Sales intelligence platform ZoomInfo reported Q1 FY2021 results that beat analyst expectations, with revenue up 50% year on year to $153 million. ZoomInfo made a GAAP loss of $33.9 million, down on its loss of $5.9 million, in the same quarter last year.

ZoomInfo (NASDAQ:ZI) Q1 FY2021 Highlights:

- Revenue: $153 million vs analyst estimates of $145 million (5.37% beat)

- EPS (non-GAAP): $0.13 vs analyst estimates of $0.10 (23.8% beat)

- Revenue guidance for Q2 2021 is $162 million at the midpoint, above analyst estimates of $153 million

- The company lifted revenue guidance for the full year from $650 million to $673 million at the midpoint, a 3.53% increase

- Free cash flow of $97.5 million, up 27.2% from previous quarter

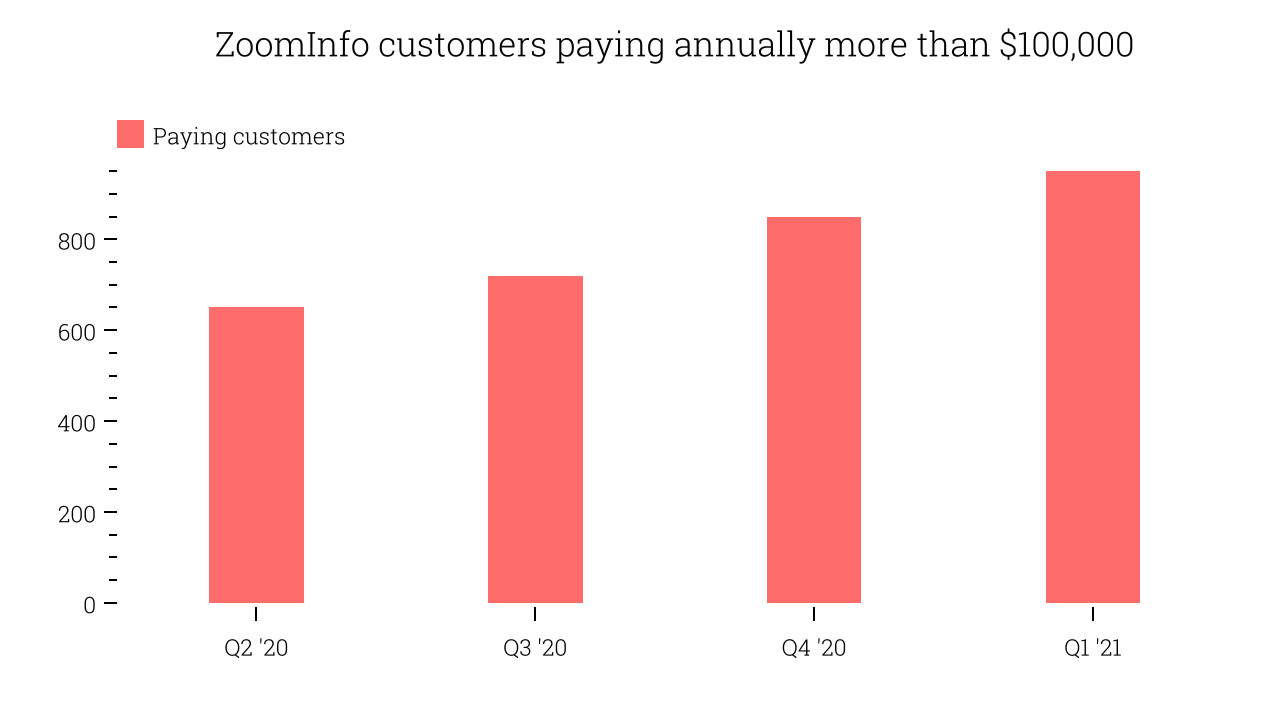

- Customers: 950 customers paying annually more than $100,000

- Gross Margin (GAAP): 86%, in line with previous quarter

"The first quarter was a strong start to the year that built on our momentum from 2020,” said Henry Schuck, ZoomInfo Founder and CEO. “We are executing well across all areas of the business, and we remain well-positioned to capitalize on the growing market opportunity in the go-to-market intelligence space, as B2B companies of all sizes modernize their sales and marketing motions.”

Intelligent Data For Salespeople

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

The company essentially runs a large database of professionals similar to LinkedIn, and it also maintains a repository of companies with information about their revenue, industry or number of employees. It then puts this data together to help sales teams find and identify potential customers, alerts them if new ones appear and provides them with contact details of prospective buyers. ZoomInfo scrapes the information and data from public websites, sources it from email communications of people who let the company scan their mailboxes or buys it from other companies.

ZoomInfo’s main competitor is LinkedIn which is owned by Microsoft (NASDAQ:MSFT), but there are plenty of smaller competitors in this space whether public, like TechTarget (NASDAQ:TTGT), or private, like Clearbit or FullContact.

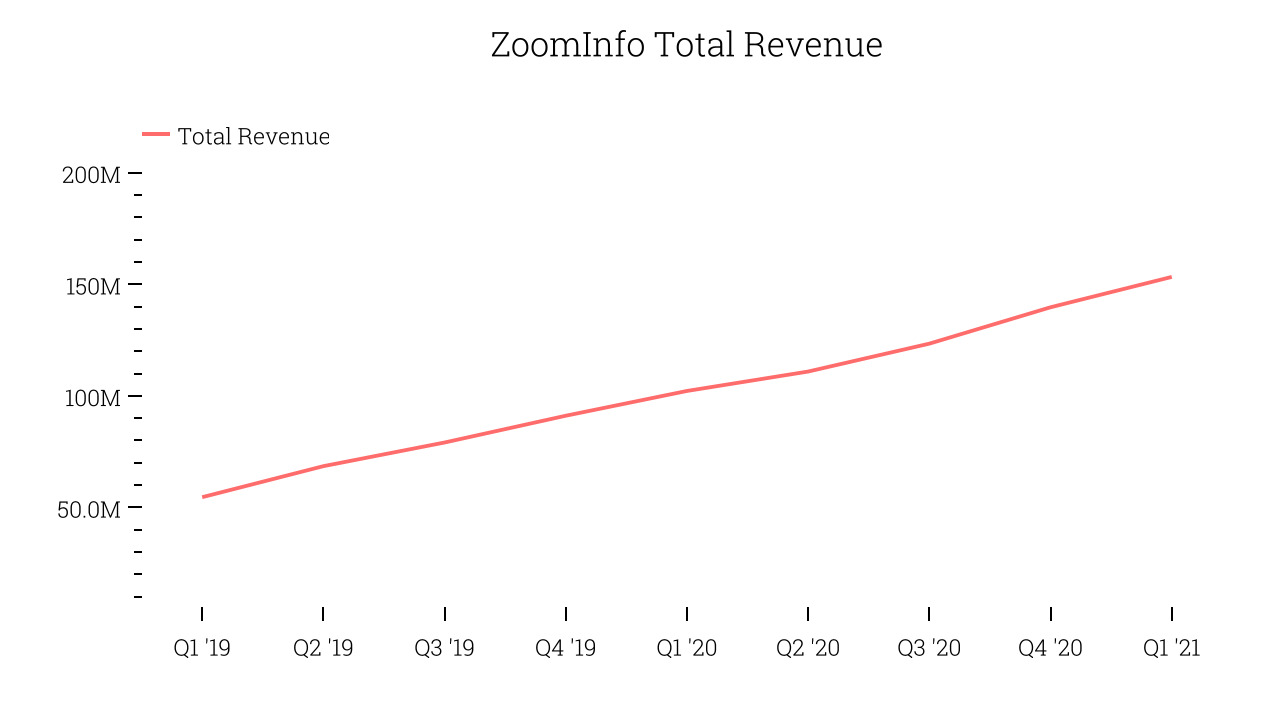

As you can see below, ZoomInfo's revenue growth has been incredible over the last twelve months, growing from $102 million to $153 million.

And unsurprisingly, this was another great quarter for ZoomInfo with revenue up an absolutely stunning 50% year on year. But the growth did slow down a little compared to last quarter, as ZoomInfo increased revenue by $13.6 million in Q1, compared to $16.3 million revenue add in Q4 2020. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Customer Base

Due to the nature of its product, ZoomInfo has a diversified customer base that spans across a wide variety of industries. Majority of its customers are small and medium sized businesses, but the company has started to also increase its footprint among large enterprises.

You can see below that at the end of the quarter ZoomInfo reported 950 enterprise customers paying annually more than $100,000, an increase of 100 on last quarter. That is a bit less contract wins than last quarter but about the same as what we have typically seen over the last year, suggesting that the company still has decent sales momentum, even if this was a weaker quarter.

Key Takeaways from ZoomInfo's Q1 Results

With market capitalisation of $9.53 billion ZoomInfo is among smaller companies, but its more than $353 million in cash and positive free cash flow over the last twelve months give us confidence that ZoomInfo has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth ZoomInfo delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was disappointing to see the slowdown in new contract wins. Zooming out, we think this impressive quarter should have shareholders feeling very positive. ZoomInfo is one of the best quality SaaS businesses out there and these results confirmed it once again.

PS. Have you noticed we published this analysis in less than 300 seconds since ZoomInfo made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.