Heading into the new earnings season, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the sales and marketing software stocks, starting with Qualtrics (NASDAQ:XM).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 22 sales and marketing software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 3.99%, while on average next quarter revenue guidance was 2.7% above consensus. Tech stocks have had a rocky start in 2022 and sales and marketing software stocks have not been spared, with share price down 26.2% since earnings, on average.

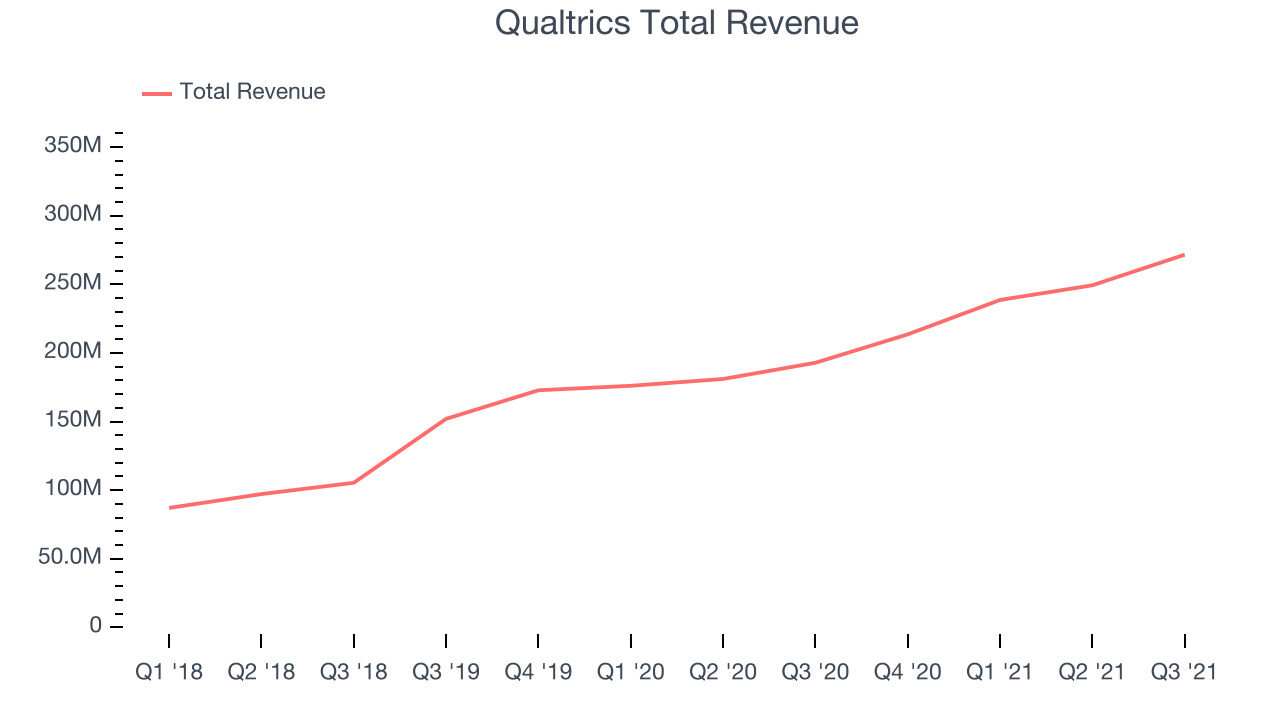

Qualtrics (NASDAQ:XM)

Founded in 2002 by Utah-based entrepreneur Ryan Smith, along with his father and brother, Qualtrics (NASDAQ:XM) provides organizations with software to collect and analyze feedback from customers and employees.

Qualtrics reported revenues of $271.6 million, up 40.8% year on year, beating analyst expectations by 5.21%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter and a full year guidance beating analysts' expectations.

"Q3 was another outstanding quarter for Qualtrics, and our leadership position has never been stronger as we continue to innovate and define the category we created," said Qualtrics CEO Zig Serafin.

The stock is down 39.1% since the results and currently trades at $26.88.

Is now the time to buy Qualtrics? Access our full analysis of the earnings results here, it's free.

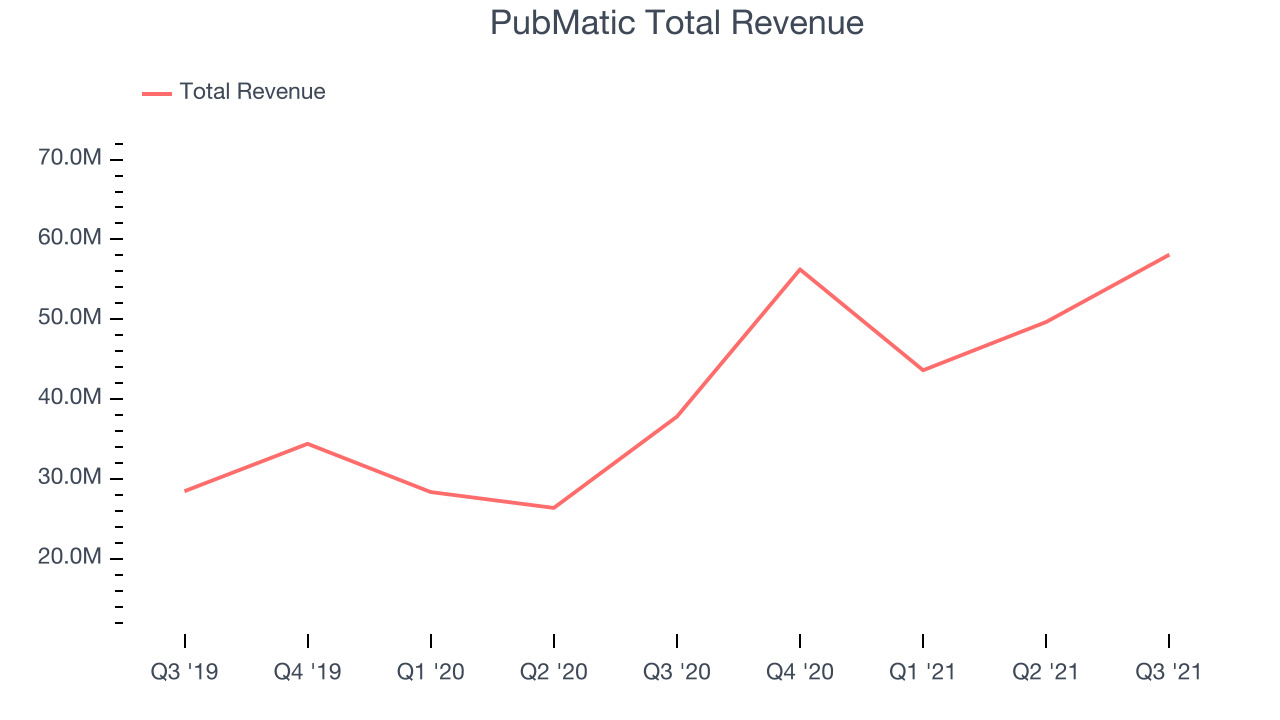

Best Q3: PubMatic (NASDAQ:PUBM)

Founded in 2006, as an online ad platform focused on ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $58 million, up 53.6% year on year, beating analyst expectations by 10.7%. It was an incredible quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

PubMatic delivered the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 25% since the results and currently trades at $24.

Is now the time to buy PubMatic? Access our full analysis of the earnings results here, it's free.

Weakest Q3: ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $49.3 million, up 15.9% year on year, beating analyst expectations by 2.76%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in gross margin.

The stock is down 11% since the results and currently trades at $16.05.

Read our full analysis of ON24's results here.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $320.7 million, up 26.2% year on year, beating analyst expectations by 1.77%. It was a decent quarter for the company, with revenue guidance for the next quarter narrowly missing what analysts were expecting.

The stock is down 32.7% since the results and currently trades at $133.51.

Read our full, actionable report on Wix here, it's free.

Semrush (NYSE:SEMR)

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

Semrush reported revenues of $49.2 million, up 52.9% year on year, beating analyst expectations by 3.73%. It was a solid quarter for the company, with an exceptional revenue growth.

The company added 3,000 customers to a total of 79,000. The stock is down 31.4% since the results and currently trades at $17.77.

Read our full, actionable report on Semrush here, it's free.

The author has no position in any of the stocks mentioned