Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Zillow (NASDAQ:ZG) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 13.1% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Luckily, real estate services stocks have performed well with share prices up 13.8% on average since the latest earnings results.

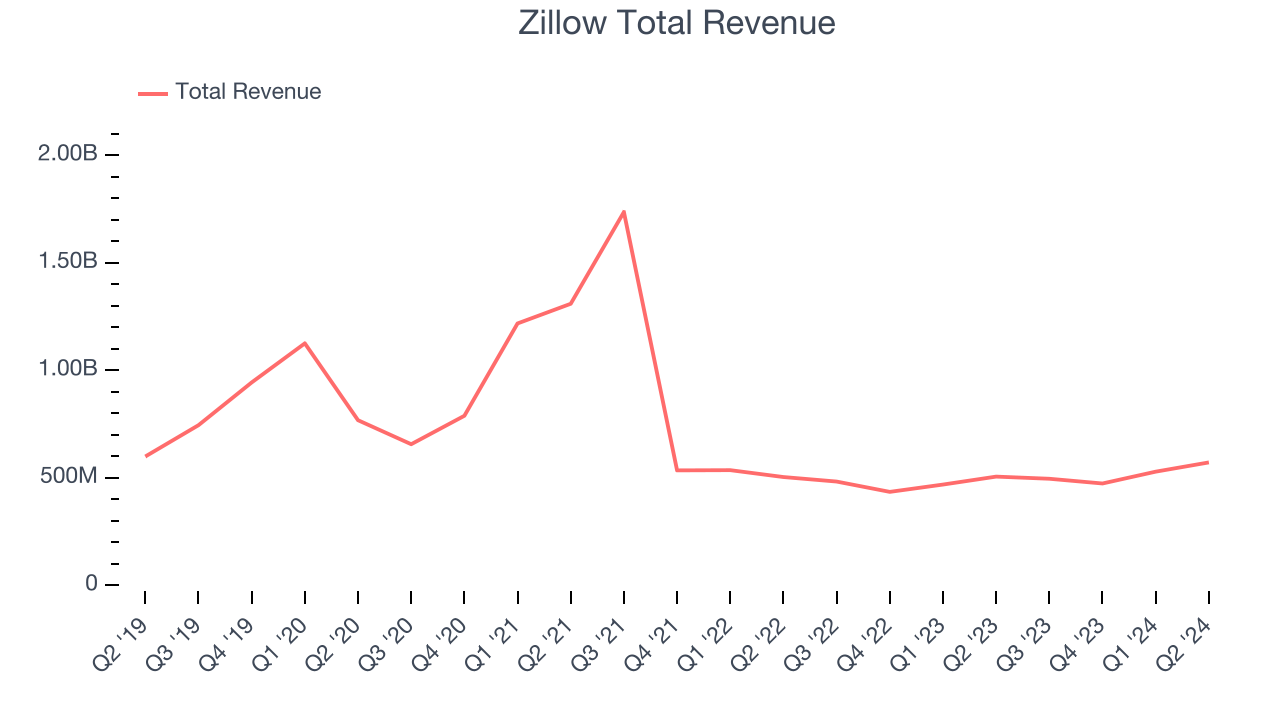

Zillow (NASDAQ:ZG)

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

Zillow reported revenues of $572 million, up 13% year on year. This print exceeded analysts’ expectations by 6.3%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ operating margin and earnings estimates.

Interestingly, the stock is up 53% since reporting and currently trades at $61.76.

Is now the time to buy Zillow? Access our full analysis of the earnings results here, it’s free.

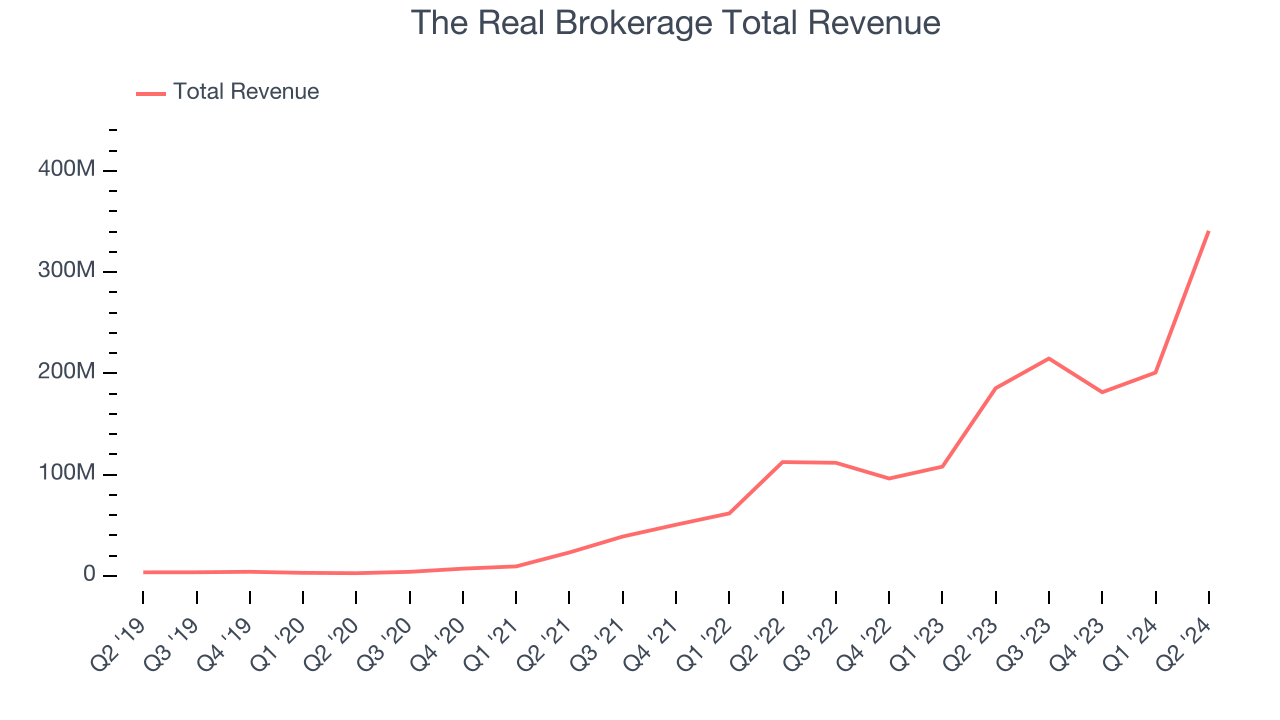

Best Q2: The Real Brokerage (NASDAQ:REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $340.8 million, up 83.9% year on year, outperforming analysts’ expectations by 28.9%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

The Real Brokerage scored the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.3% since reporting. It currently trades at $5.16.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Offerpad (NYSE:OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE:OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $251.1 million, up 9.1% year on year, falling short of analysts’ expectations by 11.4%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Offerpad delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 24.1% since the results and currently trades at $2.96.

Read our full analysis of Offerpad’s results here.

RE/MAX (NYSE:RMAX)

Short for Real Estate Maximums, RE/MAX (NYSE:RMAX) operates a real estate franchise network spanning over 100 countries and territories.

RE/MAX reported revenues of $78.45 million, down 4.8% year on year. This number met analysts’ expectations. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ operating margin estimates and full-year revenue guidance exceeding analysts’ expectations.

The stock is up 42.1% since reporting and currently trades at $12.31.

Read our full, actionable report on RE/MAX here, it’s free.

CBRE (NYSE:CBRE)

Established in 1906, CBRE (NYSE:CBRE) is one of the largest commercial real estate services firms in the world.

CBRE reported revenues of $8.39 billion, up 8.7% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ earnings estimates.

The stock is up 28.5% since reporting and currently trades at $126.39.

Read our full, actionable report on CBRE here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.