Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at ZoomInfo (NASDAQ:ZI), and the best and worst performers in the sales software group.

The Internet and the exploding amounts of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, with sales and marketing software providers the tools of evolving customer interaction.

The 15 sales software stocks we track reported a a decent Q2; on average, revenues beat analyst consensus estimates by 3.21%, while on average next quarter revenue guidance was 2.61% above consensus. The market rewarded the results with the average return the day after earnings coming in at 1.05%.

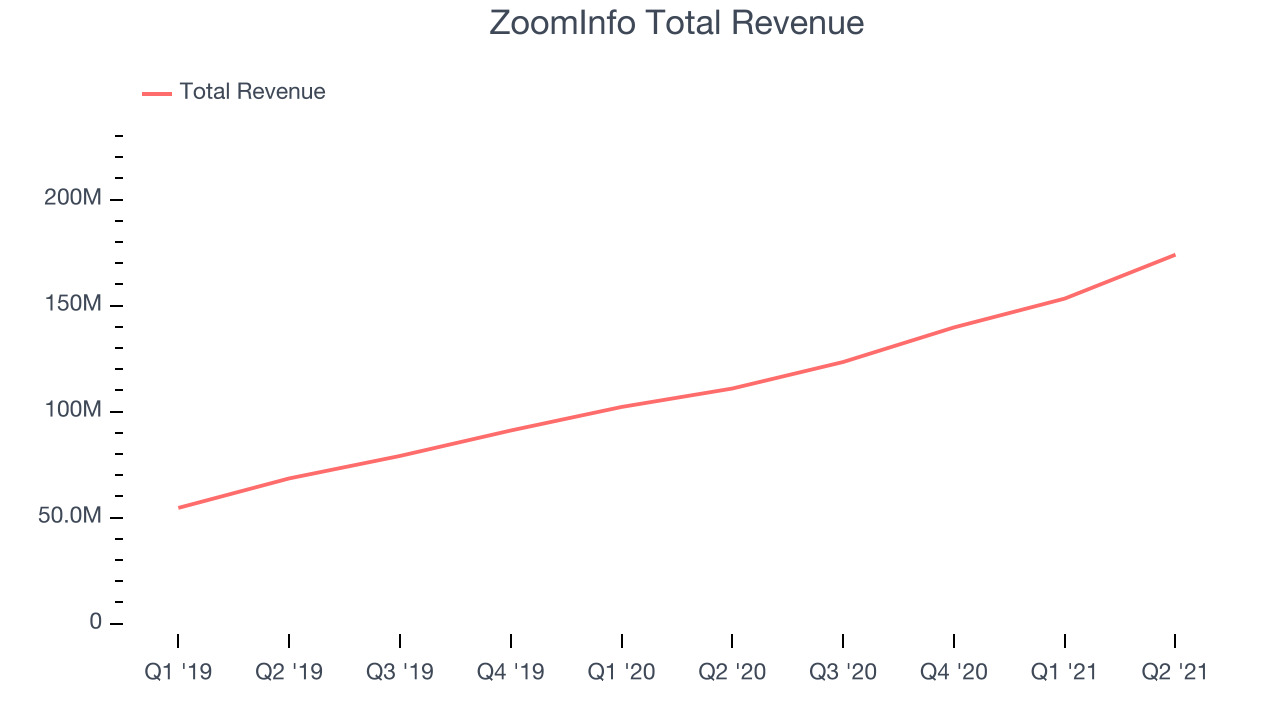

Best Q2: ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $174 million, up 56.8% year on year, beating analyst expectations by 7.09%. It was an impressive quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

"ZoomInfo delivered another record quarter, including the highest levels ever for both retention activity and customer engagement, and accelerating revenue growth, as customers in all industries continue to choose ZoomInfo to transform their go-to-market motion,” said Henry Schuck, ZoomInfo Founder and CEO.

ZoomInfo pulled off the strongest analyst estimates beat of the whole group. The company added 150 enterprise customers paying more than $100,000 annually to a total of 1,100. The stock is up 3.21% since the results and currently trades at $61.11.

Read why we think that ZoomInfo is one of the best sales software stocks, our full report is free.

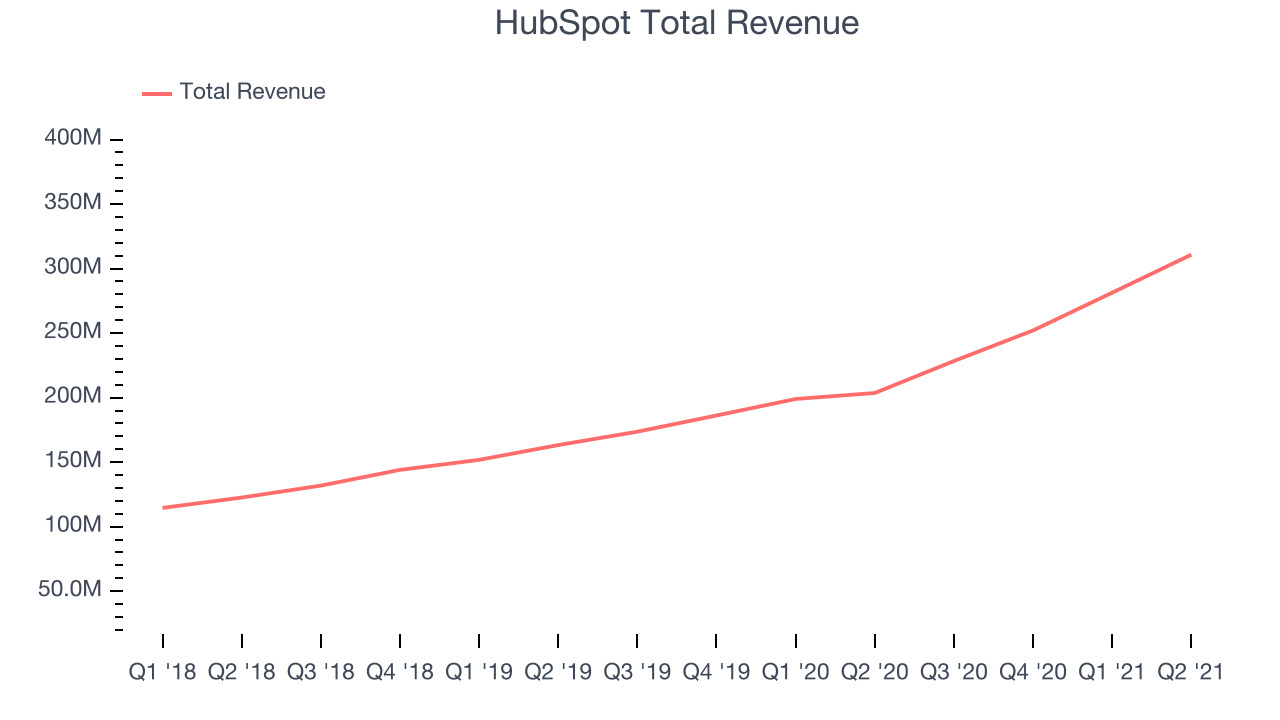

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $310.7 million, up 52.6% year on year, beating analyst expectations by 4.99%. It was a solid quarter for the company, with an exceptional revenue growth and a decent beat of analyst estimates.

The stock is up 11.8% since the results and currently trades at $690.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Zendesk (NYSE:ZEN)

Founded in 2006 by three Danish friends who got tired of implementing complex old-school solutions, Zendesk is a software as a service platform that makes it easier for companies to provide help and support to their customers.

Zendesk reported revenues of $318.2 million, up 29% year on year, missing analyst expectations by 0.73%. It was a weaker quarter for the company, with a miss of the top line analyst estimates and an underwhelming revenue guidance for the next quarter.

Zendesk had the weakest performance against analyst estimates in the group. The stock is down 13.2% since the results and currently trades at $116.75.

Read our full analysis of Zendesk's results here.

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce is a software as a service platform that helps companies access, manage and share sales information.

Salesforce reported revenues of $6.34 billion, up 23% year on year, beating analyst expectations by 1.51%. It was a decent quarter for the company, with a strong sales guidance for the next quarter.

The stock is up 2.45% since the results and currently trades at $274.09.

Read our full, actionable report on Salesforce here, it's free.

The author has no position in any of the stocks mentioned