Online survey software provider Qualtrics (NASDAQ:XM) reported Q2 FY2021 results beating Wall St's expectations, with revenue up 37.7% year on year to $249.3 million.

What do these results signal for the future of Qualtrics? Get early access our full analysis here

Qualtrics (XM) Q2 FY2021 Highlights:

- Revenue: $249.3 million vs analyst estimates of $241.6 million (3.18% beat)

- EPS (non-GAAP): $0.04 vs analyst estimates of -$0.02 ($0.06 beat)

- Revenue guidance for Q3 2021 is $258 million at the midpoint, above analyst estimates of $246.5 million

- The company lifted revenue guidance for the full year, from $982 million to $1 billion at the midpoint, a 2.74% increase

- Free cash flow of $53.7 million, up from negative free cash flow of -$81.24 million in previous quarter

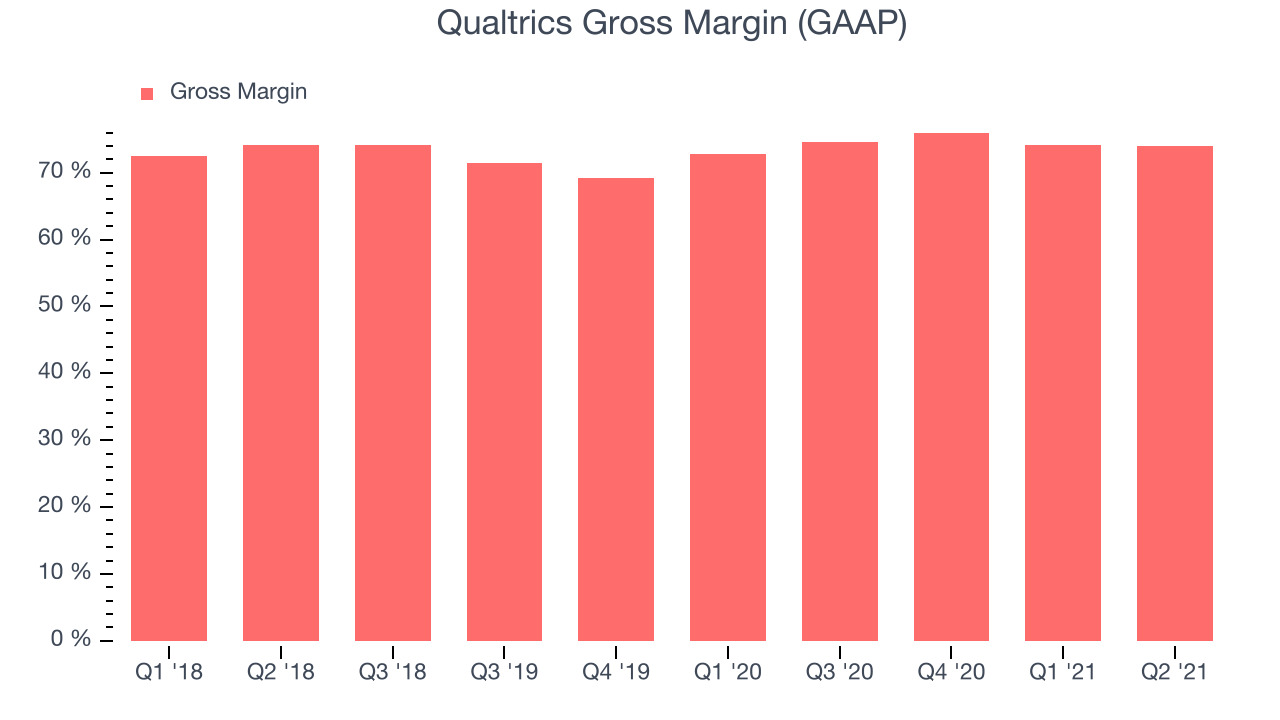

- Gross Margin (GAAP): 74%, in line with previous quarter

"Today the experiences companies deliver are absolutely vital to staying competitive," said Zig Serafin, Qualtrics CEO.

Founded in 2002 by Utah-based entrepreneur Ryan Smith, along with his father and brother, Qualtrics (NASDAQ:XM) provides organizations with software to collect and analyze feedback from customers and employees.

The growing adoption of digital tools means that organizations are generating more data that can be used to analyze their brands and products. This trend should increase demand for experience management software in the years ahead.

Sales Growth

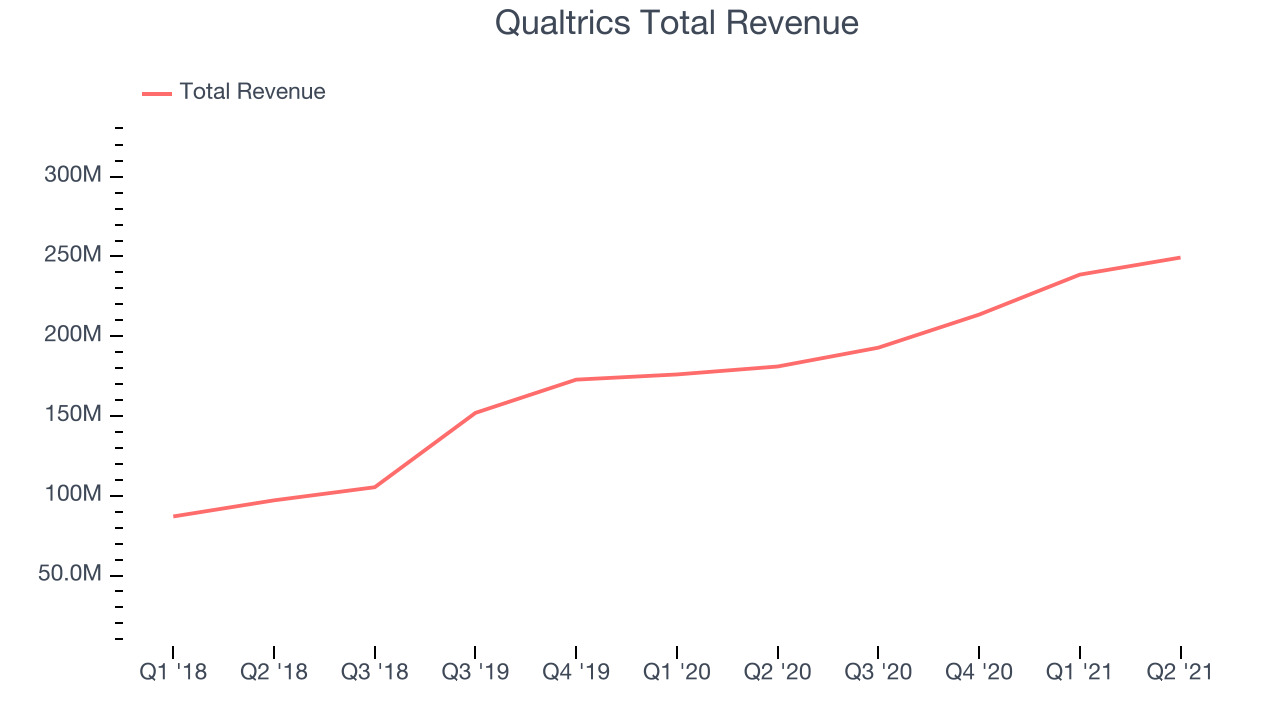

As you can see below, Qualtrics's revenue growth has been very strong over the last year, growing from quarterly revenue of $181 million, to $249.3 million.

And unsurprisingly, this was another great quarter for Qualtrics with revenue up an absolutely stunning 37.7% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $10.7 million in Q2, compared to $25 million in Q1 2021. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Analysts covering the company are expecting the revenues to grow 19.8% over the next twelve months, although would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Qualtrics's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 74% in Q2.

That means that for every $1 in revenue the company had $0.74 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the average of what we typically see in SaaS businesses, but it is good to see that the gross margin is staying stable which indicates that Qualtrics is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Qualtrics's Q2 Results

Since it is still burning cash it is worth keeping an eye on Qualtrics’s balance sheet, but we note that with market capitalisation of $19 billion and more than $635.1 million in cash, the company has the capacity to continue to prioritise growth over profitability.

We were impressed by the very optimistic revenue guidance Qualtrics provided for the next quarter. And we were also excited to see the really strong revenue growth. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. The company is up 1.37% on the results and currently trades at $38.4 per share.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.