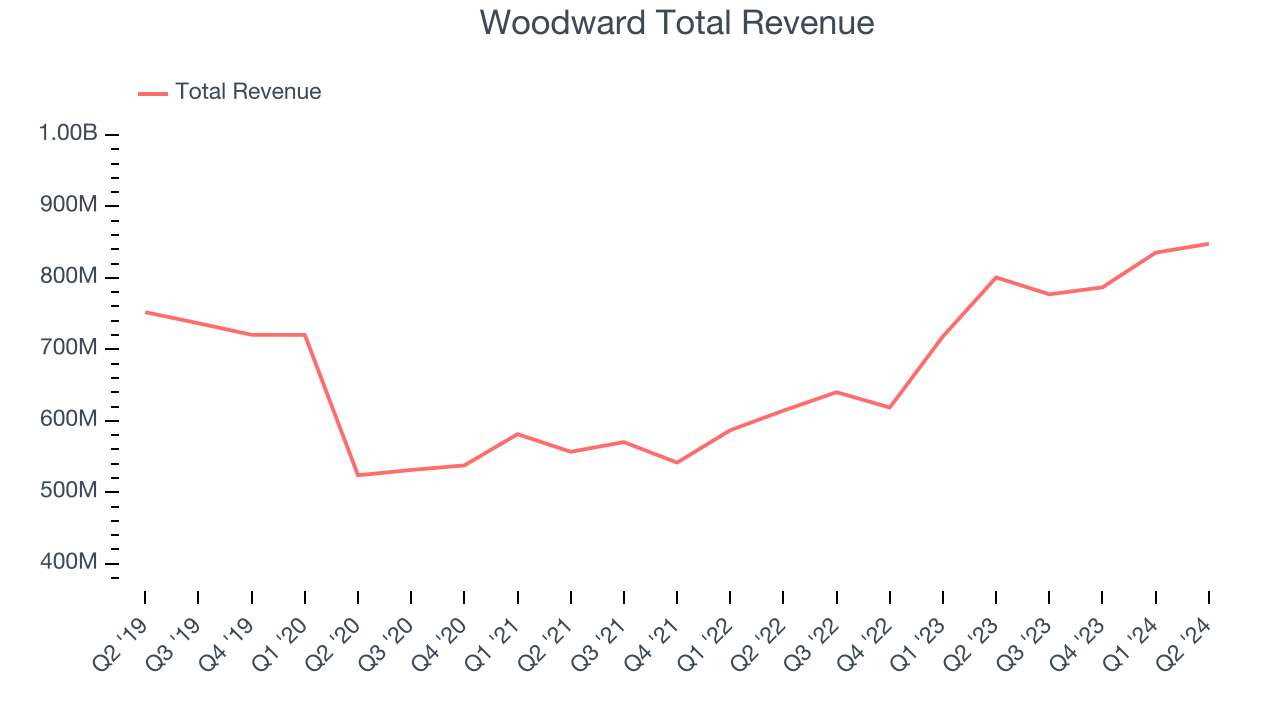

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ:WWD) designs, services, and manufactures energy control products and optimization solutions.

Woodward reported revenues of $847.7 million, up 5.9% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ organic revenue estimates.

"We delivered a solid quarter, driven by robust end-market demand and the dedicated efforts of all our members,” stated Chip Blankenship, Chairman and Chief Executive Officer.

Unsurprisingly, the stock is down 10.4% since reporting and currently trades at $164.31.

Read our full report on Woodward here, it’s free.

Best Q2: Ducommun (NYSE:DCO)

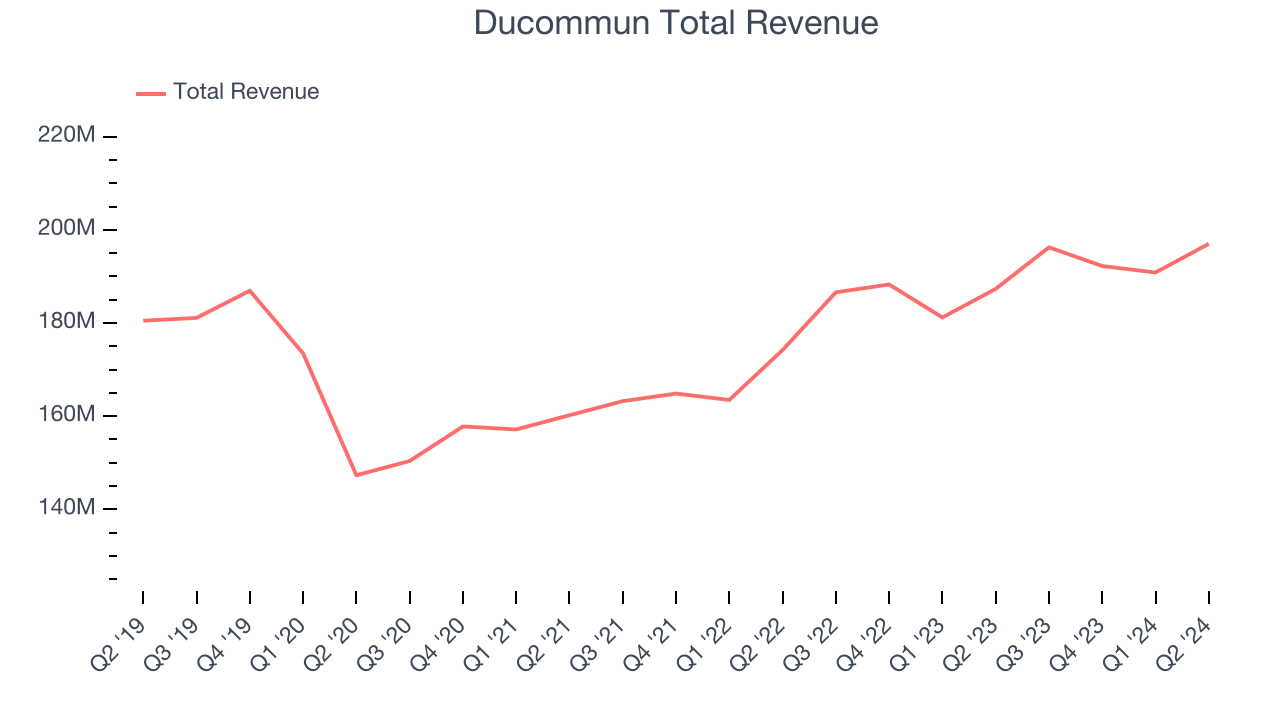

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Ducommun reported revenues of $197 million, up 5.2% year on year, outperforming analysts’ expectations by 1.1%. The business had an exceptional quarter with an impressive beat of analysts’ earnings and operating margin estimates.

The market seems happy with the results as the stock is up 8.9% since reporting. It currently trades at $64.56.

Is now the time to buy Ducommun? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: AerSale (NASDAQ:ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $77.1 million, up 11.2% year on year, falling short of analysts’ expectations by 12.7%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

AerSale delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 7% since the results and currently trades at $5.18.

Read our full analysis of AerSale’s results here.

Astronics (NASDAQ:ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $198.1 million, up 13.6% year on year. This print topped analysts’ expectations by 3.7%. Overall, it was a very strong quarter as it also logged full-year revenue guidance exceeding analysts’ expectations.

Astronics delivered the highest full-year guidance raise among its peers. The stock is down 8.4% since reporting and currently trades at $19.98.

Read our full, actionable report on Astronics here, it’s free.

TransDigm (NYSE:TDG)

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm reported revenues of $2.05 billion, up 17.3% year on year. This print surpassed analysts’ expectations by 1.9%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ operating margin estimates and a solid beat of analysts’ organic revenue estimates.

The stock is up 13.6% since reporting and currently trades at $1,374.

Read our full, actionable report on TransDigm here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.